With the announcement in late February that Lyft, the San Francisco-based ride-hailing service, was planning to start its roadshow in early March—the run-up to an initial public offering—the 2019 IPO season is finally underway.

Lyft is one of a number of closely watched, privately-held, Unicorn companies whose public listing has been highly anticipated by investors. Other firms expected to go public this year include Uber, Airbnb, and Slack.

After delays caused by U.S. President Donald Trump's partial government shutdown, Lyft is the first one out of the gate. Though its official IPO date is still unknown, it's expected to happen in the coming weeks, possibly as early as the end of March. The company will likely trade under the ticker symbol LYFT.

Lyft's S-1 filing, the mandatory financial disclosure form that precedes an IPO, was made public last Friday. Here are the numbers and key fundamentals that can and will affect both the offering and its forward valuation.

Lyft Valuation

A word of warning first: the risks associated with investing in any initial public offering are higher than a similar investment in equities that have been trading for a considerable period of time. Newly publicly traded stocks tend to be more volatile, and with little historical data it's more difficult to call which way shares might head next.

As well, even with Lyft's S-1 information, there's much that remains unknown about the company. We'll have to wait for its quarterly reports for answers to those questions.

Still, we now have a better understanding of many of Lyft's fundamentals. The company, which competes directly with Uber, Gett and traditional taxi services, operates a platform that matches independent drivers with customers looking for transportation, via Lyft's app. Much like Uber, Lyft collects service fees and commissions from drivers for using the company's platform. Those fees account for Lyft's total revenue stream right now.

Estimates for Lyft's valuation range between $20 and $25 billion dollars. There won't be an exact number released until just days before the IPO, so for this post, we'll assume it will be in the $22 billion range.

Revenue And Net Income

The S-1 provides insight into the company's financials for the past three years. Lyft's revenue growth has been substantial.

In 2016, the company brought in $343 million. That grew to $1.05 billion in 2017, then doubled to $2.15 billion in 2018. Over two years, that's an impressive 500% increase.

However, like many young companies fueled by venture capital, net income has not kept pace, nor to be honest has it been a point of emphasis thus far. In 2016 and 2017, Lyft lost $682 and $688 million, respectively. Losses were even higher in 2019: $911 million dollars. Reasons given were costs of developing the platform, plus additional budgeting for marketing, R&D and operations.

One positive: the losses-to-revenue ratio is shrinking. In 2016, losses were twice the size of its revenue; by 2018 losses were just 42% of the size of its revenue. Nonetheless, we don't see Lyft becoming profitable anytime soon.

But then Wall Street is infamous for caring more about growth than profits. As such, Lyft is likely to get a pass on profitability if it can manage to continue its impressive growth streak.

Key Make-Or-Break Metric

When it comes to growth, more than anything else, Wall Street loves user growth. Not-yet-profitable companies such as Netflix (NASDAQ:NFLX), Twitter (NYSE:TWTR) and most notably Tesla (NASDAQ:TSLA), have been boosted or hammered solely on this metric. At the same time, investors almost completely disregarded their revenues and profits.

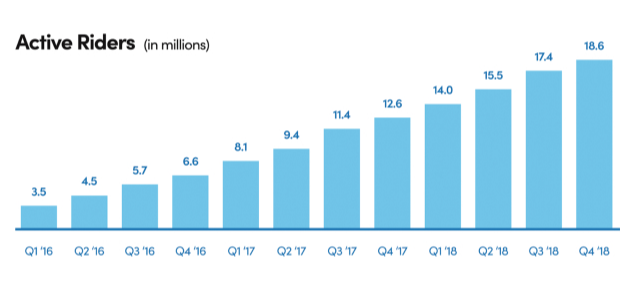

We believe Lyft will be judged similarly, with investors focusing mostly on its active rider metrics. An active rider is anyone who uses the service at least once during the quarter.

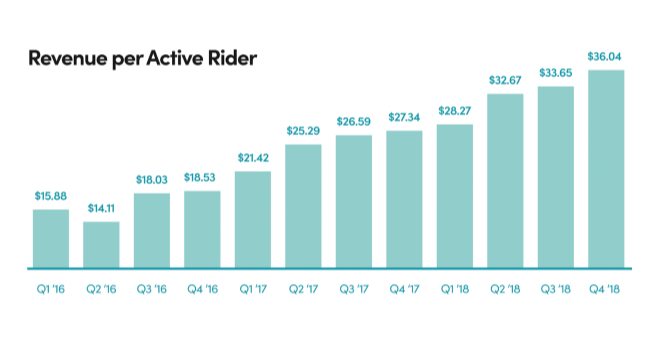

All charts courtesy Lyft's S-1

Lyft's active riders figures are trending upward, growing every quarter, rising from 3.5 million in Q1 2016 to 18.6 million during Q4 2018. Year-over-year growth for active riders grew 104% between 2016 and 2017, and 57% between 2017 and 2018. Of course, Lyft will need to continue to grow rapidly on this metric in order to justify a $22 billion valuation with $2 billion in revenue and almost $1 billion in losses.

To its credit, Lyft has done well at efficiently monetizing its active riders. In Q4 of 2018, the company's average revenue per active user was $36.04, compared with $27.34 in the same quarter a year prior. The strong uptick was made possible primarily by fee increases and a reorganization of the driver incentive structure.

But number of trips taken by active riders has slowed considerably. Between Q4 2016 and Q4 2017, the number of rides per active rider accelerated, from 7.96 rides to 9.23, +16%. However, in the past year, that metric moved from 9.23 to just 9.59, an uptick of only 4%.

Unfortunately, based on the information in its S-1, both Lyft's financials and growth don't justify a $22 billion valuation. And there are additional negatives.

Market Positioning

Lyft isn't a market leader. According to reports, it has a 28% share of the U.S. market while Uber dominates with an approximate 70% share. Its revenue in Q3 2018, $563 million, pales in comparison to Uber's reported $3 billion over the same period.

We believe much of Lyft's growth is a result of Uber's management scandals, as well as legal and safety issues. In addition, since Uber's S-1 hasn't yet been made public, it's difficult to do a true comparison. Once Uber's filings are completed we'll be able to more effectively gauge which of the two companies is measurably better—and might be positioned to deal a serious blow to its competitor.

Bottom Line

Considering all the known factors—revenue growth, user expansion, competitive strength—it's difficult to recommend investing in Lyft at the estimated valuation. But IPO valuations, ahead of the event, are often overly optimistic. And newly listed shares tend to progress or plummet during the days following their listing. Over a longer period it's possible Lyft shares will provide a better entry-point for interested investors.

For that reason, the company's very first earnings report will be crucial. We'll revisit our recommendation once it's released.