Street Calls of the Week

The DXY correction continues:

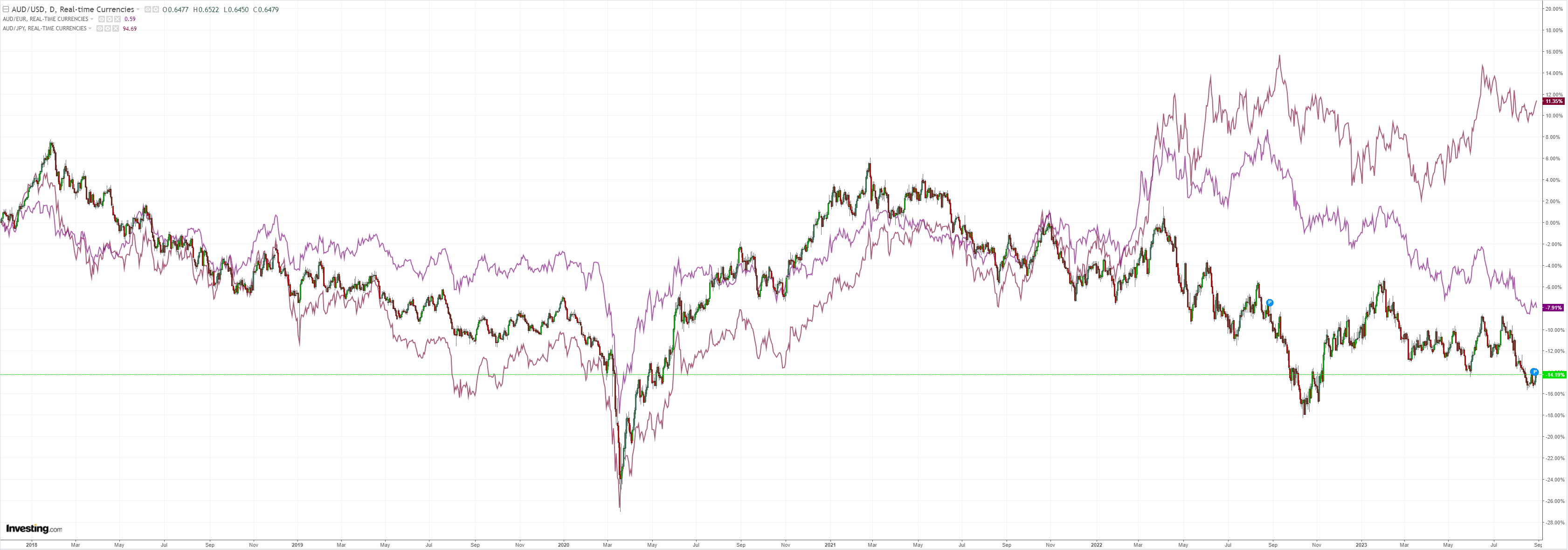

AUD ignored it:

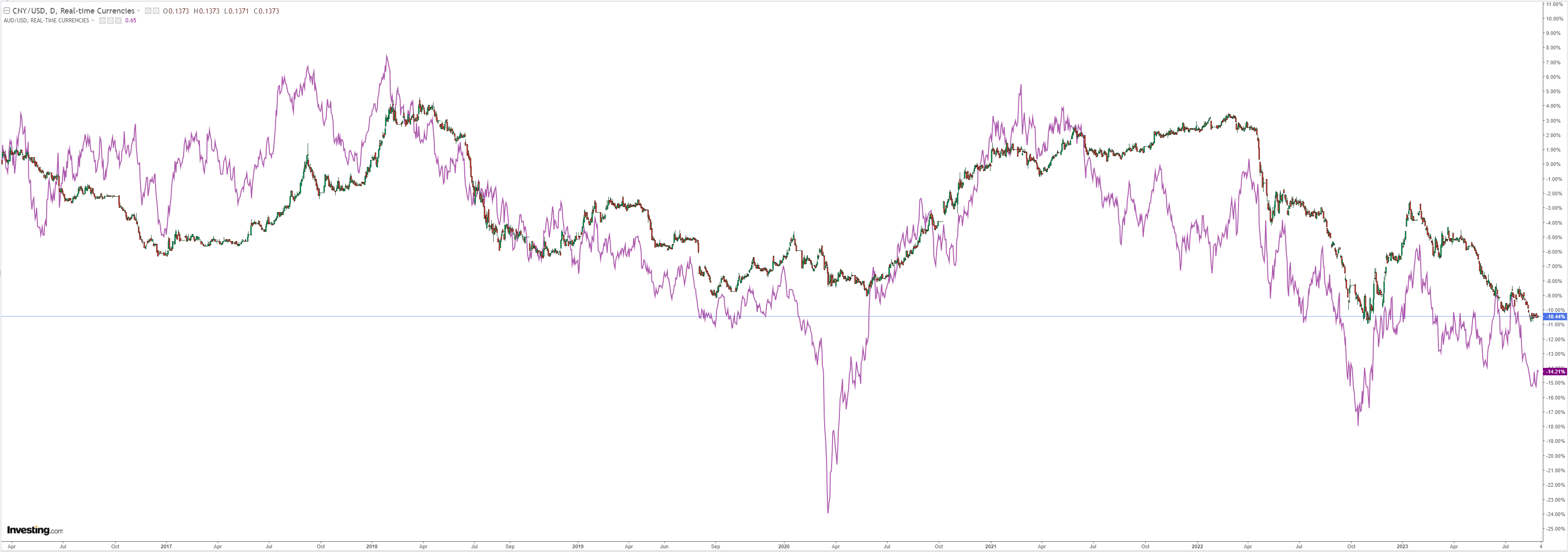

It is anchored to a sunken yuan:

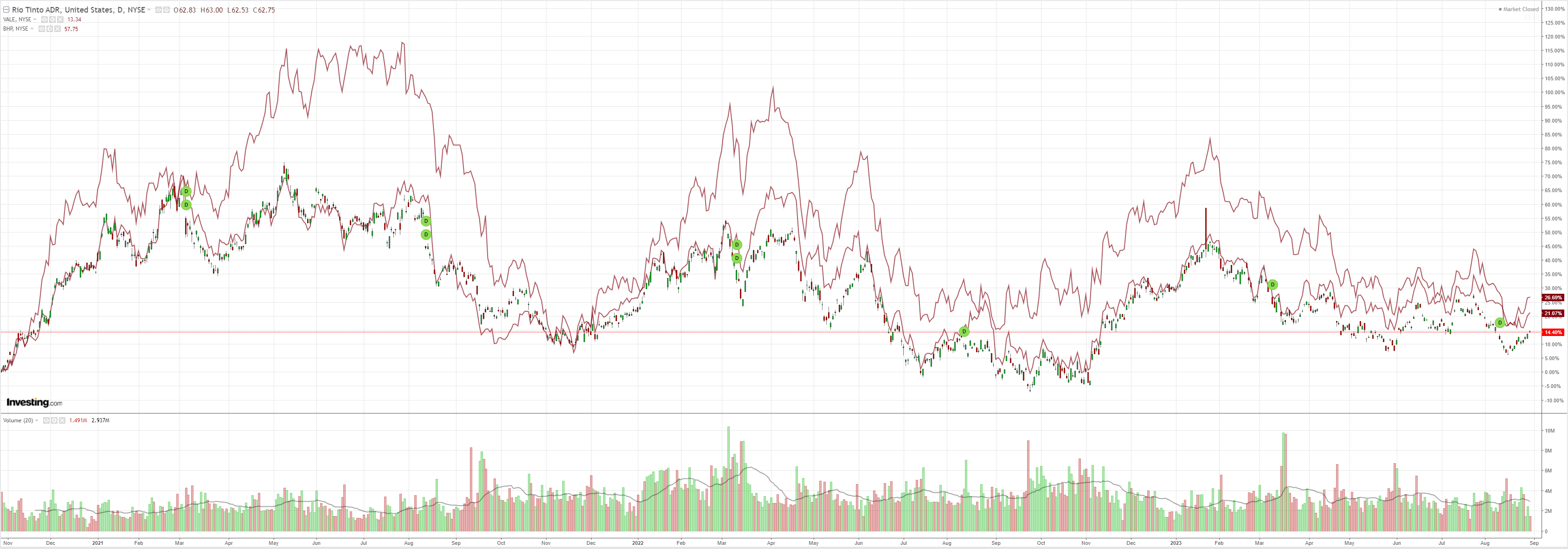

Commodities lifted:

Miners a little:

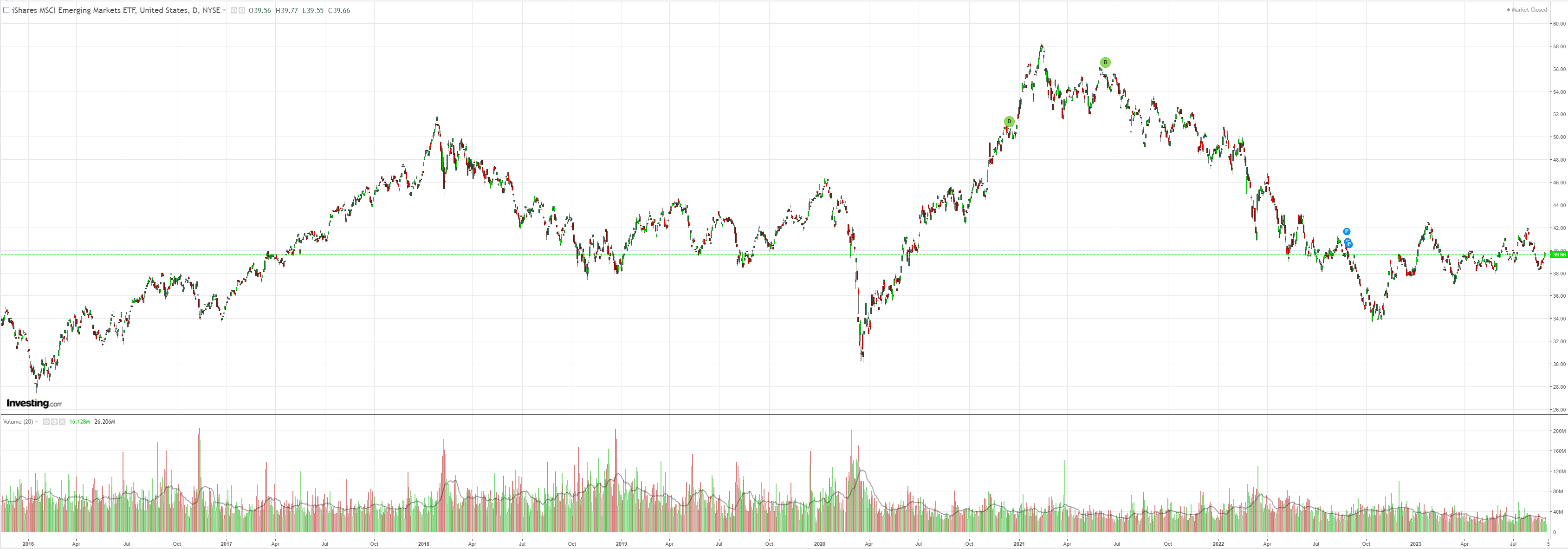

EM dead:

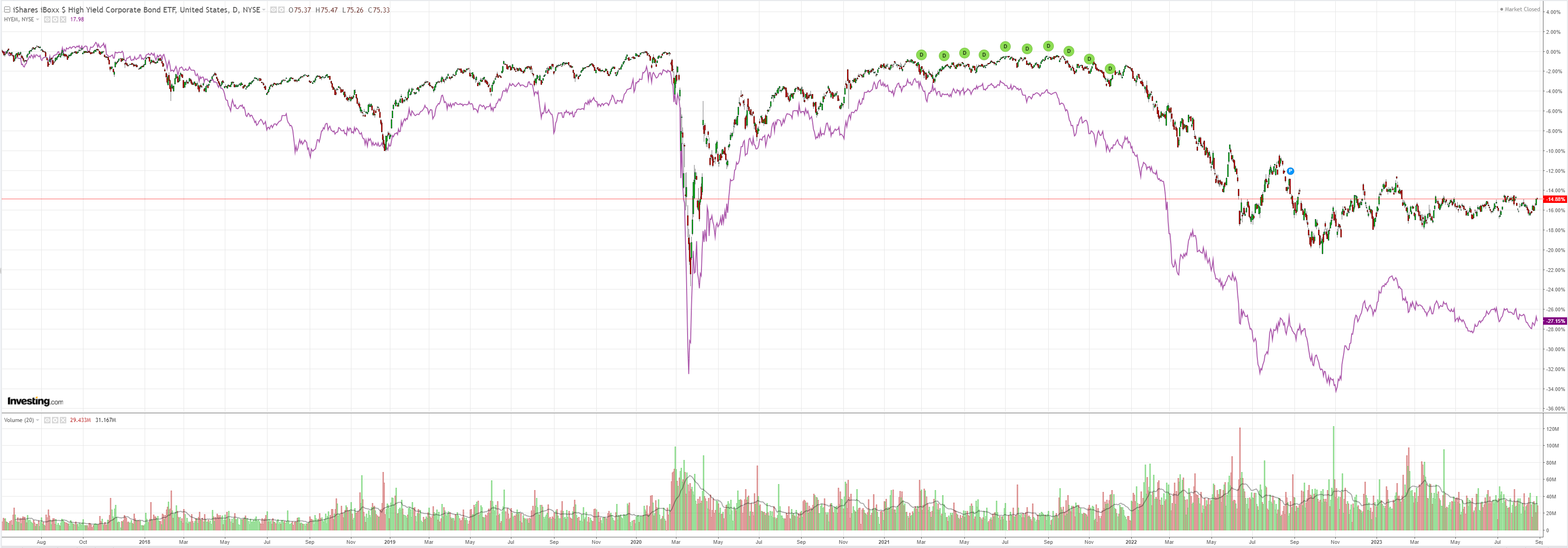

Junk fail:

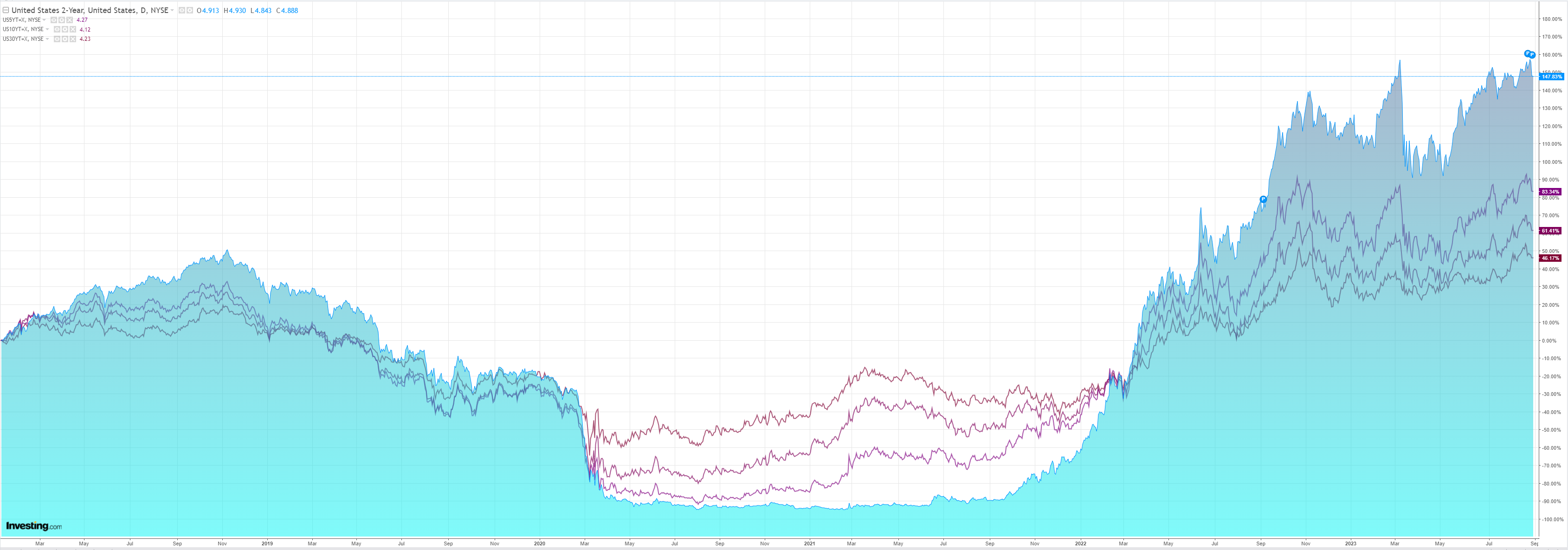

Despite Treasury bull steepening:

Broken stocks range trade with robots:

US data was on the soft side. Goldman:

Real GDP growth was revised down by three tenths to +2.1%annualized in the second quarter, below expectations and driven by weaker inventory and net trade contributions. Gross domestic income rebounded modestly following gdeclines in Q4 and Q1. We boosted our Q3 GDP tracking estimate by one tenth to+2.7% (qoq ar) and our Q3 domestic final sales growth forecast by the same amount to +2.8%. We left our month-over-month July core PCE inflation estimate unchanged at +0.21%, now corresponding to a year-over-year rate of +4.20%, and our headline PCE inflation estimate unchanged at +0.21% (mom), corresponding to a year-over-year rate of +3.25%. According to the ADP (NASDAQ:ADP) report, private sector employment rose by 177k in August, 18k below consensus expectations. The August ADP report is consistent with the sequential softness in other alternative employment indicators, and we left our nonfarm payroll forecast unchanged at a below-consensus +149k ahead of Friday’s release. Wholesale inventories declined slightly in July, but beat expectations for a larger decline, while the goods trade deficit widened more than consensus expectations in July. Pending home sales increased 0.9% month-over-month in July, against consensus expectations for a 1.0% decline.

That was enough to continue the natural correction in the DXY rebound. There may be a little more ahead, most notably as NFP comes out Friday, but I still don’t see it weakening far.

European inflation was still quite strong, so its recession will have to deepen, and China hasn’t stimulated a brass razoo. Nor has CNY lifted at all as a battle royal between the PBoC and markets is underway.

So DXY remains the cleanest dirty shirt for now, and AUD is anchored to the sunken CNY.