DXY is copping a post-FOMC shellacking:

Triggering an AUD mini-boom:

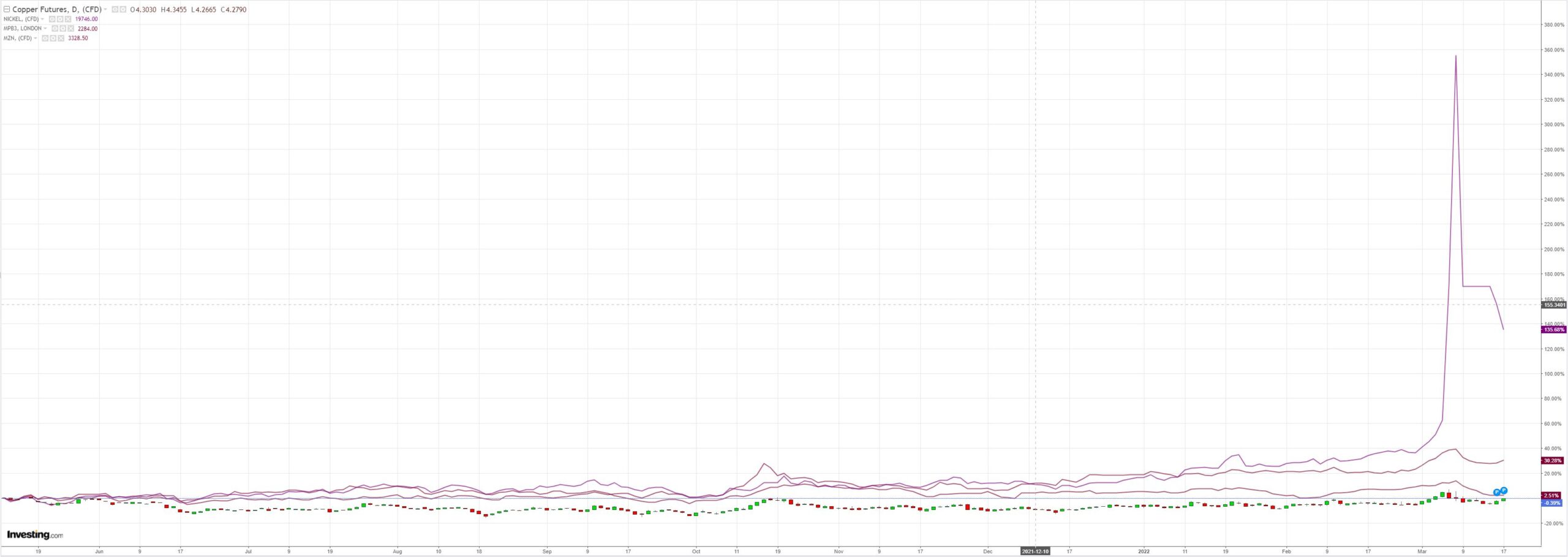

As commodities rebound:

Miners (LON:GLEN) popped:

EM stocks (NYSE:EEM) too:

Junk (NYSE:HYG) not so much:

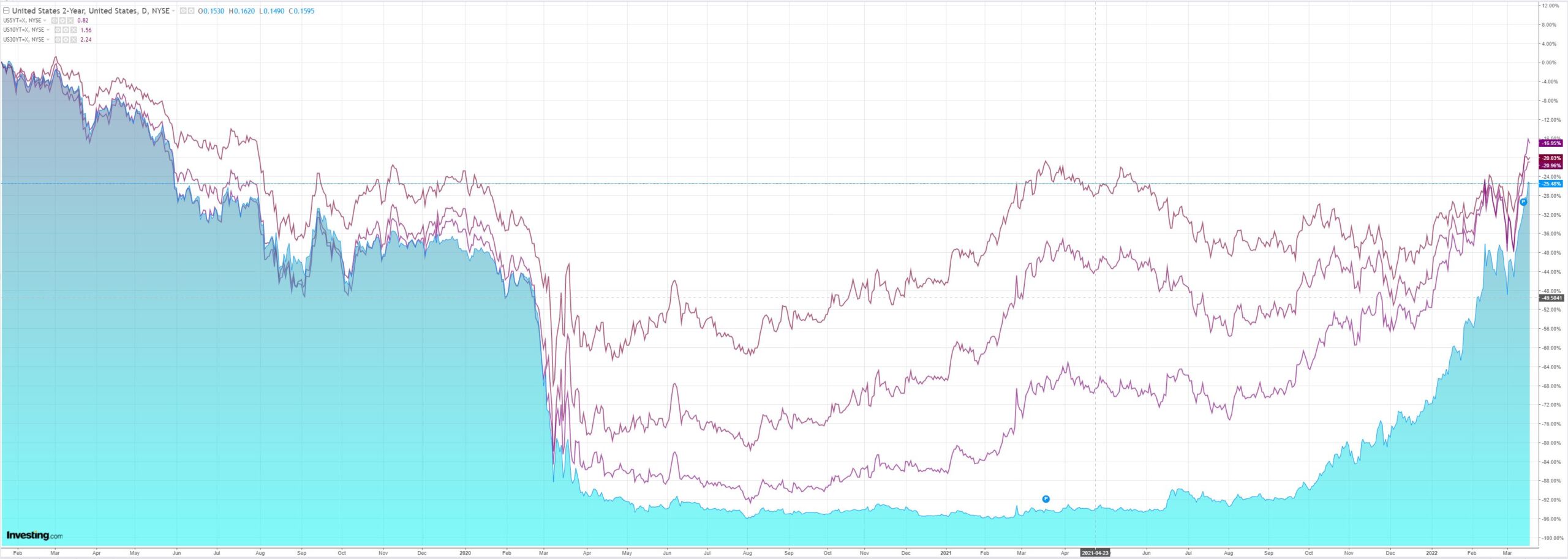

Curve flattened!

Stocks added to yesterday’s gains though slowed:

Westpac has the wrap:

Event Wrap

US industrial production in February rose 0.5%m/m (as expected). Manufacturing production was firm at +1.2%m/m (est. 1.0%m/m, prior +0.1%m/m). Philadelphia Fed business survey rose to 27.4 (est. 14.5, prior 16.0), with solid gains in new orders, employment, shipments and prices paid. However, the six-month outlook pulled back from 28.1 to 22.7. Weekly initial jobless claims were close to expectations at 214k and continuous claims at 1.419m. Building starts in February rose to 1.769m (est. 1.700m), with permits at 1.859m (est. 1.850m).

Eurozone CPI for February was finalised slightly higher at 5.9%y/y (prior 5.8%y/y), although core was unchanged.

The Bank of England raised its policy rate by 25bps to 0.75%, as was widely expected, but guidance was less hawkish than markets had expected, and one member (Cunliffe) dissented in favour of an on-hold decision. The statement tone was cautious regarding the impact of supply distortions and surging inflation on consumer and business confidence and activity.

Event Outlook

Japan: February’s CPI result is expected to move beyond pre-pandemic levels, highlighting the need for robust wages growth (market f/c: 0.9%yr).

Eur: Elevated import costs are set to sustain the European trade deficit (market f/c: -€9.0bn).

US: Another fall in existing home sales is anticipated for February as the strength in demand continues to outpace the rebuild of inventory (market f/c: -6.2%). The February leading index should meanwhile reflect the US’ robust economic momentum (market f/c: 0.3%). The FOMC’s Barkin will discuss the economic outlook; Bowman is due to speak too.

More “sell the fact” then. I thought the Fed was very hawkish so I do not expect it to last very long.

We are in the typical late-cycle period when everybody keeps dancing even though the music has stopped.

The AUD is one of those cavorting on tables amid the gawking onlookers.

We all know where that ends.