Kathy Lien, Managing Director Of FX Strategy For BK Asset Management

Daily FX Market Roundup November 4, 2019

The Australian dollar is in focus this week with a number of market-moving economic reports and a monetary policy announcement on calendar. Having traded to 3-month highs last week, A$ retreated ahead of Monday’s Reserve Bank of Australia monetary policy announcement. No changes to interest rates are expected from the RBA, which cut borrowing costs 3 times in the last 5 months. When it lowered interest rates at its last meeting, the RBA left the door open to additional easing but no one expects another move this year. Interest-rate futures show only a 24% chance of a fourth cut in 2019, which explains why the Australian dollar recovered throughout October.

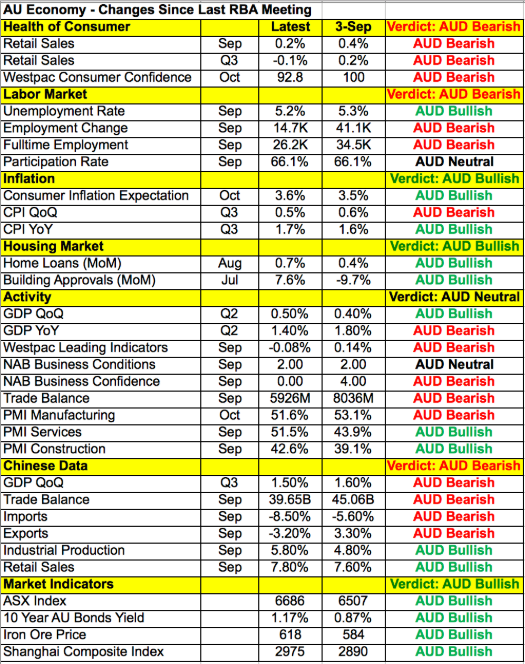

Unfortunately, since the last policy meeting we’ve seen further weakness in Australia’s economy. Sunday night, retail sales missed expectations, growing only 0.2% in September and contracting by -0.1% in the third quarter. Although the labor market is the strongest part of the economy, job growth is slowing. Business confidence and manufacturing activity also weakened as exports and imports in China declined. The only improvements were in the housing market and inflation but according to RBA Deputy Governor DeBelle, the worse is yet to come for Australia’s housing slump.

With RBA Governor Lowe reminding us that he’s prepared to ease rates further late last month, there’s no question that the central bank will maintain a cautious outlook. Despite the rumblings of a phase-one trade deal being close to complete, there’s still significant uncertainty around U.S.-China trade relations and the upcoming December tariffs that will keep the RBA cautious. We don’t expect any major changes to the RBA statement – the tone will remain dovish, which should be enough to trigger additional profit taking in the currency. We expect AUD/USD to pull back to at least .6850 but further losses will hinge on the trade balance, PMIs and China’s trade report.

The New Zealand and Canadian dollars also followed A$ lower. New Zealand has labor-market numbers scheduled for release in the next 24 hours and the risk is to the downside. Meanwhile, we continue to look for the loonie to catch up with other currencies. USD/CAD should be trading above 1.32 and Tuesday’s trade balance report could do the trick by finally shifting USD/CAD momentum to the upside. Euro tumbled despite upward revisions to final manufacturing PMI.

Finally, the main theme Monday was renewed demand for U.S. dollars. The greenback traded higher against all of the major currencies extending its gains above 108.50. U.S. factory orders and durable goods numbers were weaker than expected but between the record high in U.S. stocks and the fact that it still pays to be long dollars, the greenback was the best-performing currency. U.S. trade data is scheduled for release along with non-manufacturing ISM – it will be interesting to see how much softer numbers impact the currency.