DXY took a breather Friday night:

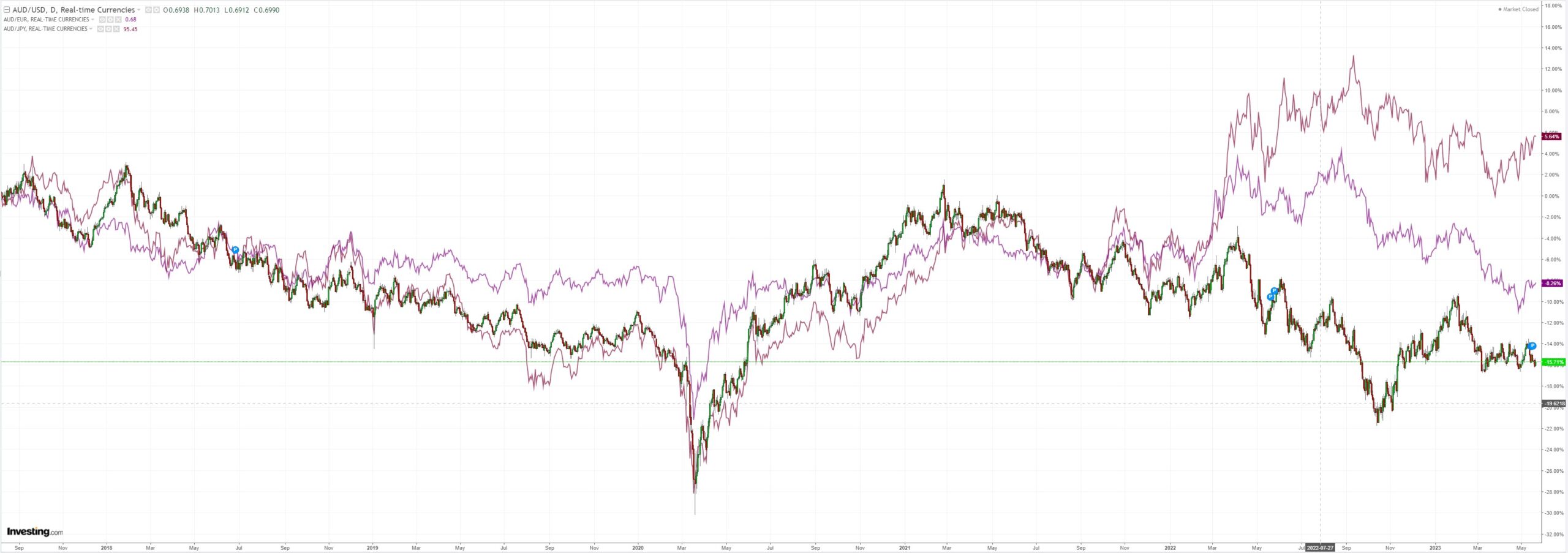

AUD held on:

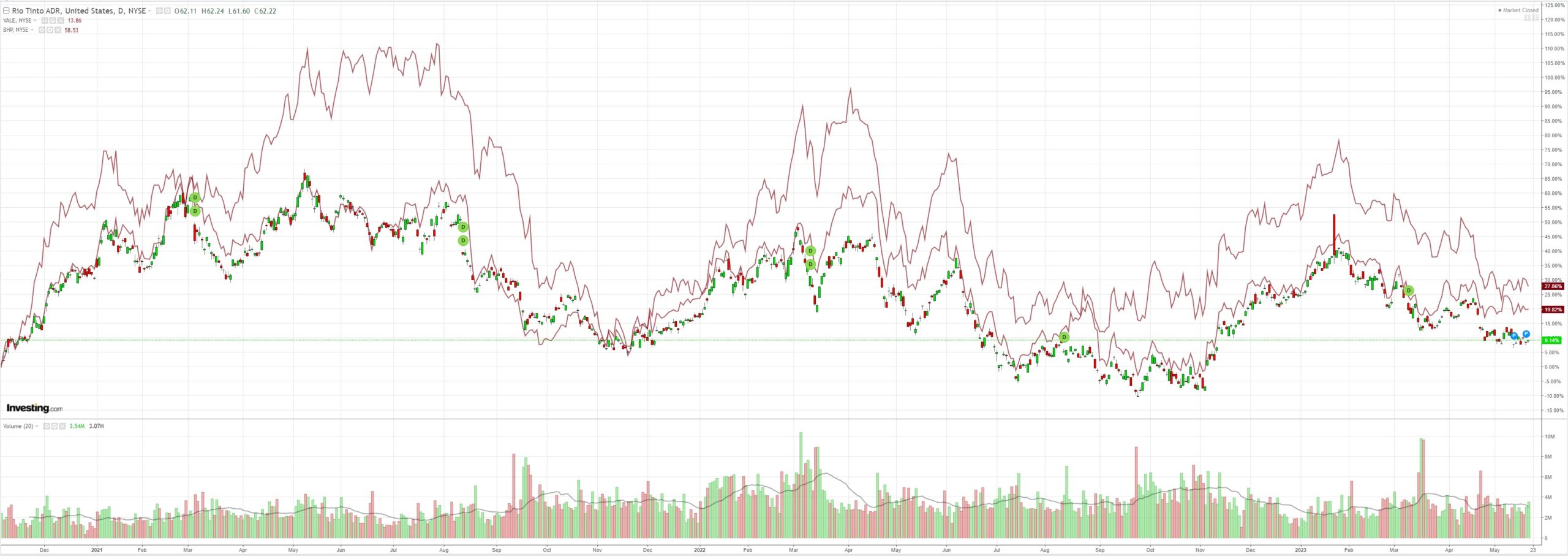

Commodities too:

And miners (NYSE:RIO):

EM stocks (NYSE:EEM) are dead:

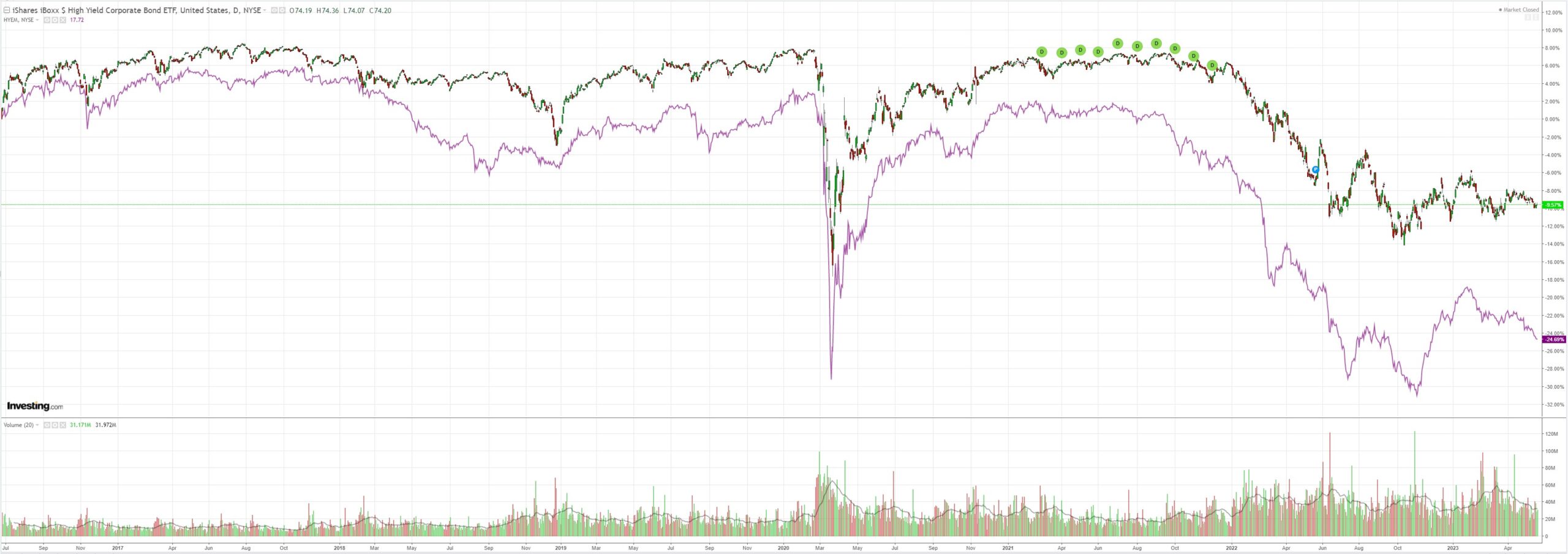

EM junk (NYSE:HYG) has declared an end to the Chinese rebound:

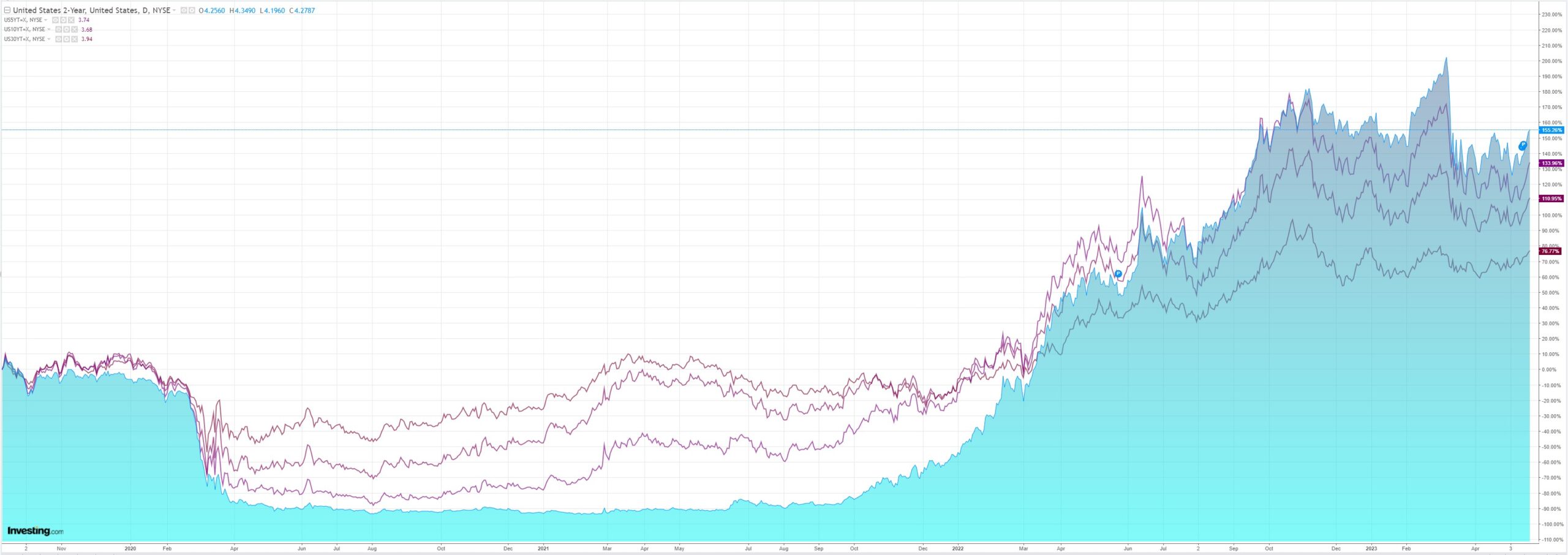

The Treasury curve is being steamrolled again:

As the AI bubble drives stocks:

Credit Agricole (EPA:CAGR) sums it up:

Investors in Asia remain torn between optimism that a US debt ceiling deal will get done and evidence that China’s economic rebound could be flagging. Alibaba’s sales disappointed to the downside, adding to investor concerns already piqued by weak China data earlier in the week. Meanwhile, the US rates markets are pricing in about a 40% chance the Fed will hike rates in June. The Fed’s Lorie Logan said the case for a pause in June is not clear. Concerns about China’s rebound and higher UST yields are curbing investor optimism, and at the time of writing, Asian bourses were trading mixed and S&P 500 futures higher. G10 FX traded in a modest risk-on fashion with the Antipodean currencies outperforming. The JPY also gained post strong Japan inflation data. Most other G10 currencies were trading in tight ranges during the Asian session.

In less than two months, the ECB is expected to shift its policy stance from tightening predominantly through rate hikes to tightening through QT. We believe that the monetary policy mix in the Eurozone would become less supportive for the EUR as a result. In particular, we believe that the shift could: (1) encourage investors to pare back ECB rate hike expectations and thus erode the EUR’s relative rate appeal; (2) contribute to the credit tightening and add to the downside risks to growth in the Eurozone; and (3) drain excess liquidity in the Eurozone and potentially weigh on the performance of risk-correlated assets like stocks and peripheral bonds.

In short, the US AI bubble is keeping its economy alive and the Fed is getting restive. Meanwhile, the Chinese recovery is weak thanks to L-shaped property.

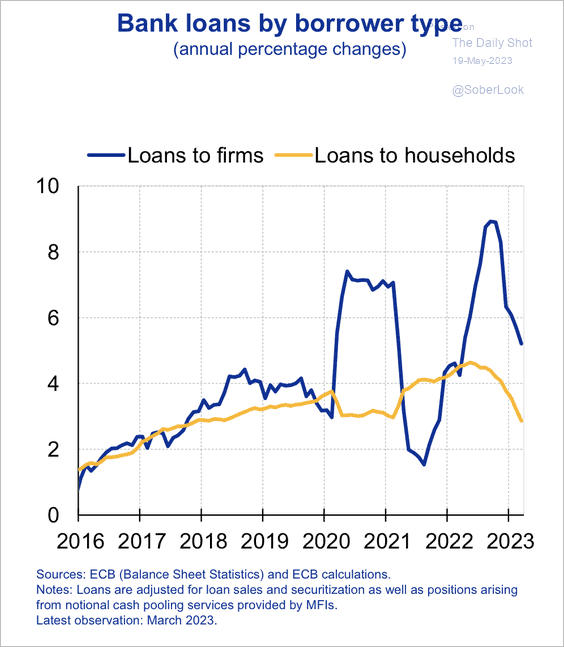

If that was not bad enough for European exports, domestic activity will follow credit down:

We are setting up for a complete reversal of the falling US dollar trade that has dominated (and underpinned) the “risk on” rally since late 2022.

This was supposed to be a “strong world” and “weak US”. Instead, it is the reverse.

As noted many times, the market is very long EUR and is on the wrong side of the shifting macro regime.

So is the AUD and pressure is intensifying.