- ABNB stock is up almost 15% so far in 2021, and saw a record high in February.

- Airbnb has been successful in disrupting the traditional hotel business, a trend that is likely to continue in the quarters ahead

- Despite potential short-term volatility potential buy-and-hold investors could regard any further short-term decline in ABNB shares as an opportune entry point

Investors in Airbnb (NASDAQ:ABNB) stock have enjoyed a solid 2021. Shares of the San Francisco-based internet 'stays and experiences' platform are up 14.8% year-to-date (YTD). The stock hit an all-time high (ATH) of $219.94 on Feb 11.

As of the close on Sept. 28, ABNB shares were at $168.58

For comparison, readers might be interested to know that the Dow Jones U.S. Hotels Index is up 20.8% YTD. However, unlike ABNB stock, the index hit an ATH on Sept. 27.

The 52-week range for shares of the San Francisco-based accommodation platform Airbnb have ranged between $121.50 - $219.94, while the company’s market capitalization stands at $115.8 billion.

Founded in 2008, the sharing-economy darling Airbnb has successfully created a platform connecting travelers with potential hosts worldwide. The company went public in December 2020 at an opening price of $146.

In its preliminary prospectus of Nov. 16, 2020 filed with the Securities and Exchange Commission (SEC), management said:

“We have a substantial market opportunity in the growing travel market and experience economy… We estimate our total addressable market (“TAM”) to be $3.4 trillion, including $1.8 trillion for short-term stays, $210 billion for long-term stays, and $1.4 trillion for experiences.”

On Aug. 12, Airbnb issued Q2 results, which beat the Street’s estimates for revenue and bookings. Revenue was $1.34 billion, up nearly 300% year-over-year (YoY) and surpassed Q2 2019 levels by 10%. However, the company lost 11 cents of earnings per share.

During the quarter, Airbnb had 83.1 million nights and experiences booked, up close to 200% YoY. Average daily rate (ADR) increased to $161, up from $160 in the prior quarter.

Put another way, customers had spent slightly more for homes and experiences. Wall Street was pleased by the 41% YoY acceleration of that figure. Investors also seem excited that Airbnb will focus more on remote cities as well as long-term rentals (i.e., over 28 days).

The pandemic, especially the Delta variant, is still a concern for management as well as the travel industry. The company noted:

“…the Delta variant will continue to affect overall travel behavior, including how often and when guests book and cancel… While the COVID-19 pandemic creates ongoing uncertainty for our future results, we expect Q3 2021 revenue to be our strongest quarterly revenue on record and to deliver the highest Adjusted EBITDA dollars and margin ever.”

In the days following the earnings announcement, ABNB stock initially declined about 5%. On Aug. 20, it hit an intraday low of $141.50. Currently, it's around $168. In other words, the shares have gone up by about 19% in less than six weeks.

What To Expect From ABNB Stock

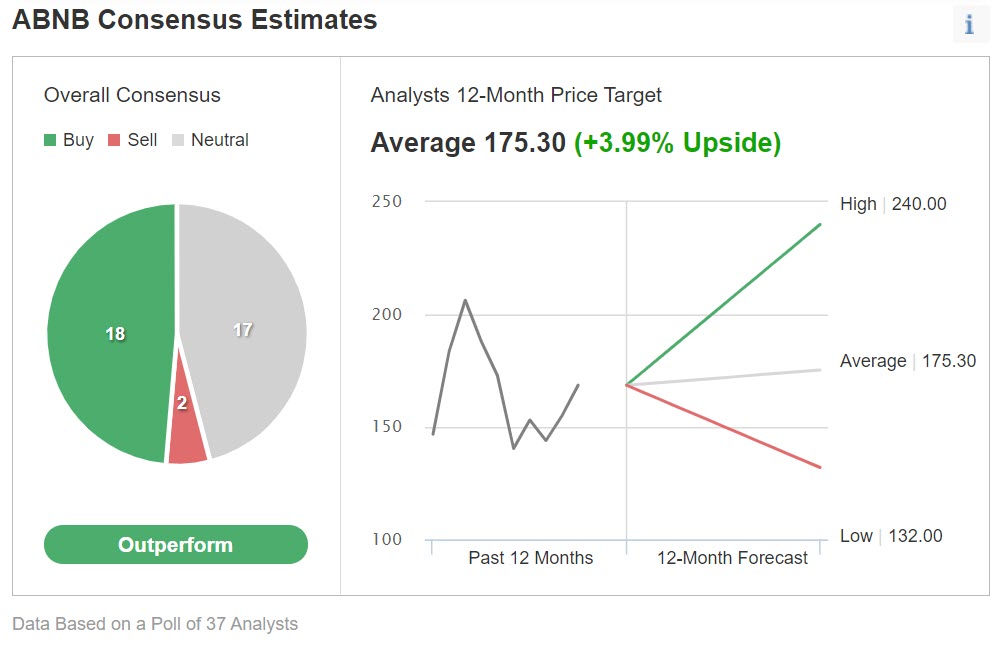

Among 37 analysts polled via Investing.com, Airbnb stock has an ‘outperform' rating.

Chart: Investing.com

The shares have a 12-month price target of $175.30, implying an increase of 4% from current levels (i.e., flat). The 12-month price range currently stands between $132 and $240.

P/S and P/B ratios for ABNB stock stand at 24.76x and 31.79x, respectively. By comparison, the same ratios for Expedia (NASDAQ:EXPE) stand at 4.43x and 23.32x. And they are 14.16x and 21.19x for Booking Holdings (NASDAQ:BKNG). Which indicates that investors have been willing to pay a premium for the growth potential of Airbnb shares.

Investors who watch technical charts might be interested to know that a number of ABNB stock short-term oscillators are overbought. Although they can stay extended for weeks, if not months, potential profit-taking could also be around the corner.

Therefore, if broader markets, or especially travel shares, were to come under further pressure during the rest of the month or in October, we could first see Airbnb stock decline toward $155, or even $150, after which it could trade sideways while it establishes a new base. In the case of such a decline, ABNB is likely to find strong support around the $150 level.

Indeed, given the recent run-up in price, our expectation is for the stock to decline another 5-7% in the short term. Some investors are likely to ring in the cash register and take some of their profits home. However, such a decline could offer a better entry point for buy-and-hold investors who expect growth to accelerate in the coming years.

3 Possible Trades on ABNB Stock

1. Buy ABNB Stock At Current Levels

Investors who are not concerned with daily moves in price and who believe in the long-term potential of the company could consider investing in Airbnb stock now.

On Sept. 28, Airbnb stock was at $168.58. Buy-and-hold investors should expect to keep this long position for several months while the stock makes another attempt at the record high of $219.94. Such a move would lead to a return of about 30%.

Meanwhile, investors who are concerned about large declines might also consider placing a stop-loss at about 3-5% below their entry point.

2. Buy An ETF With ABNB As A Main Holding

Many readers are familiar with the fact that we regularly cover exchange-traded funds (ETFs) that might be suitable for buy-and-hold investors. Thus, readers who do not want to commit capital to ABNB stock but would still like to have substantial exposure to the shares could consider researching a fund that holds the company as a top holding.

Examples of such ETFs include:

- ETFMG Travel Tech ETF (NYSE:AWAY): This fund is up 9.1% YTD, and ABNB stock’s weighting is 4.57%;

- Renaissance IPO ETF (NYSE:IPO): The fund is flat YTD, and ABNB stock’s weighting is 2.46%;

- SoFi Gig Economy (NASDAQ:GIGE): The fund is down 4.3% YTD, and ABNB stock’s weighting is 3.74%;

- VictoryShares NASDAQ Next 50 ETF (NASDAQ:QQQN): The fund is down 3.1% YTD, and ABNB stock’s weighting is 4.49%.

3. Bear Put Spread

Readers who believe there could be more profit-taking in ABNB stock in the short run might consider initiating a bear put spread strategy. As it involves options, this set up will not be appropriate for all investors.

It might also be possible for long-term ABNB investors to use this strategy in conjunction with their long stock position. The set-up would offer some short-term protection against a decline in price in the coming weeks.

This trade requires a trader to have one long Airbnb put with a higher strike price and one short ABNB put with a lower strike price. Both puts will have the same expiration date.

Such a bear put spread would be established for a net debit (or net cost). It will profit if Airbnb shares decline in price.

For instance, the trader might buy an out-of-the-money (OTM) put option, like the ABNB 21 January 2022 160-strike put option. This option is currently offered at $11.10. Thus, it would cost the trader $1,110 to own this put option, which expires in about four months.

At the same time, the trader would sell another put option with a lower strike, like the ABNB 21 January 2022 140-strike put option. This option is currently offered at $4.75. Thus, the trader would receive $475 to sell this put option, which also expires in about four months.

The maximum risk of this trade would be equal to the cost of the put spread (plus commissions). In our example, the maximum loss would be ($11.10 - 4.75) X 100 = $635.00 (plus commissions).

This maximum loss of $635 could easily be realized if the position is held to expiry and both ABNB puts expire worthless. Both puts will expire worthless if the Airbnb share price at expiration is above the strike price of the long put (higher strike), which is $160.

This trade’s potential profit is limited to the difference between the strike prices or ($160.00 - $140.00) X 100 minus the net cost of the spread (i.e., $635.00) plus commissions.

In our example, the difference between the strike prices is $20.00. Therefore, the profit potential is $2,000 - $635 = $1,365.

This trade would break even at $153.65 on the day of the expiry (excluding brokerage commissions).