AUD Employment Error. Crazy Price Action:

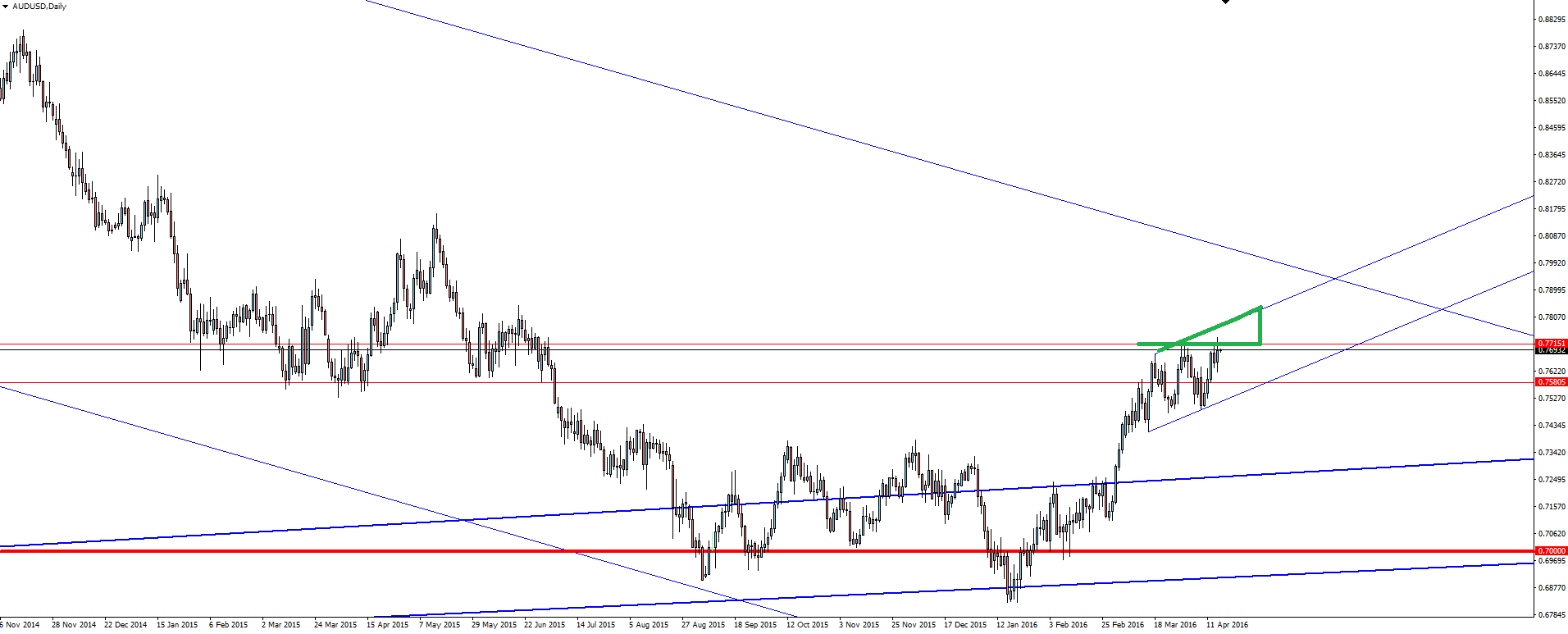

The Aussie dollar once again made a new overnight high, poking it’s head through the resistance zone we’ve been watching before easing a little bit to end the session.

It’s been a good week for AUD sensitive data, with strong NAB Business Confidence data Tuesday, a market positive Chinese Trade Balance Wednesday and yesterday’s Employment data beat all helping the Aussie reach for the stars.

But something out of yesterday that I haven’t seen talked about was the error in reporting the release and the insane price action that followed!

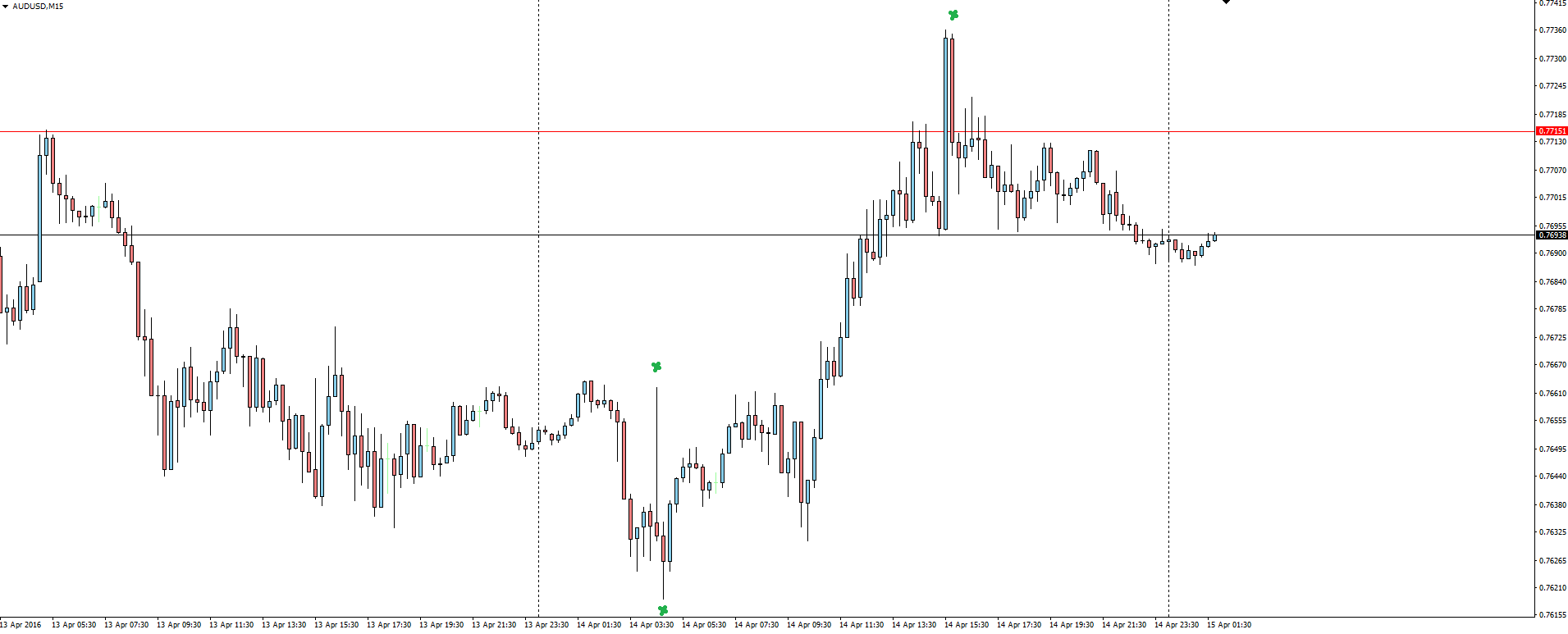

You can see from the above price action GIF immediately after the release, the Aussie liked what it immediately saw and spiked up hard and fast. The +26,000 jobs added was a better than expected print so this wasn’t really out of the ordinary.

But then price fell hard and actually dropped to below the pre-release level… Wait what?!

It turns out that the Reuters feed that some brokers and news services used to report the number actually printed it as +260,000 rather than +26,000!

So as you can see from the above, marked 15 minute AUD/USD chart, price spiked up on the initial print, soon realised that there is a serious error in some of the reporting so spiked back down equally as hard, before finally coming to the conclusion that the +26,000 print in this bullish AUD climate is actually pretty damn good and pushed onto new highs.

The algos eat this sort of stuff for breakfast. Crazy turn of events!

Today’s economic calendar is highlighted by tier one Chinese GDP and Industrial Production. Any sort of beat is expected to push the Aussie dollar through the AUD/USD daily support/resistance zone, but will still likely be capped here.

Chart of the Day:

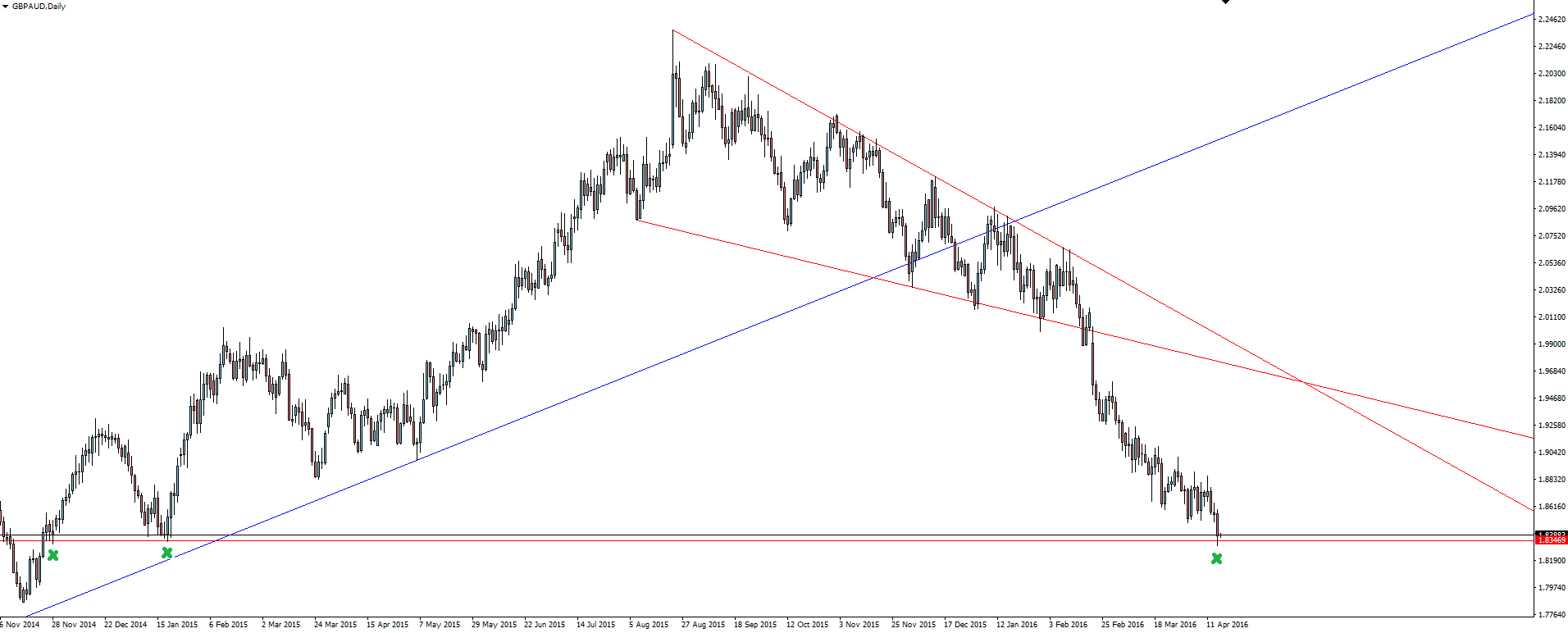

Moving forward and yesterday’s Bank of England decision failed to surprise, with a unanimous 9-0 vote to keep interest rates on hold as expected.

The minutes were however on the dovish side, with central bank officials most concerned about the risks to economic growth that the Brexit referendum is likely to have on subsequent data releases.

“Sterling has depreciated further over the past month. Risk-free interest rates in the United Kingdom and elsewhere have also declined. Together with rises in the prices of many risky assets, these movements should support economic activity. That said, the likelihood that much of the fall in sterling reflects uncertainty surrounding the forthcoming referendum on the United Kingdom’s membership of the European Union raises questions regarding whether the lower level of sterling will persist and its net economic impact.”

GBP/AUD Daily:

GBP/AUD is back at an interesting level which we’ve seen a reaction off in the past. That momentum is pretty damn obvious though so blindly buy support at your own peril.

On the Calendar Friday:

AUD RBA Financial Stability Review

CNY GDP q/y

CNY Industrial Production y/y

CNY Fixed Asset Investment ytd/y

CNY NBS Press Conference

CAD Manufacturing Sales m/m

USD Prelim UoM Consumer Sentiment

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Australian Forex Broker Vantage FX on the MT4 platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.