AUD/NZD break below from flag pattern

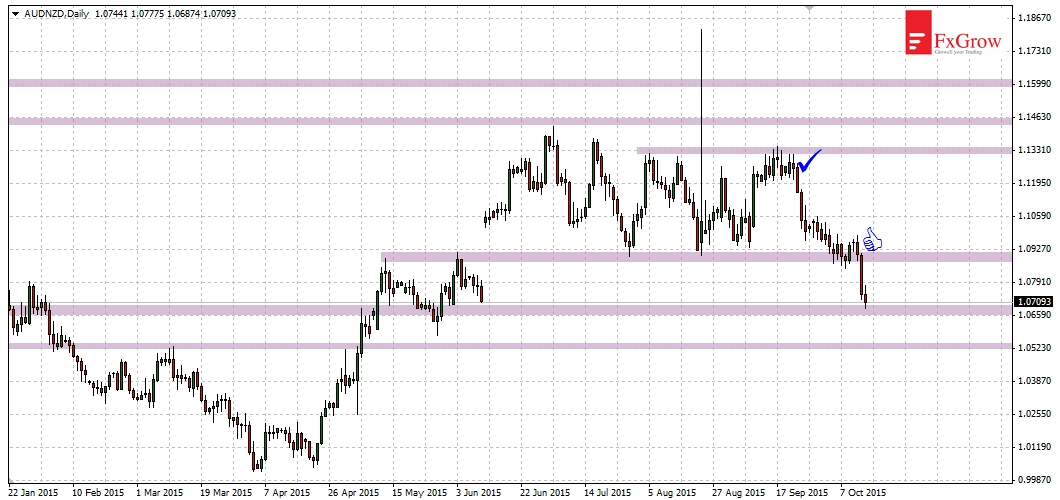

In the analysis of September 23 I wrote: "AUD/NZD now rebounded from the resistance at the indicated level and is heading 1.0900". On October 2 the specified target level for the descent was reached. But this support did not cause rebound. Yesterday's strong downward candle broke through the support level of 1.0900. Today, the price reached to the next support at level 1.0700. At the moment, there should be a rebound. The key to the future price is behaviour AUD/NZD in level 1.0900. Rebound confirm falls, and the return above 1.0900 will be back into consolidation.

Wider view, time-frame W1 From mid-June AUD/NZD moved in a flag formation, which yesterday was break below. In August, there was an attempt of break it above, which ended with a fakey. Currently, we have to deal with the same. However, it should be noted that the main trend for AUD/NZD is a downward trend, which means that the breakout is in line with the trend.