DXY fell overnight as the energy crisis rolls on. EUR rose:

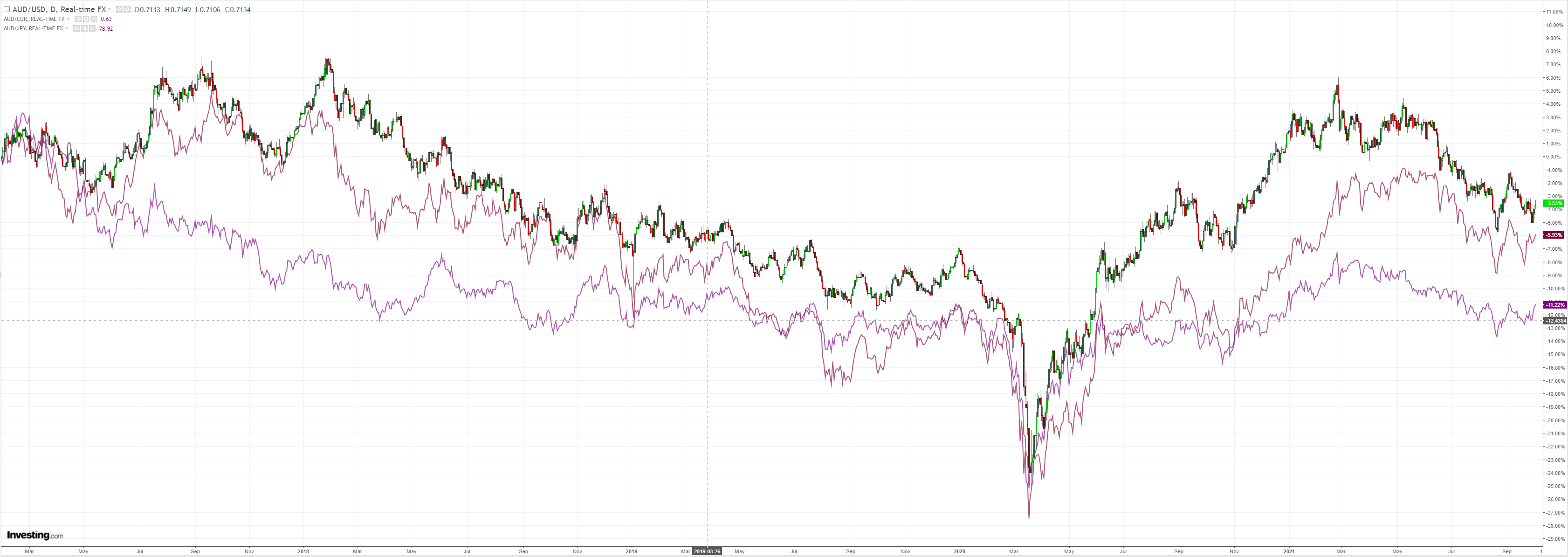

Australian dollar rose on all crosses and looks strong:

Oil is going to the moon. Gold not so much:

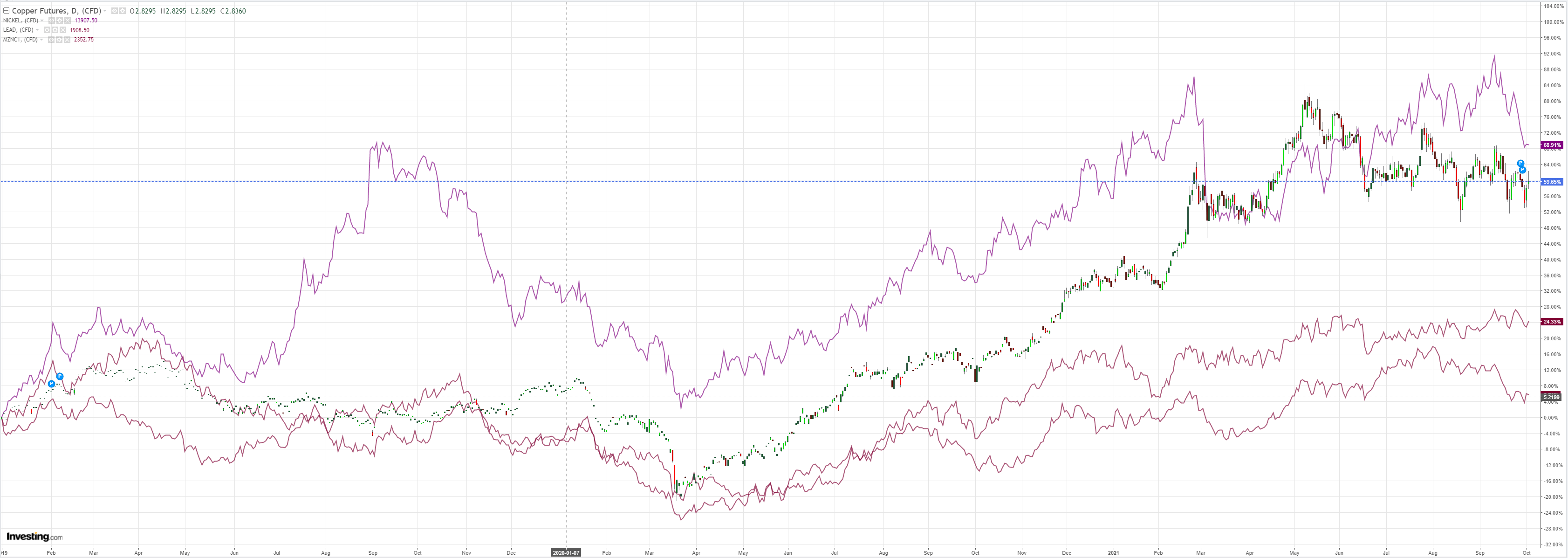

Metals held on:

Miners didn’t:

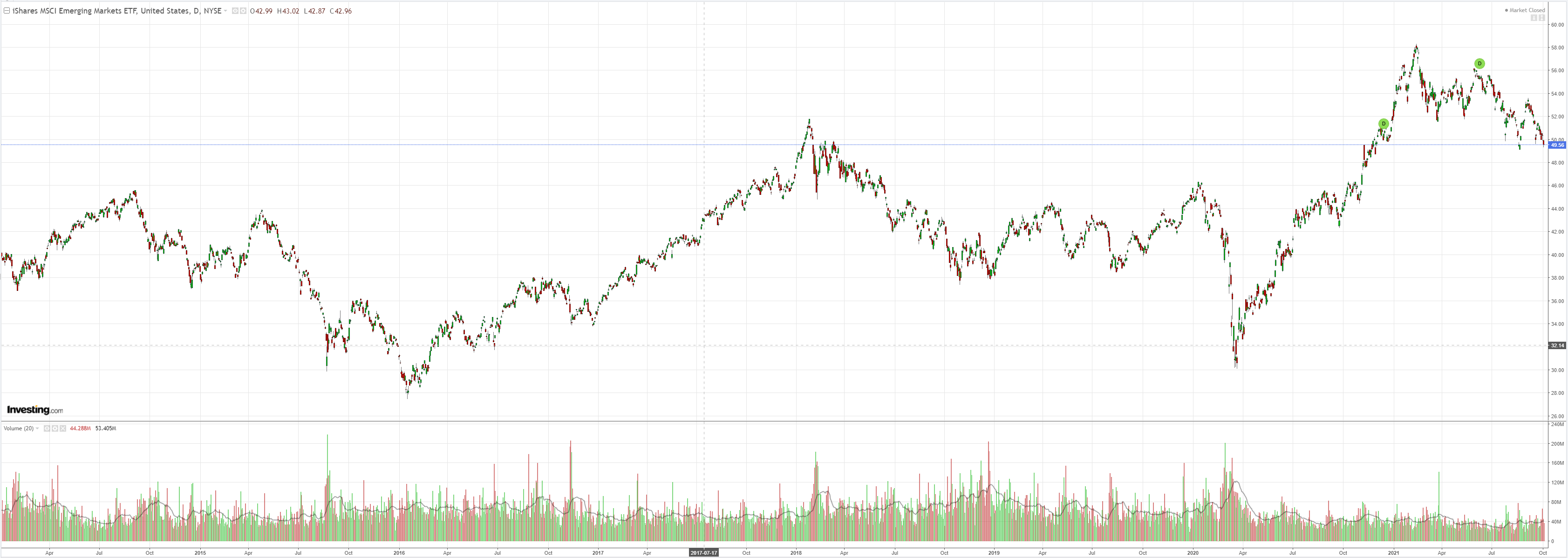

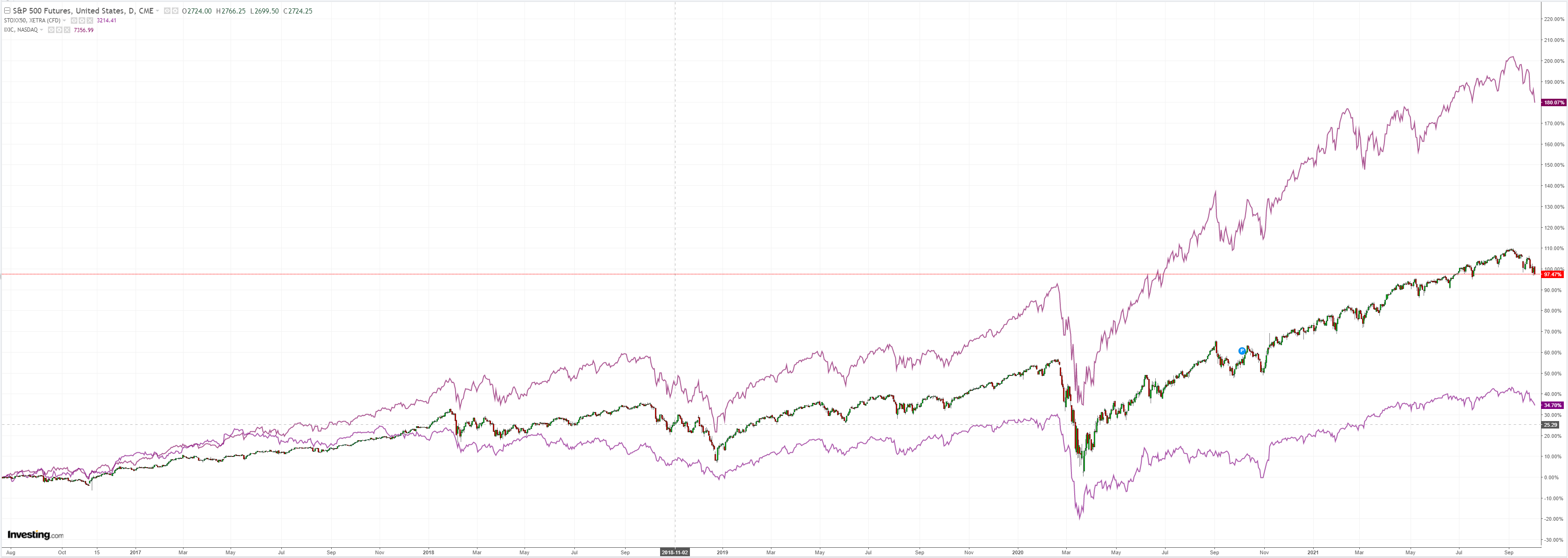

EM stocks are breaking:

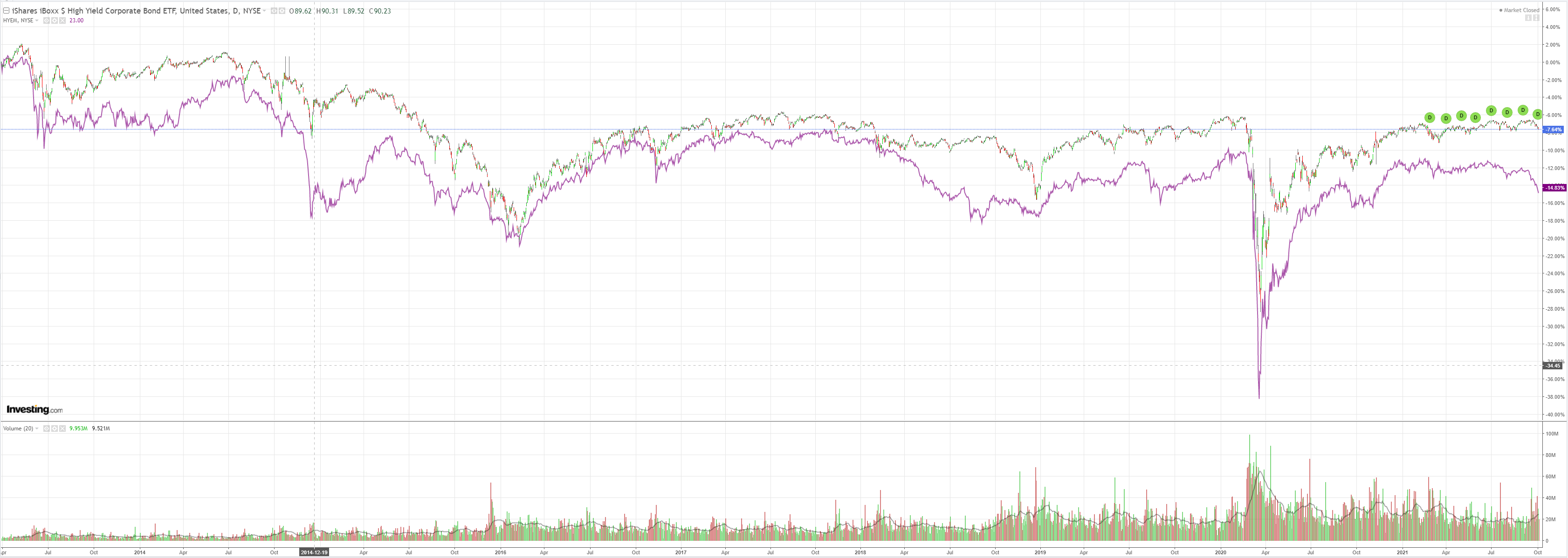

EM junk is broken, delivering a huge warning to DM stocks:

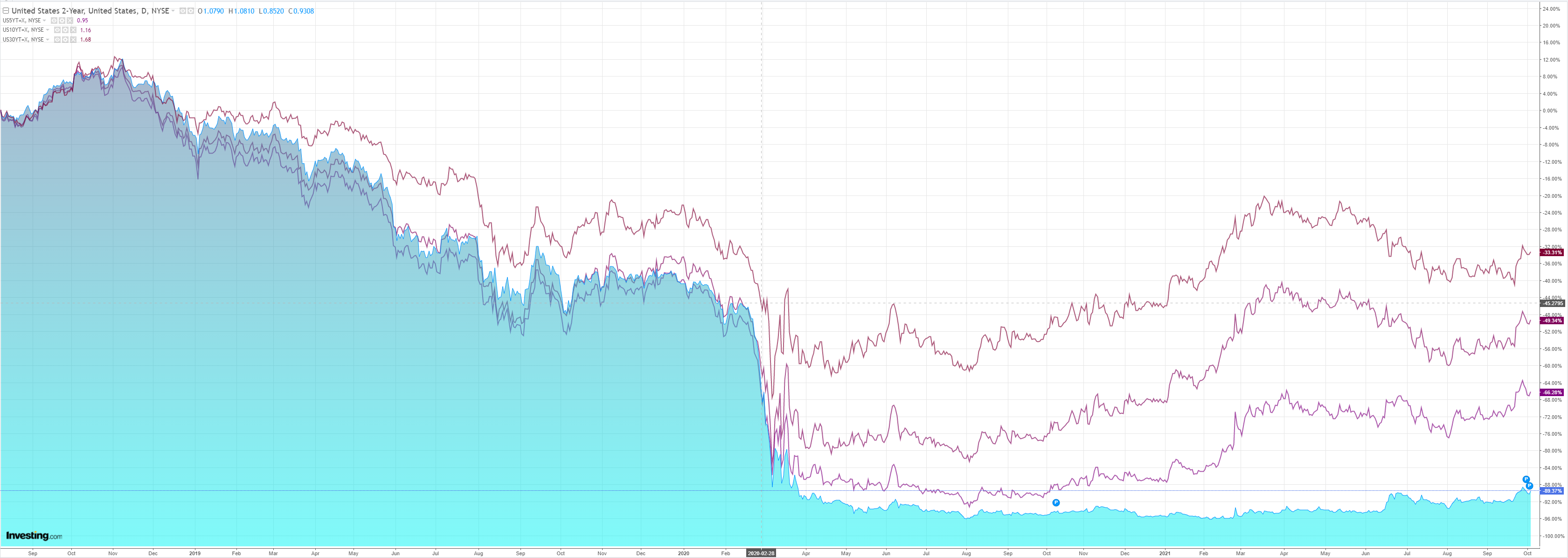

Yields rose:

Stocks sank, led by FAAMGs:

Westpac has the wrap:

Event Wrap

US factory orders in August rose +1.2%m/m (est. +1.1%m/m, prior revised to +0.7%m/m from +0.4%m/m), with ex-transport up a more modest +0.5%m/m (est. +0.4%m/m, prior revised to +0.8%m/m from +0.8%m/m). Durable goods orders were unchanged from the provisional reading of +1.8%m/m, with a minor increase to the ex-transportation component.

FOMC member Bullard continued to warn of upside inflation risks. He is concerned it could take longer than expected for pressures to subside, and that could start to change inflation expectations. He expects core inflation to be around 2.8% in 2022.

OPEC+ agreed to increase output in a gradual manner, up 400,000 barrels per day in November. Markets were expecting an increase of around 800,000. The world’s largest oil company, Saudi Aramco (SE:2222), said the global natural-gas shortage has boosted crude consumption by 500,000 barrels a day.

Event Outlook

Australia: We expect the stance of policy will subsequently be left unchanged by the RBA at its October meeting. Westpac is forecasting the August trade balance to narrow to $10.3 billion on lower iron ore prices. Finally, while vacancies remain at record highs, lockdowns should affect September ANZ jobs ads.

New Zealand: The Q3 QSBO business opinion survey is likely to see a sharp drop in current conditions due to lockdowns. September ANZ commodity prices should meanwhile firm on elevated meat and dairy prices over the month.

Japan: The September CPI is expected to show delta continuing to act as a headwind for recovery (market f/c: -0.1%yr).

US: The trade deficit should remain wide in August on imports to meet consumer demand (market f/c: -$70.6bn). Finally, the September ISM non-manufacturing index is likely to be influenced by delta pressures but also consumer spending rotating to services (market f/c: 59.9).

It was an odd night of trading given DXY weakness amid the energy blowoff. I will put that down to Biden stimulus and debt ceiling jitters though, in truth, who knows? The AUD was exactly tearaway, either, in the circumstances.

The truth is, this energy blowoff is going to ravage China and Europe well before it hurts the US so I’ll put the night down to some contrary activity.

While energy blows off and yields rise, obviously this will hit Growth in particular and stocks in general. I still think it sinks the AUD as well, just not so far as a regular risk-off event given our energy advantages.

When the energy blow-off ends you’ll have to ask the new Tsar of Russia as cuts gas, coal and oil to the global economy all at once.