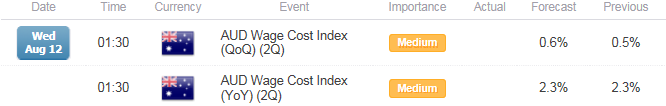

Trading the News: Australia Wage Cost Index

A pickup in Australia’s Wage Cost Index may keep the Reserve Bank of Australia (RBA) on the sidelines and prompt a larger rebound in AUD/USD as it highlights an improved outlook for growth and inflation.

What’s Expected:

Why Is This Event Important:

Signs of stronger wage growth may encourage the RBA to adopt a more hawkish outlook for monetary policy, and Governor Glenn Stevens may look to conclude the central bank’s easing cycle in 2015 should the fundamental developments coming out of the $1T economy boost expectations for a stronger recovery.

Expectations: Bullish Argument/Scenario

|

Release |

Expected |

Actual |

|

Employment Change (JUL) |

10.0K |

38.5K |

|

Retail Sales (MoM) (JUN) |

0.4% |

0.7% |

|

Gross Domestic Product s.a. (QoQ) (1Q) |

0.7% |

0.9% |

The pickup in private-sector consumption along with the improvement in the labor market may encourage Australian firms to boost wage growth, and a strong print may heighten the appeal of the aussie as market participants scale back backs for lower borrowing-costs.

Risk: Bearish Argument/Scenario

|

Release |

Expected |

Actual |

|

NAB Business Confidence (JUL) |

||

|

Building Approvals (MoM) (JUN) |

-1.0% |

-8.2% |

|

-- |

46.4 |

However, the ongoing slack in the $1T economy may continue to drag on household earnings, and a dismal development may put increased pressure on the RBA to further reduce the cash rate in an effort to stem the downside risks surrounding the region.

How To Trade This Event Risk(Video)

Bullish AUD Trade: 2Q Wage Cost Index Climbs 0.6% or Greater

- Need green, five-minute candle following the report for a potential long AUD/USD trade.

- If market reaction favors a long aussie trade, buy AUD/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bearish AUD Trade: Australia Wage Growth Falls Short of Market Forecast

- Need red, five-minute candle to consider a short AUD/USD position.

- Carry out the same setup as the bullish aussie trade, just in the opposite direction.

Potential Price Targets For The Release

AUD/USD Daily

Chart - Created Using FXCM Marketscope 2.0

- AUD/USD stands at risk of giving back the rebound from the end of July as the Relative Strength Index (RSI) threatens the bullish momentum carried over from the previous month.

- DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-long AUD/USD since May 15, but the ratio appears to be pushing back towards recent extremes as it advances to 2.99 with 75% of traders long.

- Interim Resistance: 0.7570 (50% expansion) to 0.7590 (100% expansion)

- Interim Support: 0.7233 (July low) to 0.7240 (100% expansion)

Impact that Australia Wage Cost Index has had on AUD during the last release

|

Period |

Data Released |

Estimate |

Actual |

Pips Change (1 Hour post event ) |

Pips Change (End of Day post event) |

|

1Q 2015 |

05/13/2015 01:30 GMT |

0.6% |

0.5% |

-20 |

-18 |

1Q 2015Australia Wage Cost Index

Australia’s 1Q Wage Cost Index increased 0.5% after expanding 0.6% during the last three-months of 2014, while the annualized rate unexpectedly slowed to 2.3% from 2.5% to mark the lowest reading since the data series began in 1998. The slowdown in wage growth may fuel speculation for lower borrowing-costs after the Reserve Bank of Australia (RBA) cut the cash rate at the May 5 meeting, while Governor Glenn Stevens looks poised to retain the verbal intervention in the local currency in an effort to further assist with the rebalancing of the real economy. Nevertheless, the dismal readings spurred a limited reaction in the Australian dollar, with AUD/USD dipping below the 0.7990 region to close the Asian-Pacific session at 0.7976.