Artificial intelligence (AI) and Bitcoin were top of mind at last week’s Paris Blockchain Week, where I had the privilege of presenting to an enthusiastic crowd. The blockchain and digital assets event, held beneath the world-famous Louvre Museum, attracted close to 10,000 people, an impressive 25% increase over last year, as Bitcoin traded near its all-time high and AI dominated headlines.

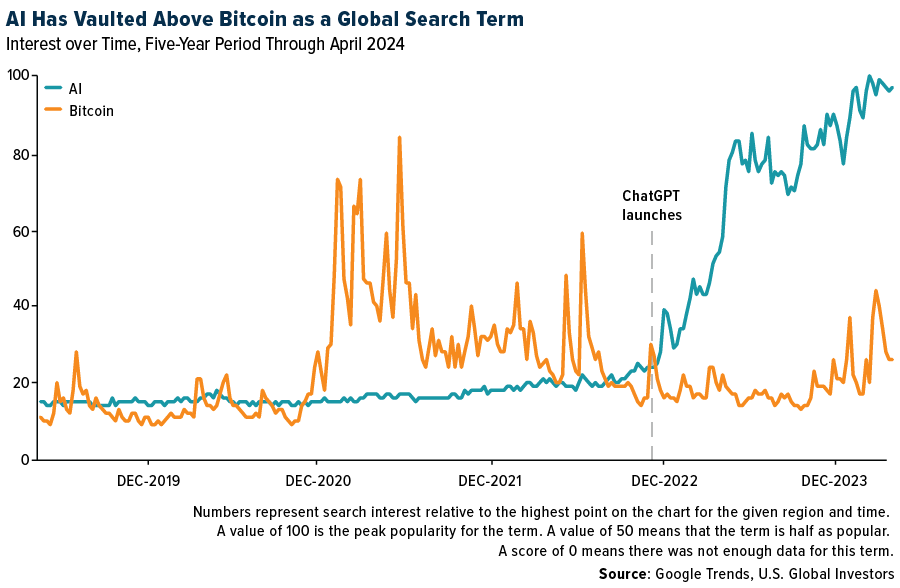

To give you an idea of just how explosive AI has been in the public consciousness, especially since the launch of ChatGPT in November 2022, consider the chart below, which compares Google (NASDAQ:GOOGL) searches for “AI” and “Bitcoin.” Post-ChatGPT, people’s interest in learning more about AI has gone parabolic.

My presentation focused on the transformative potential of Bitcoin and AI through the lens of Complex Adaptive Systems (CAS) theory, highlighting how these nascent technologies are already reshaping our world in profound ways. By exploring some of the key features of CAS—including decentralization, network effects and nonlinear dynamics—I sought to show how Bitcoin and AI are prime examples of complex systems whose influence on our lives will only continue to grow.

Ultimately, my goal was to leave attendees with a renewed sense of excitement and optimism for AI and Bitcoin. I genuinely believe that, if done right, these technologies can help us build a future that’s more opportunistic, fair and sustainable.

Smart Contracts and Your Digital Afterlife

A good example of what I’m talking about are smart contracts. These self-executing applications, which are still in their infancy, have the potential to streamline complex transactions, increase efficiency and reduce costs.

Doug Levin, serial entrepreneur and Executive-in-Residence at Harvard Business School, laid out the perfect use case for smart contracts in the oil industry. According to Levin, these contracts could incorporate different transactions occurring automatically at different prices, based on varying market conditions. This has the power to create a fairer, more efficient and transparent marketplace for both oil buyers and sellers.

The efficiency of blockchain transactions is already evident. A few years ago, everyone was astonished to learn that a $1 billion transaction between two anonymous Bitcoin wallets settled in under an hour with a fee of only $700. Meanwhile, moving money from a New York bank to a Paris bank can still take up to a week to fully settle.

Looking further into the future, Ryan Condron, creator of the Lumerin protocol, shared his thought-provoking vision of the world where everyone has their own personalized AI that knows everything about them, from childhood to, well, the very end. Theoretically, this AI could continue to make investment decisions and deploy capital on that person’s behalf, even after they were gone, based on their preferences and the AI's deep understanding of who they were during their lifetime.

With AI, paired with Bitcoin, maybe you’ll be able to take it with you after all.

The Transformative Power of AI

In case you missed it, Elon Musk made a bold yet plausible prediction last week regarding AI, saying he believes the technology will become “smarter than the smartest human” by next year or 2026 at the latest. I don’t know who the smartest human currently living is, but if (and when) this happens, we may need to redefine what it means to be “smart.”

The Tesla (NASDAQ:TSLA) chief’s forecast might not come as a surprise to anyone who’s been paying attention. For months now, AI has been able to pass a number of rigorous human tests, including the Uniform Bar Exam (UBE). In February, a team of researchers reported that the most recent version of ChatGPT exhibits characteristics that are “statistically indistinguishable from a random human.” Way before that, in 1997, IBM’s Deep Blue beat world chess champion Garry Kasparov.

Another highly influential business leader, JPMorgan (NYSE:JPM) CEO Jamie Dimon, also weighed in on AI last week. In his annual letter to shareholders, Dimon speculated that the technology has the potential to be “as transformational as some of the major technological inventions of the past several hundred years,” citing examples such as the printing press and the internet.

I agree whole-heartedly with Dimon on this point, even if I don’t agree with his negative views on Bitcoin. The world’s largest digital asset poses a serious challenge to his business, and it’s easy to imagine that Dimon, as CEO of the world’s largest bank, sees his role as protector of centralized finance, fiat currency and the traditional banking system.

Interestingly, Dimon raises a number of major risks in his letter—from record-high government debt to political polarization to escalating global tensions—that could also double as reasons to own an uncorrelated asset like Bitcoin.

As one Bitcoin-related X account quipped, “Jamie Dimon is a #Bitcoin salesman and doesn’t even know it.”

Jamie Dimon is a #Bitcoin salesman and doesn't even know it. pic.twitter.com/sbCa808Dbz

— Bitcoin News (@BitcoinNewsCom) April 8, 2024

Optimism in the Age of Bitcoin and AI

From smart contracts that streamline complex transactions to personalized AI assistants that can make decisions on our behalf, the possibilities of AI are endless. And with the added security and decentralization provided by Bitcoin, we may be on the cusp of a new era of financial freedom and innovation.

There’s a lot of doom and gloom surrounding Bitcoin and AI, but I choose to approach them with a sense of optimism, and I hope you choose to do so as well.

***

Past performance does not guarantee future results.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (3/30/2024): Tesla Inc.