- Three of these stocks have received a consensus recommendation of 'buy' from all analysts, and the fourth stock has 95% of analysts backing it

- This is a relatively uncommon occurrence, and it calls for some analysis before deciding to buy

- As the market rebounds, these stocks are worth your consideration

Analysts giving a buy recommendation on stocks is very common. But, it's not common to see stocks all analysts have rated as a buy. Of course, it is not a guarantee that the stock will rise, but examining these stocks is always worthwhile, even if only out of curiosity.

Specifically, we will examine four stocks, with three of them enjoying the full support of all firms that track them, while the fourth has 95% backing.

We will use the InvestingPro tool to conclude whether these stocks are worth buying at current levels.

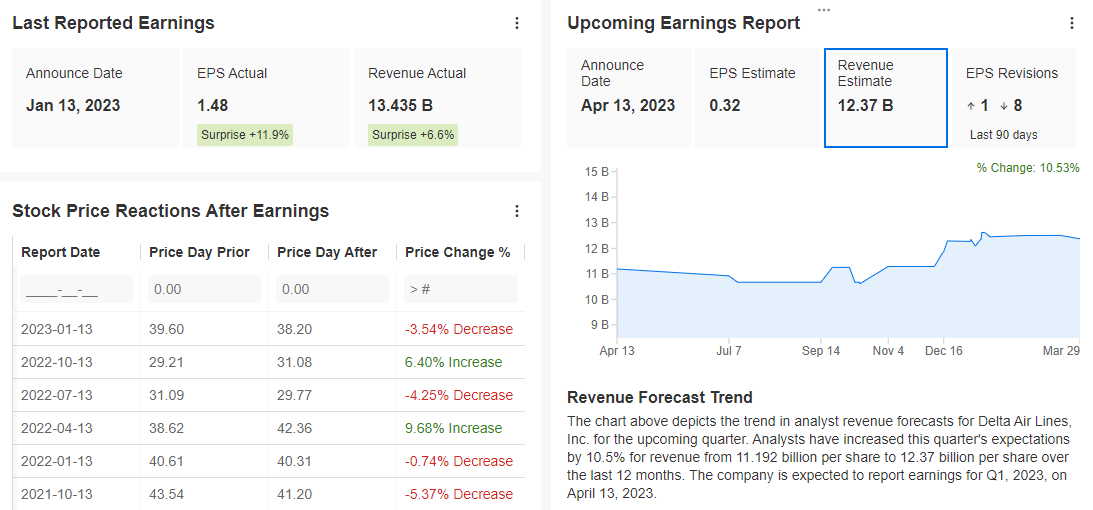

1. Delta Air Lines

Source: InvestingPro

Delta Air Lines (NYSE:DAL) is a commercial airline headquartered in Atlanta, Georgia. It is the biggest U.S. airline in transatlantic flights, covering more destinations in Europe and Asia than any other airline.

It is also the second-largest U.S. carrier in Latin America, second only to American Airlines Group (NASDAQ:AAL). Moreover, this airline is a founding member of SkyTeam, an airline alliance that provides its customers with many destinations worldwide.

Its earnings report for the quarter is scheduled to be released on April 13, with expected earnings per share of $0.33. Additionally, its profits are forecasted to increase by 11.7% this year. All the firms that track the company have given it a buy rating.

From a technical standpoint, the stock's strong support, which has been consistently effective, is at $27.98.

However, it is noteworthy that the stock has historically rebounded significantly every time it has entered oversold territory, as it did in July and September last year. Currently, the stock has once again entered oversold territory.

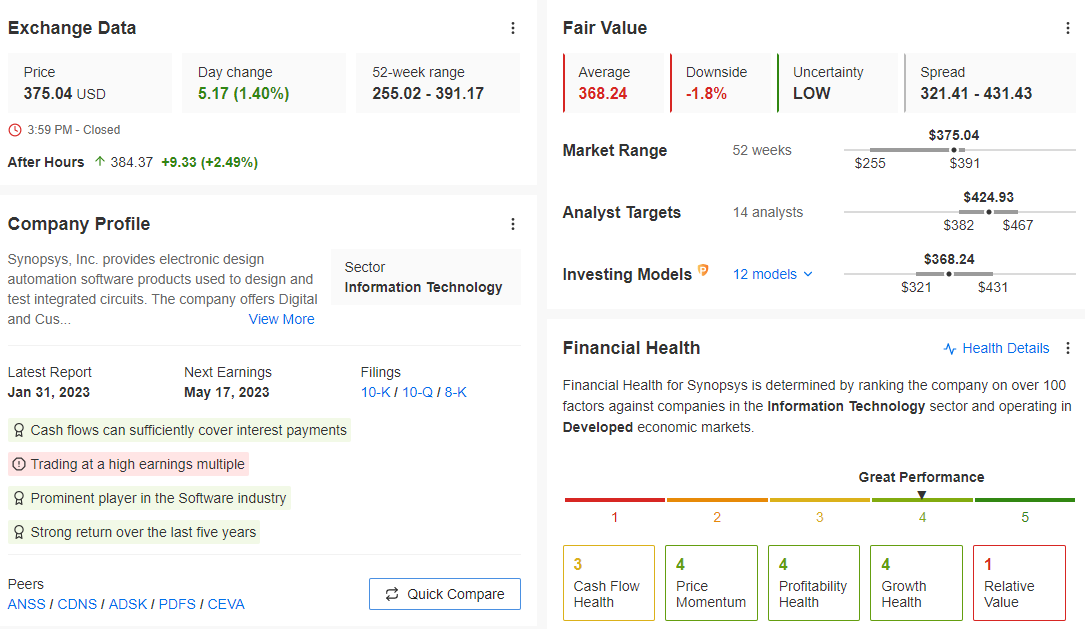

2. Synopsys

Synopsys (NASDAQ:SNPS), which was established in 1986, is a prominent developer of specialized software for integrated circuit design.

The company is a semiconductor, computer, communications, aerospace, and electronics supplier.

Source: InvestingPro

Its earnings report for the quarter is scheduled to be released on May 17, with expected earnings per share of $2.46.

Furthermore, the company's profits are projected to increase by 4.6% this year. All the firms that track the company have given it a buy rating.

From a technical perspective, the stock is currently in an uptrend and is moving within its ascending channel. It is approaching a resistance level at $390.45, and a breakthrough would indicate a new buying interest.

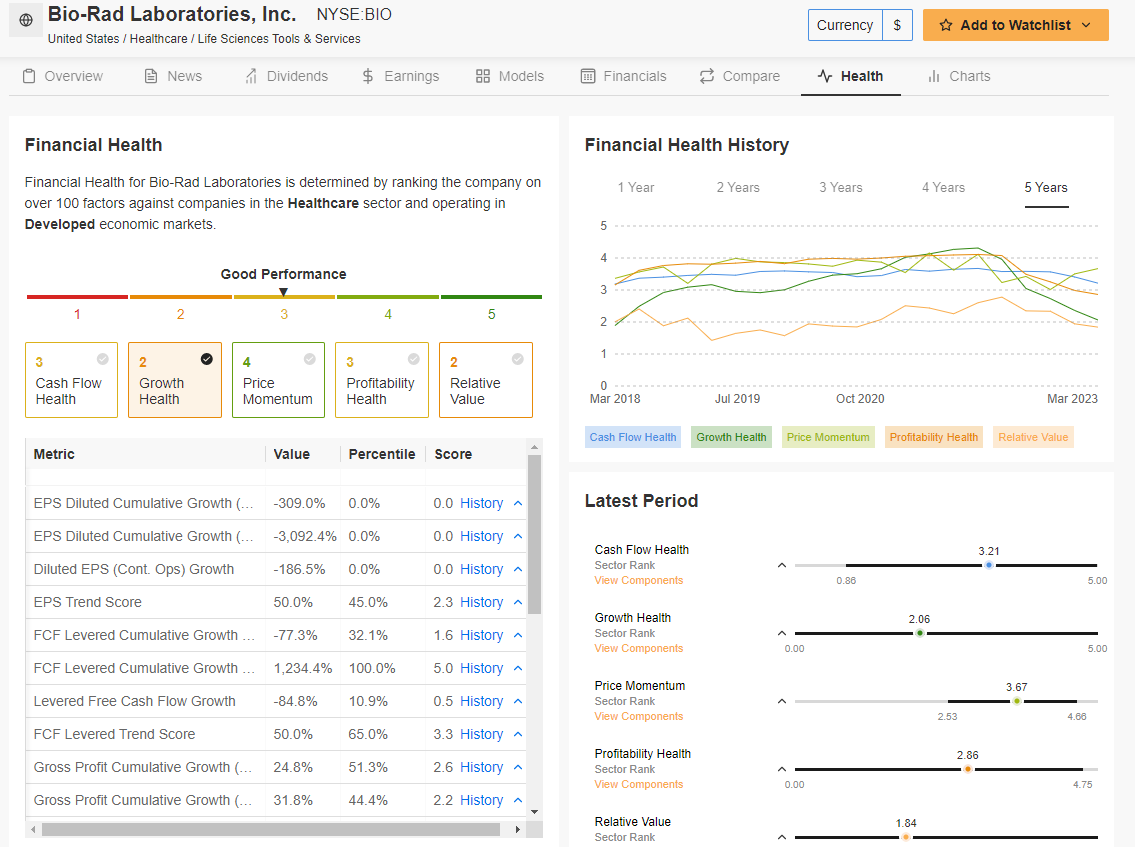

3. Bio-Rad Laboratories

Source: InvestingPro

Bio-Rad Laboratories (NYSE:BIO) is a US-based developer and manufacturer of specialized technology products for the life sciences research and clinical diagnostics markets.

The company was established in 1952 in Berkeley, California, and is currently headquartered in Hercules, California, with operations worldwide.

Its quarterly results are scheduled to be reported on April 27, with expected earnings per share of $3.81. Furthermore, the company is projected to generate a profit of almost $700 million this year. All the firms that track the company have given it a buy rating.

From a technical view, the stock has been on the rise since last November and has recently entered a period of consolidation. It has reached its first Fibonacci level and is now bouncing back up. A breakthrough above $512.79 would indicate a new level of strength.

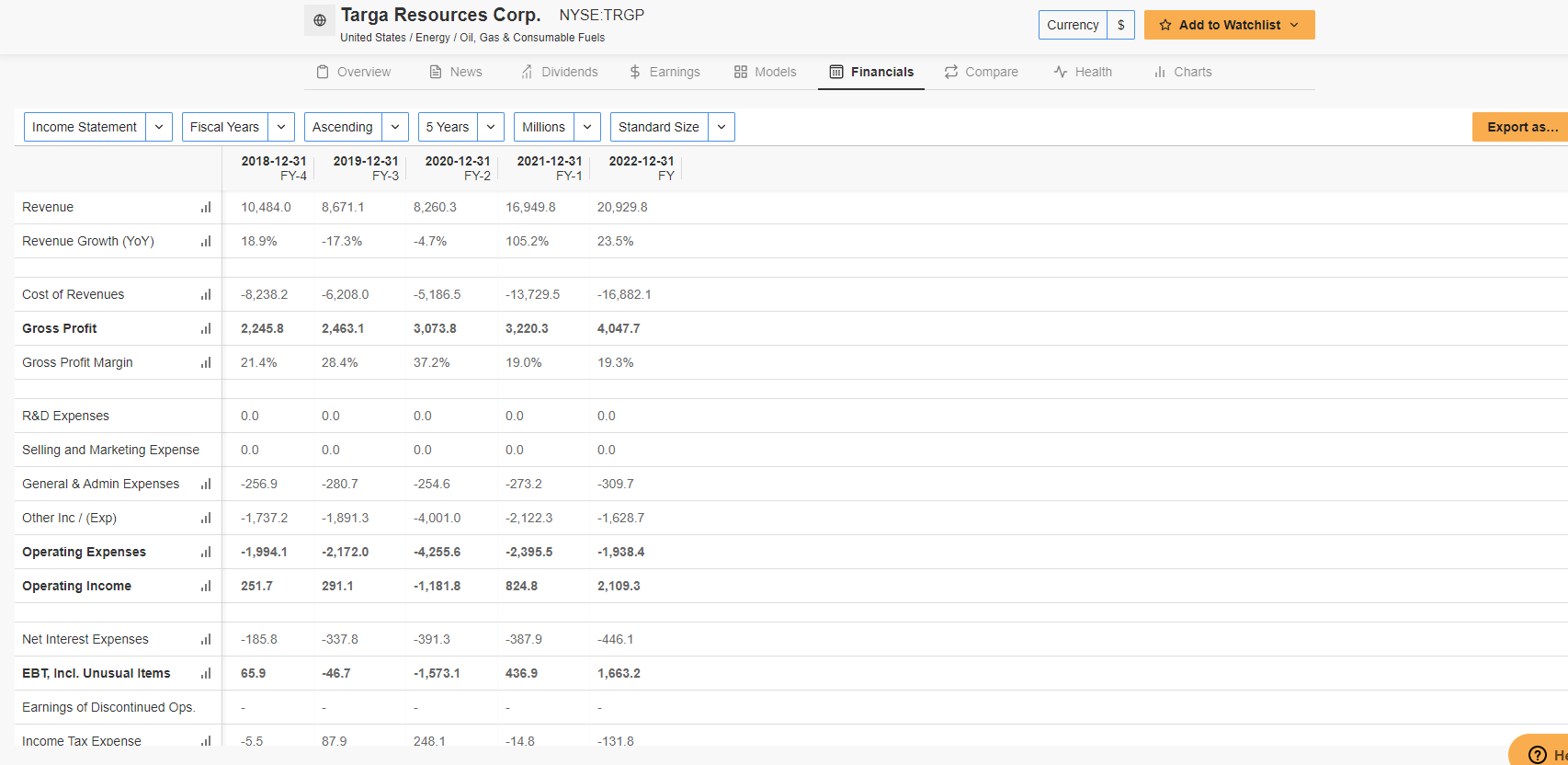

4. Targa Resources

Targa Resources (NYSE:TRGP) was established in October 2005 and is headquartered in Houston, Texas. It is one of the largest companies in the United States that deals with natural gas supply infrastructure.

The company primarily operates on the Gulf Coast, with a significant presence in Texas and Louisiana.

Source: InvestingPro

The company is scheduled to report its quarterly results on April 3, with expected earnings per share of $1.13.

Additionally, it is forecasted to achieve a 2.1% increase in profit this year. Furthermore, 95% of the firms that monitor the company recommend it as a buy.

From a technical perspective, the stock has been exhibiting bullish strength since March 2020.

However, since May of last year, it has been trading within a rectangular range and performing well whenever it touches either end of the range.

A break above the $79.24 level would indicate a continuation of the bullish trend.

Disclosure: The author does not own any of the securities mentioned.