Key Points:

- AUD breaches 100 MA.

- Parabolic SAR reverses to downside.

- AUD likely to turn bearish.

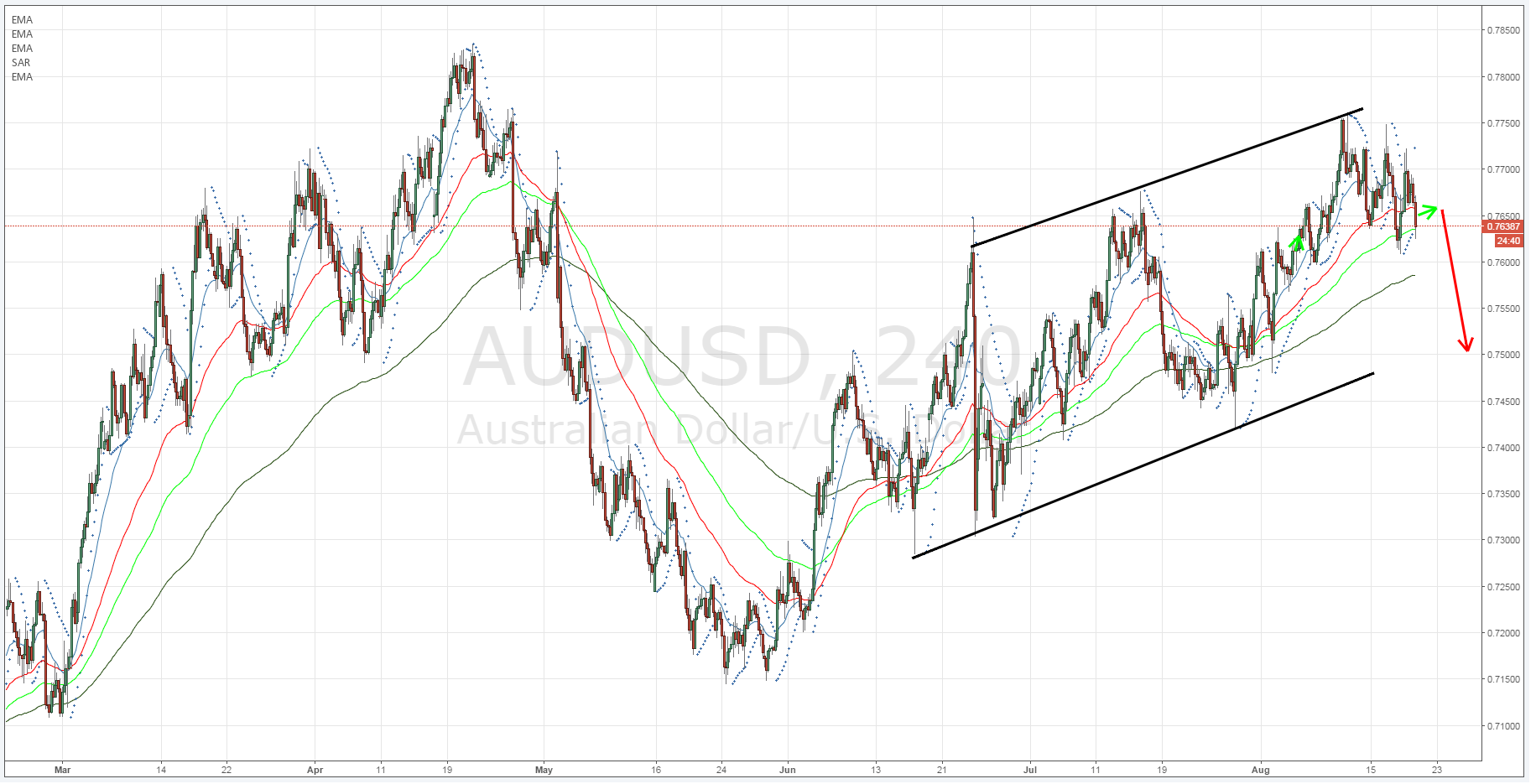

The Australian dollar has been relatively bullish of late as the pair continues to trade within a relatively robust pricing channel. However, despite the medium term buoyant direction, price action has just broken down below the 100 period EMA (4-hr) signalling that there could be some bearish activity ahead.

It is abundantly clear from the medium term charts that, as the currency has risen over the past few months, a strong bullish pricing channel has formed which has largely constrained the pair’s price action.

In particular, taking a look at the daily chart demonstrates almost a near linear trend as having developed since early June. However, the past few weeks have seen price form a new high at the top of the channel and then the subsequent pullback and development of lower lows.

Subsequently, the break down in price action largely predisposes the pair to a further decline.

In addition, taking a cursory look at the technical indicators is illuminating given that the RSI Oscillator clearly shows a down trend in progress.

Also, the breakdown of price action below the 100-period MA is a clearly bearish signal which subsequently supports the short contention. Additionally, Parabolic SAR has also just reversed towards the downside largely following price action’s recent decline.

Subsequently, given that the highs are getting lower, whilst price action continues to break below key MA levels, a short move in the coming session is highly likely. In particular, a move below the key 76 cent handle is likely to set the pair up for a sharp pullback.

However, the RSI Oscillator is currently nearing oversold levels so a period of moderation might be head to relieve some of that pressure prior to a sharp challenge to the next handle.

Ultimately, the technical indicators are largely biased towards the short side and any breach of the swing candle at 0.7608 is likely to bring plenty more pain for the venerable Aussie dollar.

Look for the pair to moderate and then move sharply through the 76 cent handle with targets around the 0.7514 mark.