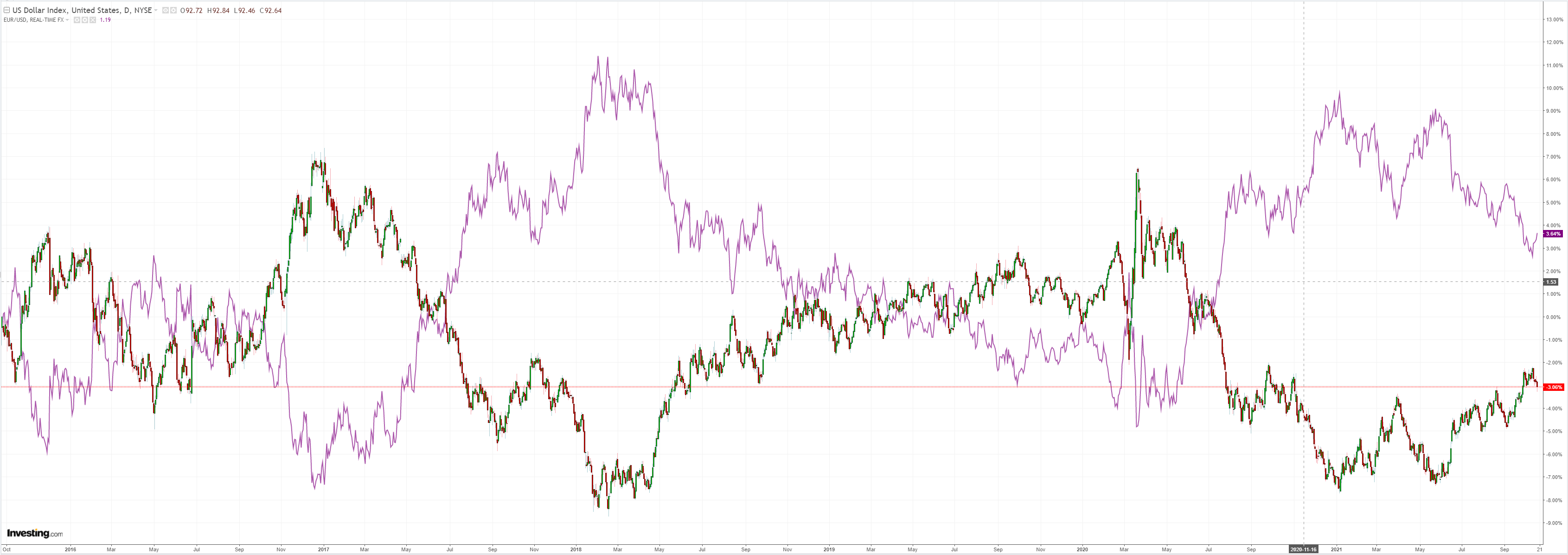

DXY is sinking just because. EUR is off the bottom:

The Australian dollar is one way energy rocket to the moon:

Oil won’t stop. Gold can’t start:

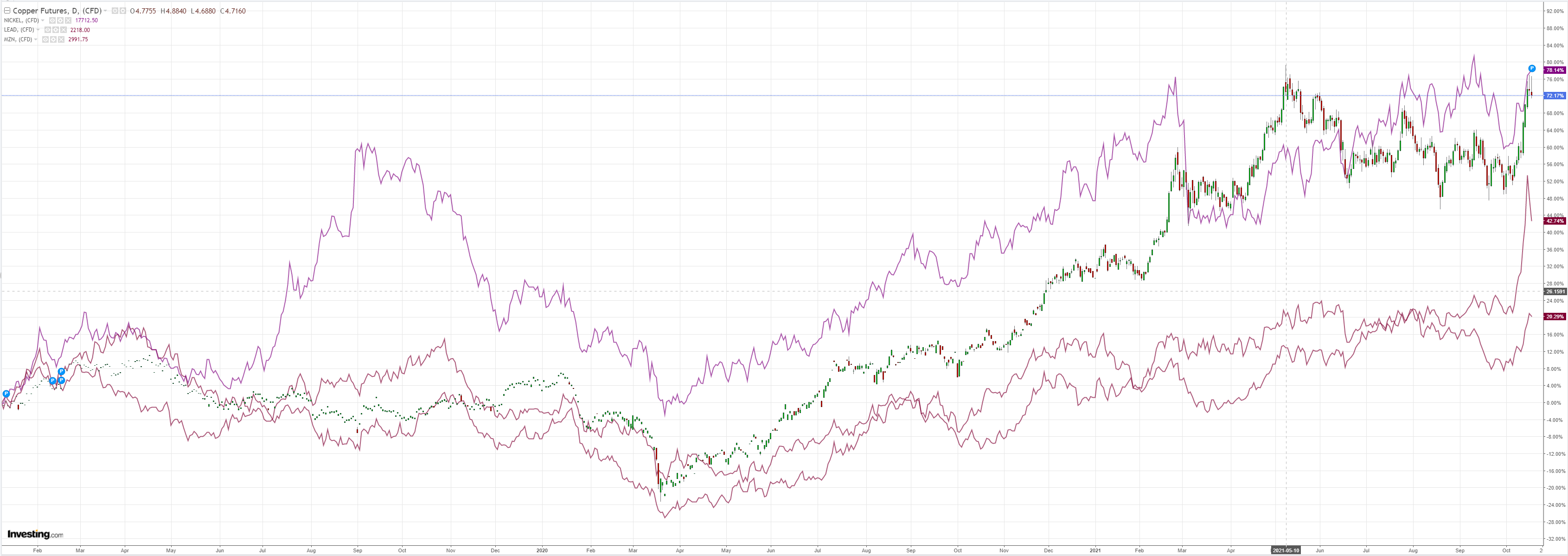

Base metals flamed out though:

As China dropped the jackboot on Coal and Glencore PLC (LON:GLEN):

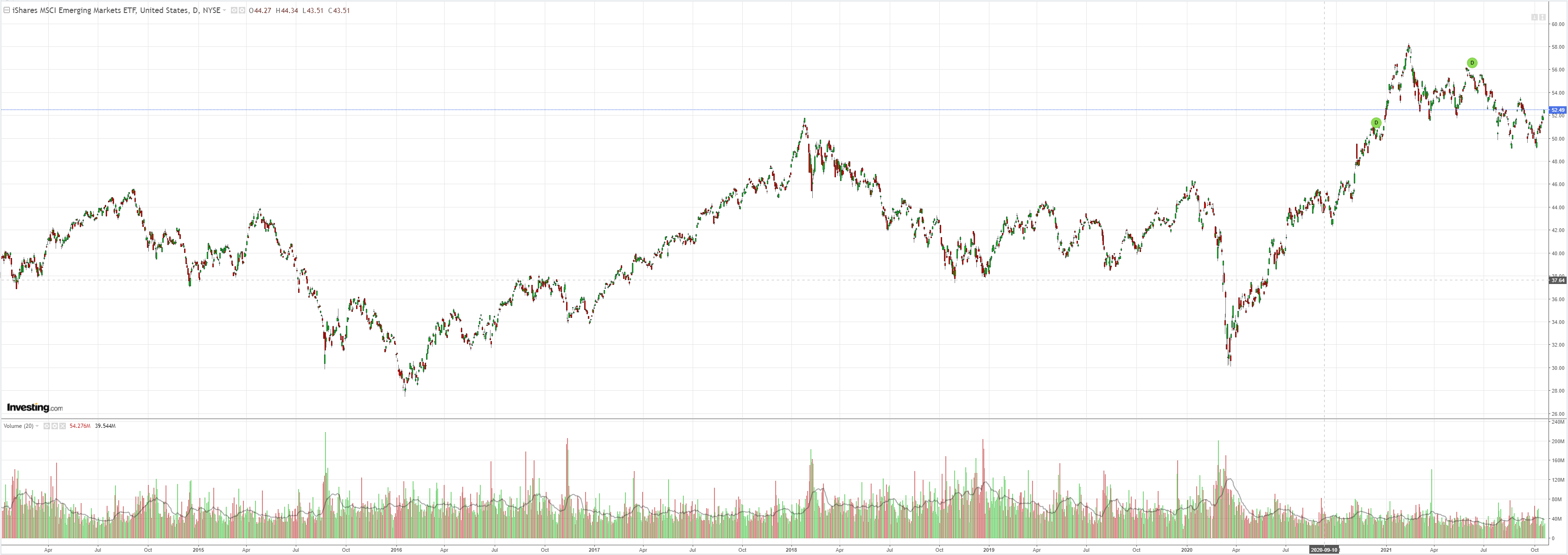

EM stocks are back, baby!

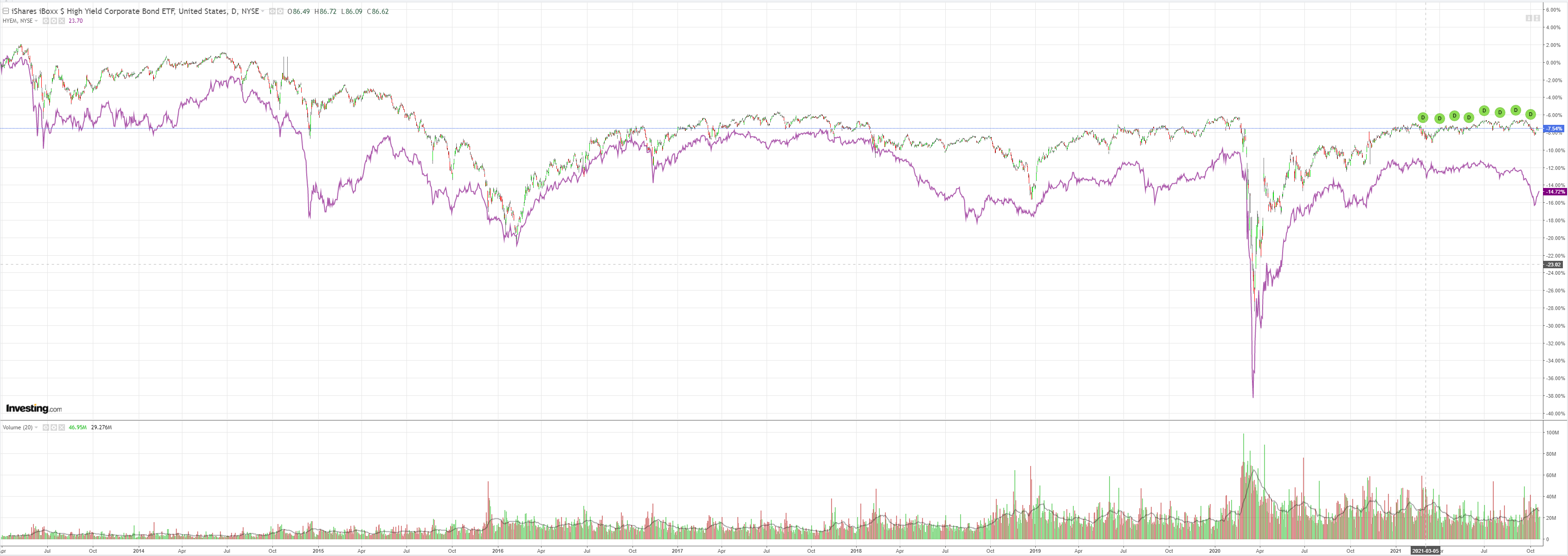

And junk:

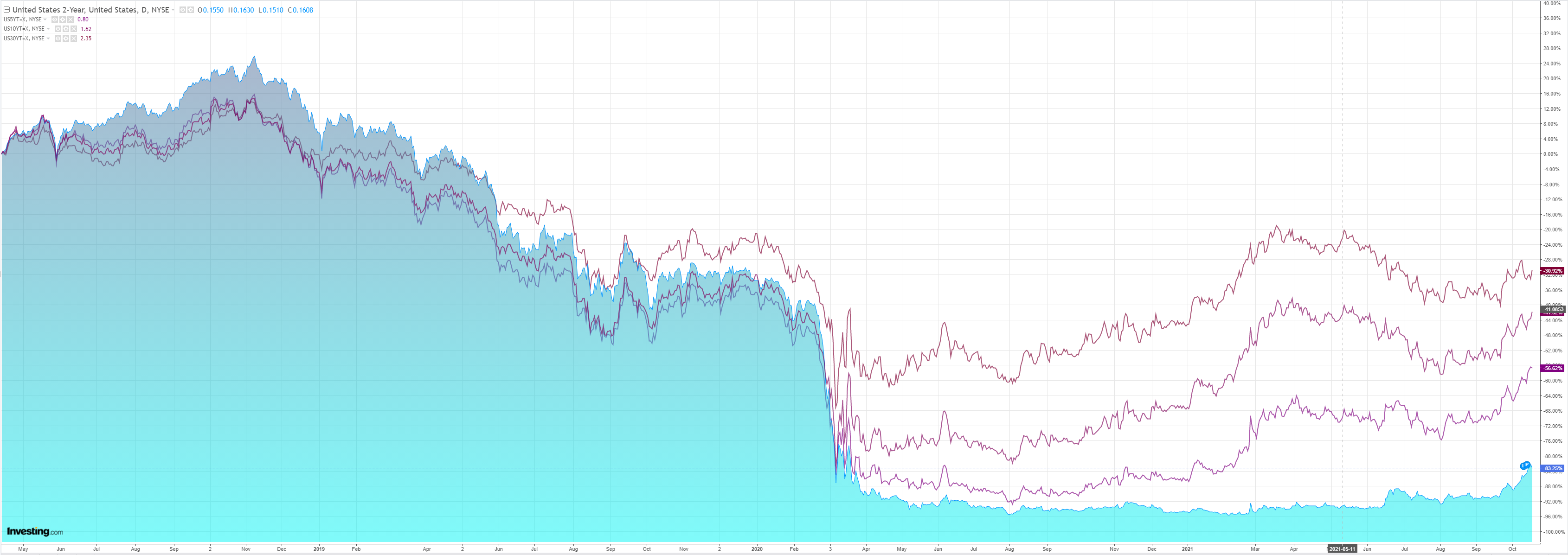

The US curve steepened:

And stocks partied:

Westpac has the wrap:

Event Wrap

US building permits and starts in September fell more than expected. Starts pulled back to 1.555m (est. 1.610m, prior 1.580m revised from 1.615m), and permits fell to 1.589mn (est. 1.68mn, prior revised to 1.721mn from 1.728mn). At play are shortages of construction materials and labour, with a heavy backlog of construction still to start. Despite the misses, core single family homes remained firm, the data still suggesting a very strong construction pipeline.

FOMC member Bowman noted a couple of factors that could be drags on the economy. She worries that lingering effects from the pandemic could have long-lasting implications for women’s job opportunities. Childcare availability may prevent women from getting back to work, or those who took reduced hours could be in weaker positions for advancement. Early retirement has also weighed on the labour market, and the loss of workers over 55 will limit productivity capacity. In Q&A she said inflation may be longer lasting than expected. Barkin said the need for workers has seen wages increase, especially for entry level positions and those at the lower end of the pay scale. He cited several barriers to employment, including skill mismatches, family care, health reasons, and incentives.

The ECB’s Villeroy, Centero, Rehn and Lane collectively spoke of slack in the region’s economy, low core inflation, the need for accommodation, and that market pricing was out of line with ECB guidance and that there is little chance of a rate move in 2022. There were also comments about the potential flexibility of APP (once PEPP expires at end 1Q).

Event Outlook

Australia: The Westpac-MI leading index fell from 1.4% in July to 0.5% in August. Delta restrictions and global uncertainty are expected to again be significant negatives in September.

Europe/UK: Annual CPI inflation in each jurisdiction is expected to be confirmed around 3%yr in September.

US: The latest Fed Beige book will provide a qualitative view of conditions across the 12 Fed districts. The FOMC’s Quarles will speak on the outlook. Bostic, Kashkari, Evans and Bullard appear too.

Credit Agricole (PA:CAGR) has some analysis:

The RBA Minutes suggest the central bank is looking for a low-inflation recovery. The RBA expects strong rebounds in household consumption and employment growth once Covid restrictions are lifted and these restrictions are being lifted earlier than the RBA expected. The RBA still expects GDP to return to its pre-delta path (trend growth) in H2 22,but it believes Australia will experience lower inflation relative to other countries experiencing similar economic recoveries. Supply-chain blockages are not having as large an impact on Australia’s CPI. Australia’s wages growth was weak before the pandemic (unlike in the US and UK) and so it will take longer for this growth to recover and accelerate to the level required to push inflation sustainably into the RBA’s 2-3% inflation target band. By the RBA’s own calculations, wages growth needs to accelerate above 4% and this will take until 2024. The Minutes also highlight that Australia’s hot housing market will not push the RBA into raising rates. Board members believe macroprudential measures are better suited to dealing with the systemic risks around the housing market. While rate hikes would lead to lower housing prices and credit growth, they would also see fewer jobs and lower wages growth. This would obstruct the path to the RBA’s goals of full employment and inflation sustainably within the target range. We continue to think the RBA and RBNZ are about to experience a historically long and large policy divergence…

I completely agree with the RBA on this. In fact, once the energy bubble bursts and takes down the commodity complex through 2022, a giant income suckhole will open under the economy and wages plus inflation will be the first to be drained away.

The AUD is a one-way ticket to ride the energy bubble but watch out when it bursts!