- For those looking to add some stability to their portfolios, the insurance sector offers a great option

- Not only is this sector resilient during market uncertainty, but it is also a sector with dividend-paying stocks that tend to perform well

- While there are many ways to gain exposure to this sector, the ETFs and stocks discussed below could be your best bets

Some investors seek dynamism and embrace risk, while others prioritize safety and stability—even if it means sacrificing some profit potential. For those inclined towards the latter, the insurance sector emerges as an appealing choice.

This year has underscored the resilience of the insurance sector, attributed to its consistent business performance and its capacity to reward shareholders with attractive dividends.

In the following analysis, we'll examine optimal avenues for investing in the insurance sector, whether through high-dividend stocks or ETFs.

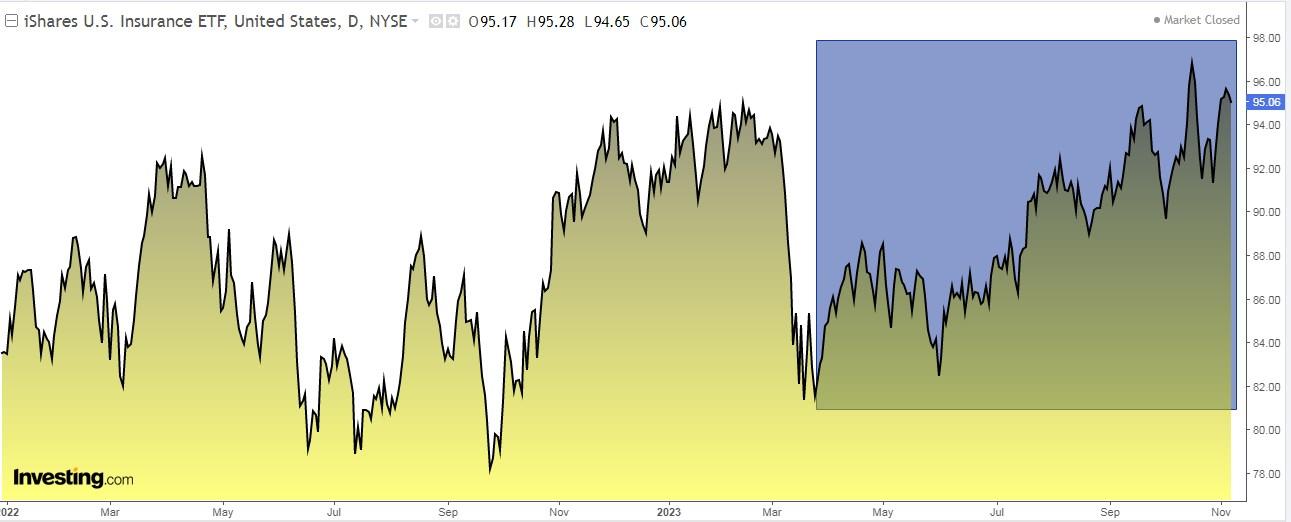

Notably, the iShares US Insurance ETF (NYSE:IAK) stands out, showcasing robust performance over the past 3 to 5 years.

While the insurance sector grapples with its challenges, certain inherent strengths make it an intriguing option for investors:

- Interest Rate Dynamics: The sector benefits from rising interest rates, making savings more attractive, particularly in the life-savings segment. Even if interest rates stabilize, the sector should fare well.

- Sturdy Capital Returns: Demonstrating a robust return on capital, the sector emphasizes financial strength and reliability.

- Potential for Positive Performance: The prospect of positive surprises in profit margins and revenue growth highlights the sector's adaptability to market shifts.

- Dividends and Buybacks: Investors find appeal in the sector's dividend yields and share buybacks, offering additional considerations for investment.

- Balanced Capital and Risk Management: With a balanced return on capital and prudent risk management, the sector maintains stability.

- Resilience in Reinsurance: Despite market uncertainties, the insurance sector exhibits resilience in the reinsurance domain, bolstering its enduring strength.

Now, if that has made the sector more appealing to you, here are three stocks that have fared well over the past year or so:

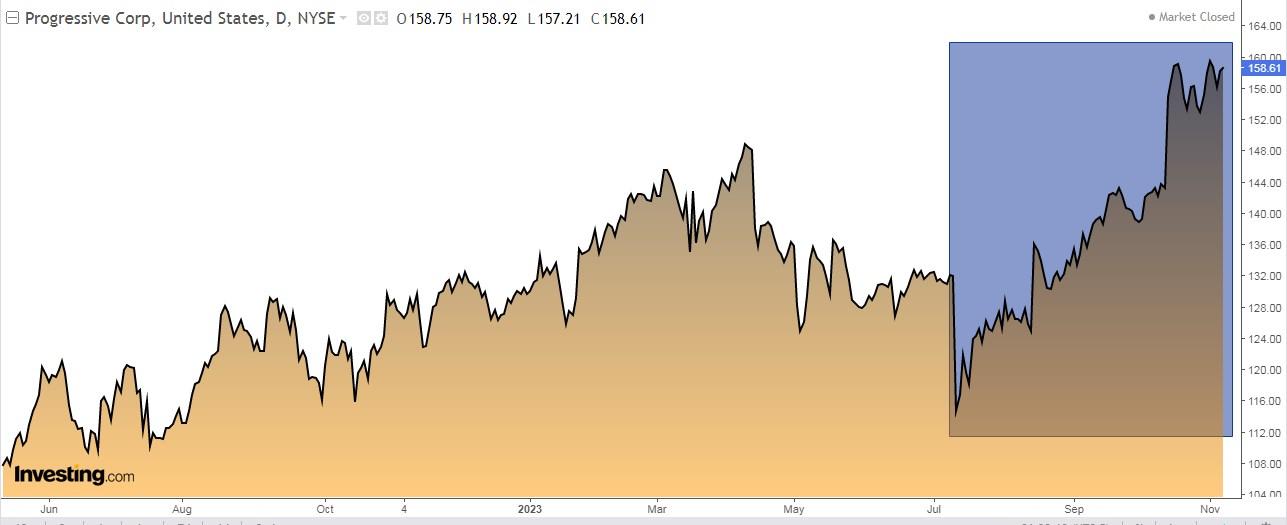

1. Progressive

Progressive Corp (NYSE:PGR) offers auto, homeowners, residential and commercial property, general liability, and other specialty products. It was founded in 1937 and is headquartered in Mayfield Village, Ohio.

The company reports on January 24 and the earnings are expected to be good with revenue up +12.05% and EPS up +23.26%.

It presents 19 ratings, of which 9 are buy, 9 are hold and 2 are sell.

InvestingPro models give it potential at $187.19.

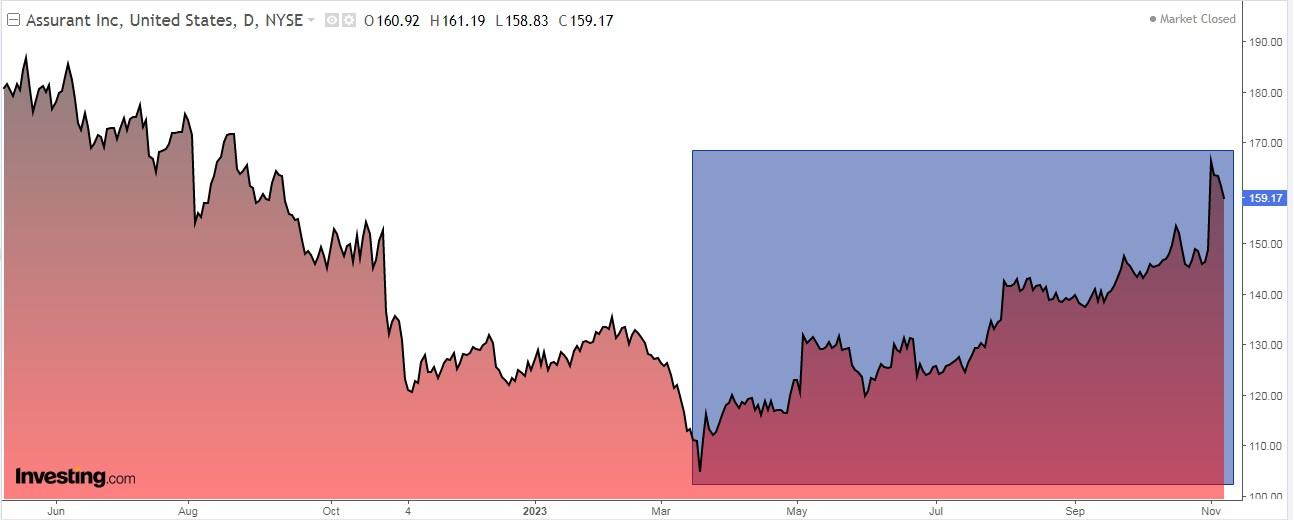

2. Assurant

Assurant (NYSE:AIZ) operates through two segments: life and homeowners. It was founded in 1892 and is headquartered in Atlanta, Georgia.

It will release its numbers on February 6 and is expected to report EPS growth of +6.33%.

It has 6 ratings, all of them being buy and none of them sell.

The market sees potential at $181.60-190.

3. Arch Capital

Arch Capital (NASDAQ:ACGL) offers insurance, reinsurance, and mortgage insurance products worldwide. It was founded in 1995 and is based in Pembroke, Bermuda.

It reports results on February 12 and is expected to report revenue growth of 25.1% and EPS growth of +26.41%.

It has 14 ratings, of which 11 are buy, 3 are hold and none are sell.

The market gives it potential at $93-95.

Top 3 ETFs to Gain Exposure to the Insurance Sector:

- iShares US Insurance: Created in 2006, It manages $376 million. It has a commission of 0.40%. It holds shares of more than 50 insurance companies and among its main stocks are Progressive, Chubb (NYSE:CB), AIG, Aflac (NYSE:AFL), AFL, MetLife (NYSE:MET) and Allstate (NYSE:ALL). Over the past 5 years, it yielded +10.48% and over the past 3 years, it yielded +19.19%.

- S&P Insurance ETF (NYSE:KIE) was created in 2005 and has a 0.35% commission. Among its main positions are Allstate, Progressive, Willis Towers Watson (NASDAQ:WTW), Arch Capital, Renaissancere (NYSE:RNR), WR Berkley (NYSE:WRB) and Assurant. Over the past 5 years, it has yielded +8.76% and over the past 3 years, it has yielded +15.54%.

- Invesco KBW Property & Casualty Insurance ETF (NASDAQ:KBWP) charges a commission of 0.35%. Its main positions are Progressive, Arch Capital, Chubb, American International Group (NYSE:AIG), The Travelers Companies (NYSE:TRV) and Allstate. Over the last 5 years, it has yielded +9.96%, and over the last 3 years +6.50%.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.