DXY is breaking out as EUR swoons:

But AUD does not care:

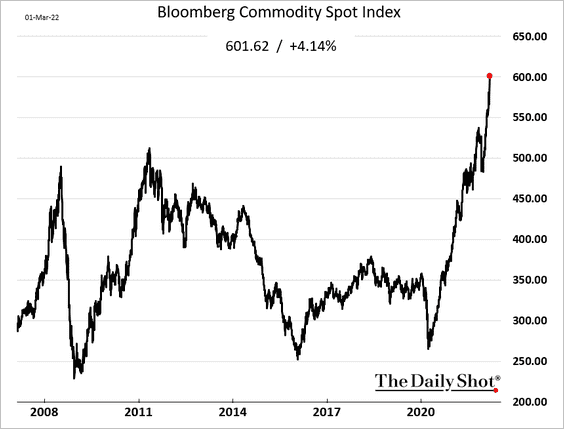

Metals moon!

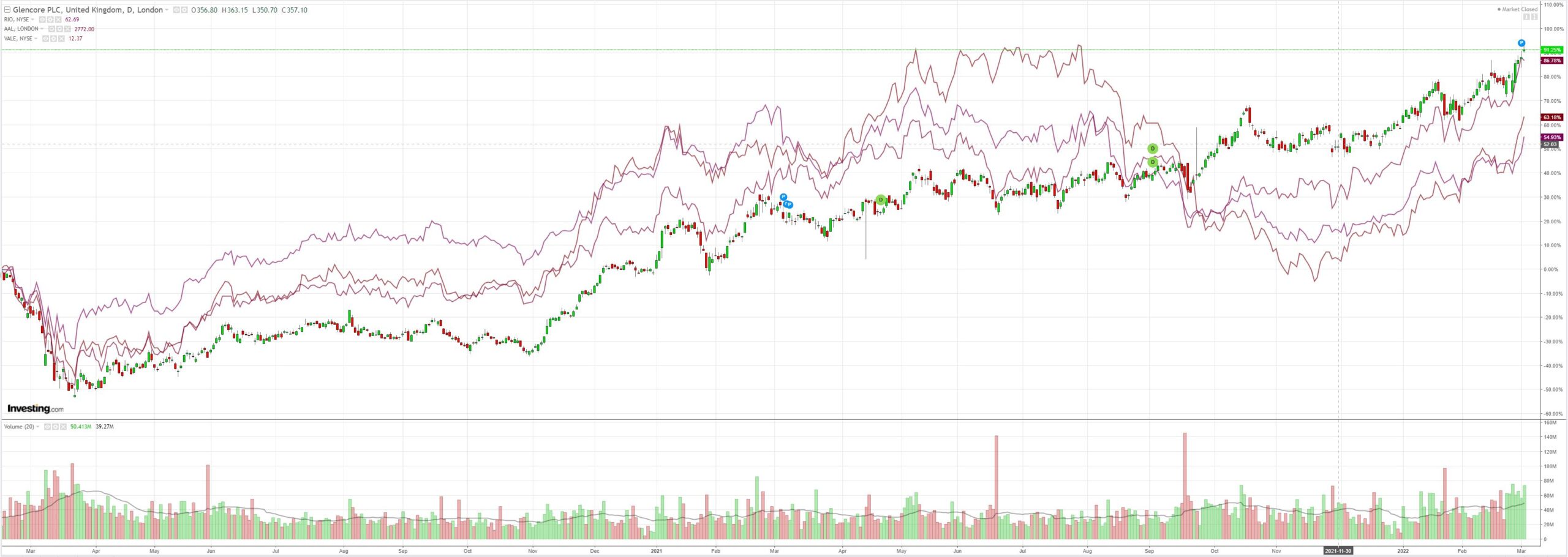

Miners (LON:GLEN) moon!

EM stocks (NYSE:EEM) the other way:

EM junk (NYSE:HYG), the best leading indicator, crashing:

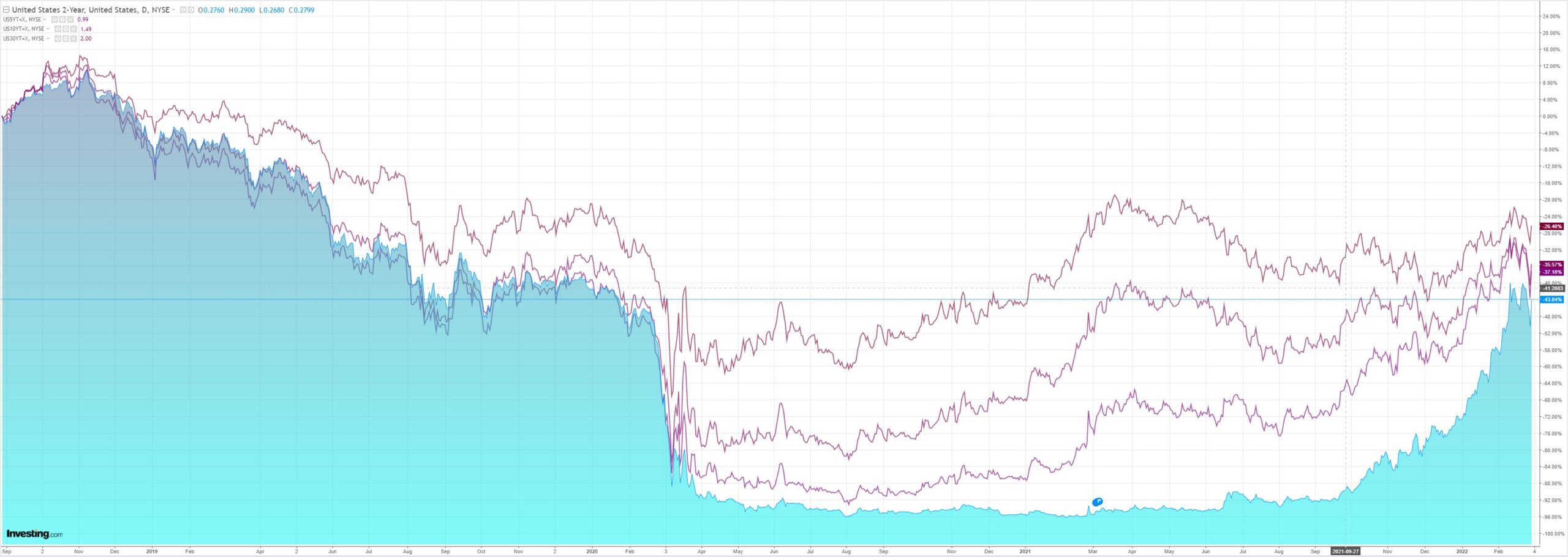

Treasury yields up and curve down:

Stocks relief rallied:

Westpac has the wrap:

Event Wrap

Fed chair Powell delivered his testimony to Congress, saying he was still in favour of a 25bp hike, and that if the economy was to remain heated they could raise by 50bp. However, the effects of the Ukraine war would be monitored, with potential for those effects to be long lasting. He added that the Fed has “institutionalized liquidity provisions” so that geopolitical pressures have not stressed the funding markets.

US ADP employment in February was stronger than expected, including a large upward revision to January. Employment rose 475k (est. 375k), with January revised from -301k to +509k. Most job gains were in services/hospitality and in larger firms, with small firms actually showing a decline.

Bank of Canada raised rates as expected by 25bps to 0.50%, and highlighted the current strength of the domestic economy, higher inflation, and potential for inflation expectations to drift higher. However, the invasion of Ukraine, whilst pushing up inflation pressures, has created a major source of uncertainty which will need to be closely followed given the potential impact on global growth.

Eurozone CPI in February rose +0.9%m/m and 5.8%y/y, with core at 2.7%y/y. Consensus estimates were +0.8%m/m and 5.6%y/y, core 2.7%y/y).

German unemployment continued to decline, -33k (est. -22.5k), the unemployment rate falling to 5.0% (est.5.1%).

Event Outlook

Aust: Dwelling approvals are expected to decline in January as the December spike in units unwinds (Westpac f/c: -4.0%). A widening of the trade surplus is anticipated for January as stronger export earnings outpace the lift in import costs (Westpac f/c: $10.4bn).

NZ: ANZ commodity prices should continue to lift in February given the strength of dairy prices.

Japan: The final estimate of February’s Nikkei services PMI is due.

China: Soft services growth is expected in the February Caixin services PMI given weak demand and elevated input costs at the start of 2022 (market f/c: 50.7).

Eur/UK: The unemployment rate should continue to highlight the robust health of the European labour market in January, although slack remains due to omicron disruptions (market f/c: 6.9%). Meanwhile, the final estimate of February’s Markit services PMI is due for both the UK and Europe.

US: A small upward revision is expected in the final estimate for Q4 productivity (market f/c: 6.7%). Meanwhile, initial jobless claims are set to remain at a very low level (market f/c: 225k). February’s Markit and ISM services PMI should reflect the robust strength of the sector despite omicron (market f/c: 56.7 and 61.1 respectively). Factory and durable goods orders should continue to build in January as businesses bring inventories back towards pre-pandemic levels (market f/c: 0.7% and 1.6% respectively). FOMC Chair Powell will testify before the Senate panel. Logan will discuss Fed asset purchases; Bostic will speak on the economy.

So, the Fed will plough on with its tightening, as expected. RBA and ECB still have time.

But that’s neither here nor there now. All that matters to AUD today is this:

I will note that the last time similar conditions transpired, during the 2014 Crimea invasion, the AUD lifted as well, by 8% with a commodities bounce:

Broader conditions were not dissimilar. Europe was recovering. The Fed was hawking up. China was slowing. Oil was $112.

Needless to say, as the crisis passed, commodities crashed and so did the AUD as China refused to boost property markets and the Fed kept tightening until markets broke into the so-called “Shanghai Accord”.

It’s not a bad analogy for today.

The AUD loves a good commodity supplier war.