DXY held its gain last night:

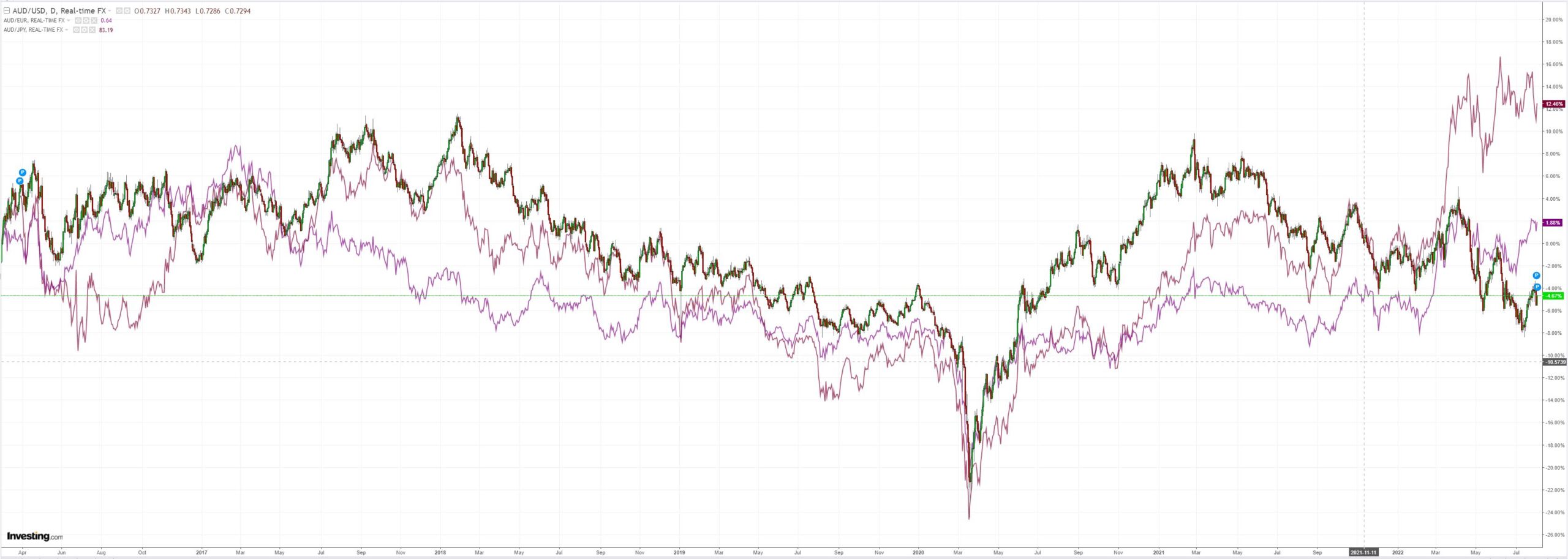

AUD rose anyway as Taiwan tensions eased:

Oil broke. Big downside potential here:

If so, metals will go too:

And miners Glencore PLC (LON:GLEN):

EM stocks (NYSE:EEM) were OK:

And junk (NYSE:HYG) bounced:

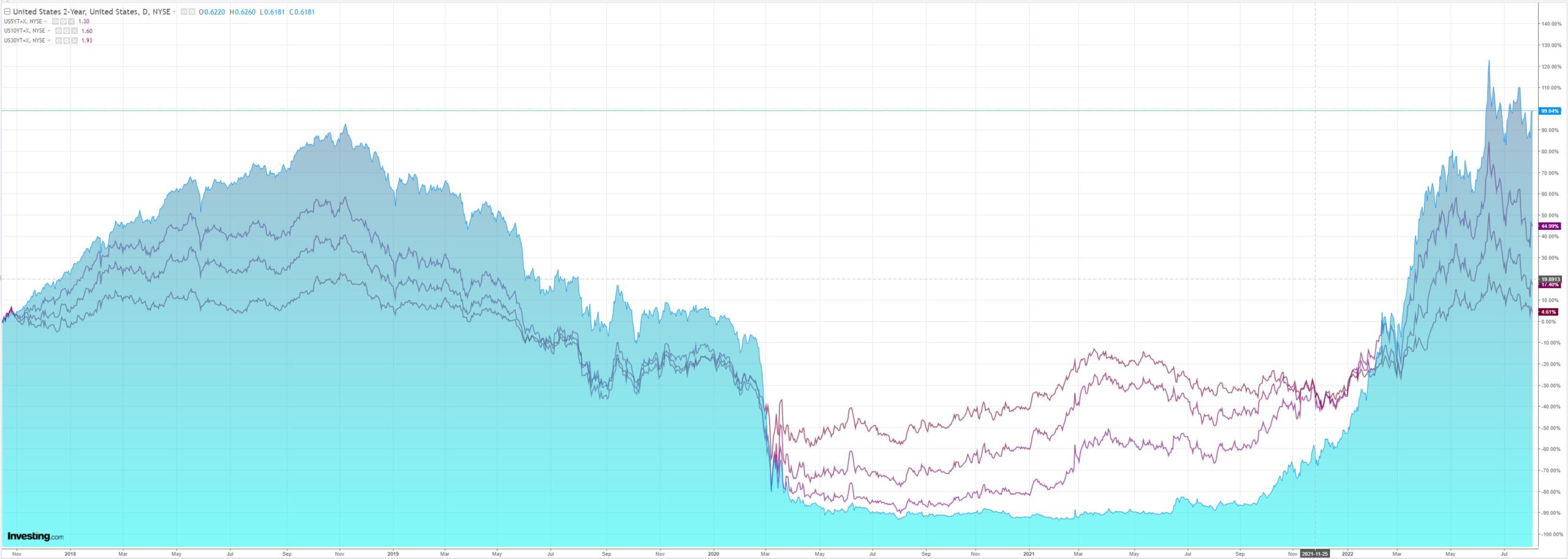

The yield curve was smashed:

But nothing gets in the way of stocks:

Westpac has the wrap:

Event Wrap

US services activity (ISM) rose to 56.7 (est. 53.5, prior 55.3), with stronger than expected new orders and production. This contrasts with the recent declines in manufacturing surveys, although industry comments still indicate concern about slowing economic activity as rates rise and demand moderates.

Factory orders in June rose 2.0%m/m (est. +1.2%m/m, prior +1.8%m/m). Durable goods orders were finalised slightly higher at +2.0%m/m (from 1.9%m/m initial reading).

FOMC member Bullard said the funds rate may need to be higher for longer in order to bring down price pressures, and that the Fed is going to be “tough” and will get inflation back to 2%. He felt it will take a while for inflation to ease. Barkin said: “there is a path to getting inflation under control. But a recession could happen in the process. If one does, we need to keep it in perspective: No one cancelled the business cycle”. Kashkari said: “we are laser-focused on getting inflation down, and whether we are technically in a recession right now or not, doesn’t change my analysis. I’m focused on inflation”, also deeming rate cuts in 2023 “very unlikely”.

Eurozone services PMIs were finalised slightly higher, with the pan-Eurozone reading edging up to 51.2 from the flash 50.6, the composite measure at 49.9 from the flash 49.4. Concerns over a cost of living related fall in demand more than offset reduced pricing pressures and worries about energy supply and prices. Retail sales in June reflected the weakness seen in German sales on Monday, falling 1.2%m/m (est. flat, prior revised to +0.4%m/m from +0.2%m/m), with y/y sales declining to -3.7%y/y (est. -1.7%y/y, prior +0.4%y/y). Eurozone PPI in June rose 1.1%m/m (est. +1.0%m/m), for a rise of 35.8%y/y (prior 36.2%y/y).

Event Outlook

Aust: The trade surplus is expected to remain elevated in June although a consolidation of exports and a lift in import value should see a slight narrowing (Westpac f/c: $14.6bn).

UK: The Bank of England is set to hike the bank rate by 50bp to 1.75% at their August policy meeting in order to quell inflation pressures.

US: The trade deficit is expected to remain wide in June (market f/c: -$80bn) and initial jobless claims are beginning to slowly lift from historic lows (market f/c: 260k). The FOMC’s Mester is also due to speak.

The Fed is desperately trying to stop the stock market reflation and failing. This raises the prospect of stronger hikes ahead even as commods come apart.

Meanwhile, Australian data is fading fast and the RBA is going to have to stop hiking in short order.

AUD downside potential is obvious.