- Shares of toymaker Hasbro are down more than 23% in 2022, trading at multi-year lows

- Increasing costs, declining consumer spending are challenges ahead

- Long-term investors could consider investing in HAS, which supports a 3.5% dividend yield

Toy and entertainment heavyweight Hasbro (NASDAQ:HAS) is known for strong global brands, including the classic board game Monopoly, Play-Doh, as well as action figures Transformers and Power Rangers. Yet, HAS stock is down 23.2% since the beginning of the year. By comparison, the shares of its main competitor, Mattel (NASDAQ:MAT), are up by 3.5% so far in 2022.

Source: Investing.com

On Jan. 5, HAS shares went over $105 to hit a multi-year high. But now they are trading at multi-year lows. The stock’s 52-week range has been $77.04-$105.73, while the market capitalization stands at $10.9 billion.

Research suggests by 2027, the size of the global toy market should exceed $103.5 billion. In the U.S., Hasbro and Mattel lead the market. Therefore, Wall Street pays close attention when these two companies release earnings.

Recent Metrics

Hasbro issued Q2 financials on July 19. While top-line performance was shy of analysts’ forecasts, the bottom line was better than estimates. The toy-maker reports results under three major segments: Consumer Products; Wizards of the Coast & Digital Gaming; and Entertainment.

The overall top line increased to $1.34 billion, a 1% year-over-year hike. Adjusted earnings per share (EPS) was $1.15 for the period as compared with $1.05 a year ago. That number suggests the market could grow at a compound annual growth rate (CAGR) of 2.5% from current levels.

On the results, CEO Chris Cocks said:

“The Hasbro team delivered strong second quarter results… Wizards of the Coast turned in its biggest quarter ever, led by 15% growth in tabletop gaming and 11% growth in MAGIC: THE GATHERING across platforms. We also significantly enhanced our digital play and direct-to-fan capabilities with the acquisition of D&D Beyond…”

For the whole year, management expects its revenue to grow in the low- to mid-single-digit range. Prior to the release of Q2 results, HAS stock was changing hands at around $79.30. Now, as we write they are at $78.20.

What To Expect From Hasbro Stock

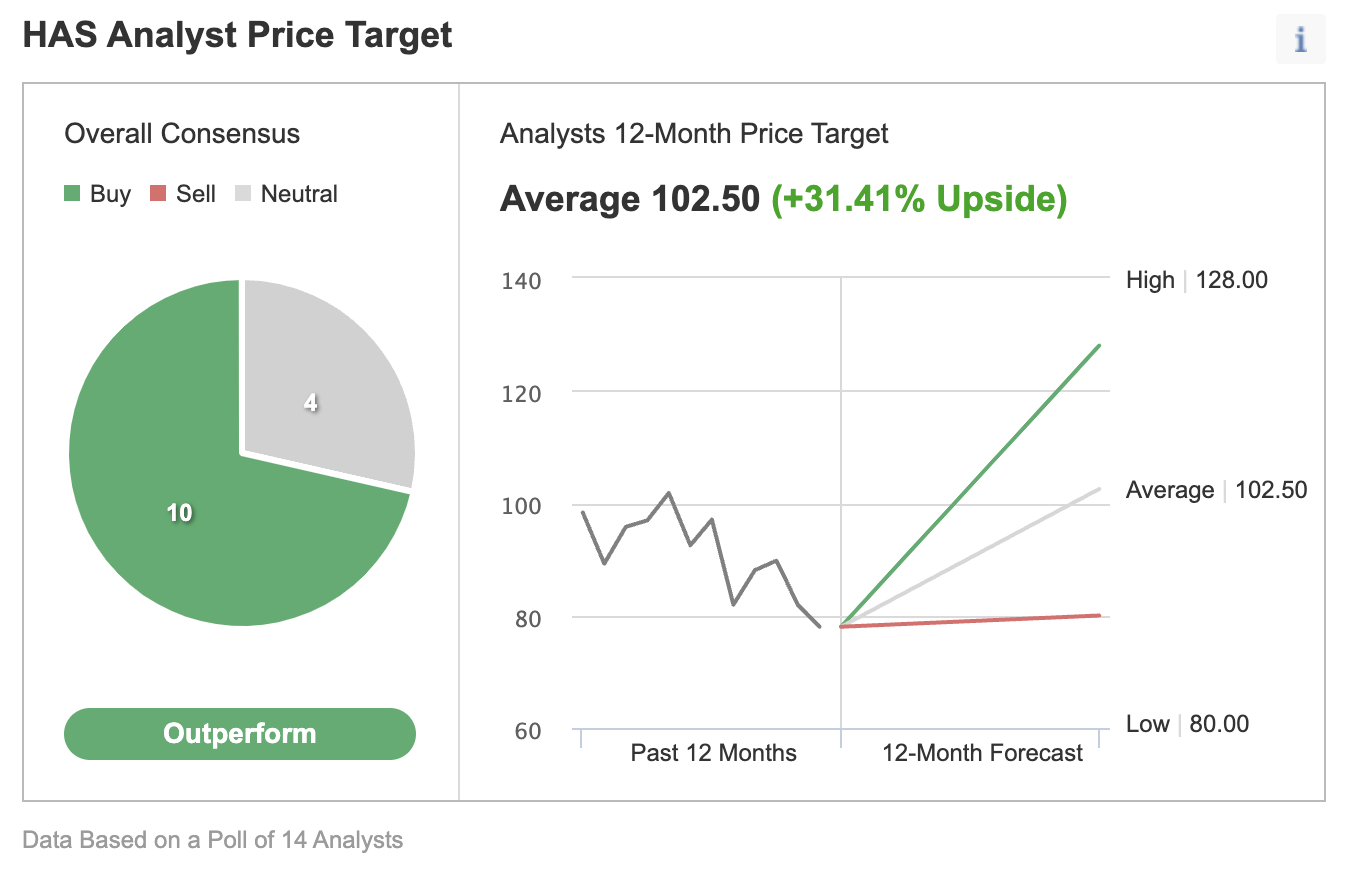

Among 14 analysts polled via Investing.com, HAS stock has an "outperform" rating.

Source: Investing.com

Wall Street also has a 12-month median price target of $102.50 for the stock, implying an increase of around 31% from current levels. The 12-month price range currently stands between $80 and $128.

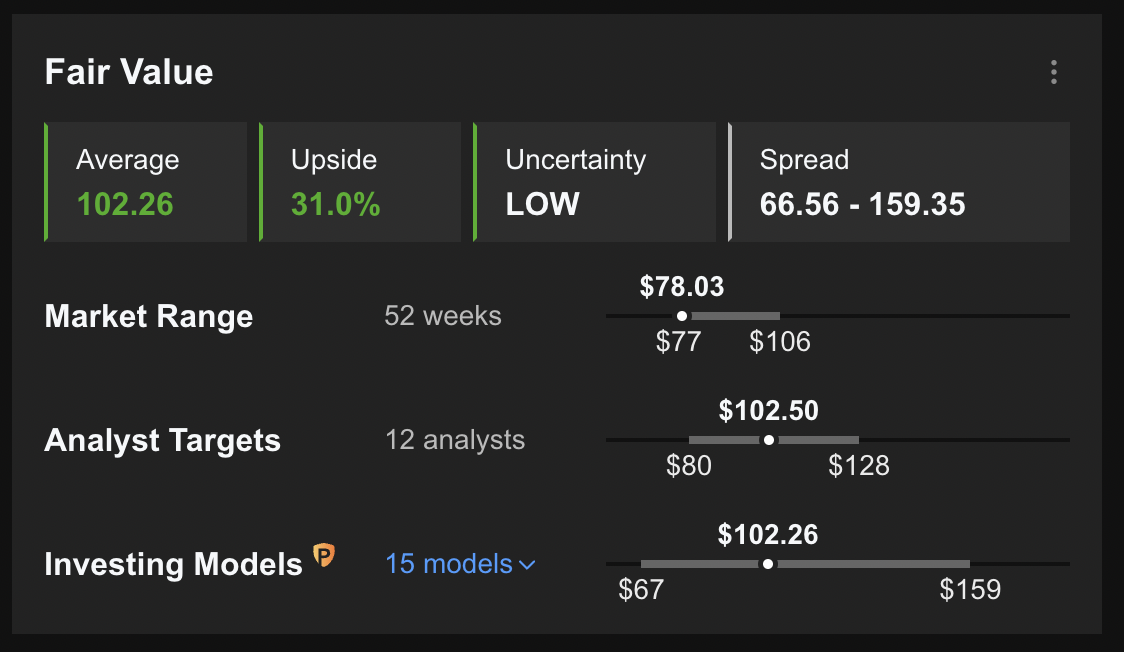

Similarly, according to a number of valuation models, like those that might consider P/E or P/S multiples or terminal values, the average fair value for Hasbro stock stands at $102.26.

Source: InvestingPro

In other words, fundamental valuation also suggests shares should roughly go up by 31%.

At present, Hasbro’s P/E, P/B and P/S ratios are 20.1x, 3.6x and 1.7x, respectively. Comparable metrics for the consumer discretionary sector stand at 8.0x, 1.4x and 1.0x, respectively. Put another way, despite the decline in the price of HAS stock since January, shares are still on the frothy side.

Our expectation is for Hasbro stock to trade in a wide range between $75 and $80 to build a base in the coming weeks. Afterwards, HAS shares could potentially start a new leg up.

Adding HAS Stock To Portfolios

Hasbro bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $102.26 as indicated by quantitative models.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has HAS stock as a holding. Examples include:

- iShares Evolved U.S. Media and Entertainment ETF (NYSE:IEME)

- ALPS Sector Dividend Dogs ETF (NYSE:SDOG)

- Invesco S&P 500® Equal Weight Consumer Discretionary ETF (NYSE:RCD)

- Invesco ESG NASDAQ Next Gen 100 ETF (NASDAQ:QQJG)

- Nuveen ESG Mid-Cap Value ETF (NYSE:NUMV)

Finally, investors who expect HAS stock to bounce back in the weeks ahead could consider setting up a covered call.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on HAS stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Covered Call On HAS Stock

Price At Time Of Writing: $78.20

For every 100 shares held, the strategy requires the trader to sell one call option with an expiration date at some time in the future.

A stock option contract on HAS (or any other stock) is the option to buy (or sell) 100 shares.

Investors who believe there could be more short-term profit-taking soon might use a slightly in-the-money (ITM) covered call. A call option is ITM if the market price (here, $78.20) is above the strike price ($77.50).

So, the investor would buy (or already own) 100 shares of HAS stock at $78.20 and, at the same time, sell a HAS Sept. 16 77.50-strike call option. This option is currently offered at a price (or premium) of $5.05.

An option buyer would have to pay $5.05 X 100 (or $505) in premium to the option seller. This call option will stop trading on Friday, Sept. 16.

This premium amount belongs to the option writer (seller) no matter what happens in the future, for example, on the day of expiry.

The $77.50-strike offers more downside protection than an at-the-money (ATM) or out-of-the-money (OTM) call.

Assuming a trader would now enter this covered call trade at $78.20, at expiration, the maximum return would be $435, i.e., ($505 - ($78.20 - $77.50) X 100), excluding trading commissions and costs.

Risk/Reward Profile For Unmonitored Covered Call

On expiration day, if the stock closes below the strike price, the option would not get exercised, but would instead expire worthless. Then, the stock owner with the covered call position gets to keep the stock and the money (premium) s/he was paid for selling the option.

At expiration, this trade would break even at an HAS stock price of $73.15, excluding trading commissions and costs.

Another way to think of this break-even price is to subtract the call option premium ($5.05) from the underlying HAS stock price when we initiated the covered call (i.e., $78.20).

On Sept. 16, if HAS stock closes below $73.15, the trade would start losing money within this covered call setup. Therefore, by selling the covered call, the investor has some protection against a potential loss in the case of a decline in the underlying shares. In theory, a stock's price could drop to $0.

Bottom Line

The exact market-timing of when HAS shares could take a breather is difficult to determine, even for professional traders. But options strategies provide tools that might prepare for sideways moves or even drops in price.

We regard covered call options as a potential way to earn additional income from your stock portfolio. Such a strategy also helps lower portfolio volatility. Interested investors might consider increasing their knowledge base.