DXY was up again Friday night and its bull market looks strong:

AUD largely paused:

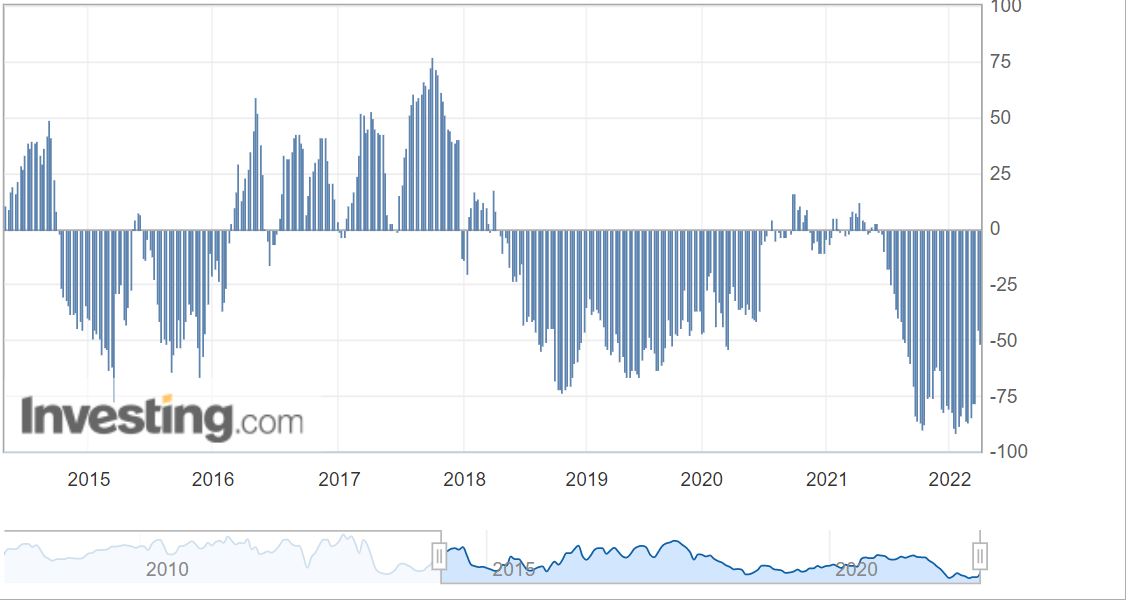

The shorts added to positions last week after the recent squeeze:

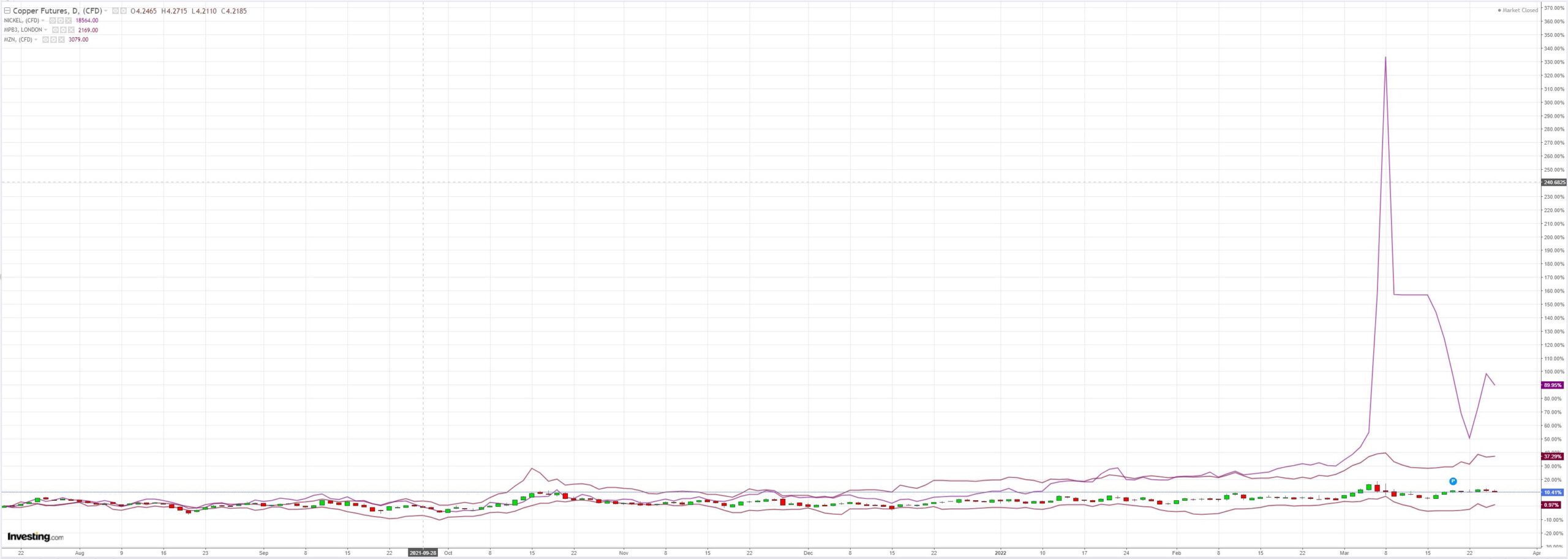

Base metals were mixed:

Big miners (LON:GLEN) mostly firm:

EM stocks (NYSE:EEM) not:

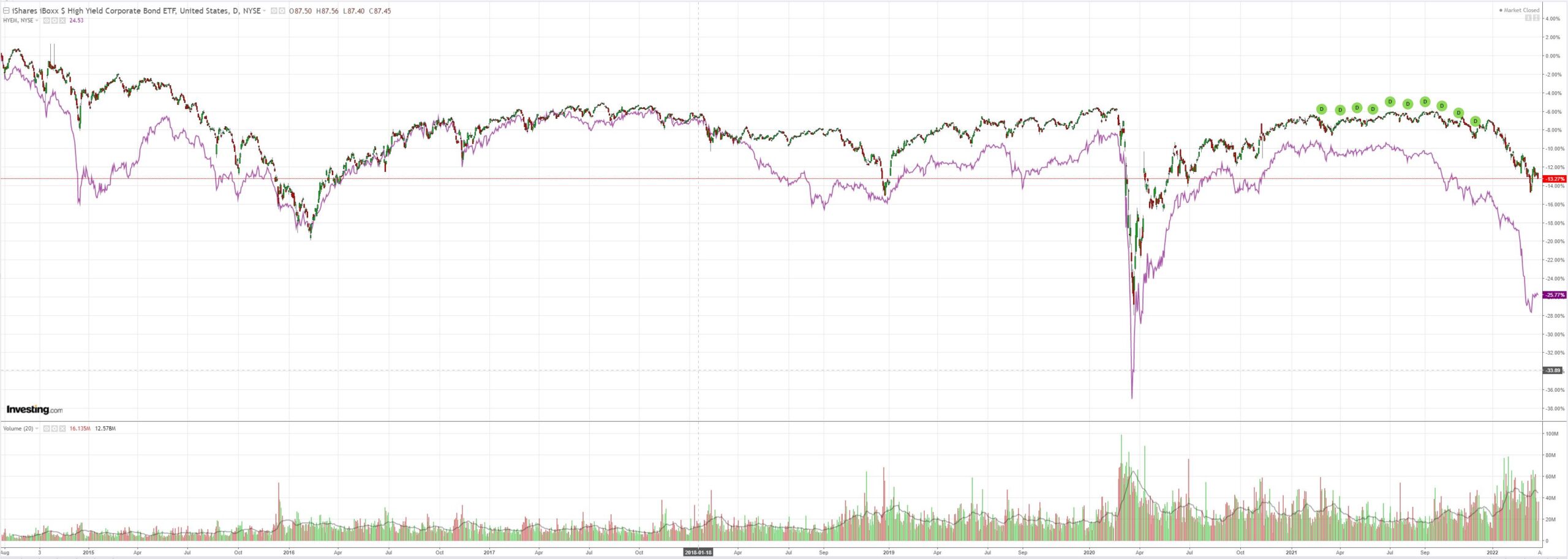

Nor junk (NYSE:HYG):

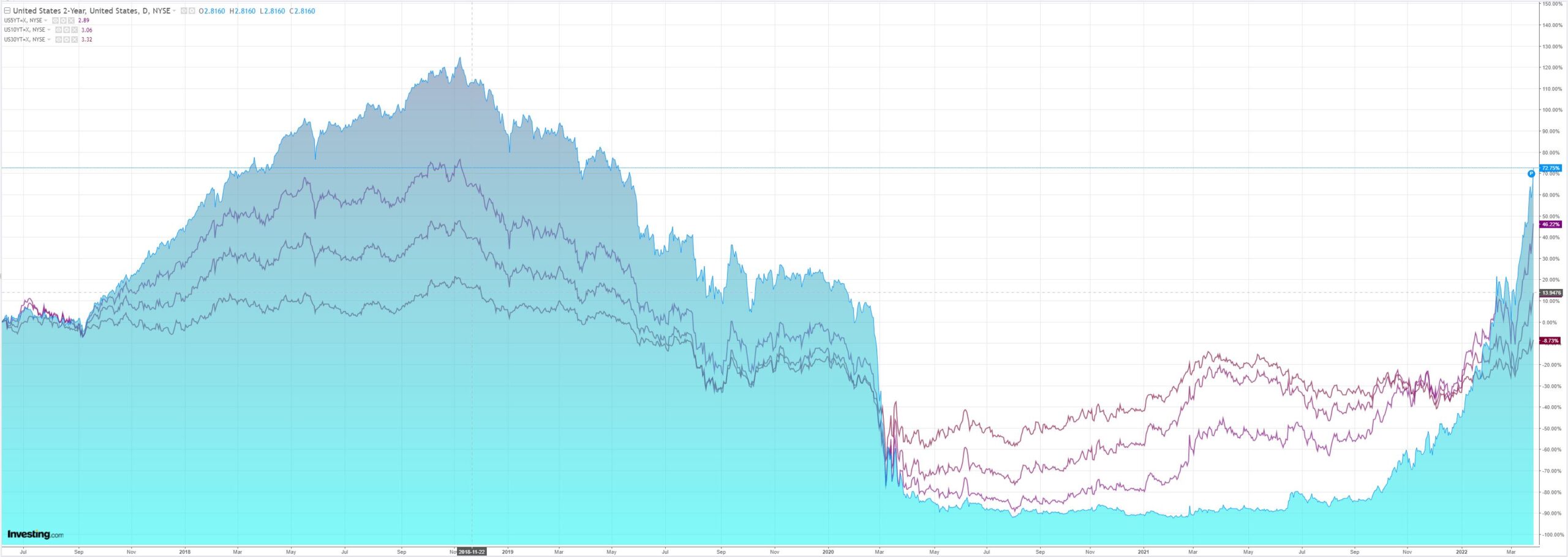

As yields soared and curve was steamrolled:

Stocks were stalled:

Equity markets have now priced out the war and in so doing discounted next-to-nothing for the Fed. Citi now sees an uber-hawkish FOMC:

We are revising our “base case” for Fed policy rates from 200bp of rate hikes in 2022 to 275bp in rate hikes in 2022. Rather than one 50bp rate hike in May (our previous base case) we now expect the Fed to raise rates in 50bp increments inMay, June, July and September followed by 25bp hikes in October and December.

While we had viewed risks around our Fed policy rate forecasts as skewed heavily to the upside, we see more balanced risk around our updated modal scenario. Should inflation moderate more than we expect or broader financial conditions tighten abruptly (e.g. a 20%+ equity market sell-off), officials might return to 25bphikes in July meaning a total of 225bp of rate hikes. On the other hand, continued5%+ annualized inflation could lead to 50bp hikes at every remaining meeting, delivering 325bp of cumulative rate increase.

Recent Fed speak raised our conviction that Chair Powell and the broader committee will support a 50bp rate hike in May (despite balance sheet reduction announced at the same meeting). It appears that 50bp would have been delivered in March if not for acute uncertainty related to geopolitical tensions.

With inflation likely to be very strong in March (headline 1%+MoM thanks to higher gasoline prices and core continuing to rise ~0.5%MoM) and to remain elevated in April, we think it will be hard for Fed officials to argue why they would not raise rates 50bp again in June.

Continued 50bp hikes in July and September will materialize if inflation stays above 2% on a monthly annualized basis and broadly across categories. Again, it will be difficult for Fed officials to explain (either internally to build consensus or externally to the public) why rate hikes should slow so long as policy rates are below 2.5% (the Fed’s estimate of long-term neutral) and inflation is not meaningfully slowing.

Steamrolled yield curves tell the tale:

The market is now pricing cuts for 23/24 but my view is that this will come earlier via crashing equities at some point. This cycle has been on speed from the beginning and why would change now if Citi is right?

Bonds are telling the story. As usual, equities are the last to know.

AUD will follow the latter.