- The three stocks I plan to discuss in this piece represent compelling value plays for investors seeking robust growth drivers at reasonable prices.

- Their above-average financial health, as assessed by InvestingPro, underscores their stability and potential.

- With significant upside potential and industry-leading positions, these stocks are well-equipped to deliver gains in the coming year.

- Looking for more actionable trade ideas? Subscribe here for 60% off InvestingPro as part of our Cyber Monday sale!

As the year-end approaches, savvy investors seeking value opportunities can turn to Block (NYSE:SQ), Endeavor Group (NYSE:EDR), and Kyndryl Holdings (NYSE:KD). Each operates in a distinct sector, offering unique opportunities for growth while trading at attractive valuations.

Below is a closer look at these companies, their business prospects, and why they make compelling buys for 2025 and beyond.

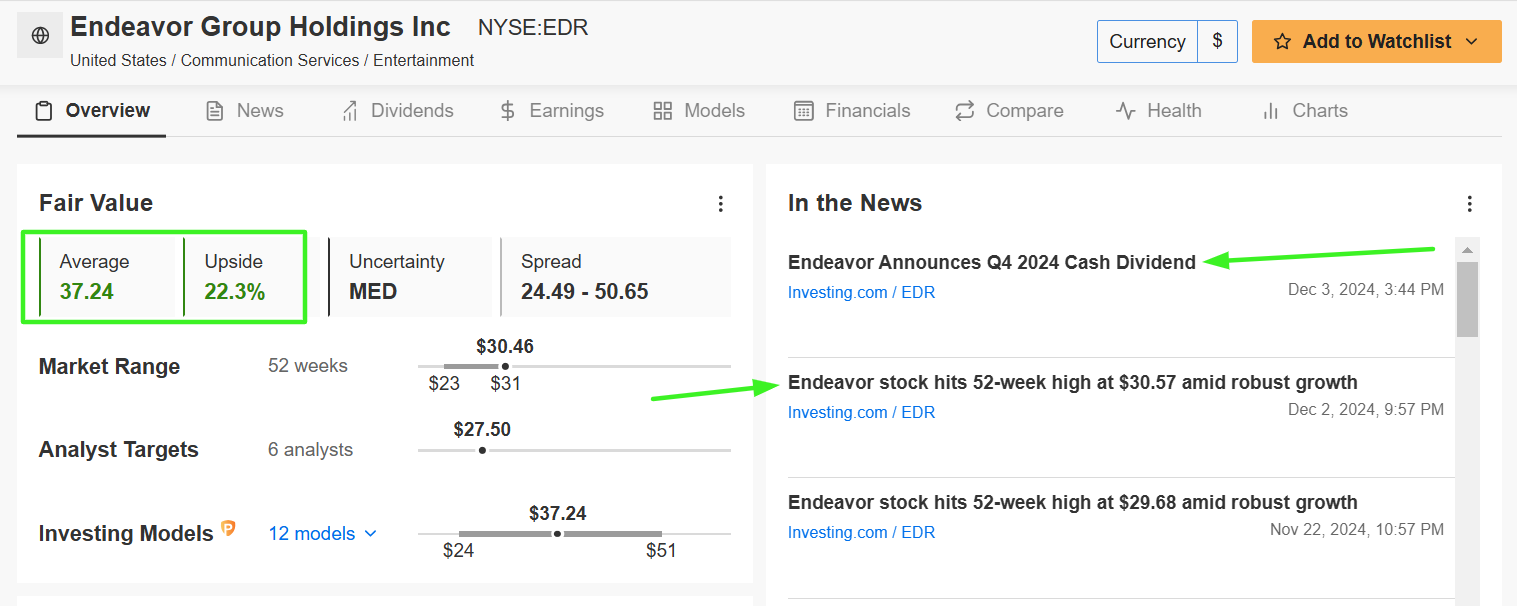

1. Endeavor Group

- Current Price: $30.46

- Fair Value Estimate: $37.24 (+22.3% Upside)

- Market Cap: $14.2 Billion

Endeavor Group operates in the entertainment and sports sectors, managing some of the world’s most iconic brands, including the UFC, WWE, and IMG.

The Beverly Hills-based company has built a robust portfolio of live events, media rights, and talent representation, making it a dominant player in the industry.

Source: Investing.com

Endeavor’s growth is driven by rising demand for live events and exclusive media content. With strong revenue streams from its sports and entertainment divisions, the company is well-positioned for continued success in 2025 and beyond.

Trading near record highs after a 28.4% YTD gain, EDR has further upside potential of 22.3% as per InvestingPro’s AI-powered valuation models, making it an attractive buy for growth-focused investors.

Source: InvestingPro

The global sports and entertainment powerhouse has an InvestingPro Financial Health Score of 3.1/5.0, reflecting its strong operational execution and high demand for live experiences.

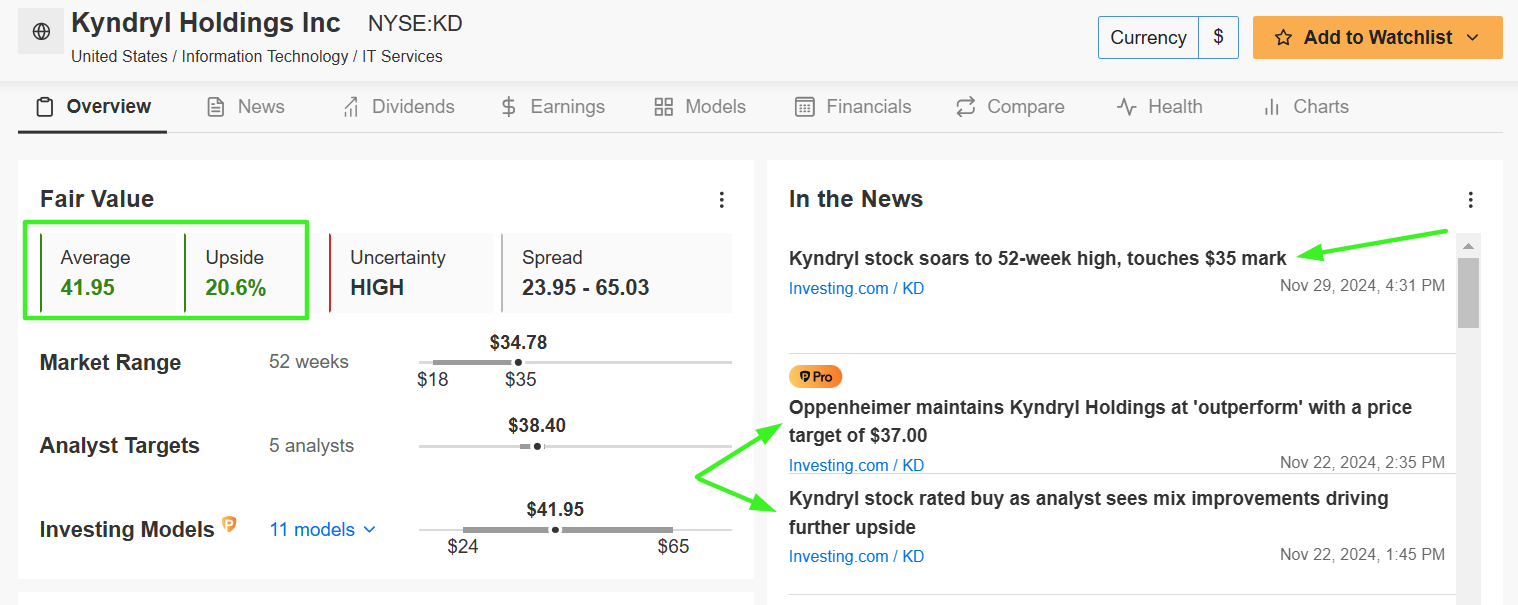

2. Kyndryl Holdings

- Current Price: $34.78

- Fair Value Estimate: $41.95 (+20.6% Upside)

- Market Cap: $8.1 Billion

Kyndryl Holdings, a spin-off from IBM (NYSE:IBM), operates in the IT services sector, specializing in infrastructure management and digital transformation solutions.

The New York-based company helps businesses modernize their IT systems, enhance cybersecurity, and leverage cloud services.

Source: Investing.com

Kyndryl has shown remarkable improvement in operational efficiency and revenue growth since its spin-off in 2021.

Its focus on expanding partnerships with cloud giants like Microsoft (NASDAQ:MSFT) and Amazon’s AWS is expected to drive further growth as enterprises prioritize digital transformation.

With an InvestingPro Financial Health Score of 2.9/5.0, Kyndryl is substantially undervalued, with a 20.6% upside potential from its current valuation.

Source: InvestingPro

Its massive 67.3% year-to-date gain demonstrates strong market approval of its turnaround efforts. As enterprises increasingly prioritize cloud services and cybersecurity, Kyndryl is positioned for sustained growth in 2025.

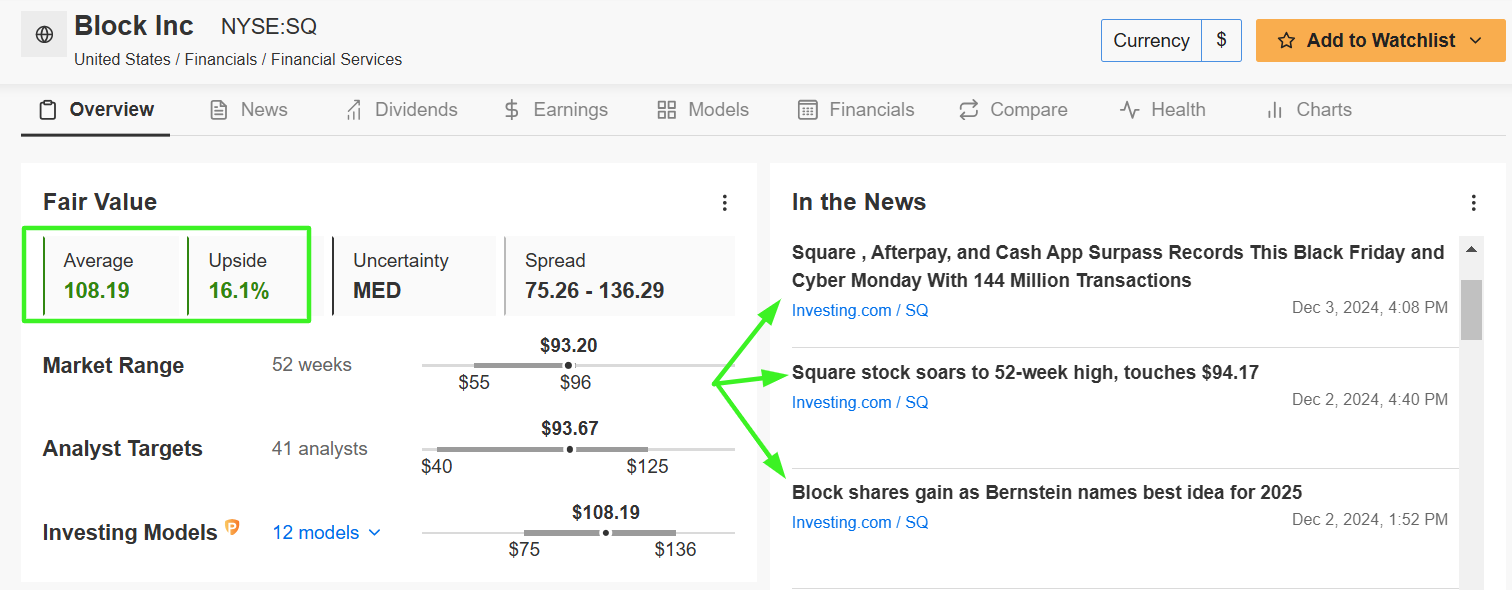

3. Block

- Current Price: $93.20

- Fair Value Estimate: $108.19 (+16.1% Upside)

- Market Cap: $57.7 Billion

Block, formerly known as Square, operates in the financial technology sector, focusing on digital payment solutions and ecosystem services for businesses and individuals. Its popular Cash App and Seller ecosystems have made it a leader in mobile payment innovation.

Source: Investing.com

Block is riding high on the digital transformation wave, with growing adoption of Cash App for peer-to-peer transactions and banking services.

The San Francisco-based company, led by Jack Dorsey, continues to expand its international footprint and explore cryptocurrency integrations, signaling long-term growth potential.

As per InvestingPro’s Fair Value models, Block offers 16.1% upside potential from its current price of around $93, adding to its allure as a strong performer in 2024, with a 20.5% year-to-date gain.

Source: InvestingPro

Supported by an InvestingPro Financial Health Score of 3.3/5.0, Block is well positioned to continue its upward trajectory in 2025 thanks to increasing Cash App penetration and international growth.

Why These Stocks Are Undervalued

Despite their strong performance in 2024, all three companies are trading at attractive valuations, with significant upside potential according to InvestingPro’s Fair Value models.

Block, Endeavor, and Kyndryl offer diverse growth drivers across financial technology, entertainment, and IT services, respectively, making them ideal choices for value and growth investors.

Position your portfolio for success in 2025 by capitalizing on these undervalued opportunities before they gain further momentum.

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now to get 60% off all Pro plans and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust (NASDAQ:QQQ) ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.