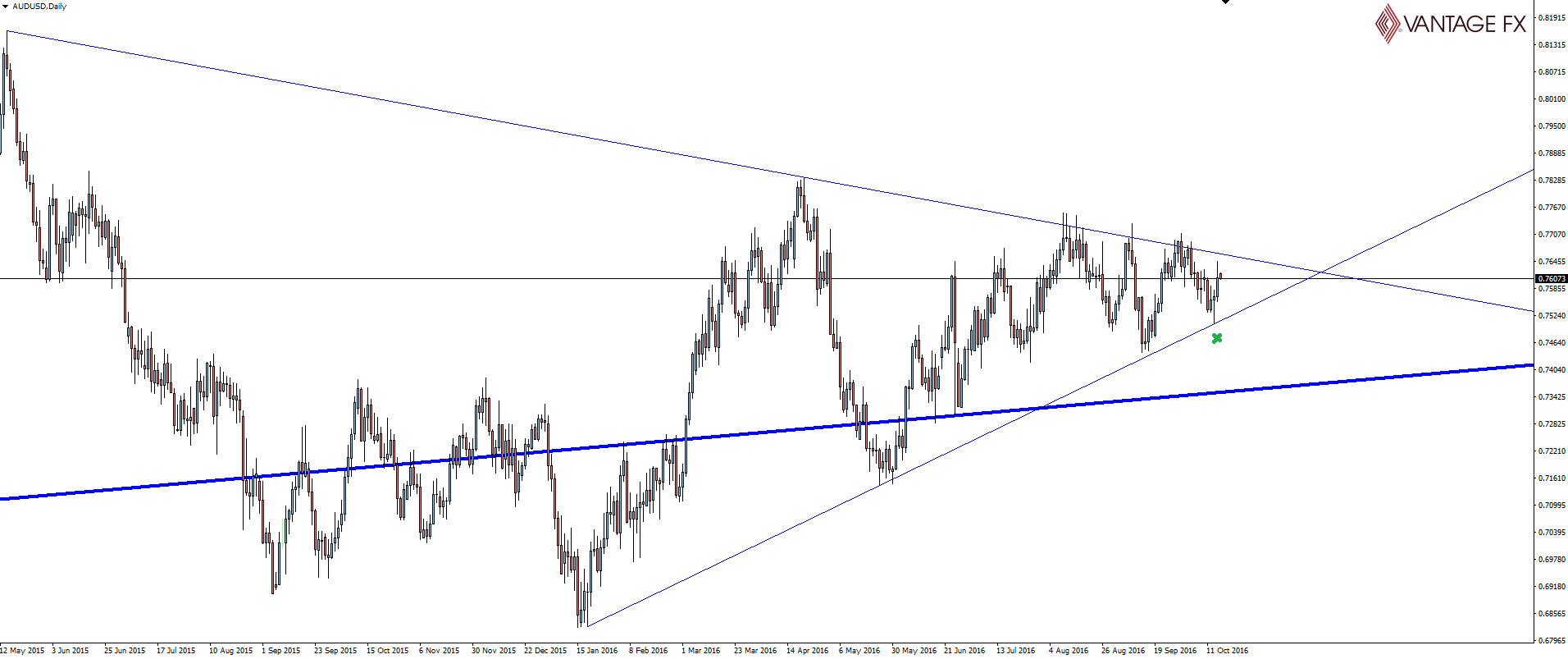

Straight into it and yesterday we spoke about the Chinese numbers having the potential to blow the AUD/USD resistance level out of the water.

Externally at least, with the Chinese economy showing good signs of growth in line with government targets, expectations were met and the Aussie was the big benefactor.

Now I’ve been a huge skeptic of Chinese data releases with, of course, the planned economy having the ability to give the market what they want to hear. But as traders, does this matter?

The answer is of course no. All we should worry about in terms of these numbers, is how the market perceives them in line with their own expectations and pricing.

This is a little harder with Chinese numbers, as we always look to trade the Aussie dollar for its liquidity over any of the CNH pairs.

As you can see, the Aussie has FINALLY broken through this resistance level. Ironic that it took Chinese GDP to get it done I guess.

Employment change and the unemployment rate this morning key to see if any domestic weakness can shift sentiment from the longs. My thoughts are that if it beats, we will continue higher no problems, but it will take one almighty miss to turn the market bearish.

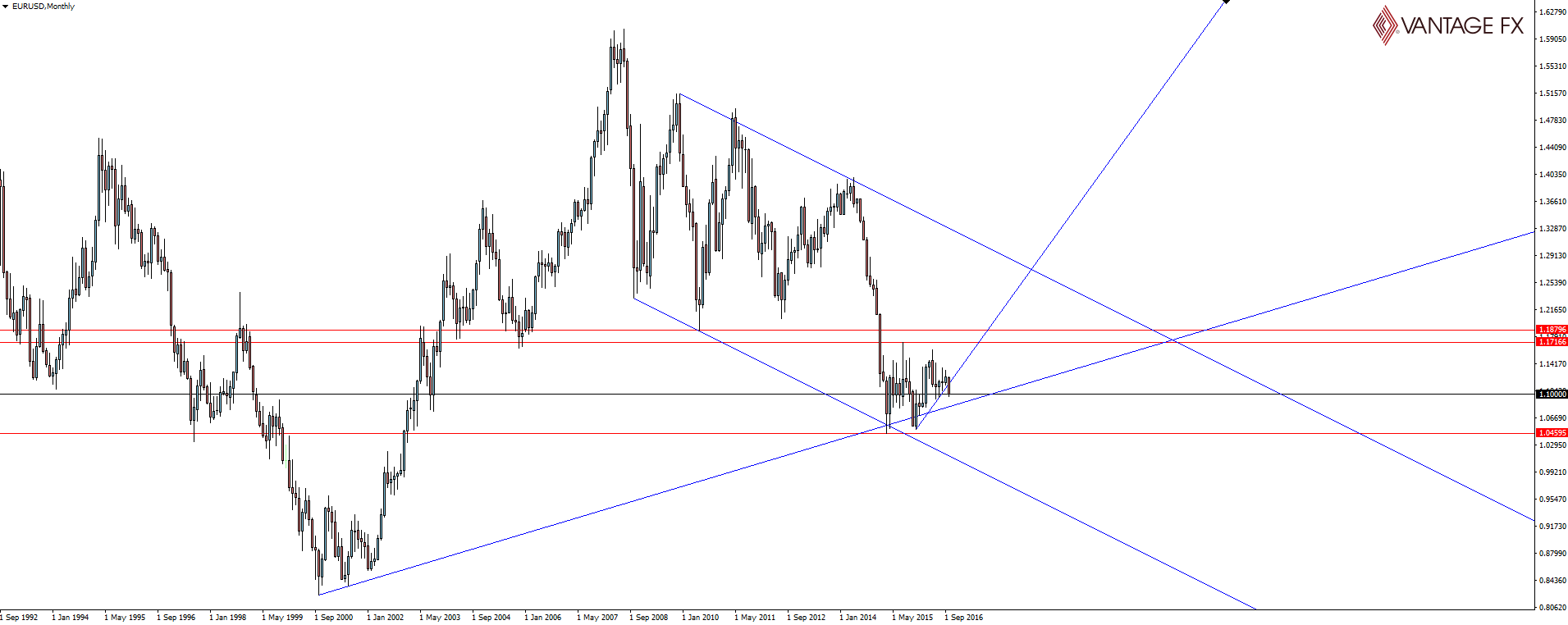

EUR/USD Higher Time Frame:

We finish the night off with the conclusion of the two day ECB policy meeting. The question here as always is will they further their stimulus program?

Most economists surveyed by Bloomberg, predict that they will simply prolong their €1.7 trillion bond-buying program in December. Something that probably wont have the whipsawing effect of past ECB meetings but with the euro hanging precariously on higher time frame support, there are still plenty of risks here.

On the Calendar Thursday

AUD Employment Change

AUD Unemployment Rate

GBP Retail Sales m/m

EUR Minimum Bid Rate

EUR ECB Press Conference

USD Philly Fed Manufacturing Index

USD Unemployment Claims

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.