DXY is right at major support. EUR is through resistance. This is a one way train for now:

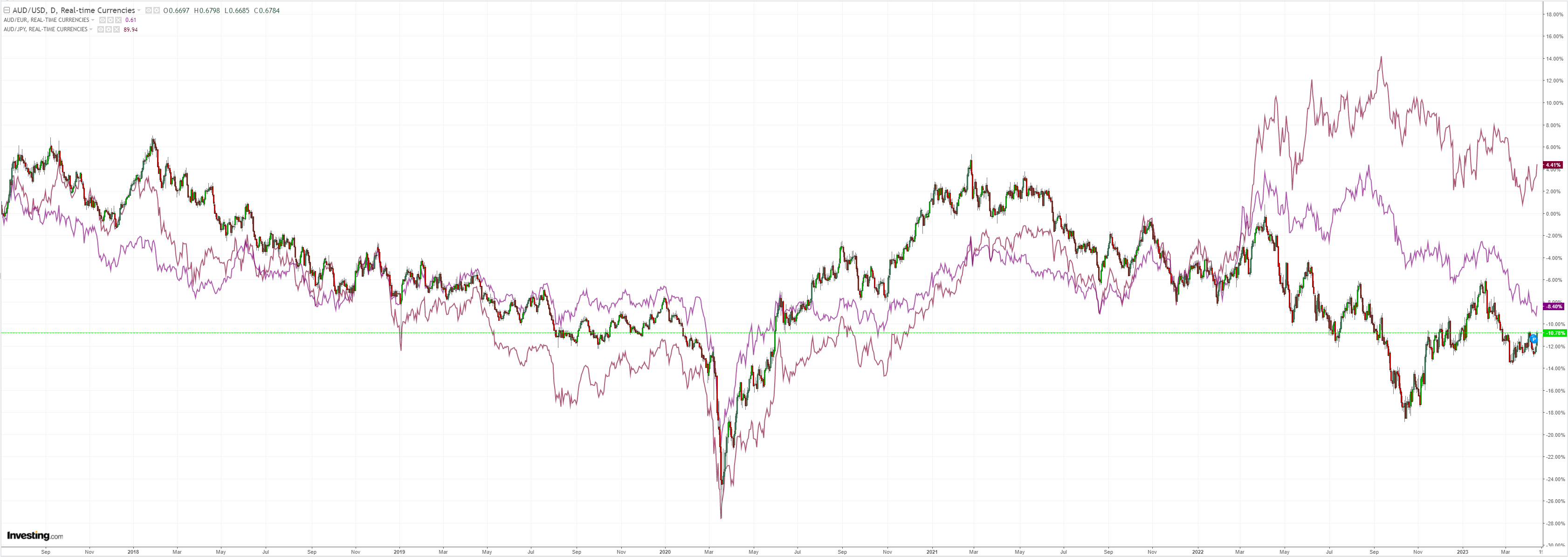

AUD is beginning to move support from the falling DXY to reflation triggered by falling DXY:

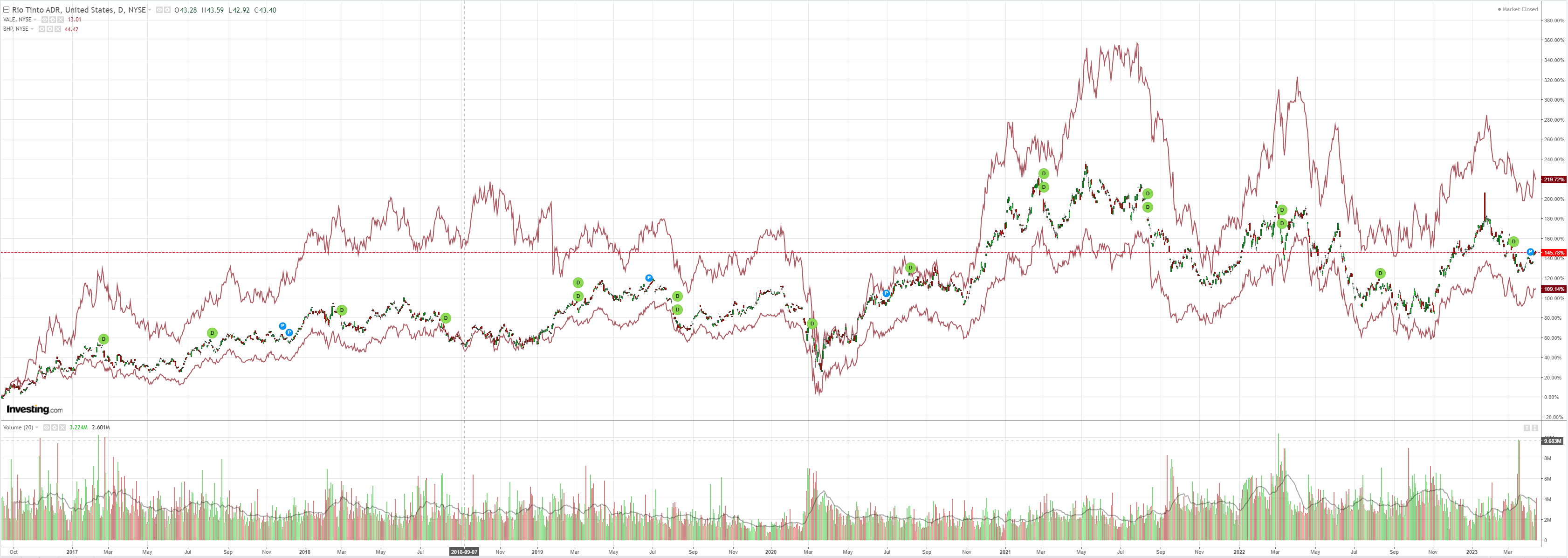

There’s no global recession in dirt:

Miners (NYSE:RIO) are more mixed:

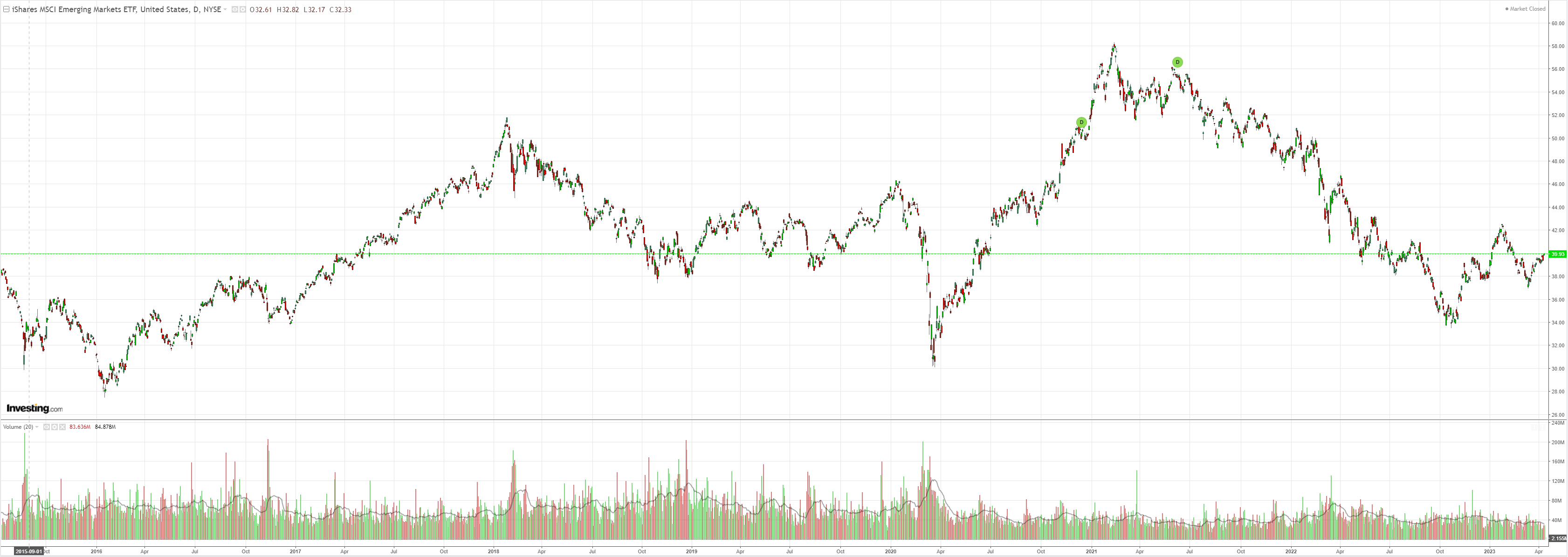

EM stocks (NYSE:EEM) gloomy:

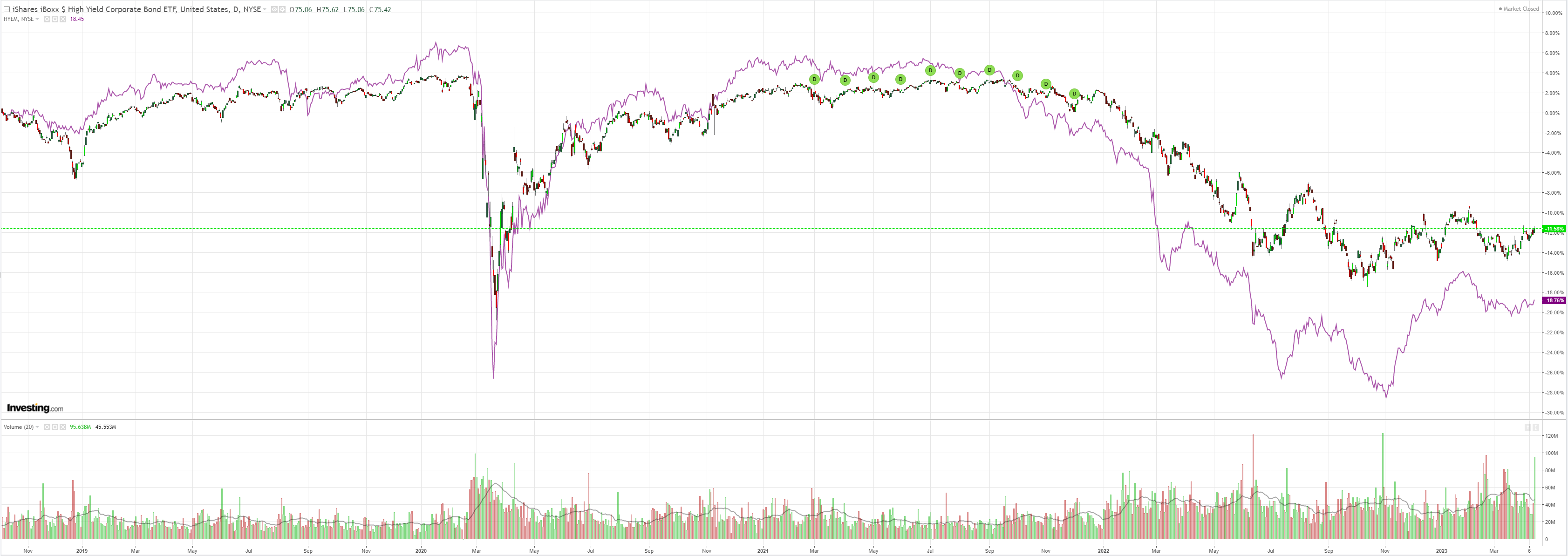

Junk (NYSE:HYG) sad:

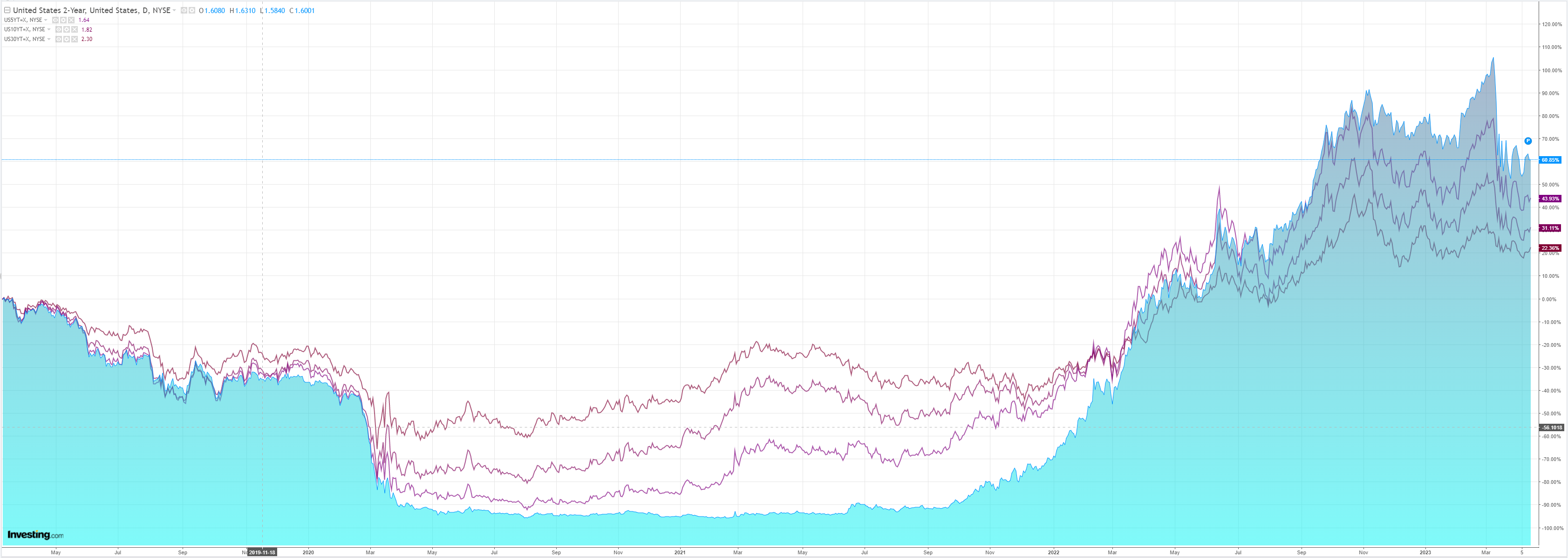

The curve steepened:

And stocks boomed on:

US data delivered a soft PPI and jobless claims. Not much, really.

We’re into another leg of falling DXY, rising growth stocks mania. Like last time it can run until either it begins to trigger reflation and yields rise, or it is challenged by some hard landing data.

I have no idea which will arrive first but still think that one or both is coming down the pipe.

Until then, AUD to the moon!