DXY is up and away:

Confirming the end of the bear market rally is the forex crosses, notably the JPY flameout:

Oil is the culprit. The Fed must end it:

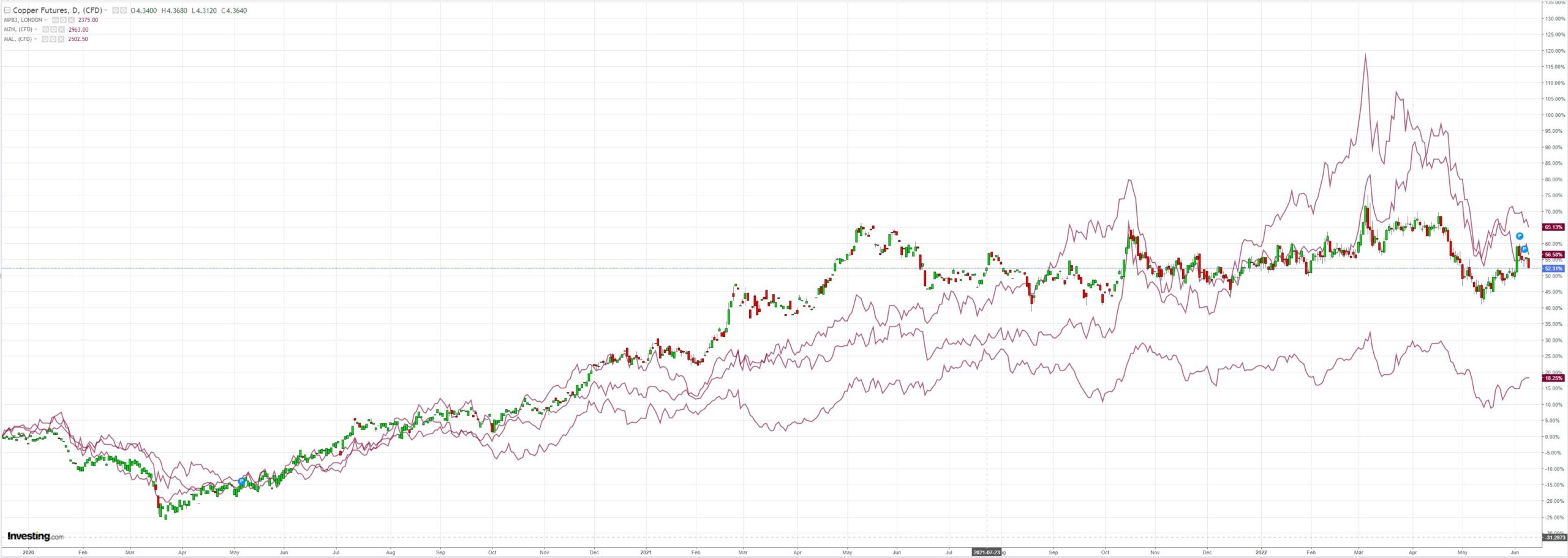

Metals being eaten now:

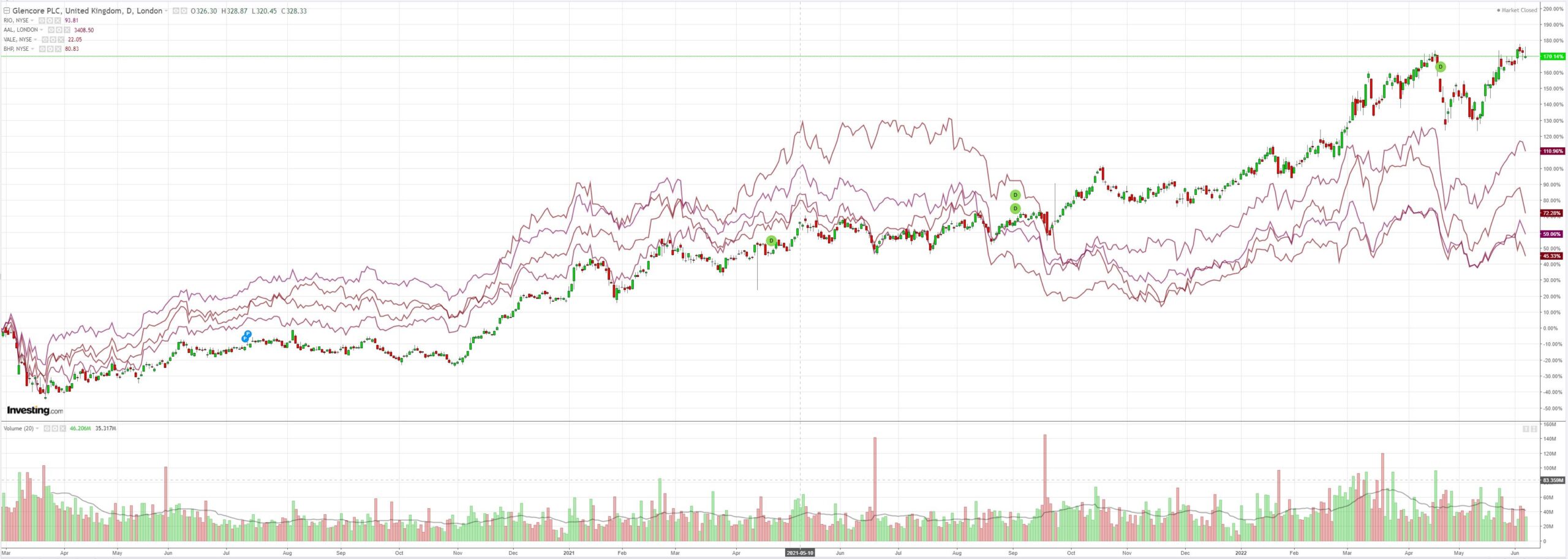

Miners (LON:GLEN) too:

Brace for new lows on EM stocks (NYSE:EEM):

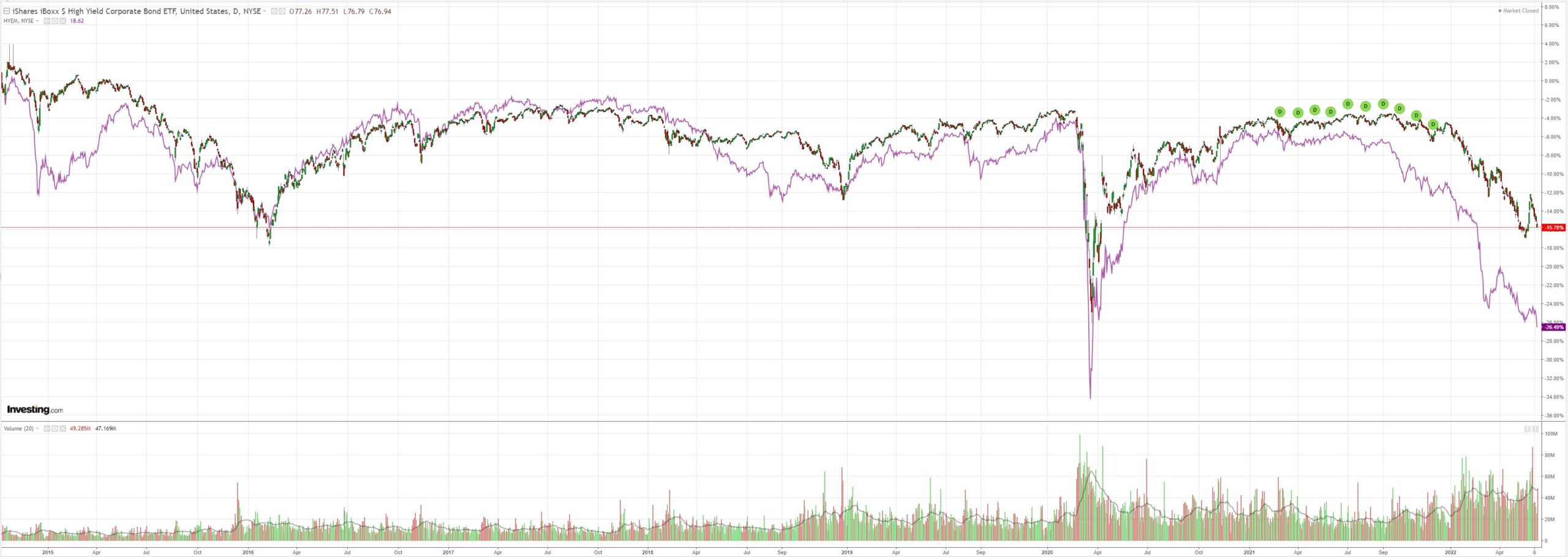

As junk (NYSE:HYG) free falls towards a credit event:

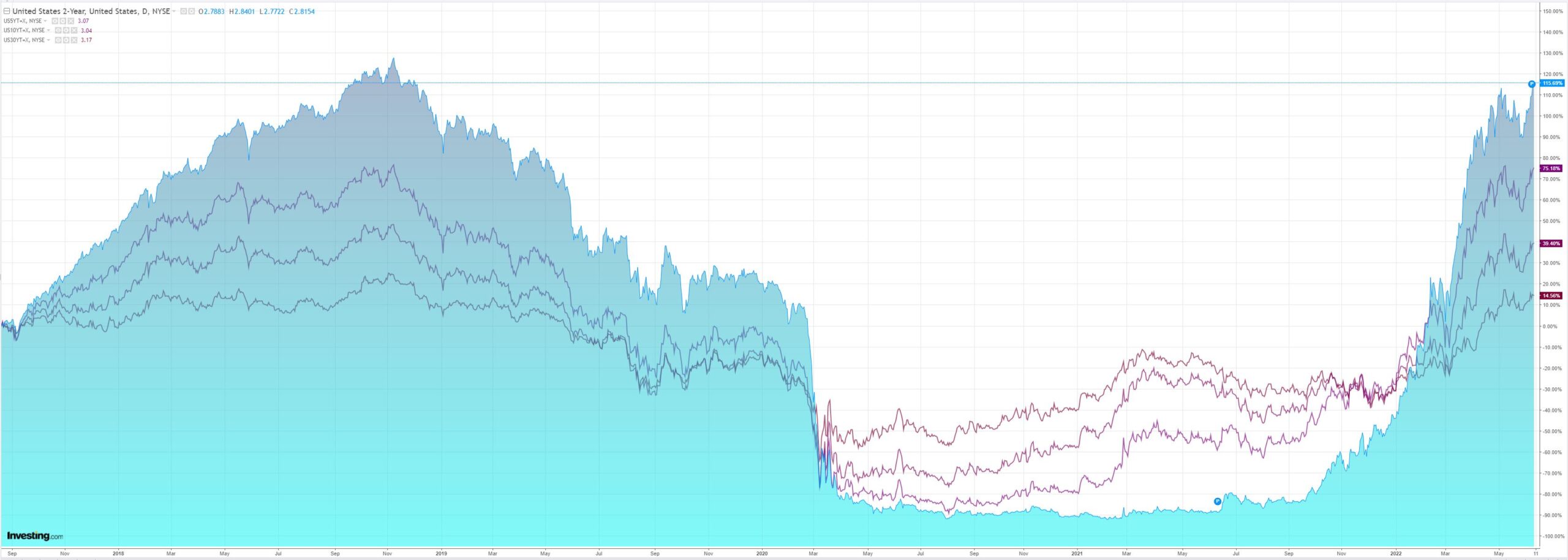

Treasuries were hammered and the belly inverted:

Stocks were flushed:

Westpac has the wrap:

Event Wrap

ECB kept its policy rate on hold at -0.5%, a was widely expected, but signalled 25bp rate hikes at the next two meetings in July and September. It also allowed for the possibility of an even larger hike at the September meeting, surprising the markets. The statement warned of inflation challenges, raising the inflation forecast and lowering the growth forecast. Inflation is expected to be at 6.8% this year, 3.5% in 2023, and 2.1% in 2024. Core inflation is expected to settle even higher in 2024 at 2.3%. Growth forecasts were revised down to 2.8% this year, and 2.1% in 2023 and 2024. Reaffirming earlier indications, net asset purchases are to end on 1 July.

US weekly initial jobless claims were slightly higher than expected at 229k (est. 206k, prior 202k), while continuing claims were steady at 1306k (est. 1303k, prior 1306k). The steady climb in claims from a 166k trough in March (which marked a 53-year low) suggests some slowing in the pace of payroll growth.

Event Outlook

NZ: Firm demand and ongoing price pressures should see a modest rise in retail card spending in May (Westpac f/c: 1.0%).

China: Annual producer inflation is expected to cool slightly but remain at an elevated level (market f/c: 6.4%yr) while the pass-through to consumer prices is still limited (market f/c: 2.2%).

US: Although annual consumer inflation looks to have crested, households are still expected to see a solid lift in prices in May (market f/c: 0.7%). This, alongside interest rate concerns, will continue to weigh on consumer sentiment in the University of Michigan’s June survey (market f/c: 58.2).

The bear market rally in risk is over. It is abundantly clear now that what has killed it is oil, as expected.

The FOMC cannot ease up until it demolishes enough demand to crash oil. It’s that simple.

That will necessitate pulling the plug on the US consumer, a probable credit event and lower asset prices, leading to a global recession starting in H2, 2022.

My best guess is that the AUD is going to 60 cents before it gets anywhere near 80 cents.