- Several stocks in the S&P 500 index have an attractive dividend yield of over +8%.

- Some of these stocks have underperformed the broader market this year.

- In this piece, we will discuss 4 such stocks with massive dividend yields and decent upside potential.

This year has proven to be less than favorable for dividend investors. Here's why:

- Among the nearly 400 S&P 500 companies distributing dividends, 46% of them have witnessed a decline in their stock market performance this year.

- A notable 75% of dividend-paying companies within the index have shown underperformance compared to the broader S&P 500.

- The S&P Dividend ETF (NYSE:SDY) has experienced a year-to-date decline of more than -3.80%.

However, in the short term, the ETF has demonstrated positive returns, with a gain of +1.22% in the last three months and +6.34% in the last month.

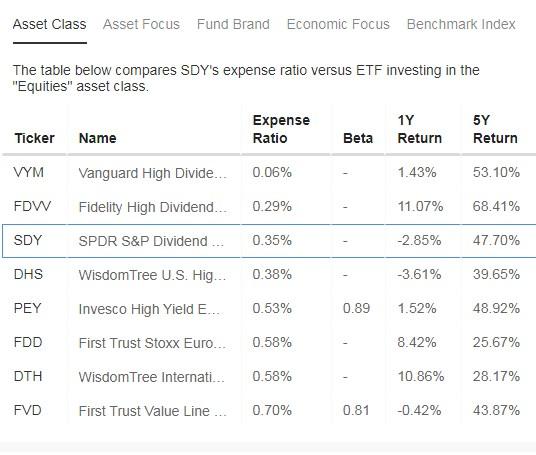

In the following table, we can see some of the main dividend ETFs with their fee and 1-year to 5-year yields.

We see that all of them present spectacular 5-year yields. But on the other hand for 1 year, out of the 8, we have 3 negative returns and 2 with minor gains.

Source: InvestingPro

But several stocks in the S&P 500 have a very attractive dividend yield, above +6%, that beat the average yield of companies on Wall Street and that the market likes.

Specifically, we will look at 4 stocks whose dividend yields more than +8%. To do so, we will use the InvestingPro tool to uncover insights about the stocks discussed below.

1. Pioneer Natural Resources

Pioneer Natural Resources Co (NYSE:PXD) is based in Irving, Texas, it is engaged in hydrocarbon exploration. It was created in 1997 through the merger of Parker & Parsley Petroleum Company and MESA.

The dividend yield is +12.21%.

Source: InvestingPro

On February 21 it presents its quarterly accounts. For 2024 it expects real revenue growth of +14.3% and earnings per share (EPS) of +11.5%.

Source: InvestingPro

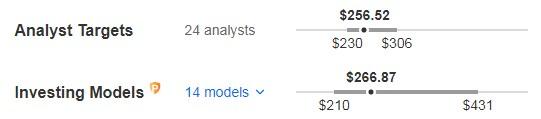

Its shares are up +8.69% in the last year. The market gives it a 12-month forward potential at $256.52, while InvestingPro's models raise it to $266.87.

Source: InvestingPro

2. Walgreens Boots Alliance

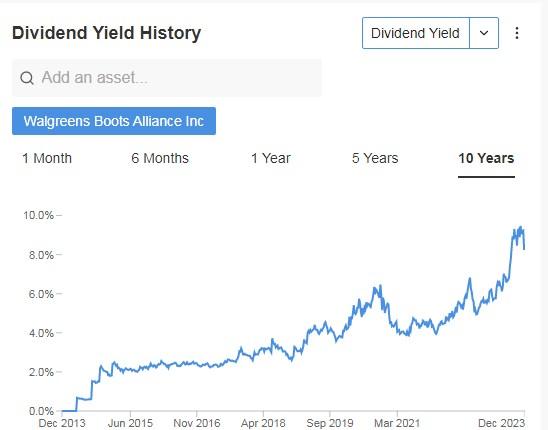

Walgreens Boots Alliance (NASDAQ:WBA) is a U.S. holding company based in Deerfield, Illinois that owns the Walgreens retail pharmacy chains in the United States and Boots in the United Kingdom, as well as several pharmaceutical manufacturing and distribution companies. The company was founded on December 31, 2014.

Its dividend yield is +9.36%.

Source: InvestingPro

It reports quarterly results on January 4. For 2024, it expects real revenue growth of +2.8% and earnings per share (EPS) of +11.5%.

Source: InvestingPro

Last Thursday its shares rose +8% following a New York court ruling that is expected to address the admissibility of evidence on the safety of Tylenol when used by pregnant women.

Its shares are up +10.63% over the past 3 months and +14.82% over the past month. The market sees a 12-month potential for it at $27.

Source: InvestingPro

3. Altria Group

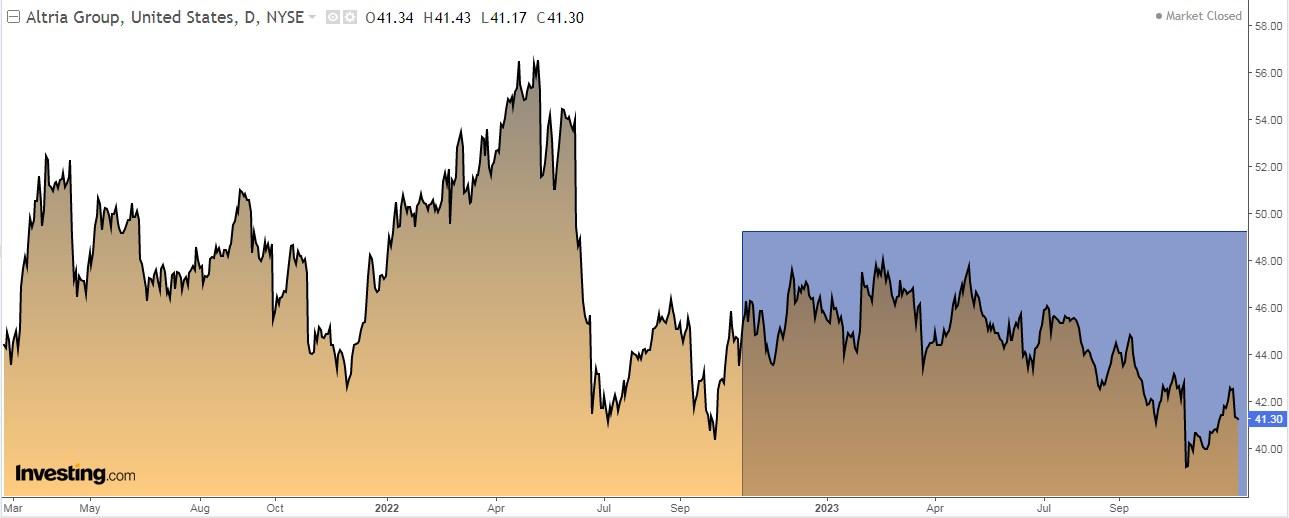

Altria Group (NYSE:MO) is one of the largest U.S. transnational companies and markets mainly food, beverages, and tobacco.

The companies that are part of the Altria Group are: Philip Morris (NYSE:PM), Smokeless Tobacco Company, John Middleton, Philip Morris, and Nu Mark. It is headquartered in Virginia.

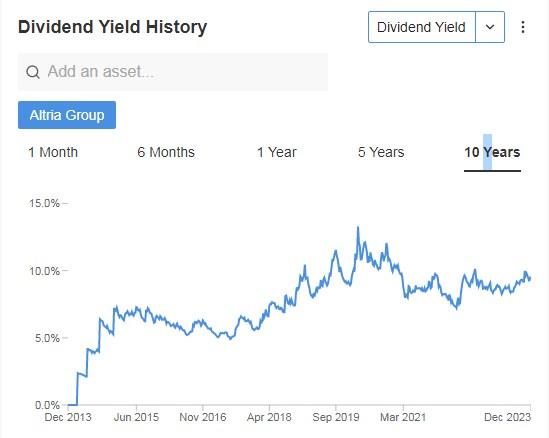

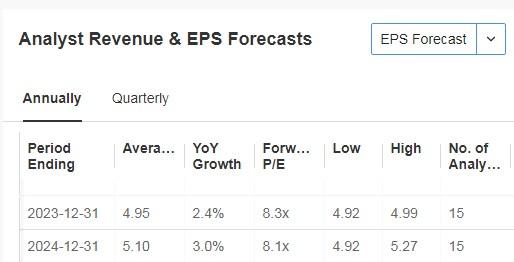

Its dividend yield is +9.21%. The dividend will be paid on January 10, 2024, to shareholders with shares before December 21, 2023.

Source: InvestingPro

Results for the quarter will be released on February 1. For the 2023 computation, EPS is expected to increase by +2.4% and for 2023 by +3%.

Source: InvestingPro

Its shares are up +3.20% in the last month. The market gives it a 12-month potential at $47.04 and InvestingPro models at $55.16.

Source: InvestingPro

4. Invesco

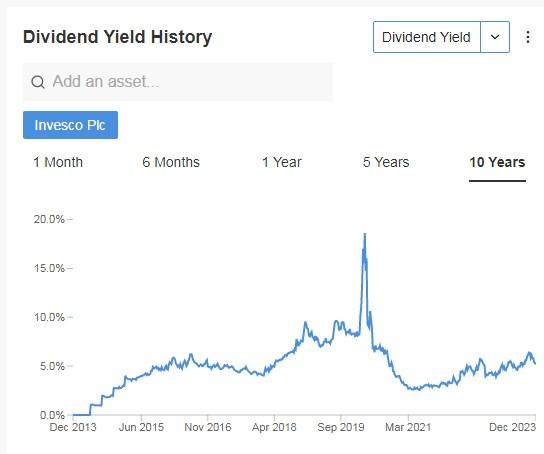

Invesco Plc (NYSE:IVZ) is one of the world's leading independent investment managers and also launches mutual funds. Invesco was founded in 1969 and has a presence in 25 countries and employs more than 8,000 professionals.

Its dividend yield is +8.27%.

Source: InvestingPro

On January 31, it is due to release its quarterly accounts. For 2024, earnings per share are expected to increase by +13.2%.

Source: InvestingPro

Its shares are up +17.28% in the last month. It presents 15 ratings, of which 2 are buy, 13 are hold and none are sell. InvestingPro models give it a potential at $17.47.

Source: InvestingPro

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your criteria. This way, you will get highly professional help in shaping your portfolio.

You can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis by clicking on the banner below.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky therefore, any investment decision and the associated risk remains with the investor.