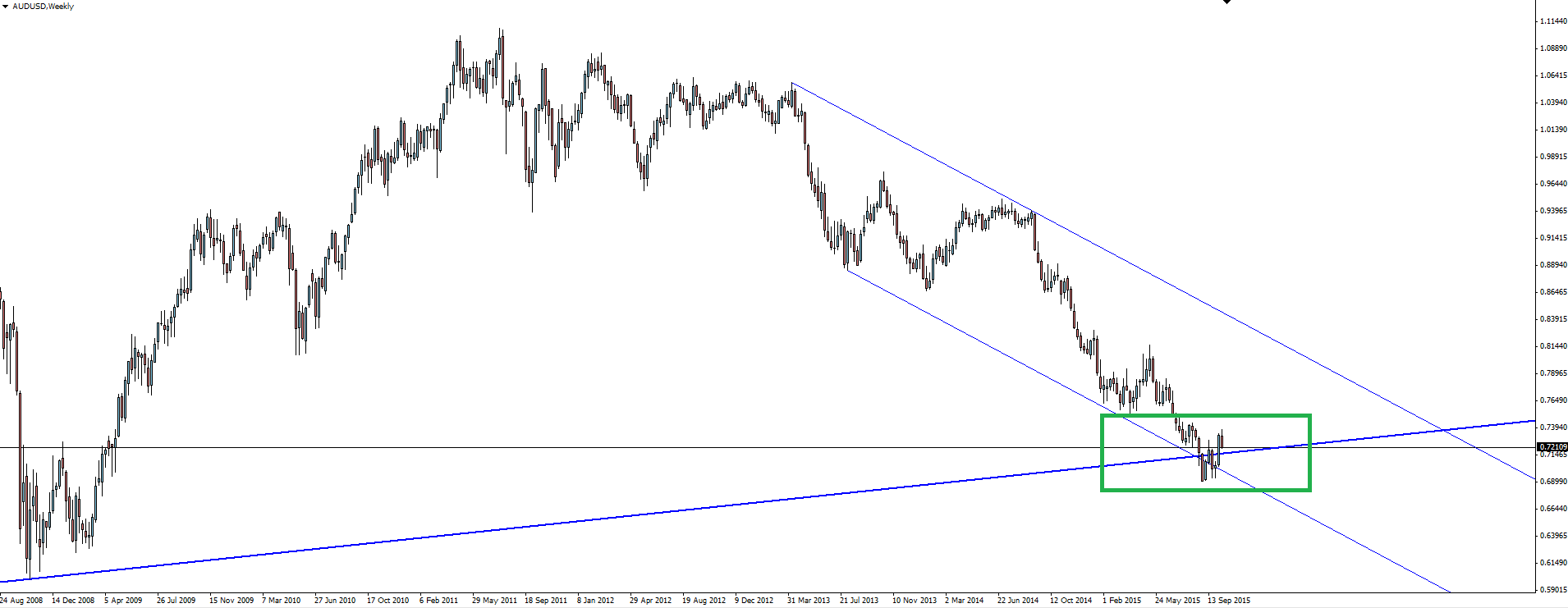

Aussie:

After a solid NINE sessions of gains, the Aussie Dollar’s rally has come to an end with a thud. The rally was the currency’s third longest since it was floated in 1983.

“AUD NAB Business Confidence (5 v 1 previously)”

“CNY Trade Balance (60.3B v 46.9B expected)”

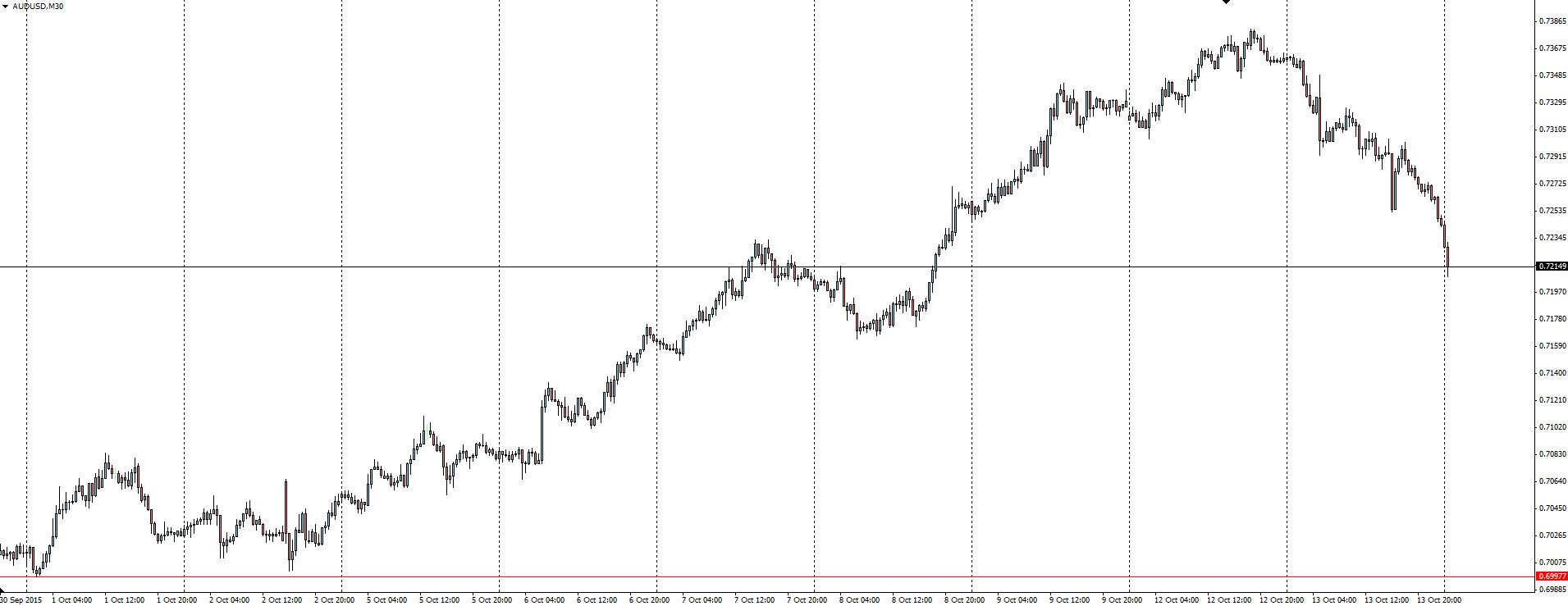

Taking a look back at yesterday’s data, we saw an inability for the Aussie to rally on increased Business confidence in the morning, before Chinese imports slid for the 11th straight month and the Aussie rolled over.

AUD/USD 30 Minute:

With Westpac today increasing its home loan rates by 0.2%, Shane Oliver, Chief Economist at AMP Capital Tweeted the following in regards to another rate cut now being further priced into the Aussie.

From a big picture technical point of view, just keep in mind that price has tucked in back above the major weekly trend line which could again be a hard nut to crack.

Kiwi:

As for the Aussie’s brother across the ditch, RBNZ Governor Graeme Wheeler delivered a speech in Auckland today which outlined the fact that further interest rate cuts are also on the cards.

“Some further easing in the OCR seems likely but this will continue to depend on the emerging flow of economic data.”

With the next RBNZ meeting on October 29, 9 of 14 economists surveyed by Bloomberg are now forecasting that they will cut rates again with the main drivers cited being slower than expected economic growth and an inability for inflation to lift into the 1% to 3% target band.

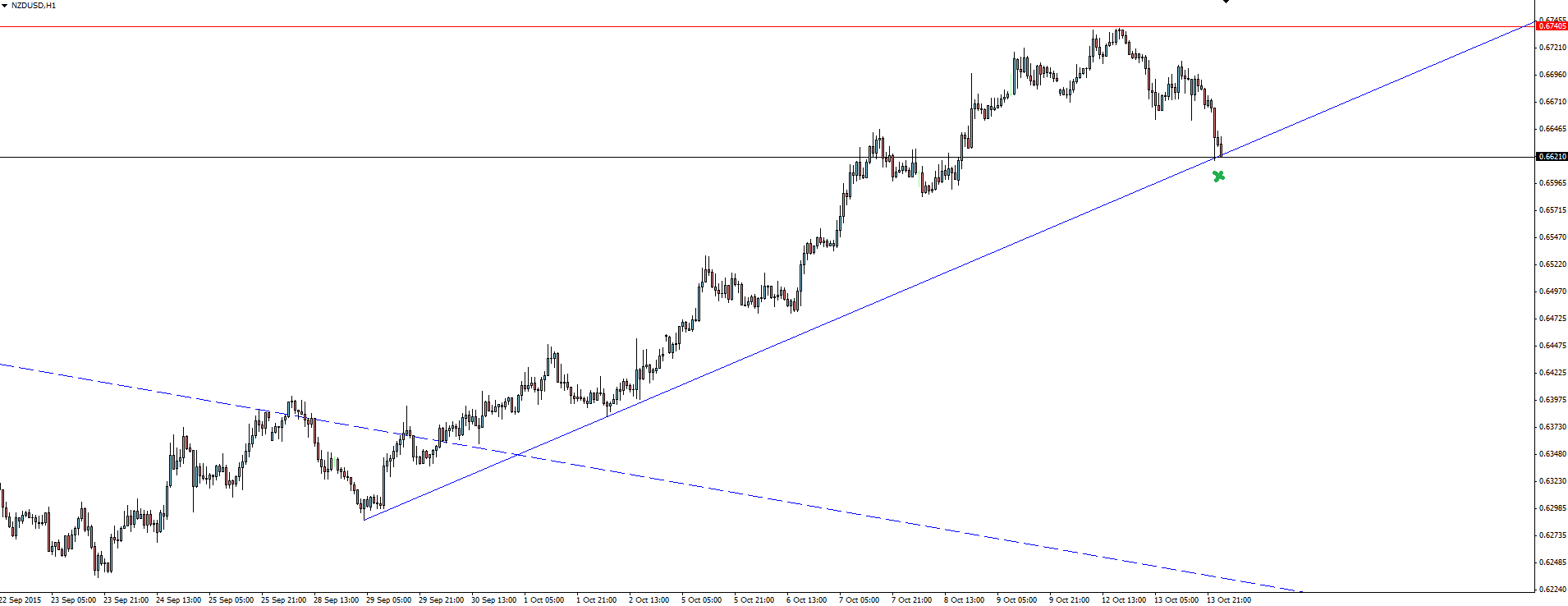

NZD/USD Hourly:

On the hourly chart you can see that the Kiwi rally has also faltered after his comments, with traders playing for a rate cut come the end of the month, but price is holding it’s trend line for now.

“The RBNZ remains conscious of the impact that low interest rates can have on housing demand and its potential to feed into higher price inflation.”

Just keep in mind this old chestnut in both Sydney and Auckland but for now it looks as though that’s just a small price to pay on the road to recovery.

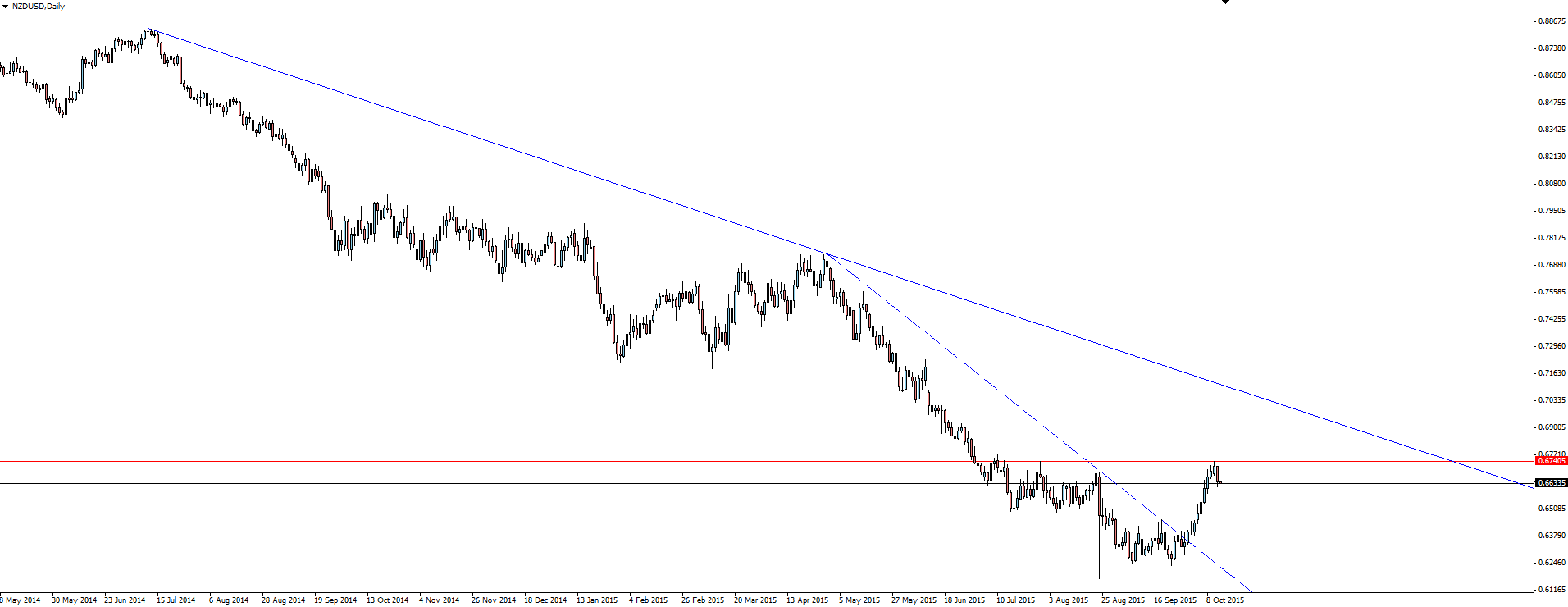

NZD/USD Daily:

On the Calendar Wednesday:

NZD RBNZ Gov Wheeler Speaks

AUD Westpac Consumer Sentiment

CNY CPI y/y

CNY PPI y/y

GBP Average Earnings Index 3m/y

GBP Claimant Count Change

USD Core Retail Sales m/m

USD PPI m/m

USD Retail Sales m/m

Chart of the Day:

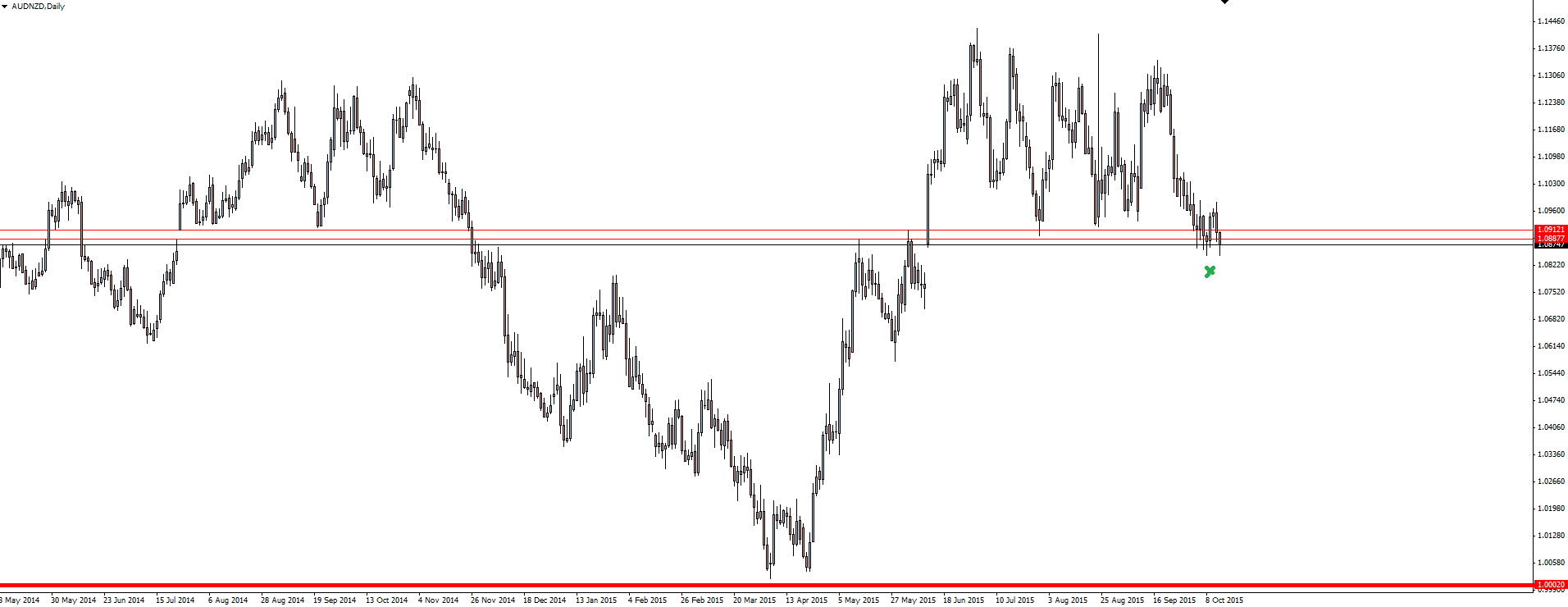

The AUD/NZD level that we highlighted last week has been chopped through a bit and is looking like its going to break.

AUD/NZD Daily:

With fresh talk of an Aussie rate cut hammering the currency and NZD/USD sitting at short term trend line resistance, we could get a nice pop to the downside off this level.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd, does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade on a live Forex account. All opinions, news, research, Forex analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a Forex trading account and acting on it does so entirely at their own risk and should thoroughly test on a Forex demo account. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.