DXY paused Friday night:

AUD did too:

Commodities dead cat bounced:

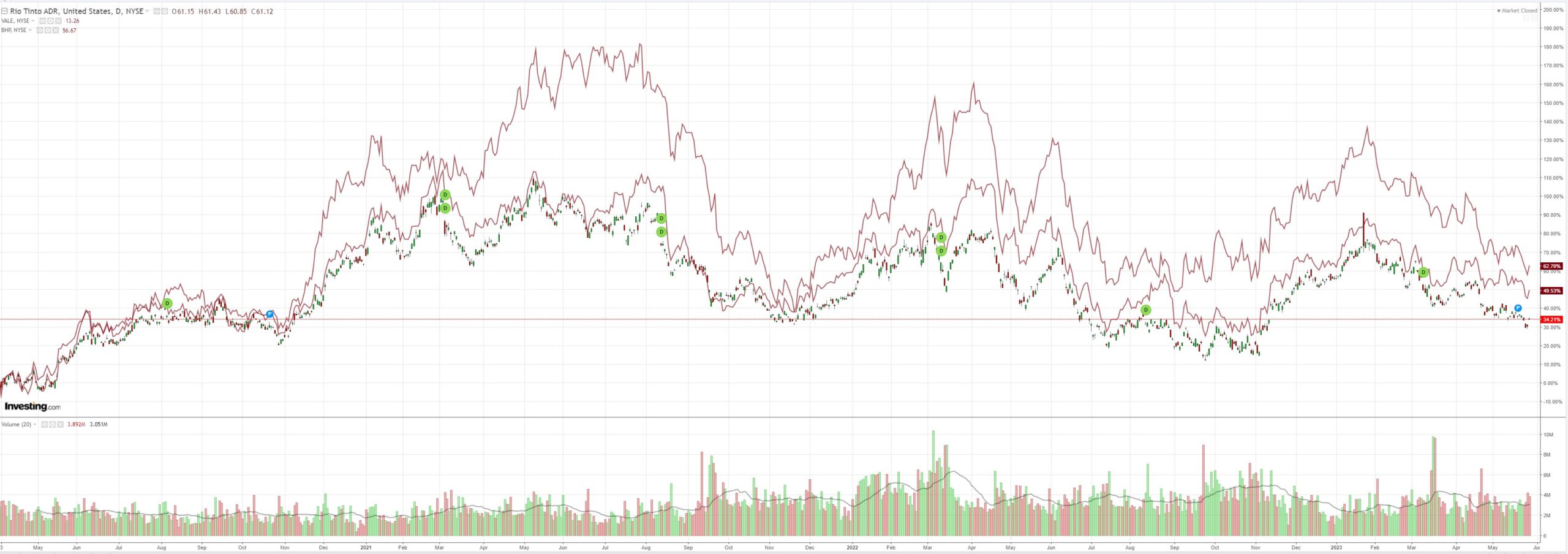

Miners (NYSE:RIO) too:

EM (NYSE:EEM) stocks are so yesterday:

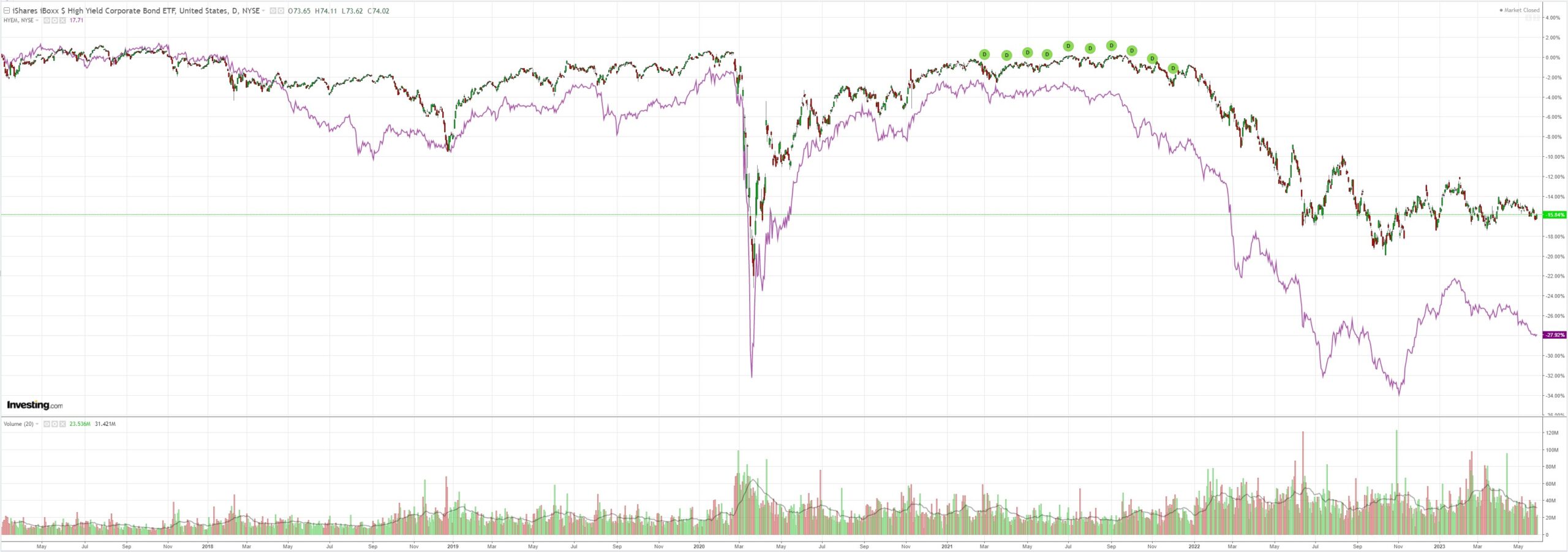

Junk (NYSE:HYG) is bleeding out:

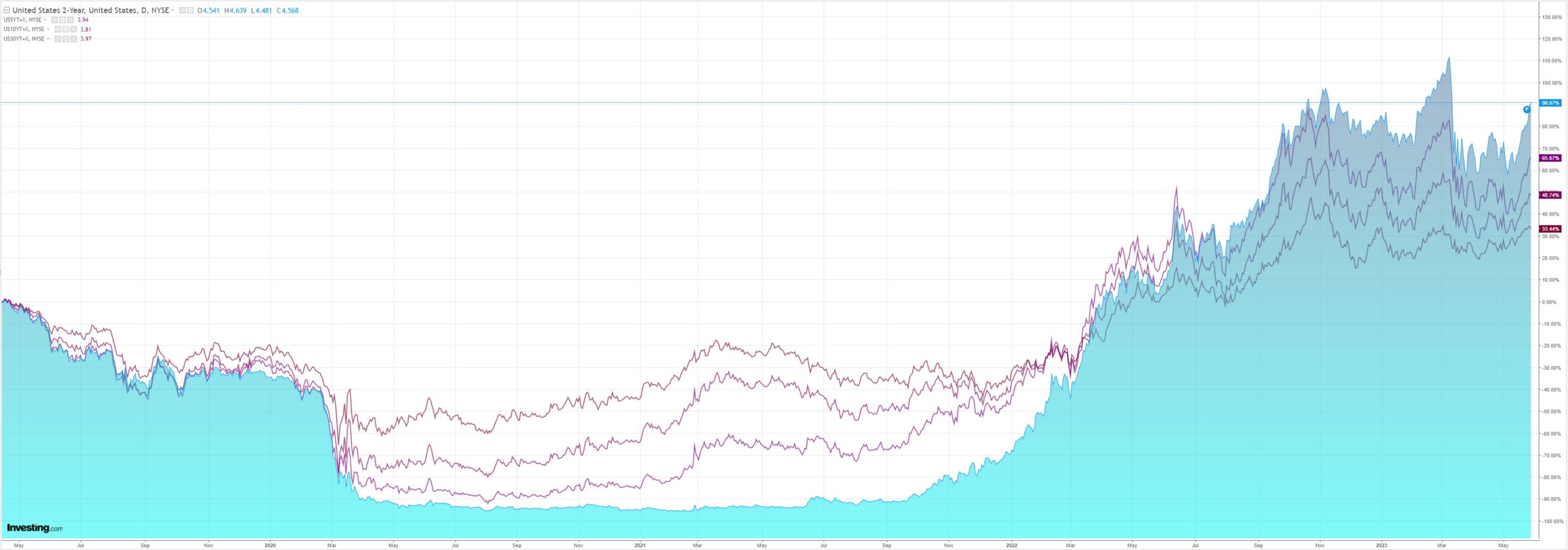

The Treasury curve was pulverised:

As the AI bubble exploded:

Friday night gave us robust US PCE inflation that is swiftly raising the prospect of more Fed hikes. There was also the specter of a resolution for X-date tensions to do the same. Both are bullish for DXY.

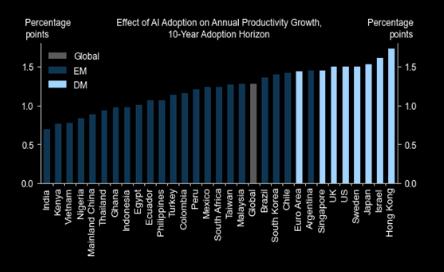

But what markets are all about now is Artificial Intelligence (AI). AI is inflating into an equity bubble around the early winners of a presumed boom in investment.

The winners are all American. So DXY is for now the indispensable currency as the AI bubble melts up like NASDAQ 1999:

Moreover, the second phase of the AI boom will be the rollout into real economic functions. This will happen to the greatest benefit in the huge services economies of developed markets.

None more so than America’s, which will muscle out margins in the substitution of human-to-human by AI-to-human operations. Goldman:

This makes DXY the indispensable currency across most of the next economic cycle as well.

Add to this that China is going ex-growth before our very eyes, which will stall Europe’s export model, and even in the beauty contest of major currencies, DXY stands out as the major winner.

This, in itself, guarantees much lower commodity prices as both financial (strong DXY) and real economy (weak China) effects combine in a negative feedback loop.

Compare this with the Australian economy and AUD.

AI will benefit Australia but its reliance upon mining and mass immigration will render it much less beneficial compared with other DMs.

Moreover, AUD is a primitive commodity currency completely out of step with a high-powered technology-led narrative.

The late nineties, Y2K panic, and the NASDAQ blowoff are the obvious analogy. It drove the US dollar to extreme highs and the AUD to extreme lows at 47 cents.

You don’t need to be ChatGPT to compute that AUD is on the verge of a very steep and long downslope to record lows.