DXY won’t go away:

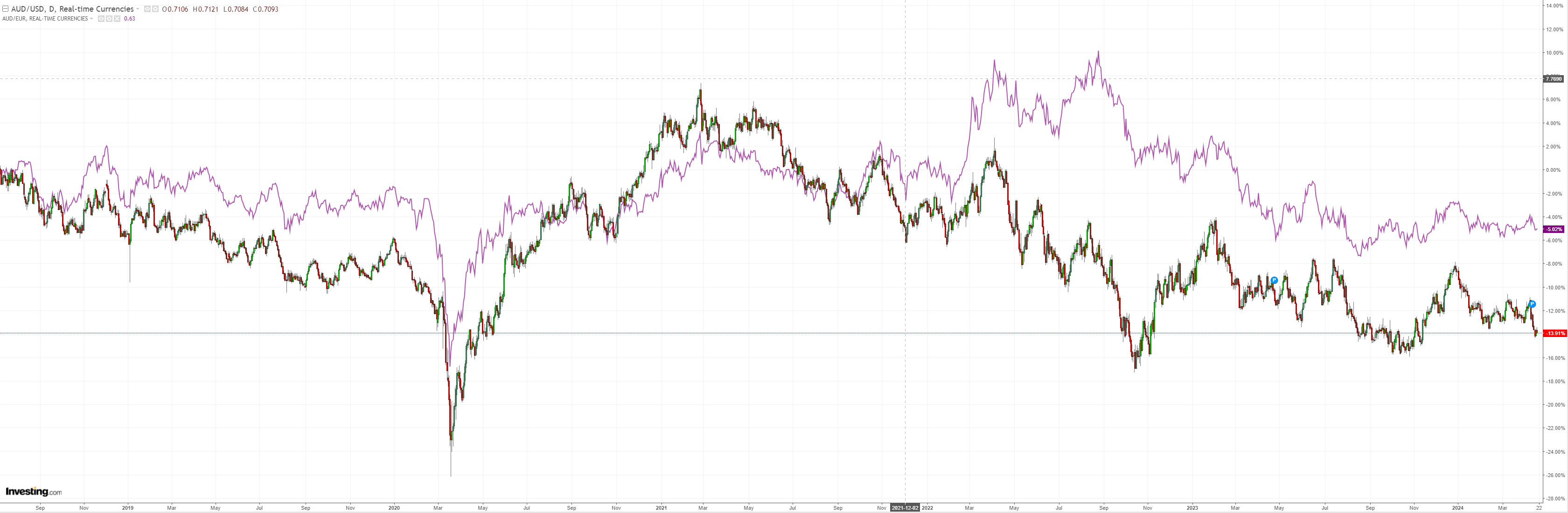

AUD is stuck at the bottom of its range:

Anyone who thinks CNY is on its way to reserve currency status is not paying attention:

Oil faded:

But the Goldman-engineered copper scam is running full tilt:

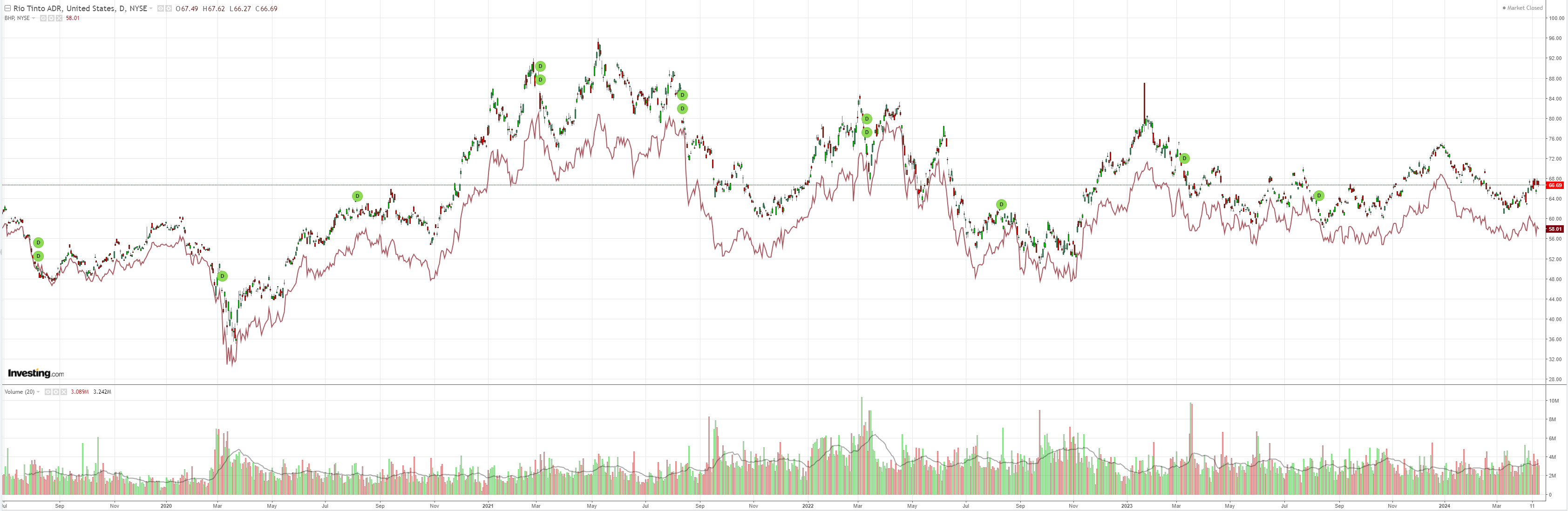

Miners weak:

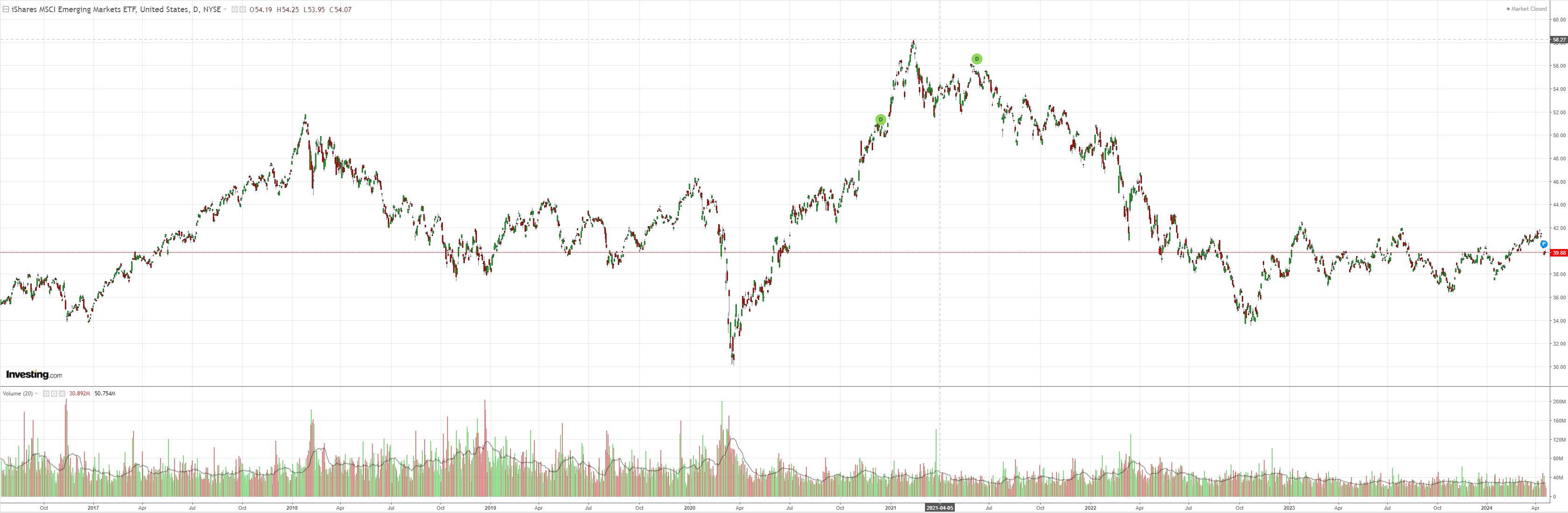

EM meh:

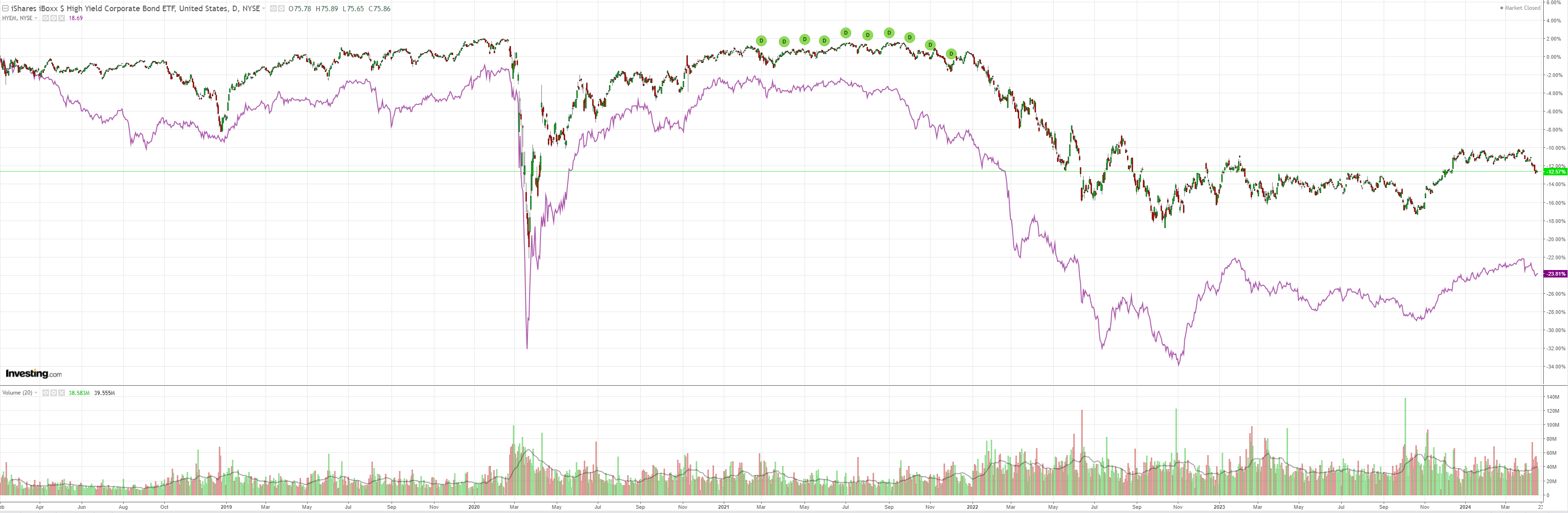

Junk hope:

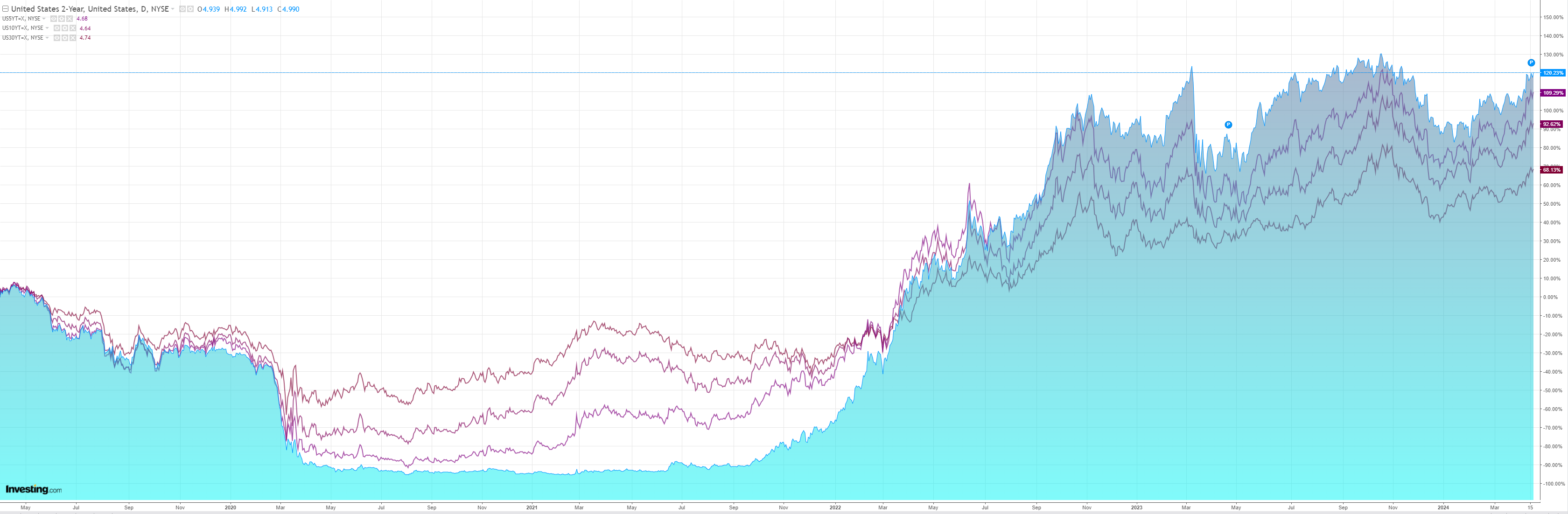

No landing yields:

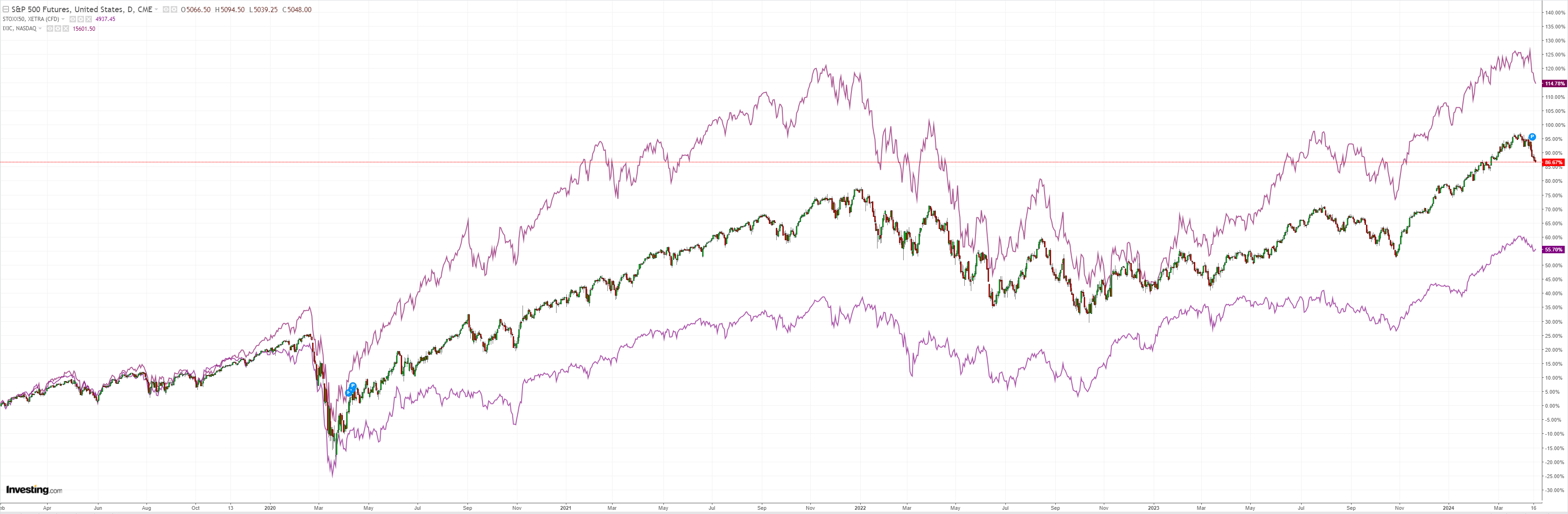

Stocks are landing instead:

Charlie McElligott at Nomura sums it up nicely:

…for the second annual Q1 in a row,the Fed secured an “own-goal” via their self-induced “premature easing” in financial conditions through signaling an embrace of an “insurance cuts” –path too early, before inflation was fully “put away”…which in conjunction with persistent fiscal largesse from the government, has then seen the market implied probabilities of a phase-shift into an economically unstable “No Landing” scenario pick-up Delta in recent weeks, risking “bad” outcomes / policy induced volatility…because “No Landings” end in “Hard Landings”.

Look no further than this morning’s Philly Fed = more “No Landing” fuel to the fire…

o*US APRIL PHILADELPHIA FED FACTORY INDEX 15.5; EST. 2.0

o*US APRIL PHILADELPHIA FED PRICES-PAID INDEX 23.0 VS 3.7

This provides the perfect segue, as the USD “wrecking ball” is again the world’s problem,has been the primary gripe of the IMF / World Bank spring meeting,and now is getting the full-tilt“official” treatment with a notable trilateral ministerial joint press statement released yesterday btwn US Treasury and Japanese / Korean counterparts, acknowledging how the Dollar’s run via the “US exceptionalism” –trade is at increasing risk of causing issues in rest-of-world.

Will we see coordinated intervention? I doubt it. The US needs a higher dollar.

The wrecking ball will keep swinging at the AUD until it has done the harm it must to snuff out another cyclical pop in inflation.