DXY is off the lows:

AUD was bashed across the board:

Oil too. It looks stuffed:

Base metals less so but good luck with that if oil breaks:

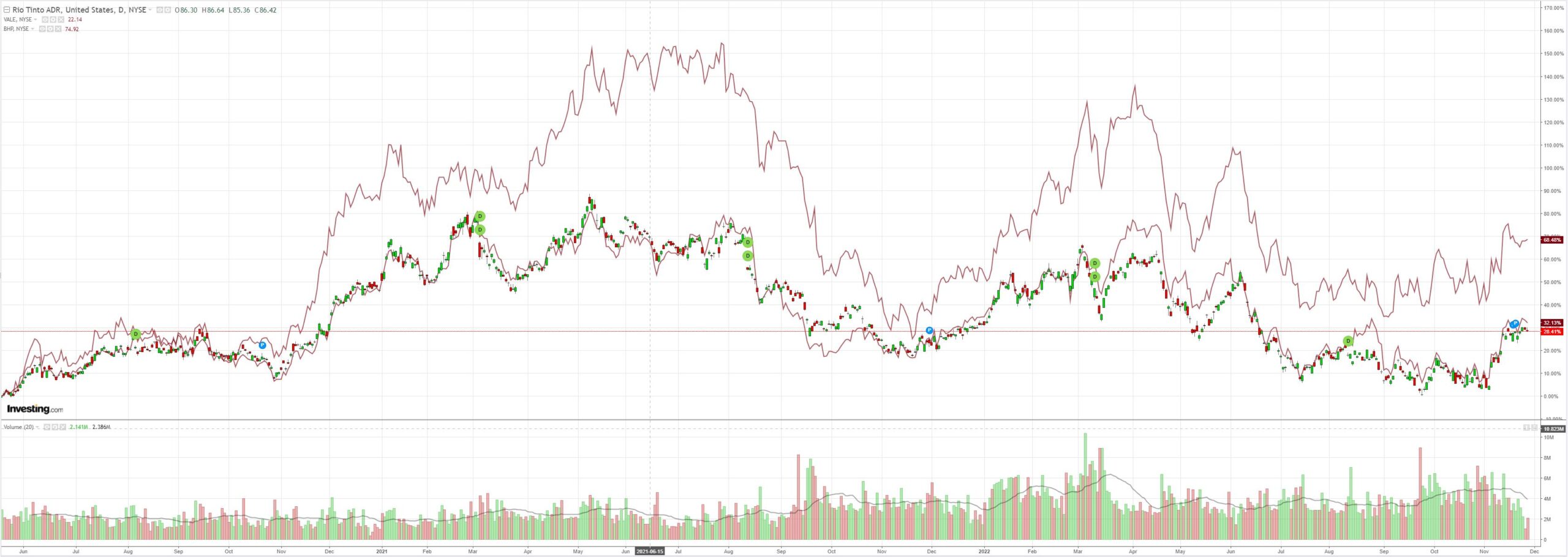

Big miners (NYSE:RIO) are clinging to the iron ore wild thing:

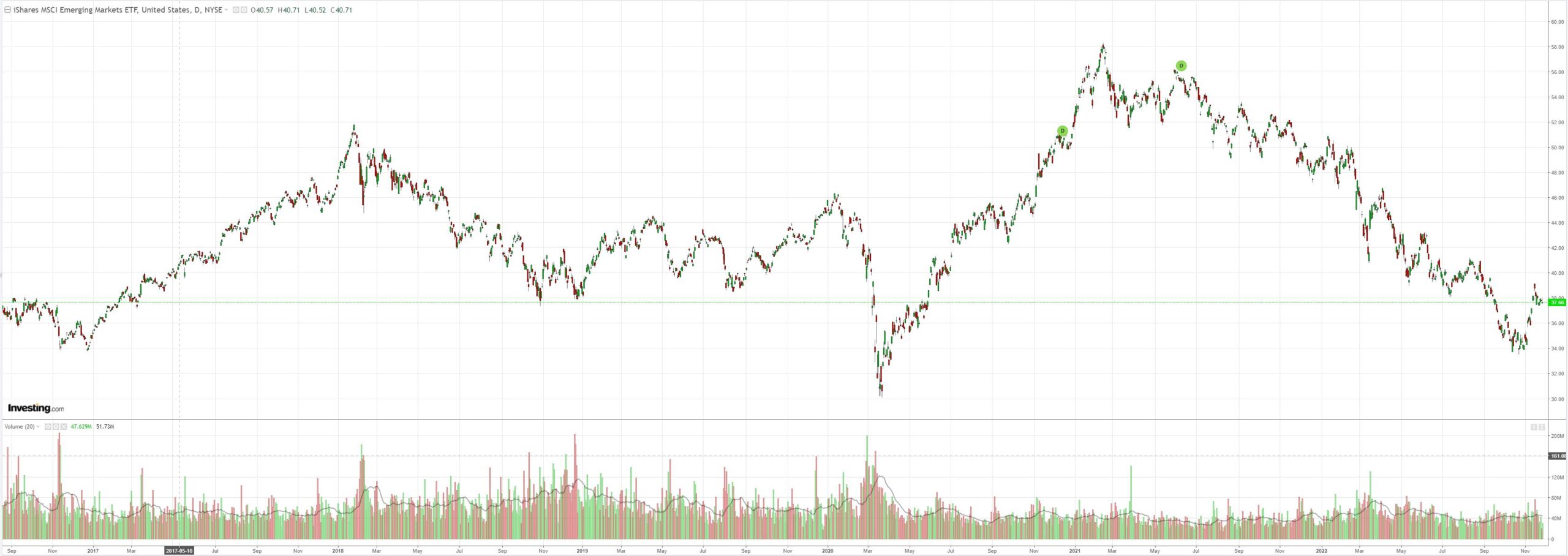

EM stock (NYSE:EEM) rebound done?

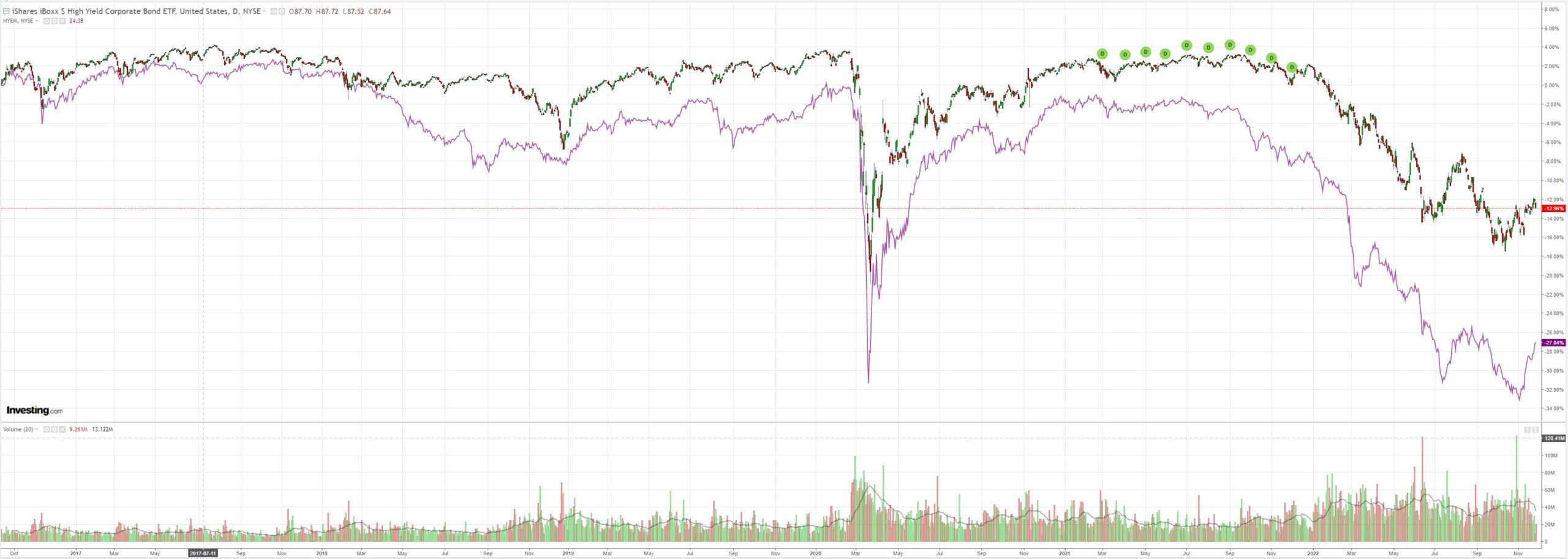

Still hope in junk (NYSE:HYG):

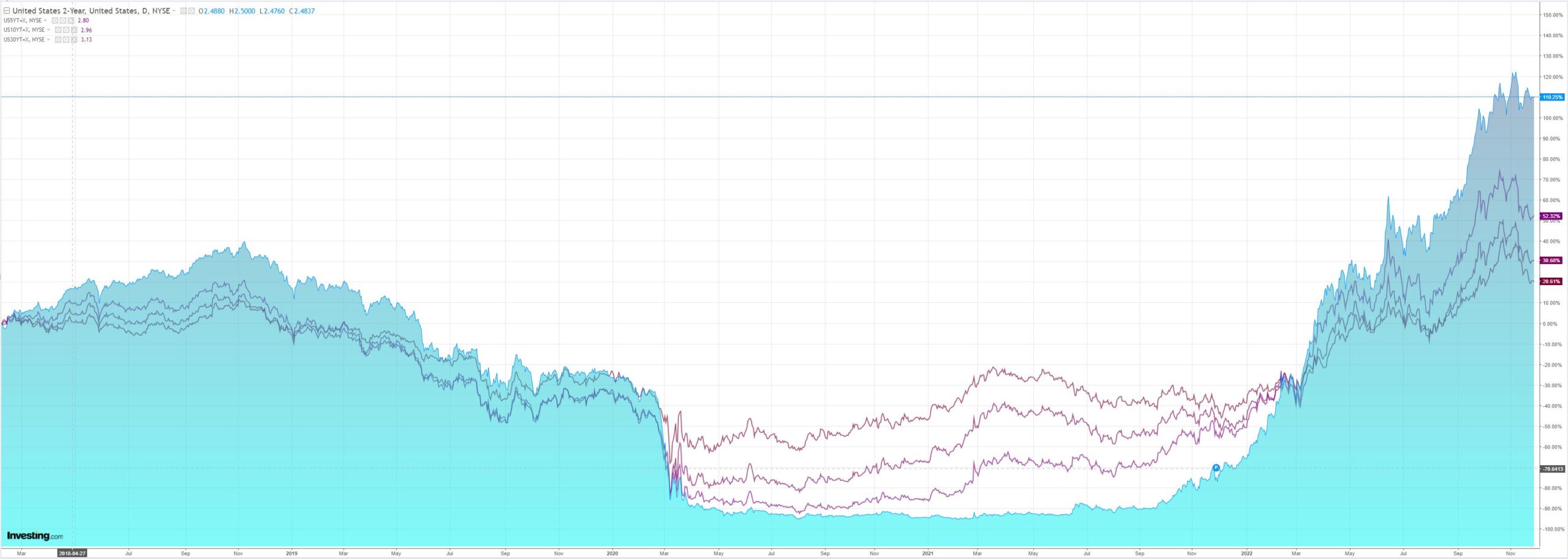

US curve inversion can’t find a shade of crimson deep enough:

Stocks puked:

The Fed rug pull that had to come arrived with James Bullard:

Federal Reserve Bank of St. Louis President James Bullard said financial markets are underestimating the chances that policymakers will need to be more aggressive next year in raising interest rates to curb inflation.

“There is still a heavy degree” of expectations that inflation will go away naturally, Bullard said Monday in a webcast interview with MarketWatch and Barron’s.

…Bullard on Monday reiterated his view that the Fed needs to at least reach the bottom of the 5% to 7% range to meet policymakers’ goal of being restrictive enough to stamp out inflation near a four-decade high.

More:

Federal Reserve Bank of New York president John Williams said interest rates need to rise further and stay high through next year but could be lowered during 2024.

“My baseline view is that we’re going to need to raise rates further from where we are today,” he said during a question-and-answer session following a speech to a virtual event hosted by the Economic Club of New York.

“I do think we’re going to need to keep restrictive policy in place for some time. I would expect that to continue through — at least through — next year.”

Remember that no Fed tightening cycle has ever peaked before the cash rate was above the rate of inflation. The cash rate is 4% and will be 5% by March. By then, annual inflation is likely to still be in the 5-5.5% range provided monthly keeps tanking.

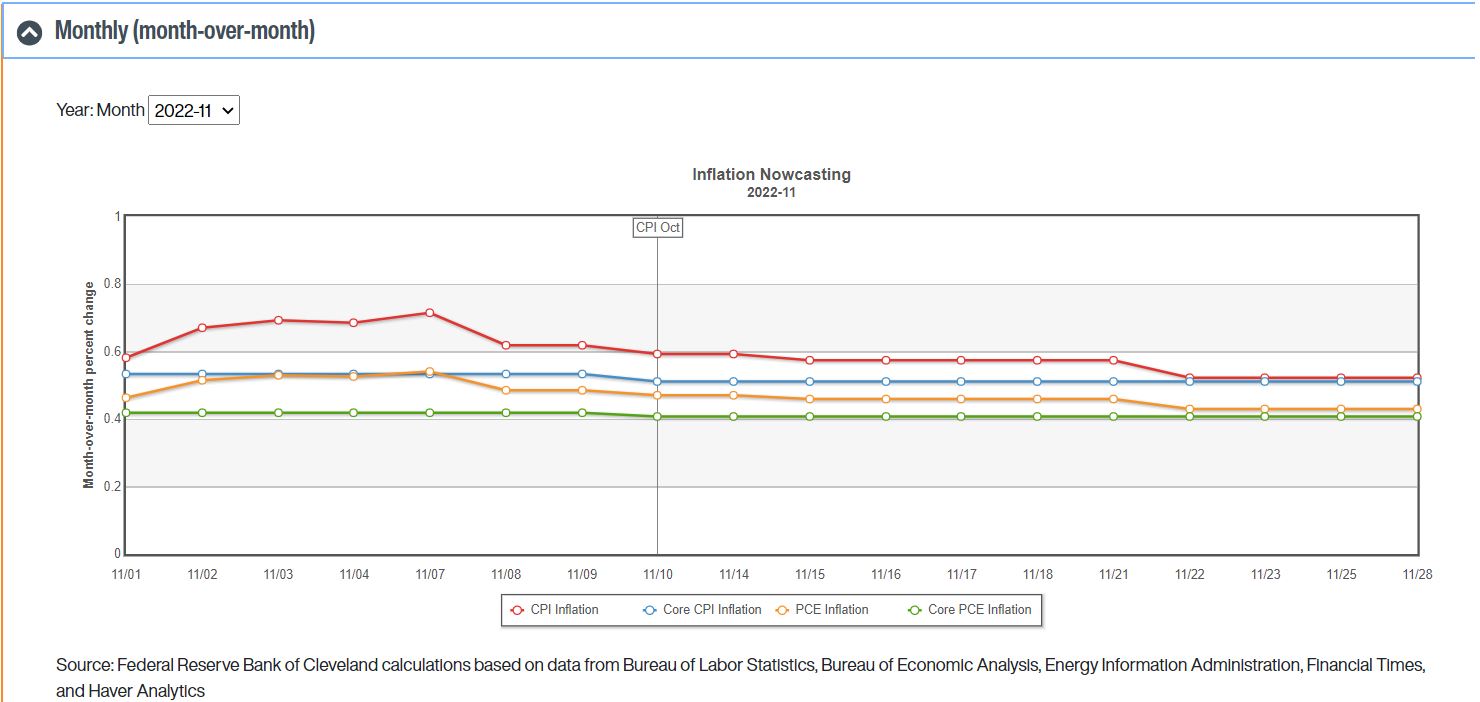

But, the bigger issue is still that CorePCE is not falling at all. Robust wages and services inflation needs greater job losses to cool:

The US terminal rate still appears to be above 5% and perhaps materially.

This is far higher than Australia with its crashing property prices, huge mortgage reset, and 2023 consumption crash.

AUD lower from here.