DXY was down a full cent overnight as EUR surged:

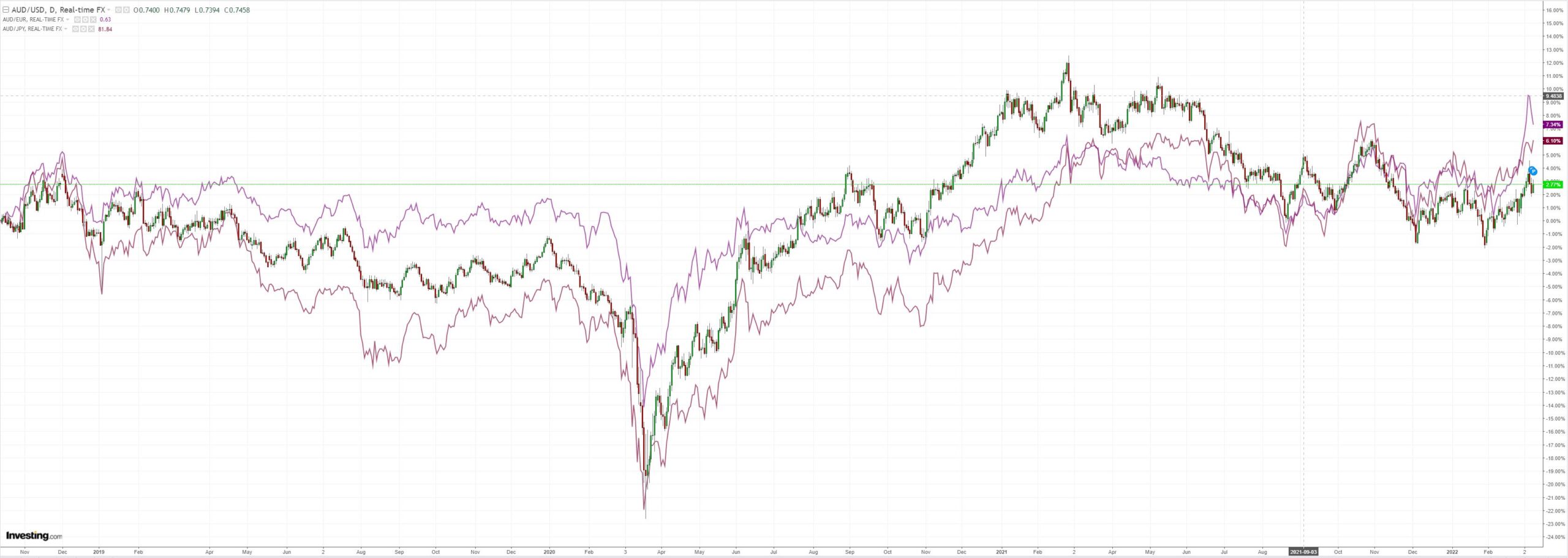

AUD was pounded vs EUR following DXY. The JPY safe haven came off hard:

Oil!

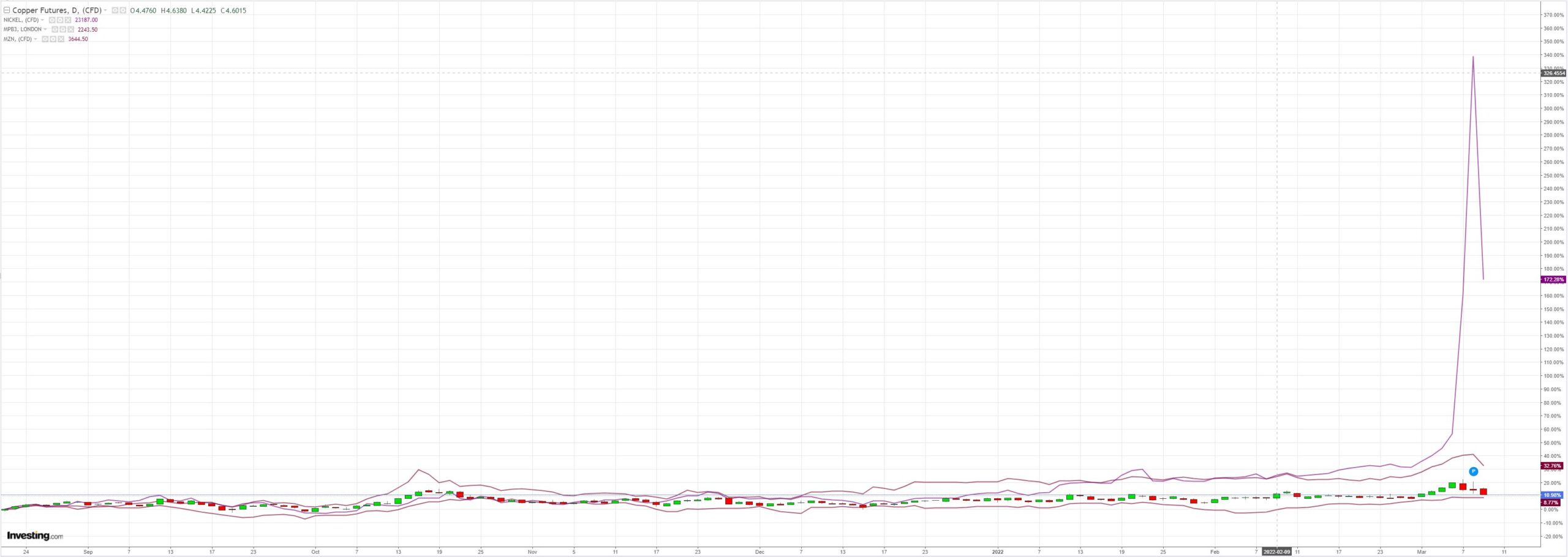

Remember that Goldman, the great commodity bubble machine, yesterday declared the Nickel price would not fall back:

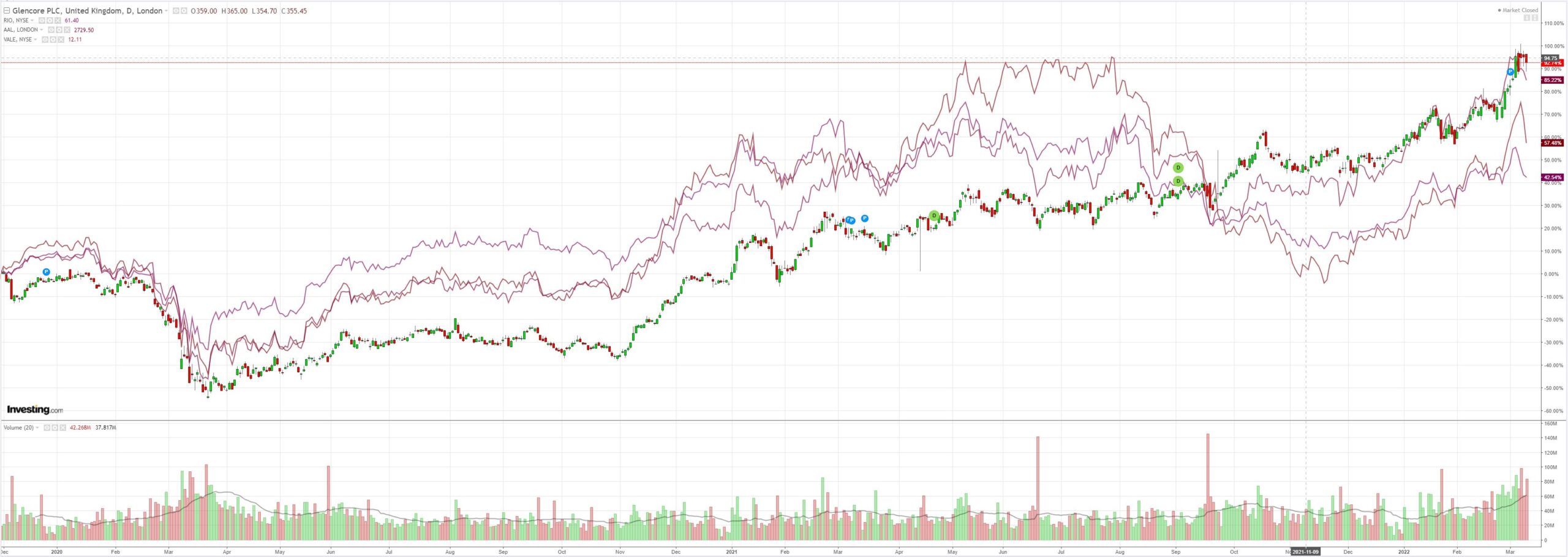

Big miners (LON:GLEN) sank with Iron ore:

EM stocks (NYSE:EEM) bounced a bit:

Junk (NYSE:HYG) a lot less:

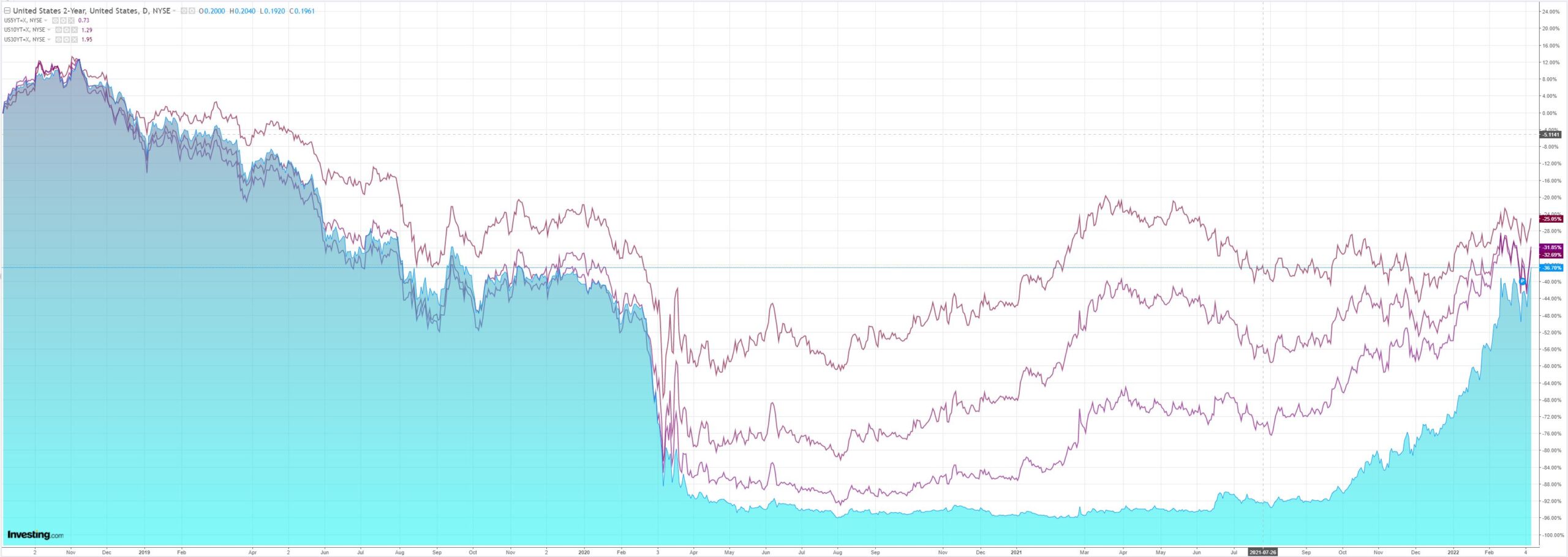

As the Treasury curve flattened some more towards recession:

Stocks proper dead cat bounced:

Westpac has the wrap:

Event Wrap

US JOLTS job openings in January were higher than expected at 11.3m (est. 11.0m, December revised to a record high 11.5m from 10.9m), reflecting a solid labour market.

Iraq and U.A.E. indicated greater willingness to raise oil output. Iraq’s oil minister said there was potential to increase production, and that production would be discussed at their next OPEC+ meeting.

Ukraine is ready for a “diplomatic solution,” according to an aide to President Zelenskiy in a Bloomberg interview. Neutrality can be discussed, but Ukraine wants a security guarantee, and won’t surrender a “single inch” of territory. Ukraine is also seeking a response to its EU application.

Event Outlook

Aust: MI inflation expectations should remain elevated in March, reflecting the lift in official CPI estimates.

NZ: Card spending is anticipated to decline in February as the surge in omicron cases reduces hospitality expenditure (Westpac f/c: -0.4%).

Eur: The ECB is expected to leave policy unchanged; focus will be centred on their updated forecasts and the Council’s views on current risks surrounding inflation and geopolitical tensions.

US: The persistence of price pressures should continue hold consumer inflation at 40-year highs in February (market f/c: 0.8%mth; 7.8%yr). Meanwhile, initial jobless claims will likely remain at a very low level (market f/c: 219k).

The war is fixed! Ukraine said it is seeking a diplomatic solution and is ready to give up on NATO membership. Pretty generous given it is currently occupied by Russia. It says it still won’t give up any territory, so Putin won’t stop leveling cities.

Also, UAE encouraged OPEC to pump more oil. Earlier this week, the Gippsland JV delayed the closure of Bass Strait gas platforms by two years. The oil price is now so extreme that every molecule in the world will be extracted and sold at the fastest possible rate. Including lots of recently obsolete energy.

I have no idea if this will break OPEC but, rest assured, more oil is coming from every single corner of the earth.

Let me correct that. More commodities are coming from every corner of the earth given prices.

Does that mean prices have peaked? Who knows? That’s down to Mr Putin. What it does mean is that supply will flow and burst the bubble before very long. This is how commodities work. Up the escalator and down the lift.

Especially so given the real enemy of bloated prices in everything is Federal Reserve tightening. It is coming even faster than before.

So, enjoy the AUD port in the storm for now but don’t be fooled.

The real storm has not arrived yet.