Street Calls of the Week

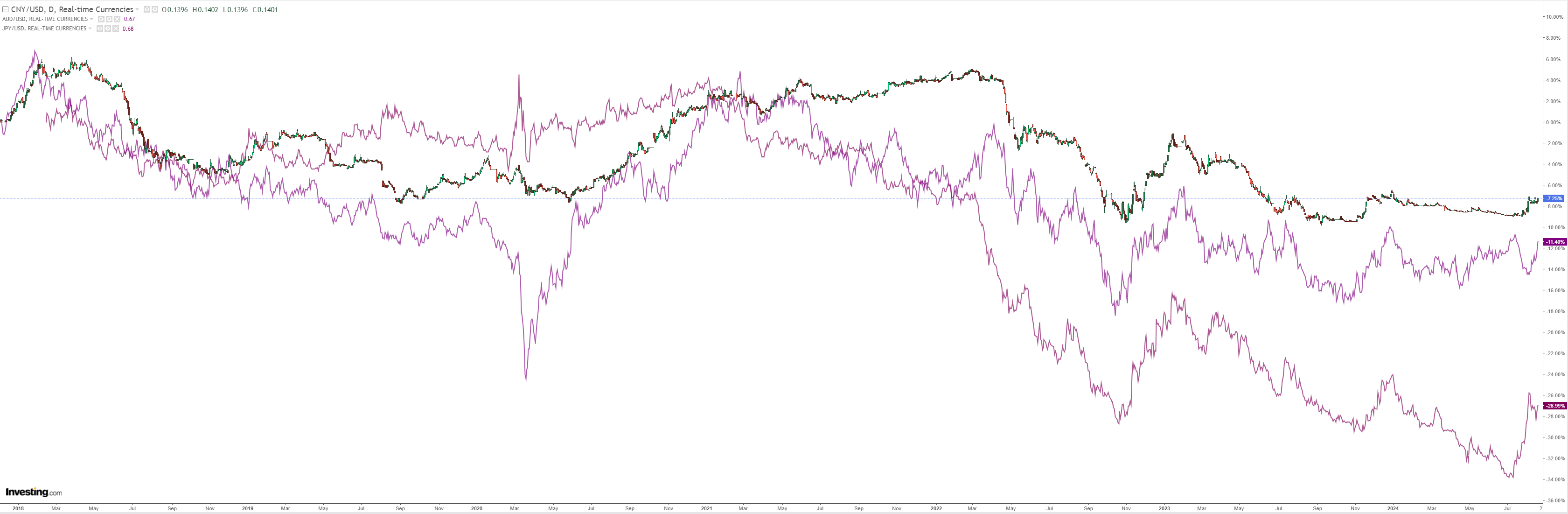

DXY is pricing Fed cuts:

AUD to the moon!

North Asia to the moon!

Only oil is earthbound:

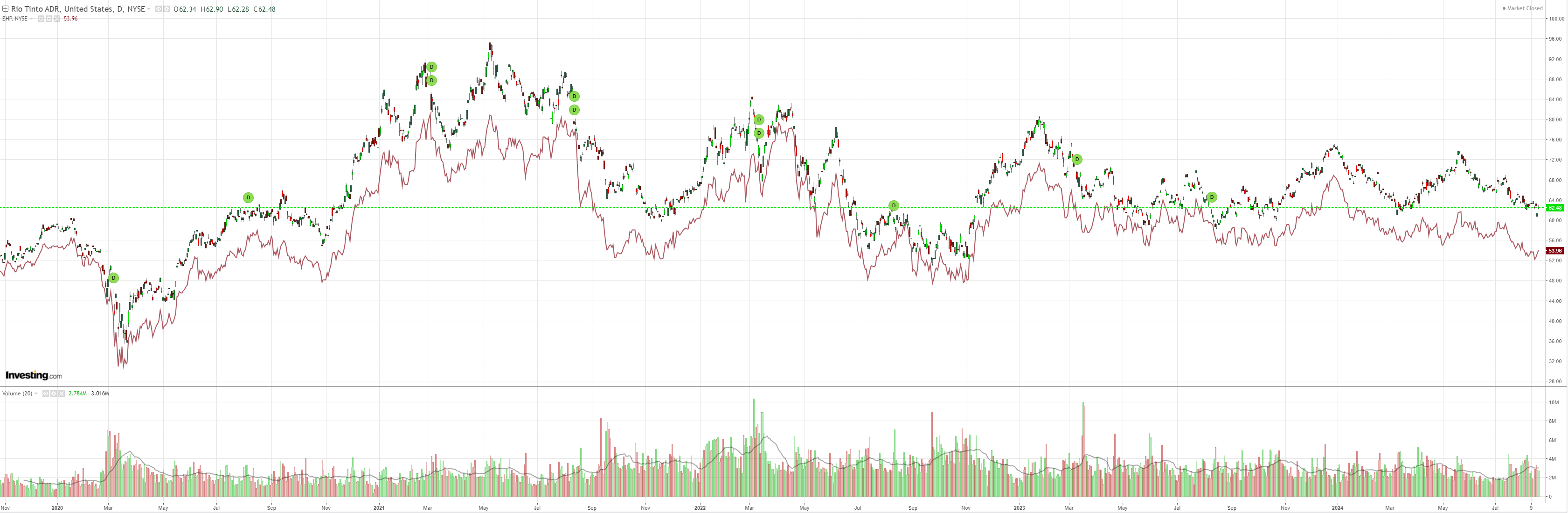

Commods to the moon!

Mining dead cat:

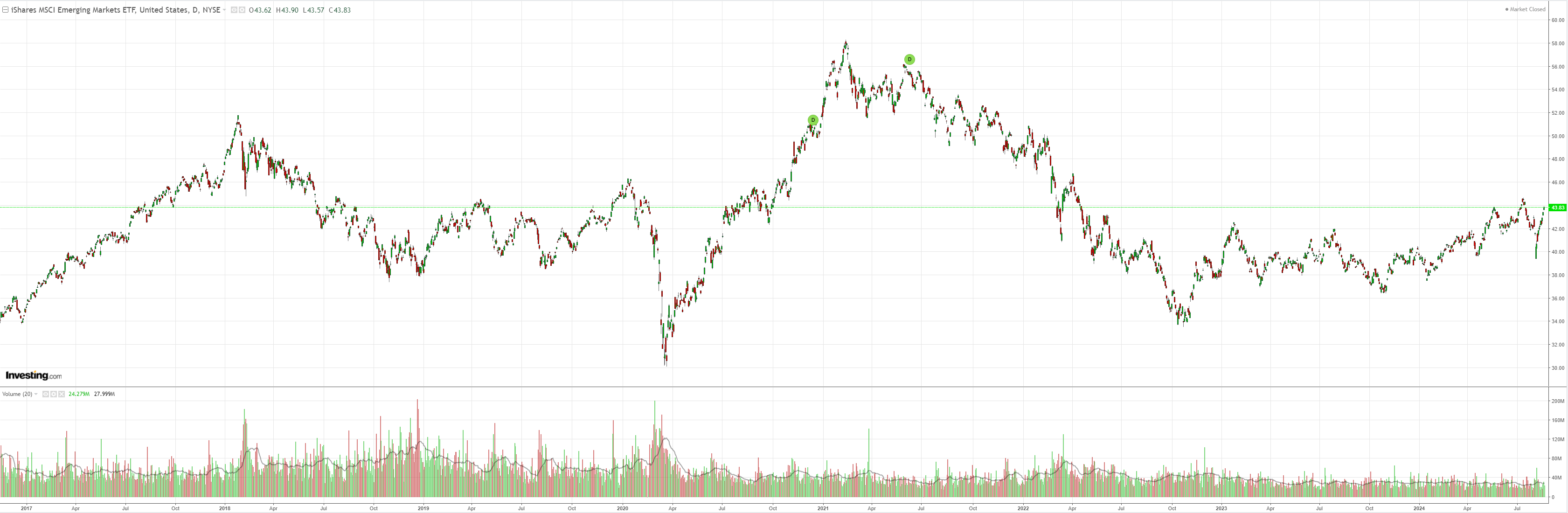

EM to the moon!

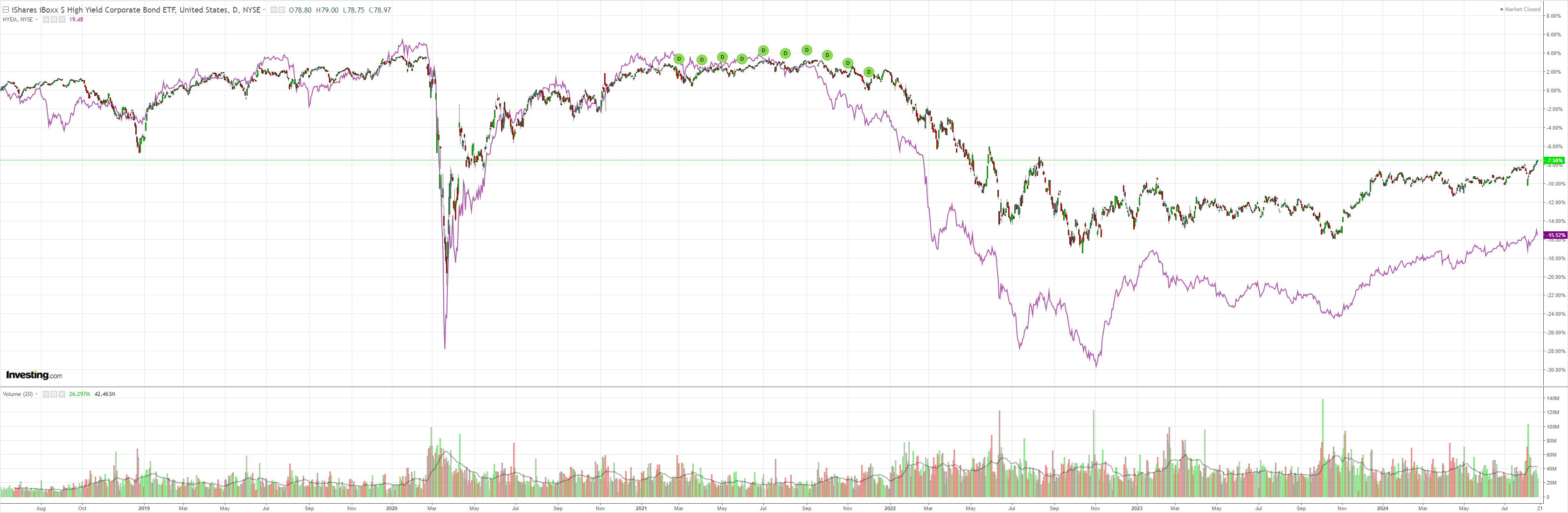

Junk spreads to the moon!

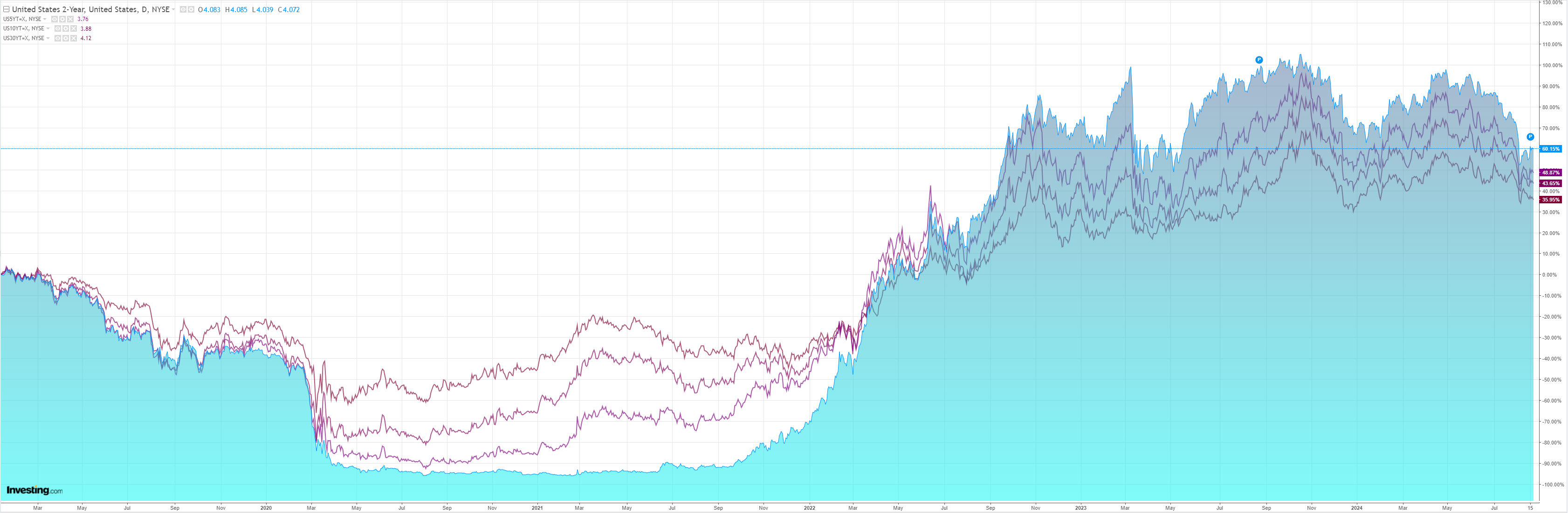

Bonds to the moon!

Stocks to the moon!

The question is, how far does DXY fall to support this automated reflation trade? Goldman:

Investors have been asking whether the wild swings relative to small data surprises over the past few weeks was the market catching up to the shifting macro backdrop, or if it was something more technical.

While clearly a mix of the two, our view is that it is more of the latter, which has created some opportunities in the stabilization bounce.

Last week we added some new carry trade recommendations sand discussed room for a tactical fad ein CHF, which we formalized this week with along GBP/CHFtrade recommendation.

But the Dollar has been mixed, for a couple of reasons.

First, the fundamental outlook has changed somewhat.

With clear evidence that the economy has slowed and the labor market has cooled, the US is ‘not so exceptional’ anymore.

Second, Fed cuts are likely to weigh on the Dollar to some extent, at least temporarily.

We see some parallels to last December, when the Fed’s signal of rate cuts caused a brief, outsized reaction in FX markets in anticipation of shifting hedge ratios and carry profiles.

That might again be short-lived if the cutting cycle proves to be more abbreviated than current market pricing, but it is hard to be an unfettered Dollar bull at least until the scope of policy adjustment becomes clearer.

…While the market has priced a faster Fed pivot, we still think other major central banks would ease policy more if the Fed gave them space to do so.

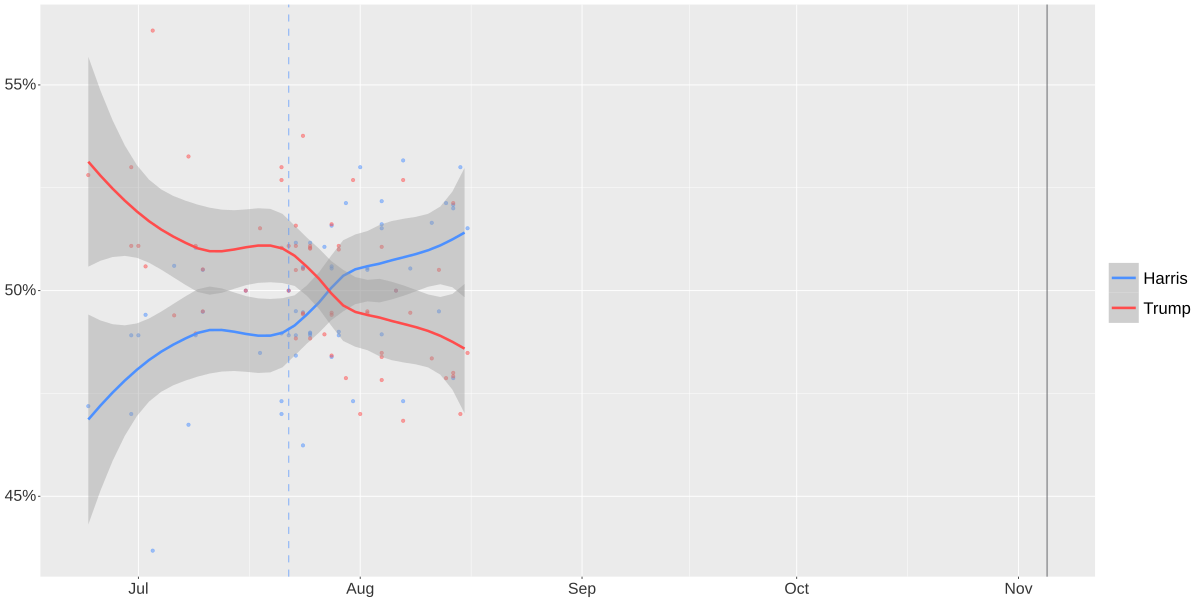

And, even though the US presidential race has also tightened, we still think trade policy uncertainty will weigh on portfolio flows and keep the Dollar somewhat elevated in the months ahead.

We’ll need to see a rally in Trump polling for that and it is still going the other way:

I am on board with a relatively shallow DXY weakness cycle as China and Europe fade away but right now there is further to go.

Hence, AUD to the moon!