Forex markets experienced broad USD strength across the board, exaggerated by weakness in commodity currencies AUD and CAD.

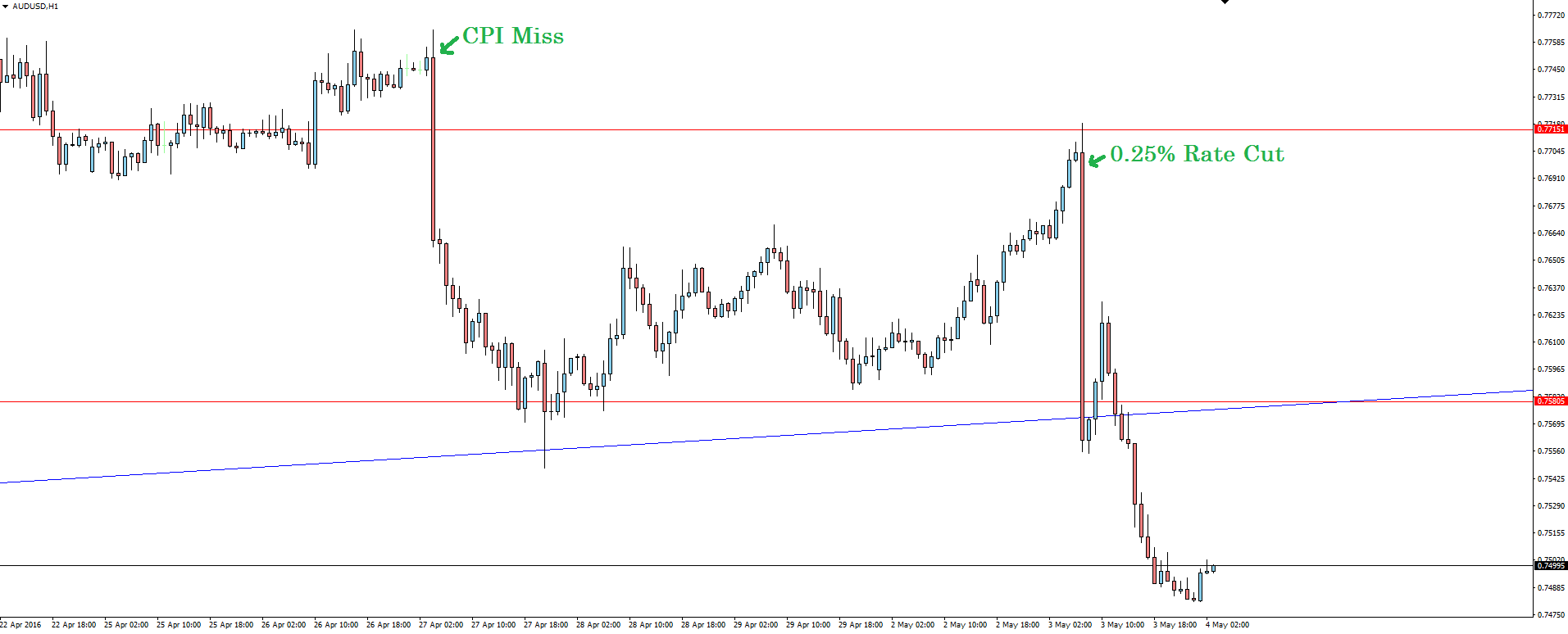

AUD/USD was hammered following the Reserve Bank of Australia’s decision to cut rates by 0.25% to 1.75% yesterday. The market was positioned in no-man’s-land heading into the release and there was always going to be a huge reaction in either direction.

AUD/USD Hourly:

Obviously, it was to the downside.

With most other domestic data points relatively positive, what this cut does is actually highlight the clear mandate that the RBA has on inflation. With the Fed continuing to delay their normalisation process, Stevens felt he had no other choice and had to act now.

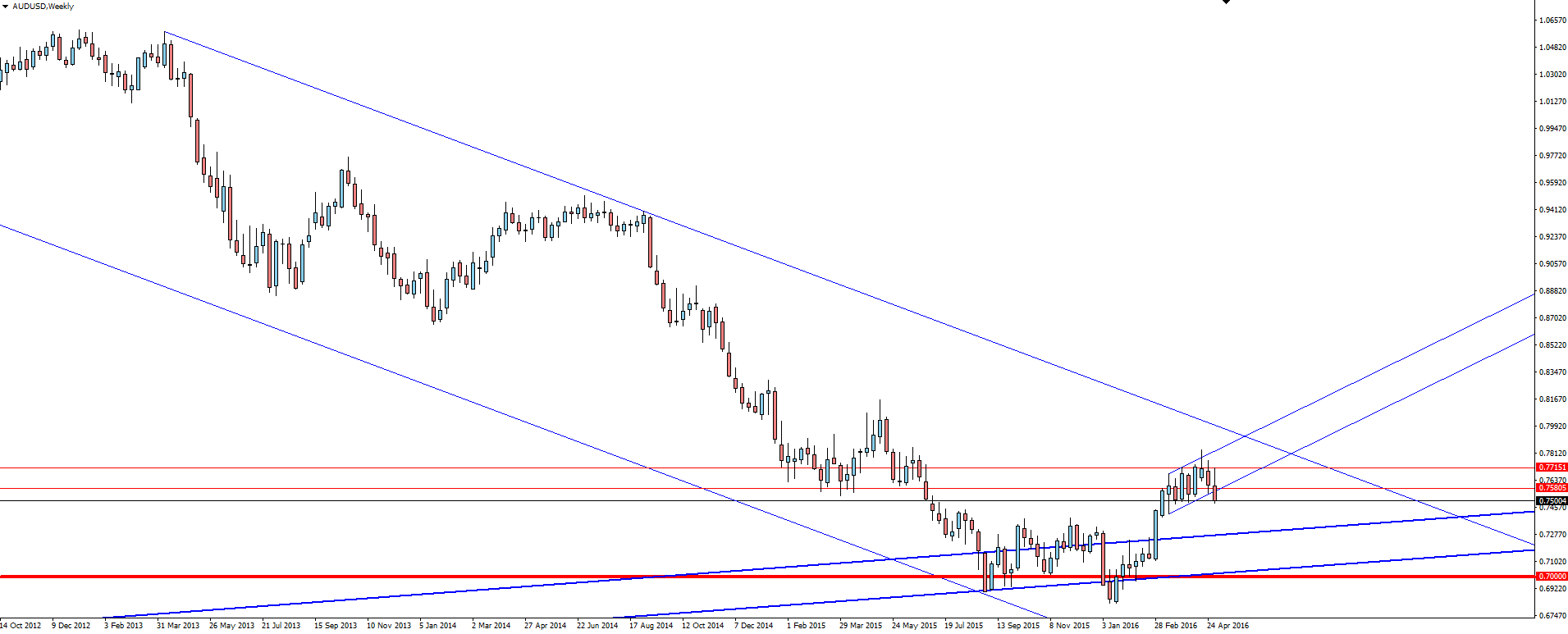

The Aussie has now started pulling back into the middle of the higher time frame bearish channel we have marked on our weekly chart. With the narrative soon to flick back to the Federal Reserve, Australia’s yields are still relatively attractive and it will be interesting to see how price reacts at any of the approaching levels of support.

I’m not flicking full blown bearish just yet.

My colleague at Vantage FX, Arthur Drakopoulos posted an alternative AUD/USD channel on the News Centre yesterday evening which is also worth a look as we head forward.

Chart of the Day:

With three solid days of Aussie dollar charts, let’s take a step back and refresh with a look at something different.

One setup that does stand out when I flick through my MT4 platform watch list is the following EUR/GBP level that we have featured before.

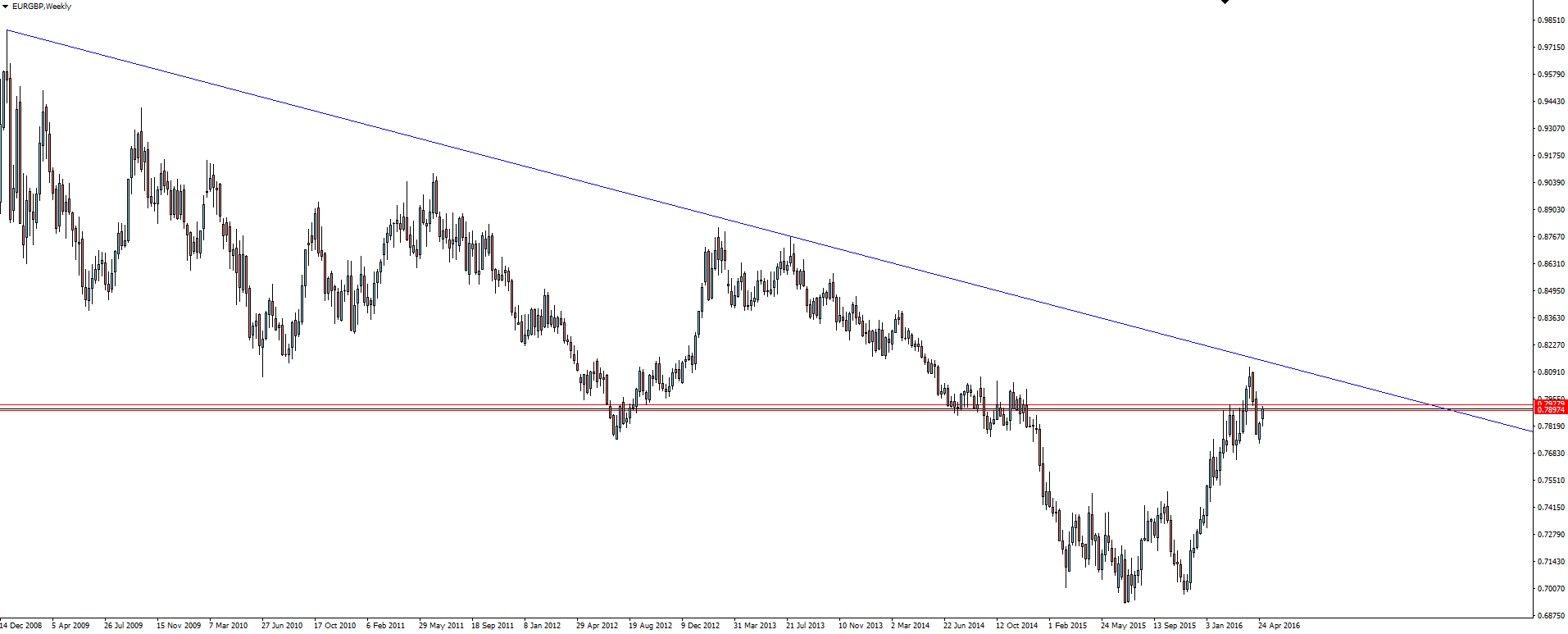

EUR/GBP Weekly:

With the weekly chart showing a long term down trend, price has pulled back up to re-test a general previous support zone as possible resistance.

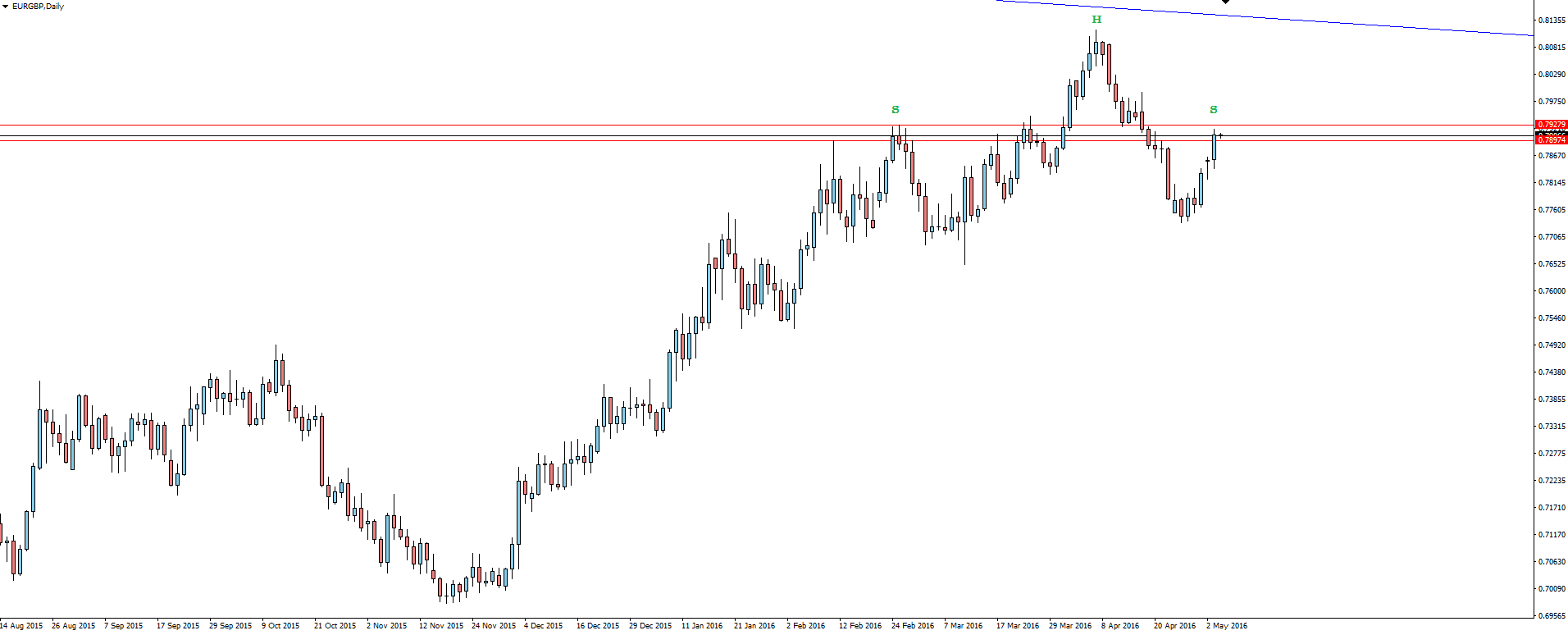

EUR/GBP Daily:

Zooming into the daily chart and the level I’ve linked to in the older blog could not only act as standalone resistance, but could possibly form a shoulder in a higher time frame head and shoulders pattern.

I have had problems trading head and shoulder patterns in the past, with my argument being that they are just too subjective to be able to consistently make the pattern work. If you trade head and shoulders patterns, let us know how you manage the subjectivity with a mention to @VantageFX on Twitter.

On the Forex Calendar Wednesday:

JPY Bank Holiday

NZD Employment Change q/q

NZD Unemployment Rate

GBP Construction PMI

USD ADP Non-Farm Employment Change

CAD Trade Balance

USD ISM Non-Manufacturing PMI

USD Crude Oil Inventories

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex Broker Vantage FX Pty Ltd does not contain a record of our prices, spreads or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, regulated Forex Broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.