- The current high-interest rates scenario favors the financial sector

- And the U.S. banking crisis brought European Banks and Insurance companies' valuations to more affordable levels

- The soundness of the European banking system ensures no particular systemic risks

- Here are 4 stocks to consider buying ahead of the ECB decision, according to InvestingPro

The panic triggered by the U.S. banking crisis spread to Europe, significantly reducing already low valuations and making European banks and insurance companies attractive investment options.

Meanwhile, the financial sector has been the main beneficiary of rising interest rates, thanks to higher interest margins and improved overall revenues.

The European banking sector is subject to greater scrutiny and supervision than its U.S. counterpart. A Silicon Valley Bank-style situation is, therefore, much less likely.

In addition, the balance sheets and regulatory safeguards (on liquidity and loans) have improved significantly in recent years.

After the Fed's decision, it is the ECB's turn, which is expected to raise rates by 25bp to 3.75%. And these 4 stocks could benefit from the current rising interest rates scenario.

1. Banco Santander

Banco Santander (NYSE:SAN) is a Spanish bank with growing profit margins and revenues, which has already shown a trend of sustainability in the medium to long term in its most recent earnings.

It has consistently outperformed analysts' estimates. While I believe the balance sheet quality of Credito Emiliano is superior, there's a bigger discount to fair value here, just above 50%.

Source: InvestingPro

2. Zurich Insurance Group

Switzerland, another victim of the banking panic, also offers some bargains, including the insurance giant Zurich Insurance Group (OTC:ZURVY).

The insurer has an average quality score of 3/5 on InvestingPro. But the discount to fair value makes the stock an interesting investment option.

Source: InvestingPro

Looking at the chart below, over the past 5 years, relative valuations have been the weak link in the overall valuation.

However, after a couple of years of stagnation, it is possible that the current scenario of higher interest rates (which are likely to be in place in Europe throughout 2023) could lead to a resumption of earnings and revenue growth and a consequent rally in stock price.

Source: InvestingPro

3. Credem

According to InvestingPro, Credito Emiliano (BIT:EMBI) is attractively valued. This small Italian bank is also one of the country's most solid banks, with a liquidity coverage ratio of 232% and a Cet1 of 13.7%.

With its growing turnover and an overall health score of 4.5 on InvestingPro, it is a good stock to consider investing in.

Source: InvestingPro

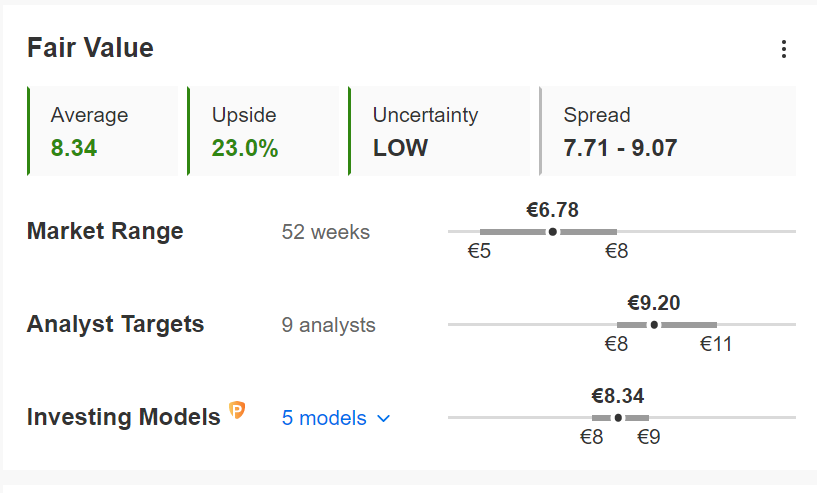

With a potential discount of around 20%, the fair value is also attractive.

4. FinecoBank

Also worth evaluating in addition to Credem in Italy is FinecoBank Banca Fineco SpA (BIT:FBK), with excellent CET1 and LCR ratios, although here valuations are already at Fair Value.

I used InvestingPro to analyze the stocks above. You can access the tool by subscribing through this link.

Disclaimer: The author of the analysis is long on Credem. This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor."