- Fed could deliver a soft landing for the economy.

- This will spark a wave of optimism in the market.

- Consider adding these stocks to your watchlist to try and outperform the market.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

As interest rates fall and inflation cools, the Fed appears poised to guide the economy toward a soft landing.

This promising landscape sets the stage for a new bullish wave, and savvy investors are eager to capitalize on opportunities that could deliver remarkable returns.

With analysts buzzing about the potential for double-digit gains, we’ve pinpointed five U.S. stocks that are primed to stand out in this dynamic environment.

In this article, we’ll explore their growth prospects, delve into their dividend policies, and highlight the key upcoming quarterly results that could serve as powerful catalysts for upward movement.

Read on further as we take a closer look at these stocks’ fundamentals and evaluate what the future might hold.

1. Domino's Pizza

Domino’s Pizza (NYSE:DPZ) has become a household name in pizza delivery, operating nearly 21,000 locations across more than 90 countries.

With a market cap of $14.3 billion, the company boasts a dividend yield of 1.41%, which has grown at an impressive rate of 18% over the past five years. Remarkably, Domino's has consistently raised its dividend for the last 12 years.

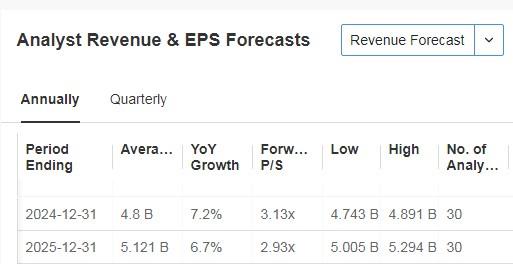

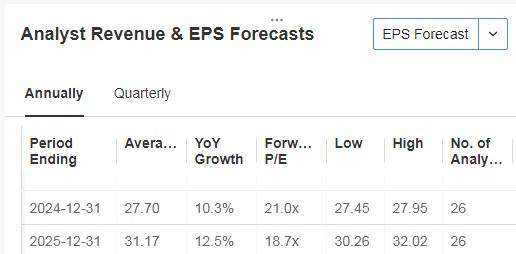

Mark your calendars for October 10, when Domino's will release its quarterly results. Analysts expect earnings per share (EPS) to rise by 10.3% in 2024 and 9.9% in 2025, with revenue growth projected at 7.2% and 6.7%, respectively.

In its most recent quarter, EPS jumped by 30.8%, marking the seventh consecutive quarter of surpassing expectations.

Source: InvestingPro

Currently, the stock enjoys 29 ratings, with 18 buys, 10 holds, and just one sell.

Source: InvestingPro

The average 12-month price target stands at $486.07, indicating robust upside potential.

Source: InvestingPro

2. UnitedHealth Group

Unitedhealth Group (NYSE:UNH) was founded in 1977 and is headquartered in Minnesota.

This healthcare company which offers a range of services and products through its commercial platforms, and is one of the largest health insurance companies in the world by revenue and has a capitalization of $531.9 billion.

Its dividend yield is 1.44%. These payouts have increased consistently over the last 15 years.

Source: InvestingPro

On October 15 it will present its accounts for the quarter. Earnings per share (EPS) are expected to increase by 10.3% and 12.5% for the 2024 and 2025 computations, respectively, while revenues are expected to increase by 7.5% and 7.8%.

Over the last 10 years it has increased its earnings at a compound annual growth rate of 10.48%. In the most recent quarter earnings per share increased 10.7% and was the 16th consecutive quarter in which it exceeded expectations.

Source: InvestingPro

It has a cash balance of $31.3 billion and has been able to make significant relevant purchases, e.g. Change Healthcare (NASDAQ:CHNG) and LHC, one of the largest home healthcare providers in the country.

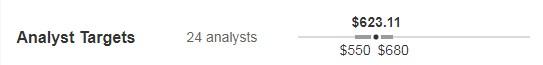

It has 23 ratings, of which 20 are buy, 3 are hold and none are sell.

The market sees potential at $623.11.

Source: InvestingPro

3. Weatherford International (WFRD)

Worth $7.01 billion, Weatherford International (NASDAQ:WFRD) is a leading global provider of innovative solutions for the oil and gas industry. It operates in 75 countries and has a market capitalization of $7.01 billion.

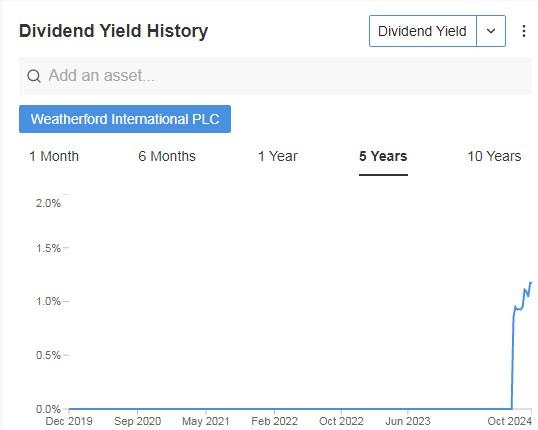

Its dividend yield is 1.71%, being a quarterly dividend of $0.25 per share.

Source: InvestingPro

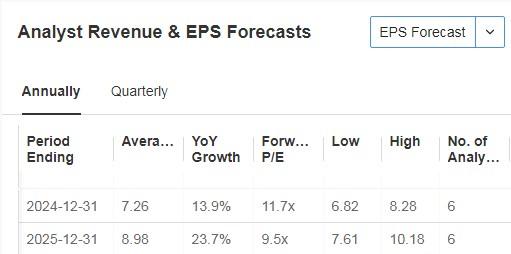

On October 23rd we will have the earnings report. The forecast is for an increase in earnings per share (EPS) of 13.9% and 23.7% for the computation of 2024 and 2025 respectively, being in the case of revenue an increase of 11.1% and 6.9%.

Source: InvestingPro

Acquired Datagration Solutions in September, placing Weatherford at the forefront of data integration and analytics, which could drive future growth and operational efficiencies.

It has eight ratings, all of which are buy ratings.

Its financial health is fairly optimal.

Source: InvestingPro

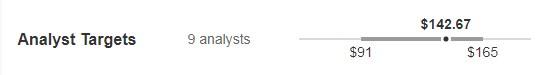

The market gives it a potential at $142.67.

Source: InvestingPro

4. Cheniere Energy

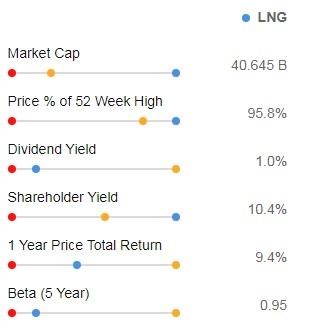

Cheniere Energy (NYSE:LNG) is a Houston-based energy company focused on businesses related to liquefied natural gas, being the largest producer in the United States and the second largest LNG operator worldwide.

Its market capitalization is $41.3 billion.

Its dividend yield is 0.97%, and it has been dishing out these payouts since 2021.

Source: InvestingPro

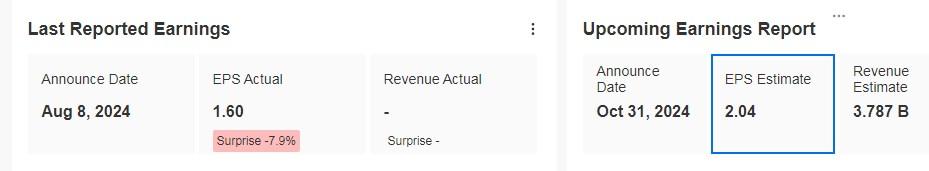

We will know its numbers for the quarter on October 31. For 2025 it forecasts revenue growth of 22% and earnings per share (EPS) of 14.5%.

In the last report, the company beat expectations with EPS of $3.84 per share, beating the estimate of $1.74. However, revenue came in at $3.3 billion, below the forecast of $3.4 billion.

Source: InvestingPro

Its beta is 0.95, meaning its shares move in the same direction as the market and with somewhat less volatility.

Source: InvestingPro

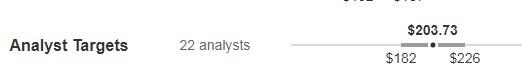

It has 18 ratings, of which 17 are buy, 1 is hold and none are sell.

Its price target set by the market would be at $203.73.

Source: InvestingPro

5. Tidewater

Tidewater (NYSE:TDW) is a leading provider of shipping and support services to the global energy industry.

Founded in 1957, it has a presence with operations in several regions, including the Americas, Europe, Africa and Asia-Pacific. It has a market capitalization of US$4.67 billion.

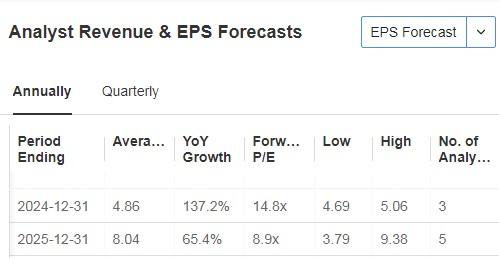

On November 6, it will present its quarterly results. The forecast is for earnings per share (EPS) growth in 2024 and 2025 of 137% and 65% respectively.

Revenues of 38% and 18%. In the previous report it beat estimates in both revenue and earnings. Revenue increased 57.8% over the previous year and earnings per share doubled from $0.43 to $0.94.

Source: InvestingPro

Tidewater's fleet size has increased 80% over the past two years due to the acquisitions of Swire Pacific Offshore and Solstad Offshore. These acquisitions have allowed it to have larger and more modern vessels.

The price target set by the market would be $117.67.

Source: InvestingPro

Bottom Line

In summary, these five stocks show promising growth potential, solid dividends, and favorable market sentiment. Keep an eye on their upcoming quarterly results and the impact of market conditions as you consider your investment options.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services.