- Investors need to look beyond the headline number before investing for dividends.

- While the announced percentage increase can be misleading, investors should focus on the actual dividend yield before investing.

- We will look at stocks that not only offer one of the best dividend yields in the S&P 500 index but also have upside potential.

- If you want to invest by taking advantage of market opportunities, don't hesitate to try InvestingPro. Sign up HERE and get almost 40% off for a limited time on your 1-year plan!

Dividend announcements can be exciting, but a high headline number doesn't tell the whole story. Take Nvidia's (NASDAQ:NVDA) recent 150% dividend hike – it might seem impressive, but it's mostly symbolic.

When it comes to investing for dividend income, the key metric to consider is the actual dividend yield.

This tells you what percentage of your investment you'll earn annually through dividends, calculated by dividing the annual dividend per share by the current share price.

Higher dividend yield translates to a greater portion of your investment recovered through regular payouts.

But wait, there's more - Just because a stock offers a high yield doesn't mean it can't also grow in value. In this article, we'll use InvestingPro to explore some of these high-yield stocks that also have some decent upside potential.

1. Altria

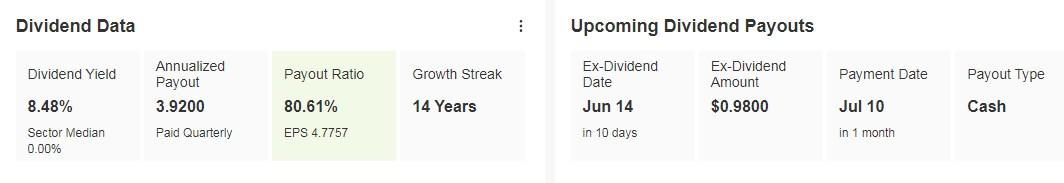

Altria Group (NYSE:MO) is one of the largest tobacco companies in the world and on July 10 it will distribute a dividend of $0.98 per share.

It is the S&P 500 company with the highest dividend yield forecast at 8.48% and is expected to maintain a yield above 10% over the next three years thanks to its cash generation capacity.

Source: InvestingPro

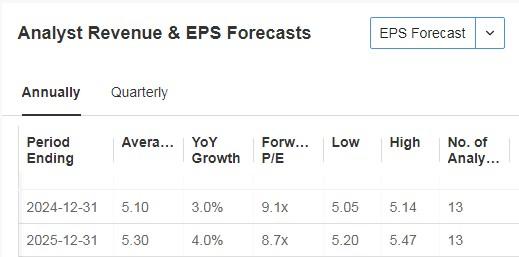

We will learn its quarterly results on July 31, with EPS expected to rise 3%.

Source: InvestingPro

Its fundamental fair value would be 16.4% above the week's closing price, at $53.82.

Source: InvestingPro

2. Verizon Communications

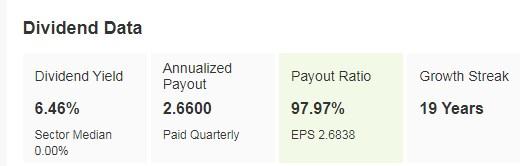

Verizon's (NYSE:VZ) dividend yield is 6.46%.

Source: InvestingPro

It presents results on July 22. Last year it generated revenues of $134 billion.

Source: InvestingPro

It is a defensive company with solid cash generation and an attractive dividend, in fact in the last 7 years it is among the best dividend stocks.

Market consensus gives it an average potential at $45.66.

Source: InvestingPro

3. Ford Motor

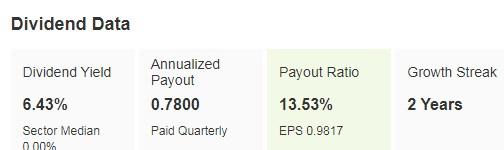

Ford's (NYSE:F) dividend yield is 6.43%.

Source: InvestingPro

It will release its income statement on July 24, with EPS expected to increase by 38%.

Source: InvestingPro

The company aims to quadruple hybrid sales in the next few years and has withdrawn some of its investments in electric vehicles.

The market assigns it an average target of around $14.13.

Source: InvestingPro

4. Realty Income

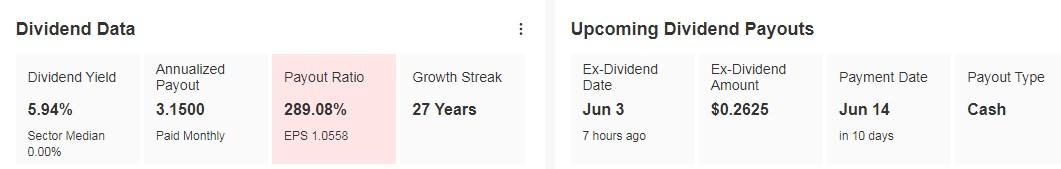

Realty Income Corp (NYSE:O) will pay a dividend of $0.2625 per share on June 14. The company has a dividend yield of 5.94%.

It is characterized by paying dividends monthly and not quarterly as is more common. This is the 125th dividend increase since Realty Income's debut on the New York Stock Exchange in 1994.

Source: InvestingPro

On July 31, it releases its numbers and is expecting EPS growth of 14.7% and revenue of 21.6% by 2024.

Source: InvestingPro

It presents 17 ratings, of which 7 are buy, 10 are hold and none are sell.

Business and investment opportunities are expected to increase in the second half of the year, with a particular focus on Europe.

The average price target given by the market is almost $60.

Source: InvestingPro

5. Vici Properties (VICI)

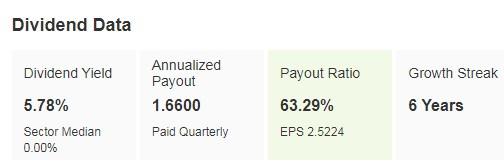

VICI's (NYSE:VICI) dividend yield is 5.78%. The company will distribute the highest profit in its history to the tune of $1.7.

Source: InvestingPro

On July 24, it publishes its accounts and by 2024 it expects EPS to increase by 8% and revenue by 6%.

Source: InvestingPro

Its asset occupancy has been at 100% for three years and will remain so for another three years, according to FactSet.

The company's revenue growth is interesting at 18.03% in the previous quarter, a testament to its strong operating performance.

It has 23 ratings, of which 20 are buy, three are hold and none are sell.

Its fundamental fair value would be at $34.99, while the average price target given by the market would be at $35.21.

6. Pfizer

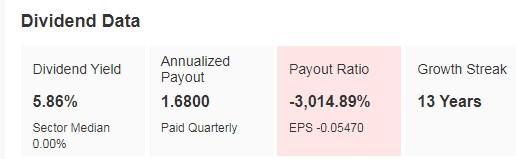

Pfizer's (NYSE:PFE) dividend yield is 5.86%. It maintains its commitment to maintain a payout of between 40% and 50% of adjusted earnings per share.

Source: InvestingPro

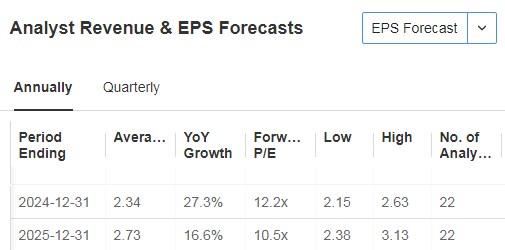

We'll have its earnings statements on July 30, with EPS expected to rise 27.3% for the year.

Source: InvestingPro

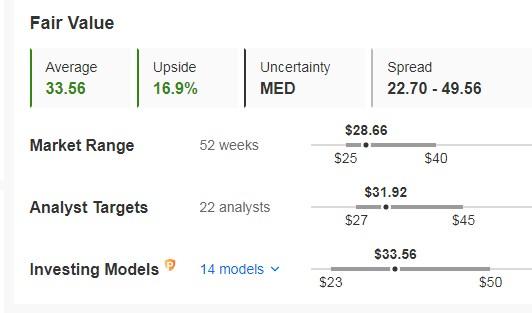

Its fundamental fair value would be at $33.56, or 16.9% above the closing price for the week. Meanwhile, the average market price target is at $31.92.

Source: InvestingPro

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.