The Aussie dollar is gearing up for what could be a protracted period of gains as a result of a number of technical indicators. Specifically, a perfect storm of EMA activity, Parabolic SAR readings, the RSI oscillator, and an impulse wave pattern are all in agreement that the pair should rally shortly. Additionally, the Commitment of Traders report is showing that the smart money is also expecting a strong recovery for the AUD.

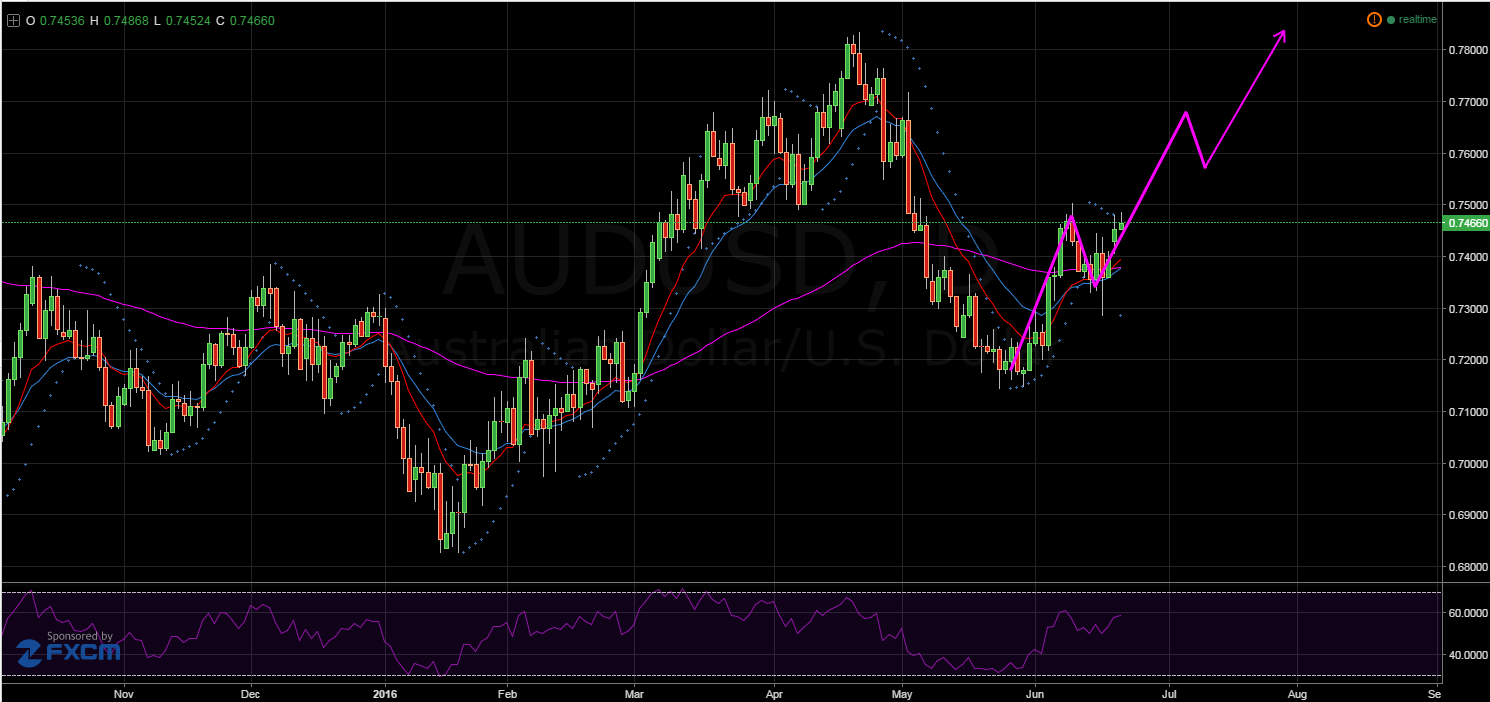

As shown on the daily chart, the AUDUSD is beginning the next leg of an Elliott Wave pattern which could see the 0.7674 zone of resistance challenged. Whilst initial upwards momentum has been relatively muted, the pair could be ready to spike significantly as a result of a number of technical indicators.

Primarily, the recent daily EMA activity is highly bullish but could be about to become even more so. As shown below, the 100 day EMA has intersected the 12 day EMA and is on the cusp of doing the same with the 20 day EMA. Consequently, this crossover could be the trigger needed to send the Aussie soaring again.

In addition, the recent change in the Parabolic SAR indicator reading is likewise signalling that the uptrend is about to gain momentum. After last session, the indicator has moved below the candles which should mean that the pair’s retracement has ended. As a result, increasing liquidity later in today’s session could see the pair stage a sizable recovery.

Furthermore, the RSI oscillator is presently neutral which means that there is little chance of the AUD becoming overbought and capping upside potential. However, this also leaves the pair with little in the way of support from the oscillator and could mean that the AUDUSD is exposed to the influence of poor fundamental indicator results.

Aside from the technicals, the Commitment of Traders report is showing that some bias remains in favour of long positions. Roughly speaking, large speculators have approximately a 3:1 bias on long positions which is little surprise given the slew of technical indicators mentioned above.

Ultimately, the Aussie dollar is looking well positioned to make a strong surge higher in the very near future. However, despite the strong bullishness of the technical indicators, keep an eye on the fundamental results due this week as they are likely to continue making themselves felt. Notably, the recent 0.2% contraction in the Australian HPI result could somewhat limit the next session’s gains and as a result, US data will now be in focus.