A 20%-plus price rise in house prices in major cities has made houses 'significantly over-valued' and APRA is poised to intervene to lower prices in 2022, says SQM Research

-20%-plus price appreciation in major Australian cities has made houses "significant over-valued"

-SQM Research predicts APRA stands ready to act to deflate house price momentum

-Apartments to rise in popularity as borders re-open

By Rudi Filapek-Vandyck

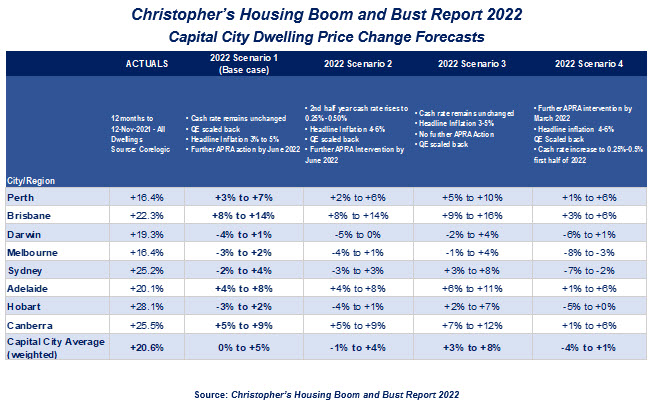

Australian capital city dwelling prices are forecast to peak in the first half of 2022, growth slowing sharply as the banking regulator, the Australian Prudential Regulatory Authority (APRA), intervenes to restrict home lending.

The base case in today's report from SQM Research is that property prices will slow rapidly from their annual 20%-plus growth rates.

Christopher’s Housing Boom and Bust Report 2022 foresees a slower rate of price rises over the coming March quarter, followed by price falls as early as mid-2022.

Price falls are expected to be led by Sydney and Melbourne houses, which SQM Research describes as significantly over-valued.

SQM believes both cities are the most sensitive to even minor intervention by the banking regulator in home lending.

SQM forecasts Brisbane will record the largest dwelling price rises over 2022 – between 8% to 14% – supported by expected strong interstate migration given relatively good housing affordability compared to Sydney and Melbourne. This gain will nevertheless represent slower growth than in 2021.

Melbourne and Sydney are likely to record house price falls from mid-2022 due to additional expected intervention by APRA to cool the market. Both cities were most affected by APRA’s intervention in 2017 and, given very stretched valuations on SQM measurements, Sydney and Melbourne are considered “most susceptible” to any action that restricts home lending.

Melbourne could be further affected by migration to other states. However, this will likely be offset by a forecast rise in net overseas migration next year, suggests the report.

SQM expects unit rental markets in both Melbourne and Sydney will post a turnaround in 2022, and believes unit price growth could outperform that of houses.

With houses being overvalued, apartments are relatively affordable and are expected to benefit from the rise in net migration from interstate and overseas now Australia’s border are open.

According to Louis Christopher, Managing Director of SQM Research: “if the Australian housing market does not slow down by mid-2022, APRA will likely keep intervening in home lending until the market does slow down.

“We cannot afford another year of 20%-plus gains across the national housing market. And so, to ensure a soft landing for the market, it is best we see additional intervention sooner rather than later to reign in property valuations.”

[Note: APRA does not target house prices directly, it targets financial stability through restrictions on riskier mortgages and investment loans which lowers credit accessability and thus impacts on house prices.]

Other forecasts from Christopher’s Housing Boom and Bust Report include:

-Dwelling prices in regional Australia to correct, particularly for inland communities, as people return to the capital cities.

-Official interest rates are likely to stay on hold until at least late 2022.

-Further APRA intervention to occur as early as December 2021.

-Expected dwelling price corrections to be moderate unless exacerbated by aggressive monetary policy action involving rate rises earlier in the year.

-Ongoing rental rises for capital cities over and above the CPI change.

"APRA To Stem House Price Momentum" was originally published on FNArena.com and was republished with permission.