DXY bounced last night:

AUD fell though not versus the crosses. Notably JPY:

Which means the CNY rebound will not last and neither will DXY down and AUD up:

Oil popped and dropped:

Metals fell:

EM stocks (NYSE:EEM) too:

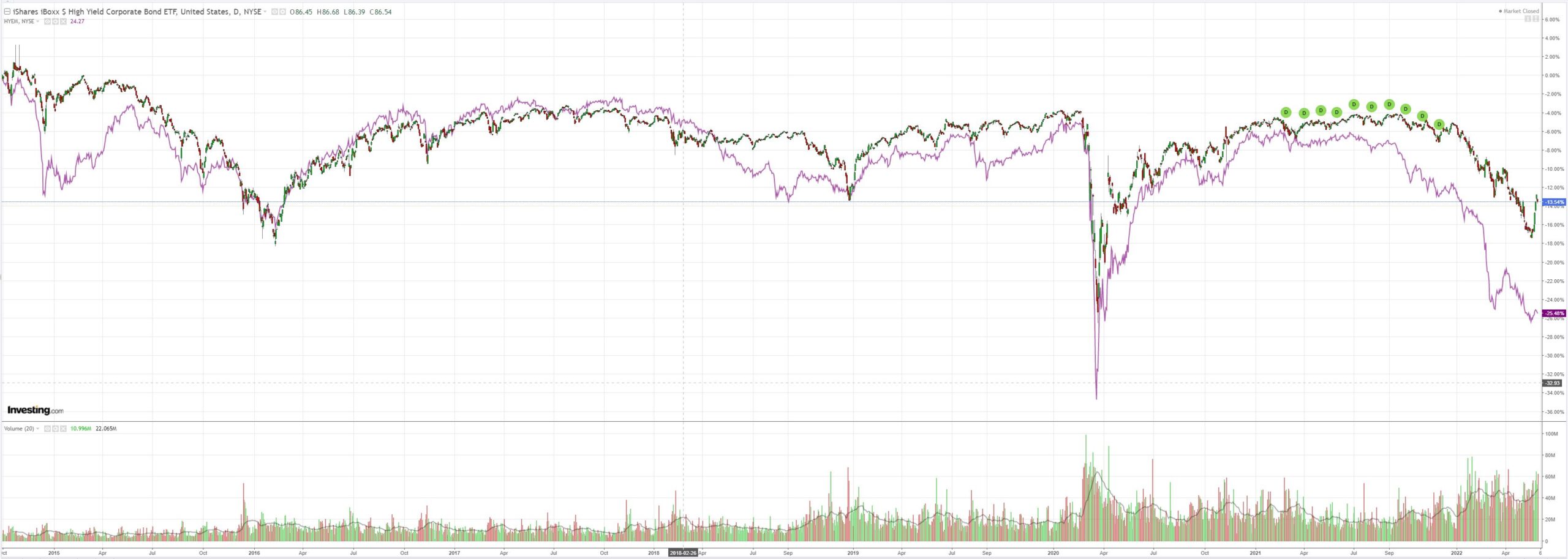

The best risk indicator in the world, EM junk (NYSE:HYG), is still sick:

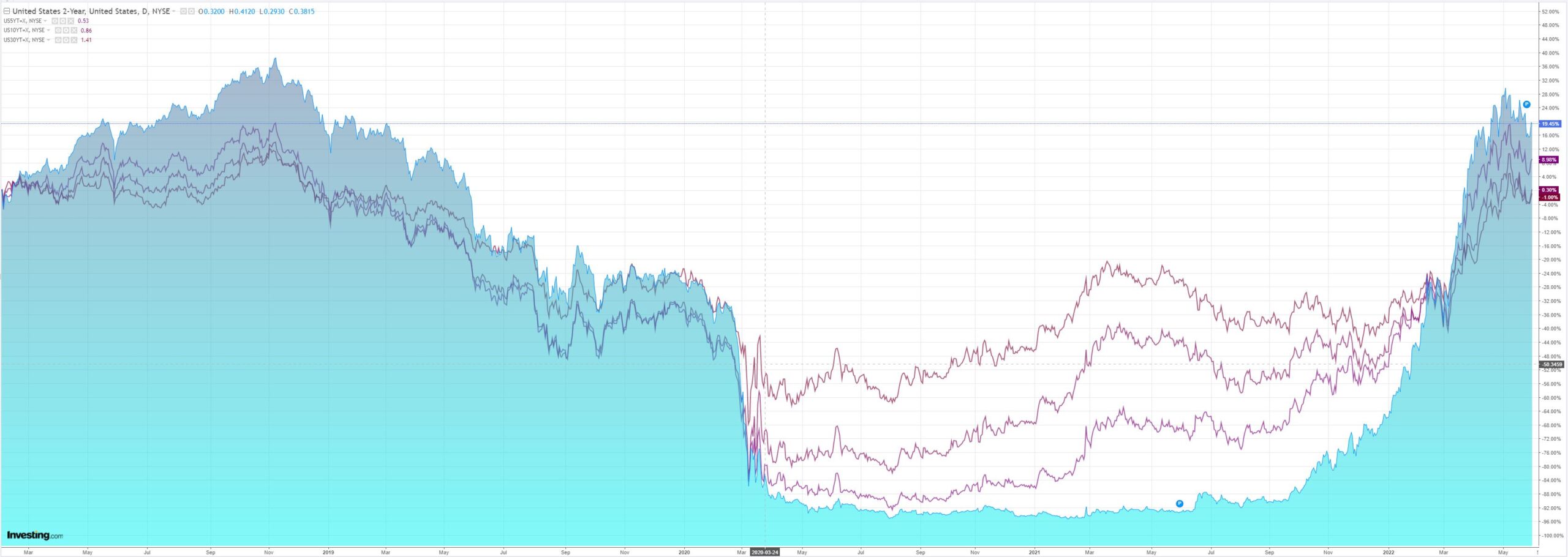

Treasury yields lifted:

So stocks fell:

Westpac has the wrap:

Event Wrap

US consumer confidence (Conference Board) was firmer than expected, at 106.4 (est. 103.8, prior revised to 108.6 from 107.3). Although the current situation dipped to 149.5 (from 152.9) it remains high. The expectations component has been extremely low and remains so at 77.5. FHFA house prices in March rose 1.5%m/m (est. +2.0%m/m), while CoreLogic prices rose 2.4%m/m. The Chicago PMI survey beat expectations at 60.3 (est. 55.1, prior 56.4). The report cited a large increase in inventories and increased concerns over supply constraints from China’s lockdowns. Demand was described as extremely strong. The Dallas Fed survey was mixed at -7.3 (est. +1.5, prior +1.1). Declining new orders and slipping expectations were offset by higher production levels.

Eurozone CPI in May was stronger than expected, rising 0.8%m/m and 8.1%y/y (est. +0.5%m/m and +7.8%y/y), with core rising 3.8%y/y (est. 3.6%y/y). The record high rates increase pressure on the ECB to shift from its accommodative policy stance.

Event Outlook

Aust: Q1 GDP will be released. A softer print in activity is anticipated given the disruptions associated with omicron and severe flooding in NSW and Qld. Consumer spending and public demand are expected to add to growth, while business investment and housing should remain subdued. Westpac’s forecast of 0.6% is close to the market median (0.7%). Meanwhile, CoreLogic’s home value index should reflect the beginning of the housing correction in May (Westpac f/c: -0.3%).

Japan: The final estimate of the May Nikkei manufacturing PMI is due.

China: The Caixin manufacturing PMI should begin to recover as COVID-19 disruptions fade (market f/c: 49.0).

Eur/UK: The European unemployment rate is set to remain near its lows in April, laying the foundation for robust wages growth (market f/c: 6.8%). The final estimate of the May S&P Global (NYSE:SPGI) manufacturing PMIs is due for both Europe and the UK (market f/c: 54.4 and 54.6 respectively).

US: Construction spending should continue to be supported by the strength of home building April (market f/c: 0.6%). The May S&P Global and ISM manufacturing PMIs are expected to reflect robust momentum in the sector (market f/c: 57.5 and 54.5 respectively). April’s JOLTS job openings will likely continue pointing towards an extraordinary demand for labour (market f/c: 11400k). The Federal Reserve’s Beige Book will provide a qualitative assessment of conditions across the 12 districts. Meanwhile, the FOMC’s Williams and Bullard are due to speak at different events.

Can: The Bank of Canada is expected to raise the policy rate by 50 basis points to 1.50% at its June meeting in order to rein in inflation.

The big news on the night was oil which was ripping higher before this:

The OPEC+ coalition will likely hold firm to its oil production plans this week even as the European Union moves to sanction group member Russia, delegates said.

Global oil supply and demand levels remain stable, with no severe disruption yet to Russian exports, and thus require little action from the 23-nation alliance, according to the officials. With most members besides Saudi Arabia and its neighbors struggling to increase production, the group’s decisions are in any case becoming largely symbolic.

…Given that Moscow is a critical member of the OPEC+ network, it would probably be difficult in any case to reach a group-wide agreement on a bigger hike that would replace Russian supplies. While the Persian Gulf nations could separately agree to raise output, such a move would likely strain ties with Russia and risk unraveling the coalition.

There is talk of Saudi replacing lost Russia volumes, which is what sank prices, but it’s far from certain.

It’s the Fed versus oil now, my friends, and there can be only one winner.

Which it is will determine AUD 60 cent or 80 cents in the next 6-12 months.