Investors currently have access to well over 2,000 exchange-traded funds (ETFs) listed in the US, including close to 170 launched in 2021.

Meanwhile, metrics from State Street highlight:

“ETFs smashed records in 2021, taking in a record $119 billion in December to push the full-year 2021 record figure to over $900 billion.”

Industry watchers expect ETF inflows to continue to grow in 2022, as well as the number of funds to increase. Today we introduce two new ETFs that began trading last month that could appeal to a range of investors. Given their short trading history, these funds are small. Therefore, interested investors should do appropriate due diligence before hitting the ‘buy’ button.

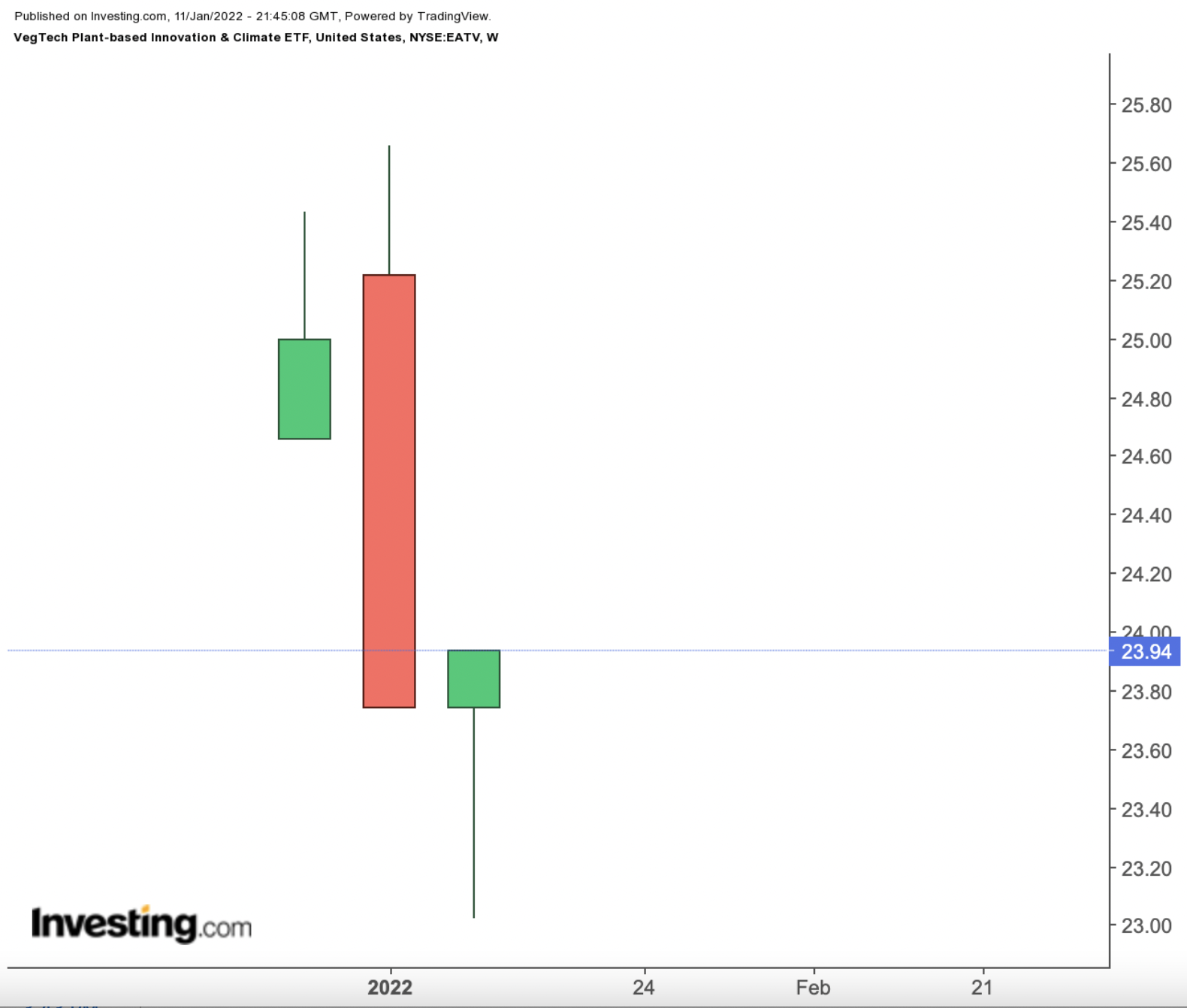

1. VegTech Plant-based Innovation & Climate ETF

- Current Price: $23.94

- 52-Week Range: $23.02 - $25.66

- Expense Ratio: 0.75% per year

Recent research suggests that by the end of the decade, the global market for plant-based foods could exceed $160 billion. As the sector increases, so does Wall Street’s interest in companies at the center of this growth.

The VegTech Plant-based Innovation & Climate ETF (NYSE:EATV) is a pure-play fund that invests in the plant-based foods market and related technologies. Firms in this actively-managed fund include producers of plant-based or precision fermented foods as well as those that focus on animal-free agriculture, materials and technology. The fund was launched in late December 2021.

EATV currently holds 37 stocks. In terms of country weightings, the US leads with 77.2%, followed by Canada (5.2%) and Sweden (5%). The top 10 holdings comprise around 58% of total net assets of $2.1 million. In other words, it is a top-heavy fund.

Plant-based meat supplier Beyond Meat (NASDAQ:BYND); producer of distilled spirits, wheat protein and starch food ingredients MGP Ingredients (NASDAQ:MGPI); synthetic biotechnology company Amyris (NASDAQ:AMRS); cruelty-free cosmetics and skin-care products provider ELF Beauty (NYSE:ELF); and Swedish oat-based products company Oatly (NASDAQ:OTLY) are among the leading holdings on the roster.

The fund started trading on Dec. 29 at an opening price of $24.66. Since then, it has declined about 6.5%. Another busy earnings season is upon us, which could mean volatility in many of the names in EATV. Interested readers could regard a possible further decline toward the $20 level as an opportunity to enter the fund for the long run.

2. Roundhill MEME ETF

- Current Price: $13.35

- 52-Week Range: $12.08 - $16.49

- Expense Ratio: 0.69% per year

In 2021, meme stocks received considerable attention. Retail investors used social media platforms like Twitter and Reddit “to synchronize on buying signals that have significantly affected the price and trading volumes of certain stocks.”

It is too early to tell if the meme stock phenomenon will also continue in 2022. However, if you’re interested in these types of shares, you might wish to research the Roundhill MEME ETF (NYSE:MEME). It started trading in early December 2021 as the first ETF to solely focus on meme stocks. Net assets stand at around $1.9 million.

MEME, an equal-weighted fund, tracks the returns of the Solactive Roundhill Meme Stock Index. The ETF currently holds 25 US-listed stocks, including special purpose acquisition companies (SPACs) that exhibit increased social media activity and a high level of short interest.

In fact, meme stock investors typically follow names with significant short interest—usually more than 15% of the float. Through a coordinated effort, these investors hope to force institutional investors, like hedge funds, into covering these short positions, potentially leading to a rapid increase in a given stock’s price.

More than 43% of the ETF’s net assets are in the top 10 stocks. Among the leading names are Digital World Acquisition (NASDAQ:DWAC), a SPAC that announced an upcoming reverse-merger with Trump Media & Technology Group, which is also under investigation by the US Securities and Exchange Commission (SEC); biotechnology firm Cassava Sciences (NASDAQ:SAVA); cruise name Carnival Corporation (NYSE:CCL), leading airline American Airlines (NASDAQ:AAL); and electric truck-maker Nikola (NASDAQ:NKLA), which is getting ready to settle a civil penalty with the SEC.

MEME began trading on Dec. 8 at an opening price of $15.58. Last week it hit a record low of $12.08. Yesterday, it closed at $13.35.

Potential investors need to appreciate the risk/return profile of meme stocks and how the phenomenon operates before committing their hard-earned cash into these shares.

On the other hand, investors whose portfolios can handle the volatility in these firms should keep the fund on their radar.