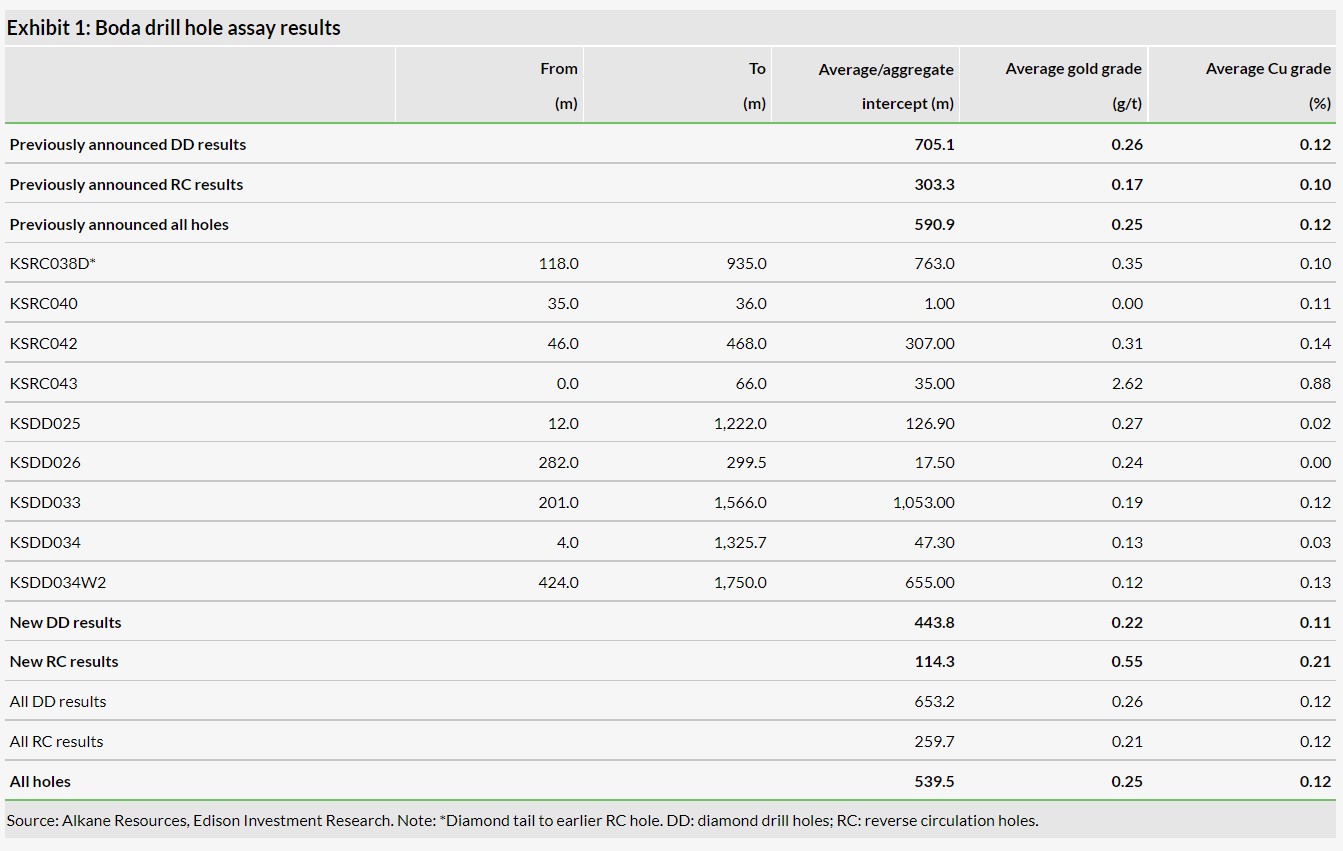

On 16 August, Alkane Resources (ASX:ALK) published the assay results of 10 more holes drilled at Boda. While our estimate of the overall mineralised inventory at Boda has changed little as a result of this set of holes, probably their most significant consequence is the increase in the potential resource contained within the high-grade sulphide cemented breccia from c 2.1Moz gold equivalent (AuE) to c 3.5Moz AuE above 3.0g/t AuE. This is as a result of the extension of this structure to at least 800m (cf 500m previously) from the interpretation of the assay results of holes KSDD034 and 034W2, KSRC038D and KSRC042 and, in particular, KSRC043, which returned an intersection of 31m from surface at a grade of 2.94g/t.

Share price performance

Initial inklings of a conceptual mine at Boda

The extension of the high-grade zone to 800m holds out the possibility of a continuous mine from surface at Boda. While it is early days, this could be in the form of a traditional long-hole open stoping mine. However, a sub-level or full cave may also be economic either initially or over time.

Next step: Working towards a maiden resource

Over the next 12 months, we expect Alkane to announce both a tighter, higher-grade resource relating to the sulphide cemented breccia at Boda as well as one for the massive mineralised envelope (probably at an economic cut-off of c 0.3g/t). Initially, it is likely that the majority of the delineated resources will be in the inferred category, although we would expect this to be successively upgraded to higher categories with subsequent drilling.

Valuation: Up to 130c per share

Our ‘base case’ valuation of the expanded and extended Tomingley operation is 35 Australian cents per share (cf 32c previously), to which may be added (as contingencies) a further 6c for the eventual development of the Roswell underground extension and potentially 12c given the current gold price. To this total of 53c, an additional 4c may be added to reflect the value of residual (unmined) resources plus 3c for ongoing exploration success at Roswell, San Antonio and El Paso to take the total for the wider Tomingley operation to 60c (including cash held centrally). Beyond that, we value Alkane’s interests in Calidus and Genesis at 9c per share and the exploration completed to date at Boda and Boda Two within the Northern Molong Porphyry Project at up to 61c with plenty of blue-sky upside still remaining to take the total up to 130c (cf 125c previously – see Exhibit 10).

Recent developments

Since our last note, Alkane has:

- Released the results of 10 additional holes drilled at Boda, Boda Two and Boda Three at its Northern Molong Porphyry Project in Central West New South Wales in Australia, and

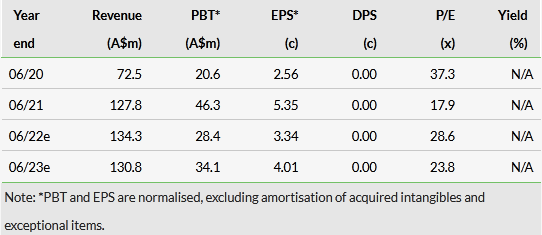

- Announced its financial results for the year to end-June 2021.

This note updates our analysis of the company with respect to both announcements. However, given that underlying earnings for FY21 were within A$1.0m (or 3.3%) of our prior forecast (see pages 9–11), primacy in this case has been given to the drilling results at Boda, which, among other things, have increased the vertical extension of the high-grade sulphide cemented breccia zone to a total of 800m (cf 500m previously) from surface.

Boda and Boda Two drilling results

On 16 August, Alkane reported the assay results of an additional seven diamond drill holes (denoted DD) and an additional three reverse circulation (RC) holes at its Boda, Boda Two and Boda Three prospects at its Northern Molong Porphyry Project. The drilling is part of a 30,000m diamond and RC core exploration programme that began in July 2020 to test the dimensions and extensions to the large, low-grade mineralised envelope at Boda, as well as any internal high-grade zones.

A summary of the nine holes drilled at Boda and Boda Two is as follows:

Click on the PDF below to read the full report: