- Amazon stock's bull run raises the stakes for its Q4 earnings, leaving little room for disappointment.

- Investors will closely watch AWS growth, AI-driven efficiencies, and holiday sales for signs of sustained momentum.

- With expectations soaring, even a small miss could trigger volatility in the stock.

- Looking for actionable trade ideas to get in on winning stocks early? Unlock access to InvestingPro’s AI-selected picks for February using this link.

Amazon (NASDAQ:AMZN) is set to report Q4 results today after the market closes, and expectations couldn't be higher.

With shares recently hitting an all-time high and analysts forecasting strong earnings growth, the e-commerce and cloud giant has little room for error. Any sign of weakness could trigger a sharp pullback.

So far, big tech earnings have been a mixed bag. Some companies have impressed, while others—like Alphabet (NASDAQ:GOOGL)—have stumbled, sparking market volatility.

Meanwhile, for InvestingPro members, market volatility hasn't been a threat - but rather an opportunity.

Our AI-driven stock picks, released at the start of each month, have helped traders identify the best entry points before they begin to march higher.

February’s picks are already out, and now is the time to position yourself before the next round of potential winners takes off.

Get in for less than $9 a month and stay ahead of the curve.

Key Numbers and What to Watch in Amazon’s Q4 Report

Amazon has started the year on a strong note, climbing 6.5% in January and reaching a record high of $242.52 earlier this week. This rally raises the stakes for its earnings report, as investors will be looking for continued momentum.

Analysts expect Amazon to post earnings per share (EPS) of $1.48, marking a 48% increase year-over-year, with revenue projected at $187.3 billion, up 10.2%.

While those headline figures matter, the market's reaction will hinge on details beyond just top- and bottom-line beats.

- Cloud Business Performance

After Microsoft (NASDAQ: NASDAQ:MSFT) and Alphabet reported a slowdown in cloud growth, investors will scrutinize Amazon Web Services (AWS). Last quarter, AWS generated $27.45 billion in revenue and $10.4 billion in operating profit. Any sign of decelerating demand or shifting AI-related cloud spending could weigh on the stock.

- AI’s Role in Future Growth

The impact of AI advancements—particularly how companies like DeepSeek are driving efficiency—will be critical. Investors will want to know how Amazon plans to leverage AI to sustain long-term cloud growth.

- E-Commerce and Supply Chain Costs

Amazon’s core e-commerce segment remains a key driver, contributing $61.4 billion in Q3 revenue (38.6% of total net sales). However, rising supply chain costs and new tariffs on Chinese imports could pressure margins. Management’s outlook on these factors will be closely watched.

- Holiday Sales Boost

The Q4 report includes results from the crucial holiday shopping season. Strong consumer spending could provide a tailwind, but any weakness might indicate a broader slowdown in discretionary purchases.

Can Amazon Stock Extend Its Rally?

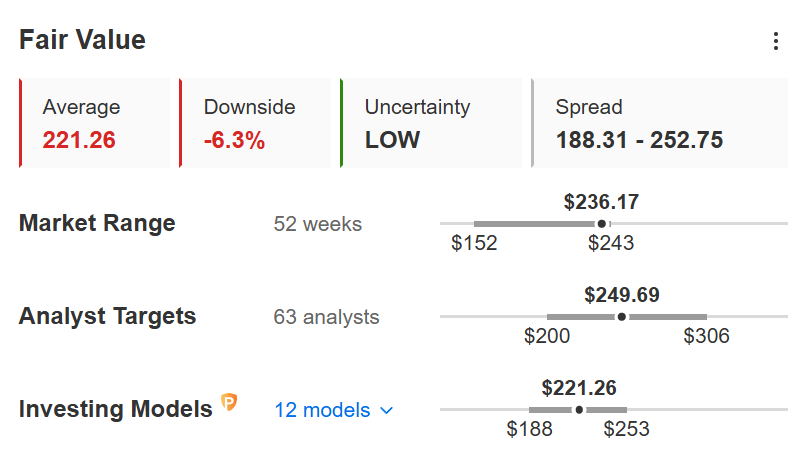

Despite its recent surge, analysts see limited upside from current levels. The average price target of $249.69 implies just a 5.7% gain, while InvestingPro’s Fair Value estimate of $221.26 suggests a downside of more than 6%.

Source: InvestingPro

This means Amazon will likely need to deliver a blowout report—or at least issue strong guidance—to keep its stock climbing.

Adding to the uncertainty, ongoing trade tensions between the U.S. and China create additional risks for the company’s global supply chain. Any cautious commentary from management on this front could temper investor enthusiasm.

Final Thoughts

With expectations sky-high, Amazon’s Q4 earnings must be near flawless to sustain its stock’s momentum.

While the company has consistently delivered strong results, a single weak spot—whether in cloud growth, AI integration, or e-commerce margins—could spark a sharp correction. Investors should brace for volatility as Amazon faces its next big test.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.