It’s been over a year since I have written about the Australian stock market mainly because I was occupied with other issues and secondly, because the market was working it’s way up past the long term average anyway as I wrote about back in January 2019. So a market correction was bound to come along eventually, as they always do, but this current correction has a real sting in its tail.

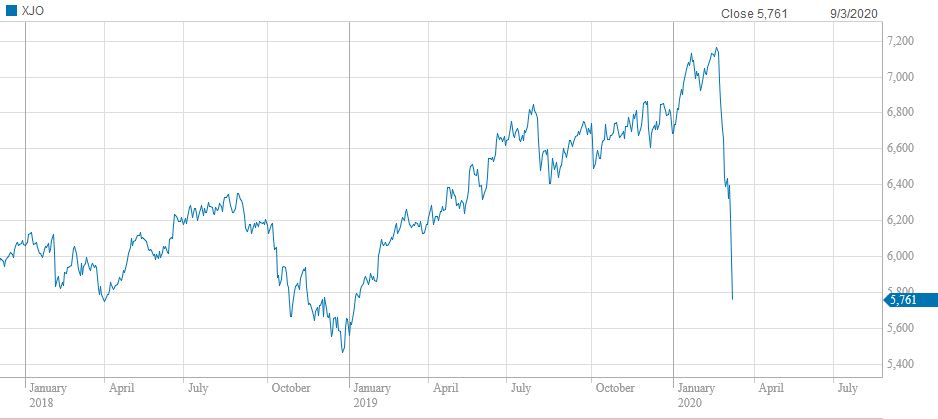

First let’s just calm things down and remember that market corrections are common and we can expect on average, at least one a year with some minor pull-backs more frequently than that. Yes the current ASX market correction has been savage but on the other hand, the S&P/ASX 200 (XJO) has over the last year had a very good run upwards as we can see from the chart below. Certainly the recent sell-off has pushed the ASX 200 back to where it was at the start of 2018, but that’s what happens when a correction hits – I.e. the market goes backwards.

S&P/ASX 200 Index (XJO) Jan 2018 – Mar 2020

Now whenever market corrections take hold my advice is not to pay much attention to the scary media headlines about “billions wiped from the market” etc., or reporters excitedly writing their usual stories about market gloom and the end of capitalism. Rather I’d suggest looking at the long term picture and observing how the market has performed in the past and also how it has recovered from past corrections and slumps. To do this I will use a simple chart of the S&P/ASX 200 Index from 1992 up until the close of the market today – 9th March 2020.

On the chart above I have drawn (without any detailed scientific analysis) two trend-lines. The bottom red line we can call the gloom line and it tracks the lowest point the market has slumped to since 1992. Basically if the ASX were to fall to just over 4000 then we would be in global financial crisis (GFC) territory and this may happen if the coronavirus is not contained. The upper green line is basically the long term trend for the ASX 200 and that suggests that perhaps the market is already over-sold and this tends to happen during corrections, especially when investors with leveraged portfolios start getting margin calls. Between those two lines is a region of uncertainly and none of us can know for sure if the ASX 200 will keep moving down into that region or not.

But what we can do is look at the other corrections and generally in the past, there has been some trading around a bottom, after which the market fairly quickly recovers and then moves back to edging upwards in line with the long term trend. So at the moment I’d be looking for the market to possibly move around the 5500 level (or a bit below) for some time and then recover to 6000 fairly quickly. However the very big unknown here is the coronavirus and trying to make a prediction about how that will spread or not spread is pure guesswork for most of us. What seems obvious though is that the tourism and travel sectors in many economies are going to take time to recover, whereas in other sectors pent-up demand should quickly help stocks in those areas bounce back relatively strongly. In Australia for example the government may implement measures to stimulate the economy and if this were to happen, then this would give a boost to a wide range of stocks.

So for now I wouldn’t be surprised if the market fell further but I don’t expect it to fall much below 5,000. This means there are some quality blue-chip stocks now available with price to earning (P/E) ratios and dividend yields that look quite attractive. I’m still very cautious regarding the outlook for the short term, but even during this uncertainty there are many ASX 200 stocks that are worth looking at closely and putting on a watch list.