DXY is sideways:

AUD did better as JPY fell:

Brent puked:

Dirt meh:

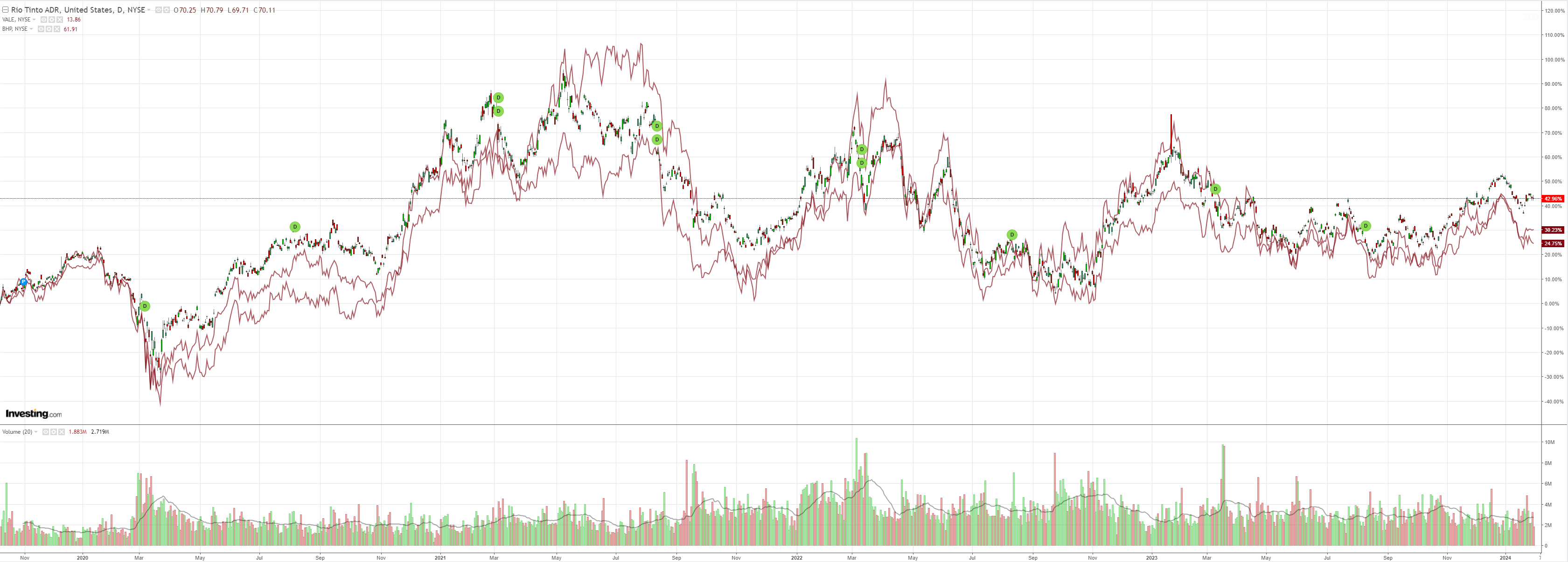

Miners meh:

EM meh:

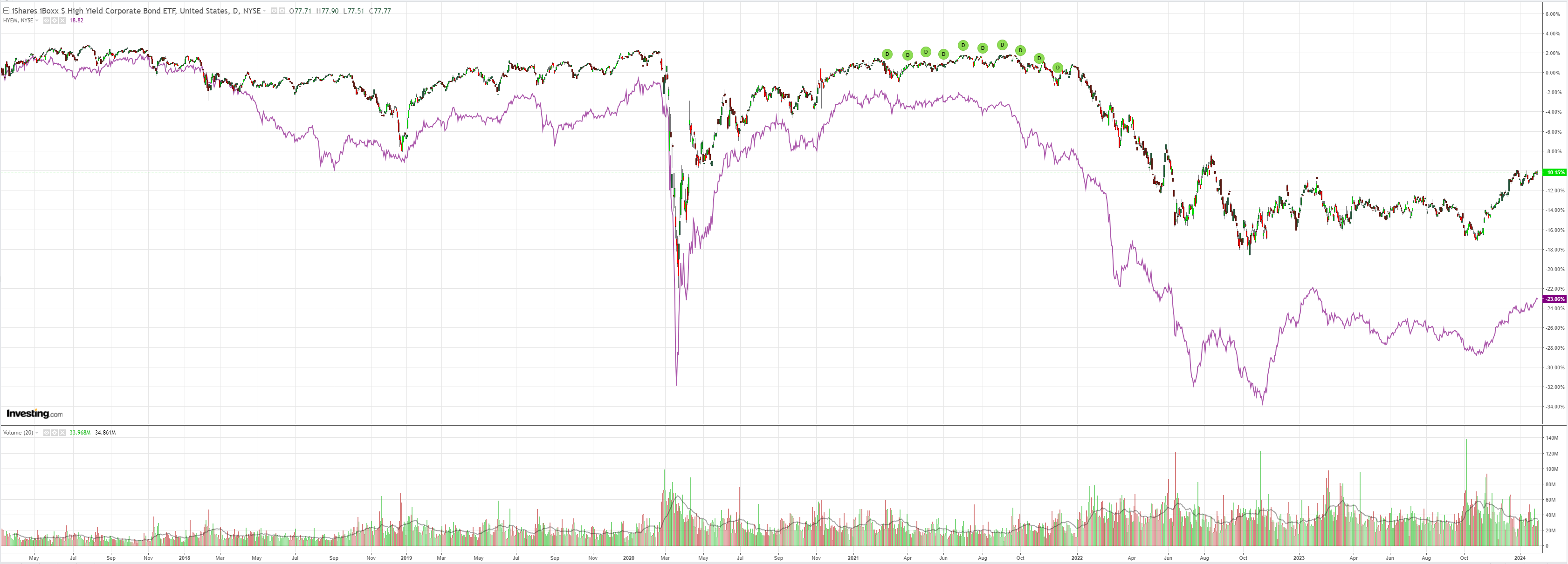

Junk meh:

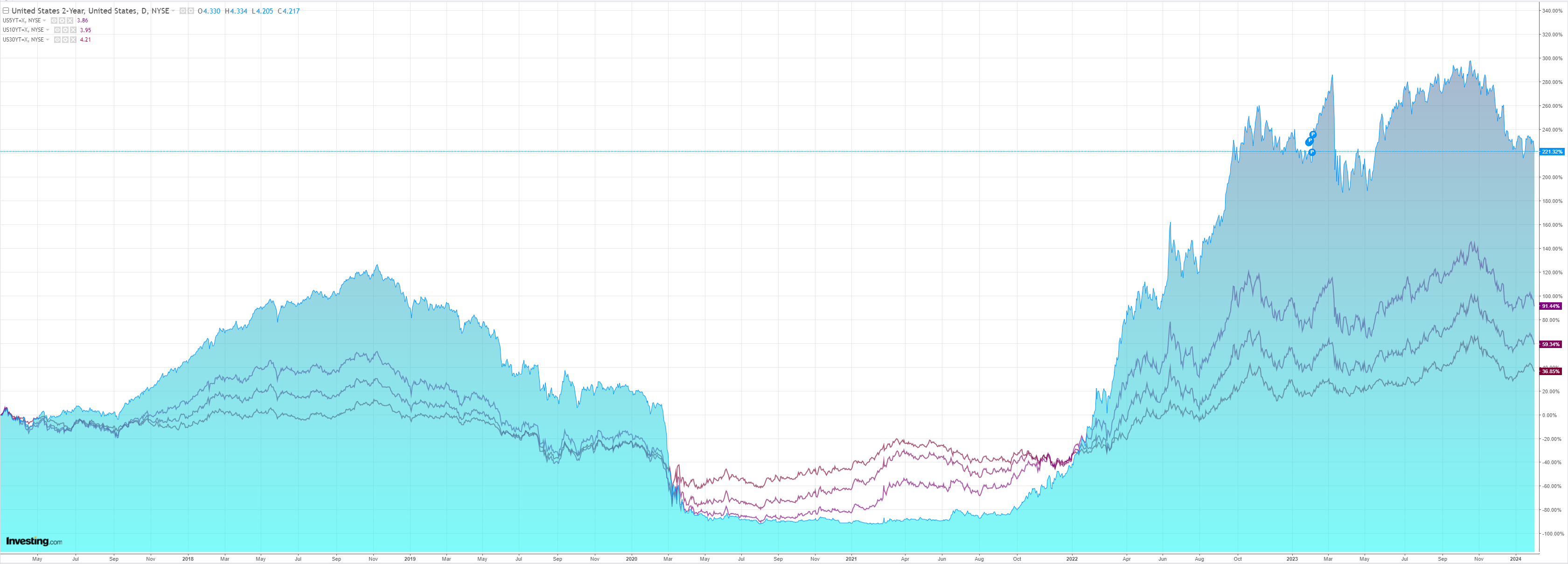

Yields fell:

Stocks corrected on Google (NASDAQ:GOOGL) and the Fed:

The Fed pushed back on rate cuts:

“The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

…“The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance.”

Looks like March is a no-go for a cut. May then.

The Aussie economy has accelerated sharply to the downside over Q4. So much so that it has caught up and surpassed other DM economies to the downside despite lagging the COVID reopening boom by six months.

Such is the nature of floating-rate mortgages. They deliver materially higher interest rate sensitivity. Especially when coupled with a giant fixed-rate reset!

My base case is that the RBA now cuts in Q2, maybe even before the Fed, to rescue the sinking Aussie consumer.

In the context of an irresistible Chinese bear market, accelerated RBA easing is the end of the AUD rally.

We may still pop up and down in a 0.65-0.68 trading range as the Fed eases but I’ve given up on 70 cents later this year.

The greater risk may be now a downside break as China hoses commodities.