Goldman with the note.

EUR: Tanker turning.

The ECB’s focus on “data not dates” is nothing new.

But,the acknowledgment that data have been trending in the right direction, faster than expected, was relatively new. And, in our view, it demonstrated a further shift than ECB speakers have previously endorsed.

We also thought it was notable that President Lagarde carefully avoided calendar guidance disguised as data dependence.

As we have discussed, there should be plenty of data available from surveys and firm contacts to make a decision before the summer if needed.

All in all, we think there is enough evidence of a shift in the ECB’s policy stance to continue to warrant a somewhat downbeat assessment of the Euro’s prospects as long as the data continue to undershoot the December projections.

On that front, this week’s PMIs offered little reprieve—while the move higher in the manufacturing sector is a positive sign of external demand, some caution is required because longer delivery times from supply disruptions accounted for about a third of the headline bounce.

And, when combined with another disappointing ifo climate index, our economists lowered their Q1 GDP tracking for Germany to 0% given the weak start to the quarter.

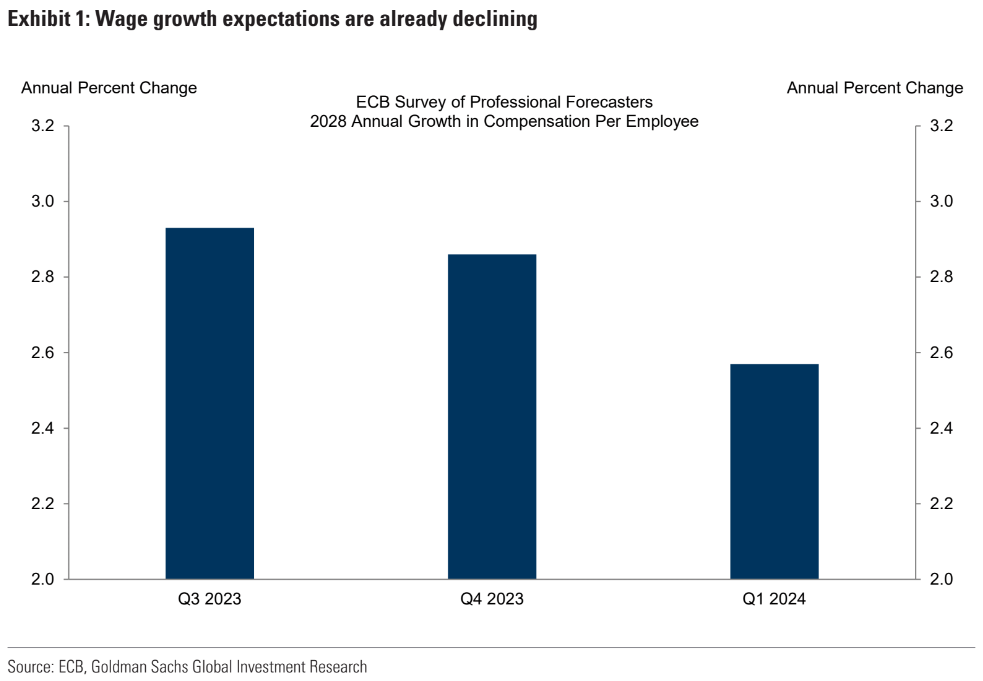

But more importantly, the ECB’s survey information demonstrated that inflation expectations are well-contained and firms’ plans to increase wages and prices are falling (Exhibit 1).

Taken together, we think the constraints on the ECB are falling away, and this should allow the real rate differential to move against the Euro in coming months.

Against this backdrop, we maintain our 3m EUR/USD forecast of 1.08 and continue to recommend investors use EUR as a funder…

As we know, where EUR goes, AUD follows:

The meek bull argument for AUD appreciation this year is still the base case but it is not strong.