It's been a roaring start to the year for equities. The benchmark S&P 500 and blue-chip Dow Industrials are both up at least 11% in 2019, each recovering from a massive drop as 2018 came to a close.

The rally has been helped for the most part by the Federal Reserve's recent dovish shift, which last month sent the clearest signal yet that its three-year drive to tighten monetary policy is close to an end.

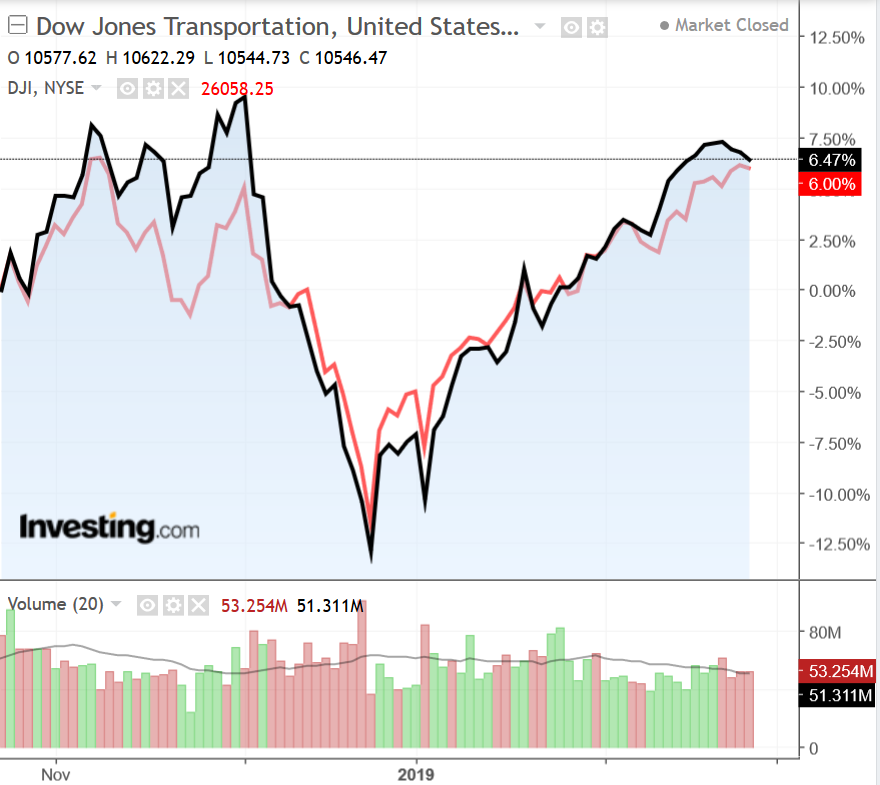

While Wall Street has been busily focusing on the once sexy, tech sector FAANGs, there's a more old fashioned corner of the market that's quietly been outperforming the major averages. To little fanfare, the Dow Transports have gained 15.4% so far this year, thanks mostly to the rebound seen in the broader market, proving the truth of the old adage, "a rising tide lifts all boats."

As well, renewed analyst interest in the space helped boost the sector.

Of the 20 stocks in this group, considered the lifeblood of the economy and an important pillar for the stock market, three names looked poised to charge higher in the months ahead due to a number of positive factors, including upbeat full-year earnings outlooks and a bullish technical picture.

1. Avis Budget Group

Avis Budget Group Inc (NASDAQ:CAR) is a leading rental car provider to the commercial segment, serving business travelers at major airports around the world. The company operates a variety of brands including Avis, Budget Rent a Car, Budget Truck Rental and Zipcar, which it acquired for $491 million in January 2013.

Investors have warmed up to Avis after the stock shed almost half its value during 2018, as most of the headwinds the company is facing, include increasing competition from rivals like Hertz Global (NYSE:HTZ) and ride-hailing companies like Uber, appear priced in, according to Goldman Sachs analyst David Tamberrino.

In a research note published on Feb. 11 ahead of the company's Q4 report, Tamberrino upgraded Avis to buy all the way from sell and hiked his 12-month price target on the stock to $35 from $30. He also said:

“With CAR’s valuation below historical averages, we see an opportunity for the company’s multiple to mean revert as we believe data points on volumes and pricing are stabilizing and the company can start realizing benefits from cost savings actions.”

Avis shares plunged nearly 49% last year, notching their worst annual performance since 2008. The stock has rallied roughly 57% so far in 2019.

It posted a big fourth-quarter earnings beat on Feb. 20. Earnings per share jumped 18% to 53 cents, much higher than consensus estimates of 37 cents. Revenue grew 2% to $2.05 billion, broadly in line with expectations.

Another positive figure for investors to digest: Avis' Americas per-unit fleet costs declined 7% during the fourth quarter, excluding exchange rate impacts. Moreover, Avis is optimistic about 2019, estimating revenue between $9.2 and $9.5 billion, and earnings between $3.35 per share and $4.20 per share.

Despite its recent stock price rebound, shares—which closed yesterday at $35.44—are still attractive as the rental car specialist looks set to enjoy expanding margins. Nonetheless, it must figure out how to adapt to ride-sharing and other changing trends in the rapidly evolving automotive transport industry.

From a technical perspective, Avis shares rose above their 200-day moving average on Feb. 21, the first time its been above that level since June 2018, indicating buyers are in control.

2. Ryder Systems

Ryder Systems (NYSE:R) is one of the largest U.S. transportation rental and leasing services, known especially for its fleet of rental trucks. It's been a stellar year for the Miami, FL-based company, with shares rising almost 29%.

Ryder reported strong earnings and sales growth in the final quarter of 2018 on Feb. 14. It earned $1.82 per share, up 33% compared to the same quarter from a year earlier, on revenue of $2.26 billion, 16% higher on a year-on-year basis.

The company saw revenue growth in all key segments and expects this to continue in 2019, boding well for the future. Fleet management solutions revenue was up 11% with operating income rising 10%, thanks to growth in its ChoiceLease rental service division.

The company also saw success in the fourth quarter from used vehicle sales. Units held for sale were at 6,900, up 900 units compared to 12 months ago. Proceeds per unit were up 18% for tractors and 8% for trucks.

Even when taking into account the strong rally at the start of the year, the stock, which closed at $62 yesterday, is still well below its 2018 peak levels, suggesting it has further room to run. It needs to rise above its key 200DMA near the $72-level in order to confirm the next breakout.

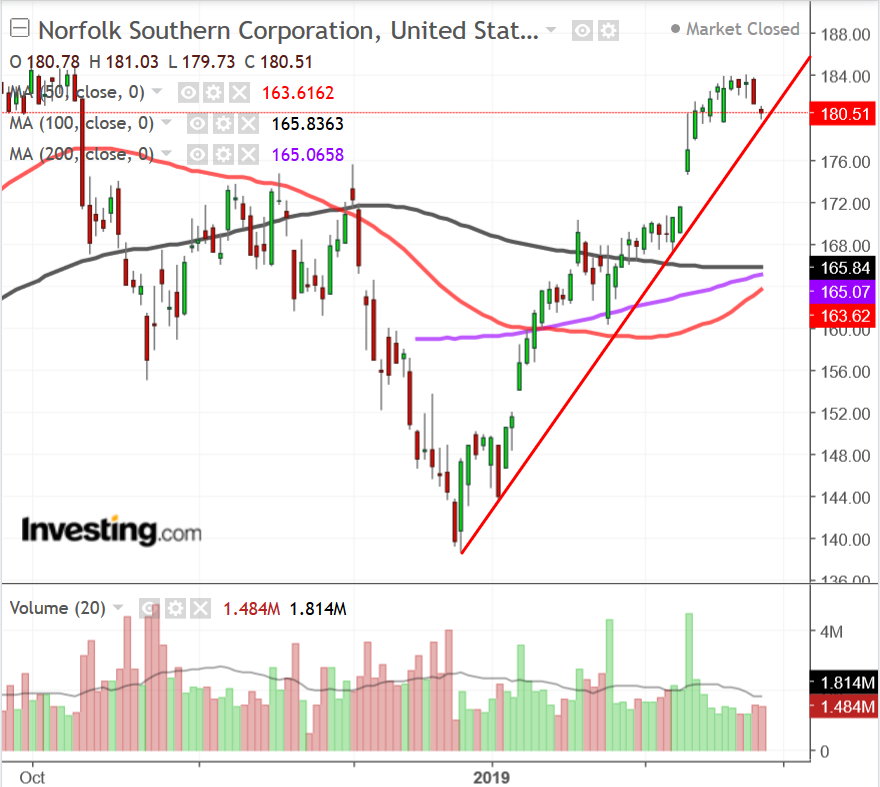

3. Norfolk Southern

Norfolk Southern Corporation (NYSE:NSC) is a holding company engaged in the rail transportation business, primarily in the U.S. Southeast, East and Midwest. The company's bullish guidance for 2019 and beyond is the main reason shares have gained about 21% so far this year. The stock closed yesterday at $180.51.

The Norfolk, VA.-based railroad company outlined a plan to increase productivity, efficiency and revenue growth during its Feb. 11 Investor and Financial Analyst Conference, targeting a healthier operating ratio of 60% by 2021, compared to 2018's operating ratio of 65.4%. Revenue is expected to grow at a compound annual rate of 5% through 2021, with capital expenditures during the period forecast between 16% and 18% of revenue.

Other targets announced included a dividend payout ratio of 33%, up from 31.5% as of December 2018, signaling the company plans to increase its dividend, which currently yields almost 2%, and continuance of share repurchases, making it a compelling play going forward.