The Aussie dollar has come under some pressure in recent weeks, but the confirmation of a double bottom could provide some short term respite.

The AUD/USD pair has seen its fair share of bearish sentiment since reaching a peak in mid-September. Since then the economic troubles in China and the bearish sentiment in commodities have taken their toll on the Aussie, which relies heavily on exports of commodities, especially to China. Many economists believe the “official” growth estimates for China are grossly overstated at 7%, and the reality is going to be between 3-5%.

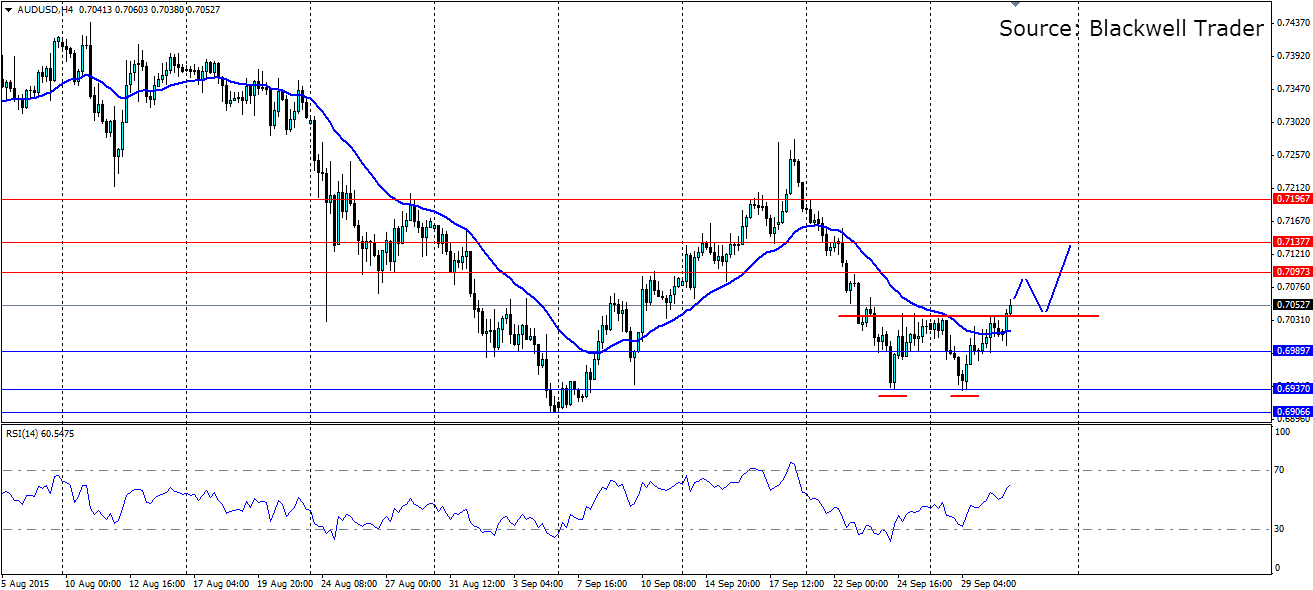

In the meantime, the selling has given way to a bit of short covering as the pair finds support just above the recent six year low. The support at 0.6937 held firm with the price not even getting a chance to test the low at 0.6907. The price tried to re-test the support at 0.6937, managing only to push the low out by 2 pips but the RSI showed some regular divergence as it posted a higher low. That was signal enough for the market to defend the level and form the double bottom.

The bulls pushed the pair up towards the neckline, which has just been broken on the slightly improved economic figures out of China today. The Caixin Chinese Manufacturing PMI reported a slight improvement, up from 47.0 to 47.2. The AUD benefited more from relief buying, rather than optimism that the rout might be over.

From here, watch for a push up to the 0.7097 level of resistance where the bears are no doubt going to try and defend. This will see a push back down to the neckline where the bulls will be waiting to load back up their long positions. This will lead to the charge we are after, with a target at 0.7137 (i.e. the same width above the neckline as the double bottom is below). This will also coincide with a 61.8% retracement of the mid-September high.

Look for resistance at 0.7097, 0.7137 and 0.7196 while support will be found at the neckline of 0.7037, with further support at 0.6989, 0.6937 and 0.6906.