The Australian Dollar has continued to feel the wrath of mounting Chinese economic concerns over the past few trading sessions. Subsequently, the pair has retained its bearish outlook, but the recent falls appear to have completed a “C” leg and set the Aussie up for a short term retracement.

The Aussie Dollar has been a darling for the bears over the past few trading sessions with a defined short trend in place. The depreciation has largely been due to the end of the commodity super cycle and mounting concerns that the Chinese domestic economy is in slow down. Subsequently, the market took a strongly risk off approach to the release of the Chinese GDP figures and the AUD felt the pinch as capital flowed away from the currency.

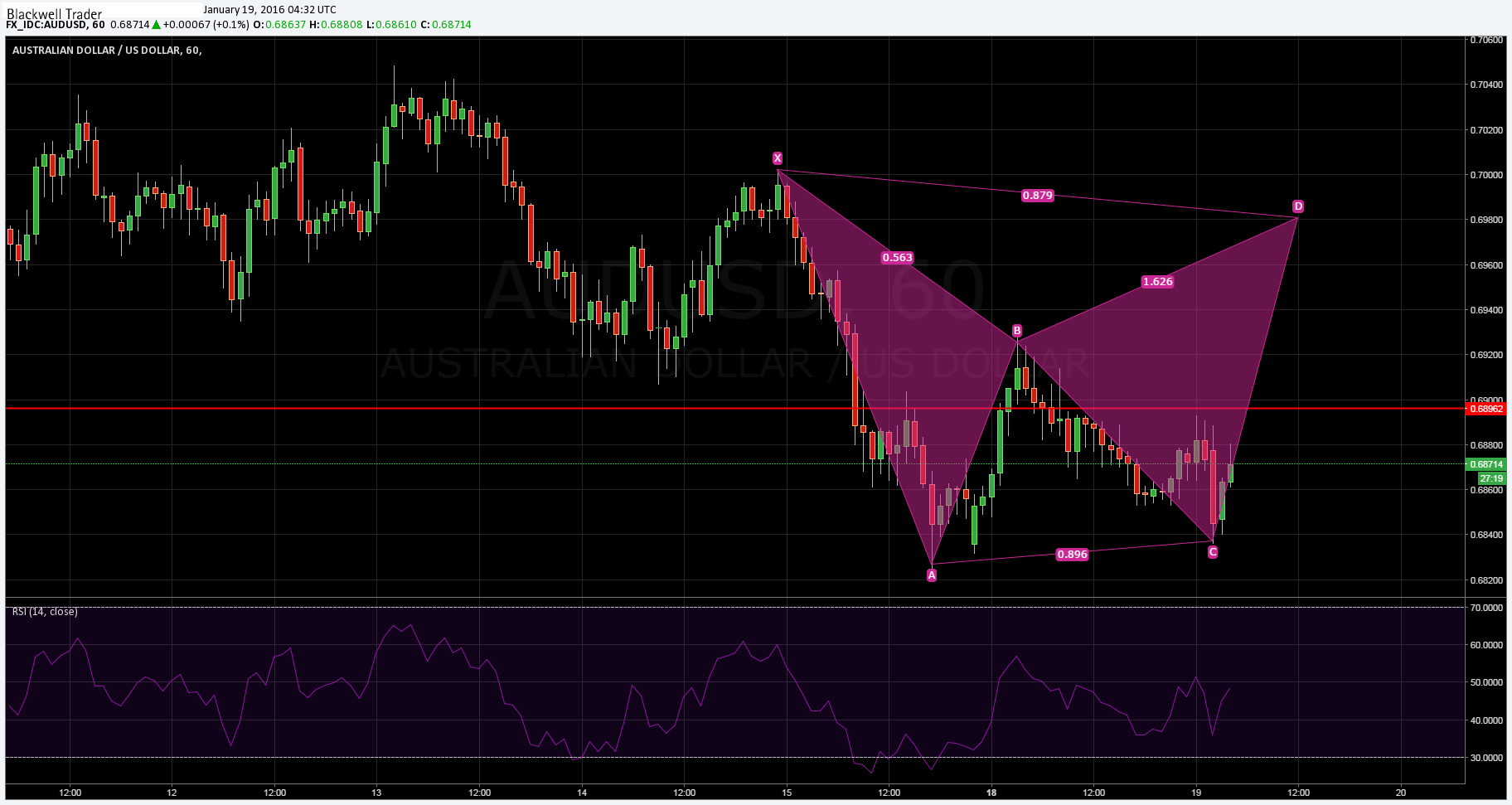

However, the Chinese doomsday scenario failed to materialise and the pair has subsequently rallied back towards resistance around 0.6880 which sets it up nicely to have completed the “C” leg of a bearish batwing. Subsequently, there is scope for a retracement back towards 0.6981 to complete the final leg.

In addition, the technical indicators are signalling a retracement in play as RSI starts to move away from oversold territory, whilst trending higher within neutral territory. In addition, the moving averages have started to trend north in response to the rally over the past few hours.

However, look for a break of the 30EMA, which is acting as dynamic resistance to confirm for an entry. The pair will also need to surmount resistance around the 0.6920 level before making a move towards the forecast “D” zone at 0.6981.

Ultimately, bat wings can be difficult to predict given the large range inherent in their structure. However, the signals are strongly pointing to a retracement to complete the final leg prior to the resumption of the strongly bearish trend. On the fundamentals front, keep a close watch on the AUD Westpac Consumer Sentiment result, due shortly, as it is likely to impact the pair strongly.