Talking Points:

- AUD/USD Technical Strategy: Short at 0.7214

- Australian Dollar Drops Most in 4 Years, Breaks Range Floor

- Short Trade Triggered Aiming for Support Below 0.71 Figure

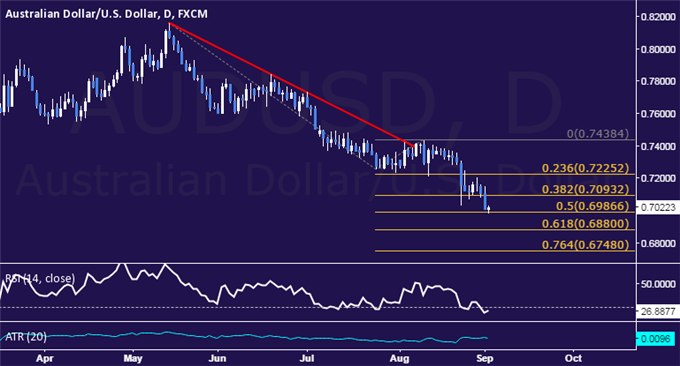

The Australian dollar resumed the decline against its US counterpart following a brief period of consolidation. The pair paused to digest losses below the 0.73 figure having issued the largest daily decline in nearly four years early last week. Prices are now testing below the 0.70 threshold for the first time in six years.

Near-term support is now at 0.6987, the 50% Fibonacci expansion. A break below this barrier on a daily closing basis exposes the 61.8% level at 0.6880. The 38.2% Fib at 0.7093 has been recast from support into near-term resistance, with a turn back above that clearing the way for another test of the 23.6% expansion at 0.7225.

We entered short AUD/USD at 0.7214. Prices have now met our initial objective of 0.7084 and we have booked profit on half of the trade. The rest of the position will remain open to capture any further weakness. The stop-loss has been adjusted to the break-even level (0.7214).