New data shows house price growth and sales are easing with building approvals falling, and property professionals are reportedly losing confidence.

The NAB Quarterly Australian Residential Property Survey Q3 2021, has shown a decrease in confidence from industry professionals.

The report from NAB stated that, "the survey is also pointing to a market that has passed its peak rate of growth after the COVID-led dip in 2020."

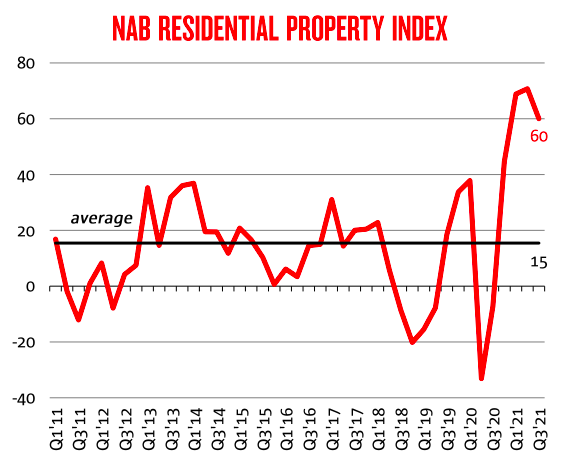

The survey measures the industry's view on housing prices and rents, and found sentiment has dropped to 60 points in the third quarter after hitting a record of 71 points in the previous quarter.

Source: NAB

Construction costs are now considered the biggest constraint on new housing developments in the country with lack of stock an issue for buyers of established property.

The ramped-up construction costs reinforce recent predictions from HIA, and CoreLogic which anticipated a decline in commencements of new detached homes from mid-2022 when homes initiated by Homebuilder near completion.

NAB has also revised its dwelling price forecast to 23% in 2021 and 5% in 2022 as impact of low rates and strong income support begin to fade.

These projections align with Westpac's predictions released earlier this month, who predicted a 22% gain for 2021 and 8% gain in 2022.

Established Property

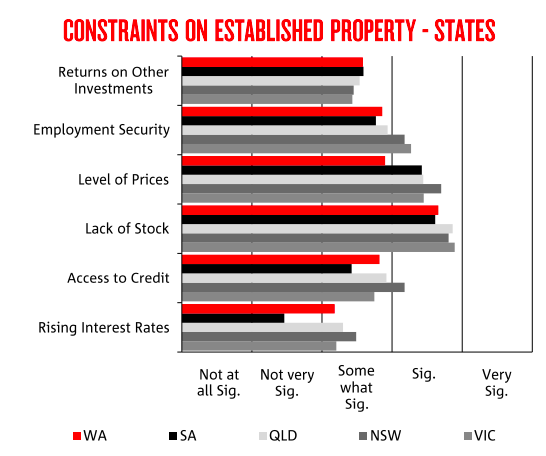

In the established housing market, lack of stock is the biggest constraint buyers face.

Source: NAB

The next biggest constraint impacting buyers was the rising price of houses, with this issue being the most prevalent in NSW.

In Victoria and NSW, employment security was also a significant constraint, impacted by lockdowns and restrictions.

Foreign Investors

Foreign buyers were slightly more present in the market in Q3 than previous reports from NAB in the last year.

During the September quarter, property professionals estimate the overall share of total sales to foreign buyers lifted to 4.4% (the highest in 12 months) in new property markets and 2.2% in established housing markets.

The highest percentage of foreign investors were seen in Victorian (5.6%) and QLD (5.0%) housing markets.

These numbers are still well below averages of 12.9% and 11.2% respectively.

Rental Markets

Over the next 12 months, the survey average predicts rents to increase by 3.1%.

House prices are expected to outpace rents, before leveling out to a similar pace in two years' time.

Migration from locked down states has seen a shift in the rental landscape in the past twelve months, with Melbourne now offering the cheapest rent for houses in any capital city.

This has led to record rental prices for Brisbane, Adelaide and Darwin, with NAB's latest projections indicating this may continue.

"Australian housing market 'past its peak'" was originally published on Savings.com.au and was republished with permission.