Street Calls of the Week

DXY is grinding higher:

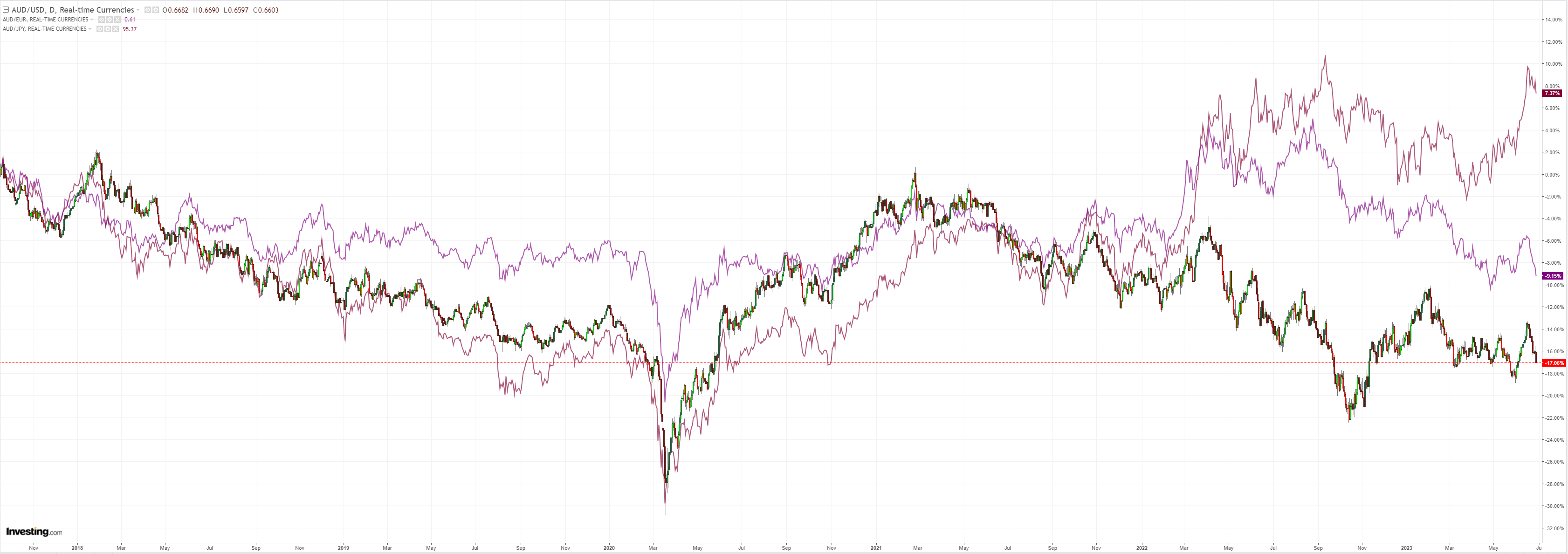

AUD was pounded lower against USD and EUR:

Oil is cooked and gold flagging:

Dirt was hosed:

Big miners (NYSE:RIO) too:

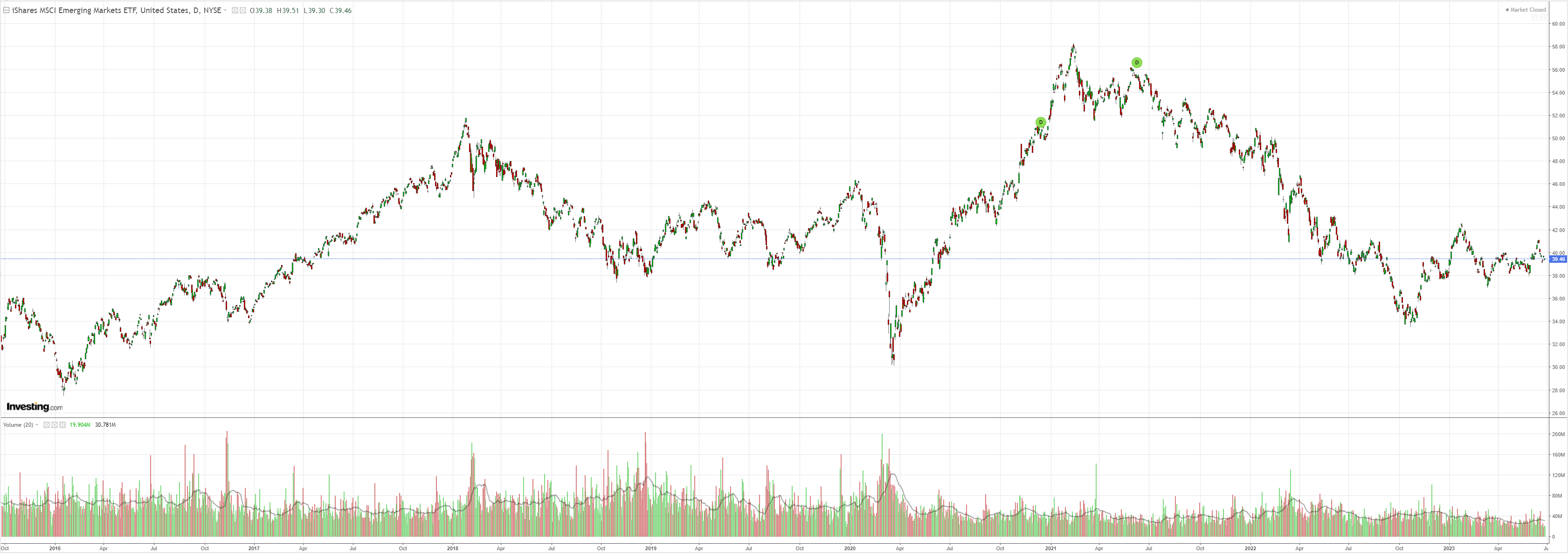

EM stocks (NYSE:EEM) are back in the mud:

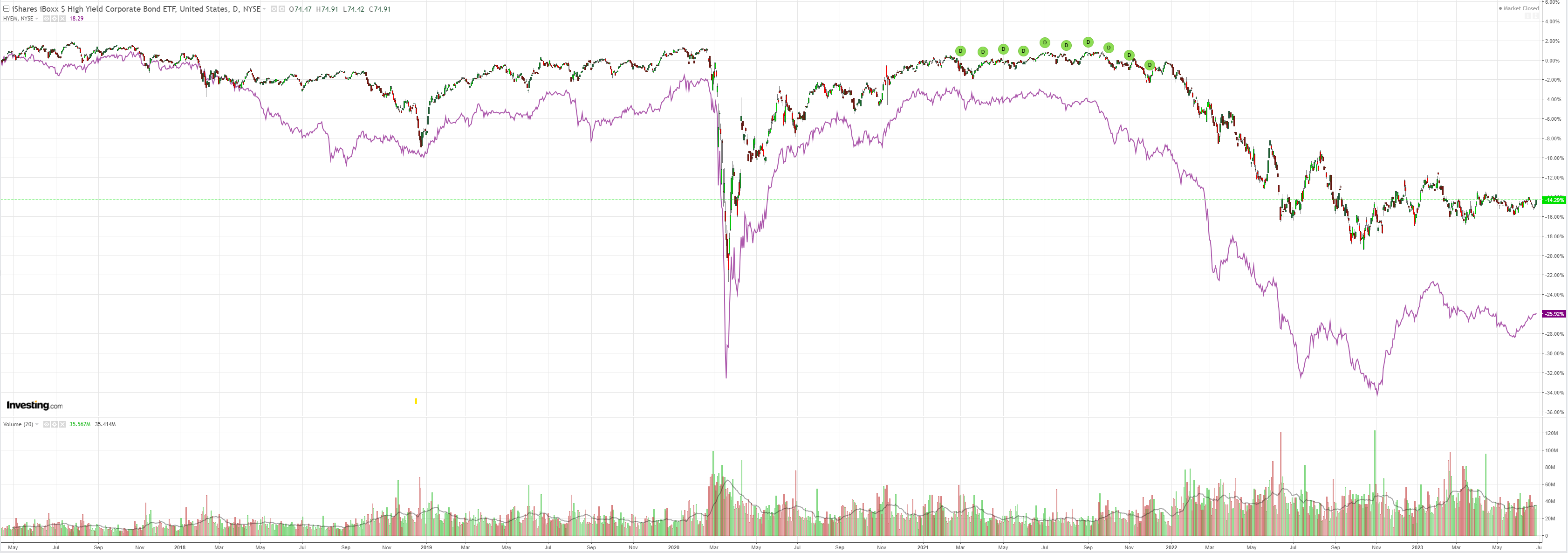

Though junk (NYSE:HYG) is better:

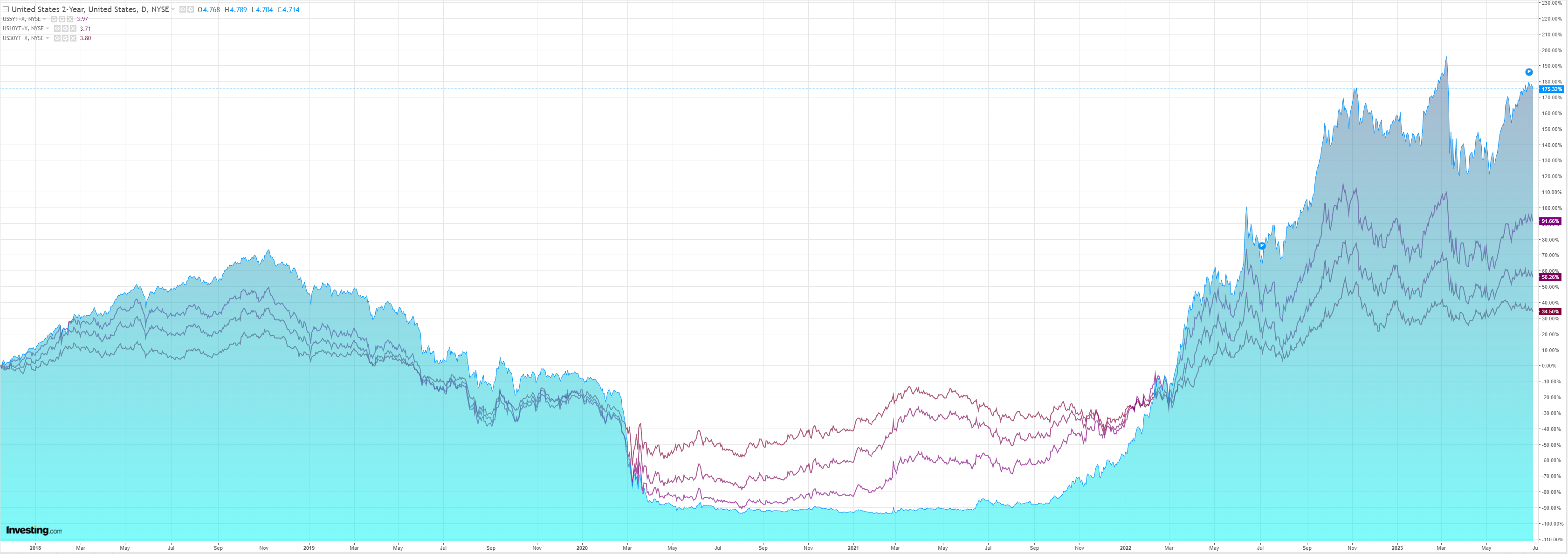

US yields eased:

As stocks did nothing:

The US economy is leading the pack again and the Fed is getting restive:

Federal Reserve chairman Jerome Powell signalled policymakers could potentially raise interest rates in July and September to curb persistent price pressures and cool a surprisingly resilient US labour market.

Asked whether Fed officials now anticipate they will raise rates every other meeting after skipping a hike this month, Powell said that may or may not happen and that he wouldn’t rule out consecutive rate hikes. He reiterated that most policymakers’ forecasts show they expect to hike at least two more times this year.

“Although policy is restrictive it may not be restrictive enough and it has not been restrictive for long enough,” Powell said on Wednesday during a panel hosted by the European Central Bank for a forum in Sintra, Portugal.

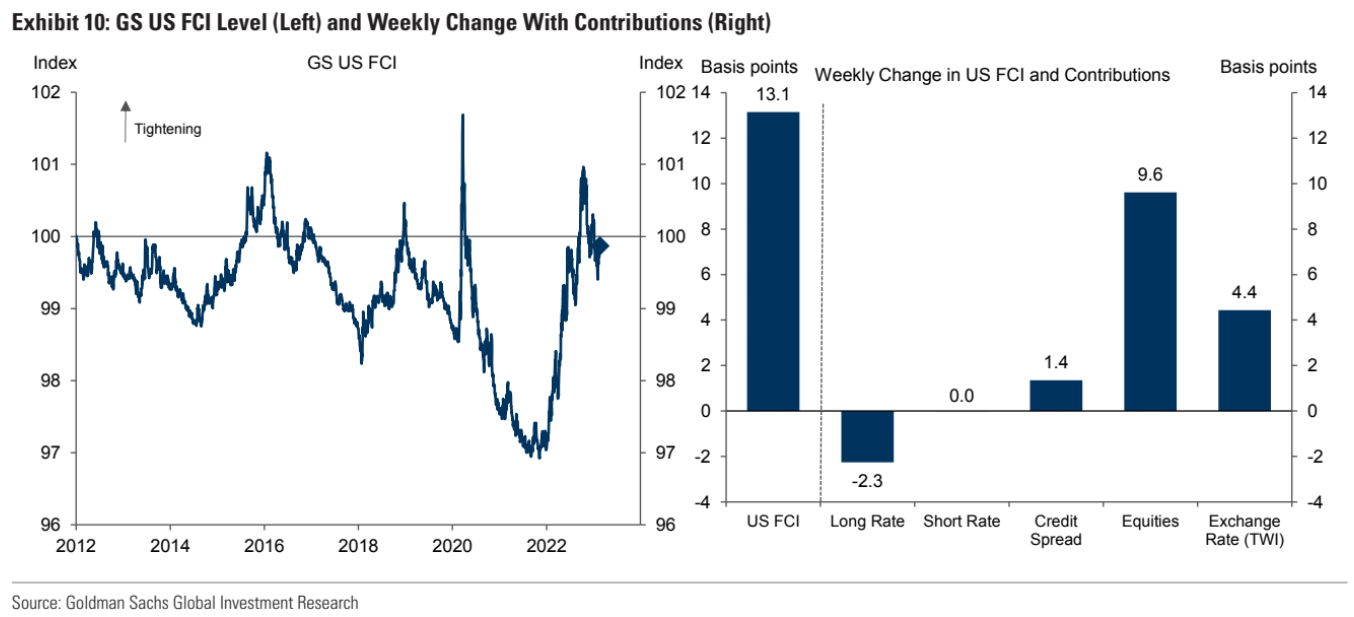

The drivers for me are obvious. The AI-bubble stock market delivers huge and swift wealth benefits to consumers. This is neatly captured in the Goldman Financial Conditions Index (FCI) which keeps easing despite the Fed tightening (though the recent selloff has helped):

As the stock market fights the Fed, the real economy keeps getting goosed, driving the Fed higher until such a point that something big enough breaks.

Either the AI bubble implodes by itself or the other likely candidate is bank credit as another round of tightening approaches.

There’s nothing bullish for AUD in this setup.