- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Asian Session Morning: Can You Decipher The Notes?

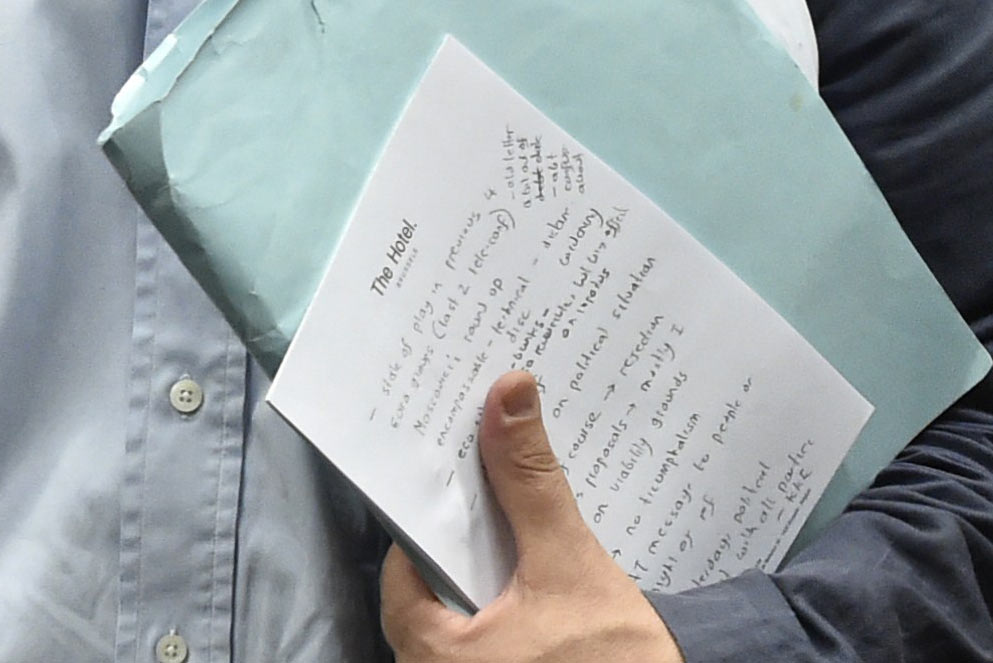

Can you decipher the notes?:

It’s now coming into Wednesday after the weekend’s referendum vote, and low and behold, Greek banks are still closed, deadlines are still being pushed back, and a solution seems as far away as ever before.

But could the answer to Greece’s problems be written on this hotel notepad that new Greek Finance Minister Euclid Tsakalotos was holding while posing for happy snaps alongside Eurogroup President Jeroen Dijsselbloem?

Maybe this is a tactic to use the media to push through negotiations ahead of deadlines? Or maybe it’s just a rookie error that could have been a lot more embarrassing for Greece’s new man.

Anyway, European leaders have now set Sunday as the deadline for Greece and its creditors to come to a deal, with all of last night’s soundbites sounding like a Grexit is now inevitable.

German Chancellor Angela Merkel:

“We have only a few days left to find a solution. I’m not especially optimistic.”

European Commission President Jean-Claude Juncker:

“We have a Grexit scenario prepared in detail.”

European Union President Donald Tusk:

“The stark reality is that we have only five days left to find the ultimate agreement. Until now, I have avoided talking about deadlines. But tonight I have to say loud and clear that the final deadline ends this week.”

RBA Holds Firm:

The Reserve Bank of Australia’s Interest Rate Statement was a bit of a non-event yesterday, with Governor Stevens taking the wait and see approach and leaving rates on hold.

There wasn’t too much meat for traders to strip off the bone of the accompanying statement either, with it not being as dovish as markets expected. The key takeaway from the statement seems to be that the RBA believes that further exchange rate depreciation seems likely, and that it would be wise to wait and see how things play out in Greece before cutting rates to fresh record lows.

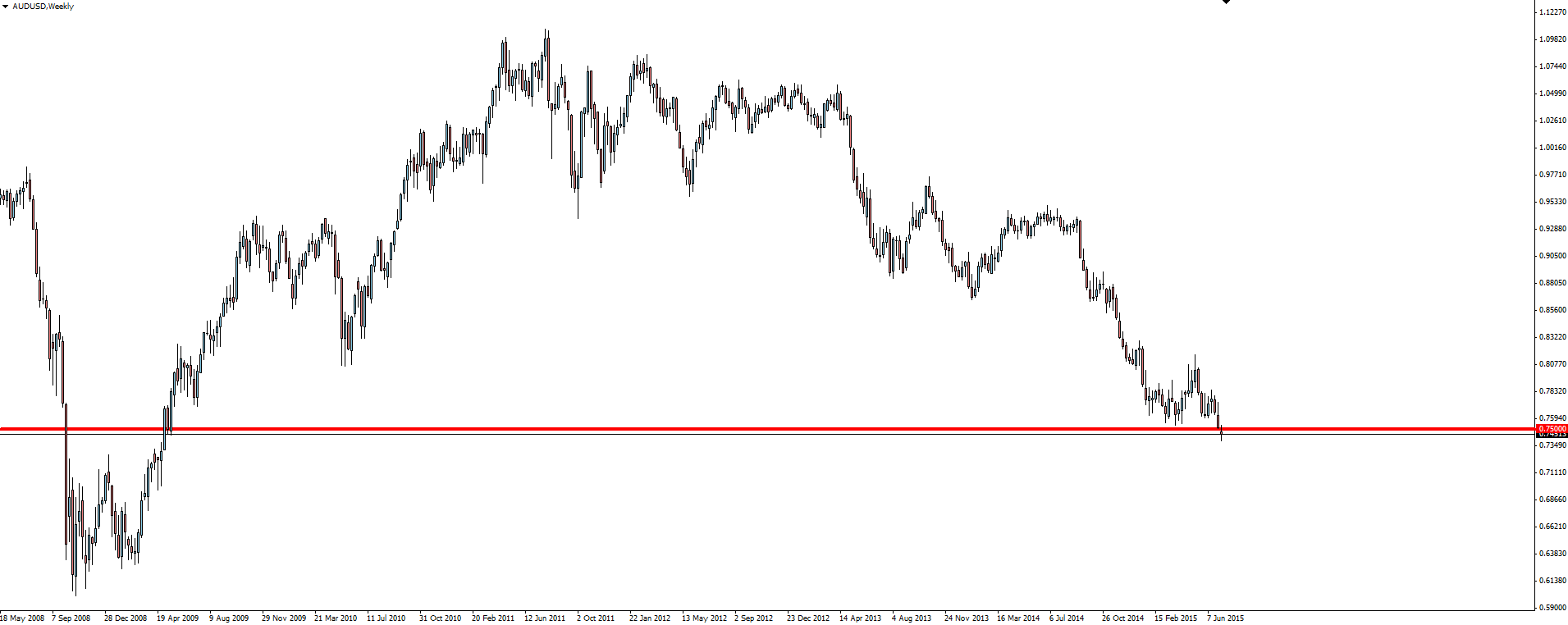

AUD/USD rallied on the statement initially, but the RBA was soon pushed onto the back-burner as European markets took charge, and the general risk on sentiment pushed AUD/USD to its lowest level in 6 years, holding below the major 75c support level.

AUD/USD Weekly:

Click on chart to see a larger view.

Something else to note was that Stevens made no mention of China in his Monetary Policy Statement. Is that faith in the PBOC’s ability to control, or yet more wait and see?

———-

On the Calendar Today:

Another chance for Greece to come to a compromise with its creditors tonight, with Eurogroup meetings running all day. FOMC Meeting Minutes are also released, but being pre-referendum, they won't contain whether fresh uncertainty has actually altered their thinking on a September rate hike.

Wednesday:

EUR Eurogroup Meetings

GBP Annual Budget Release

CAD Building Permits

USD FOMC Meeting Minutes

———-

Chart of the Day:

We have been looking at building a short position in gold over the last few weeks in anticipation of a break lower through major support. The level of that price is testing the bottom now.

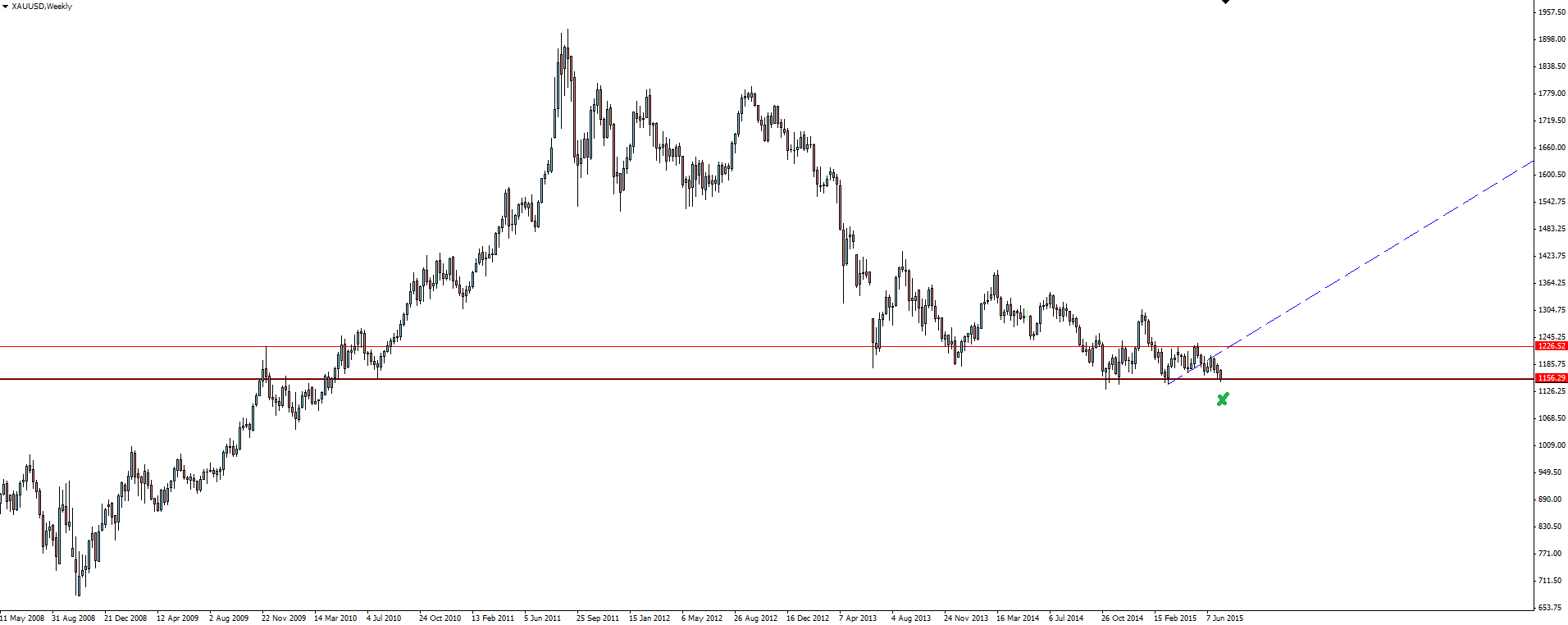

Gold Weekly:

Click on chart to see a larger view.

On the weekly chart, you can see that price is now testing the lower band of the major support zone that we have been looking for a break. Price failed to make a new high, and was rejected off the underside of the broken trend line support, now turned resistance.

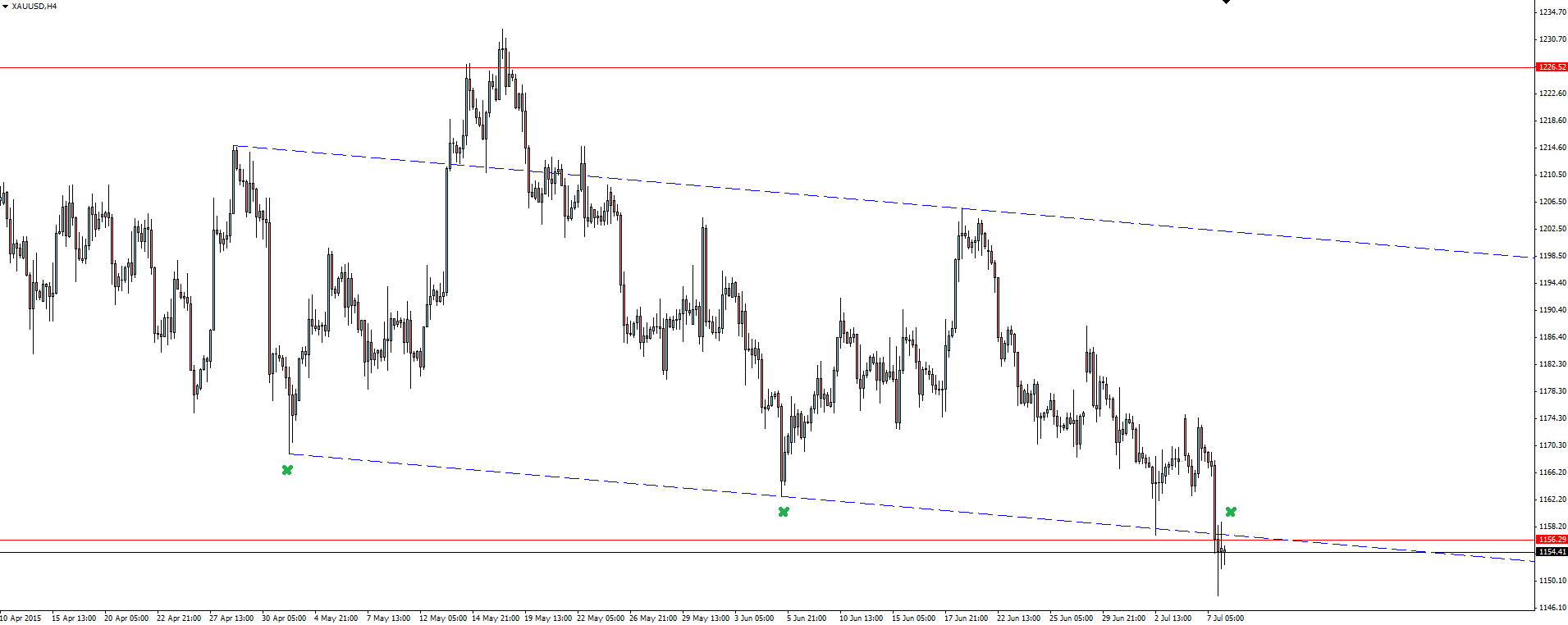

Gold 4 Hourly:

Click on chart to see a larger view.

Zooming into the 4 hourly, we have a short term channel bottom in play, with 3 touches as support, followed now by a retest. This could be a perfect chance to add to any short positions you may have taken, or a last chance to find a clear level to manage your risk around to try and get in before any major breakout comes.

Related Articles

Recent headlines appear to have shaken investor sentiment. It’s premature to read too much into a few days of weaker-than-expected survey numbers. More importantly, the latest...

The stock market sold off on a decline in February's Consumer Confidence Index (CCI), confirming a similar decline in February's Consumer Sentiment Index (CSI), which was reported...

The EU’s most costly budgets, bitcoin’s market swings, and rising US bankruptcies. Each week, the Syz investment team takes you through the last seven days in seven charts. 1. The...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.